Form 1120 2014

What is the Form 1120

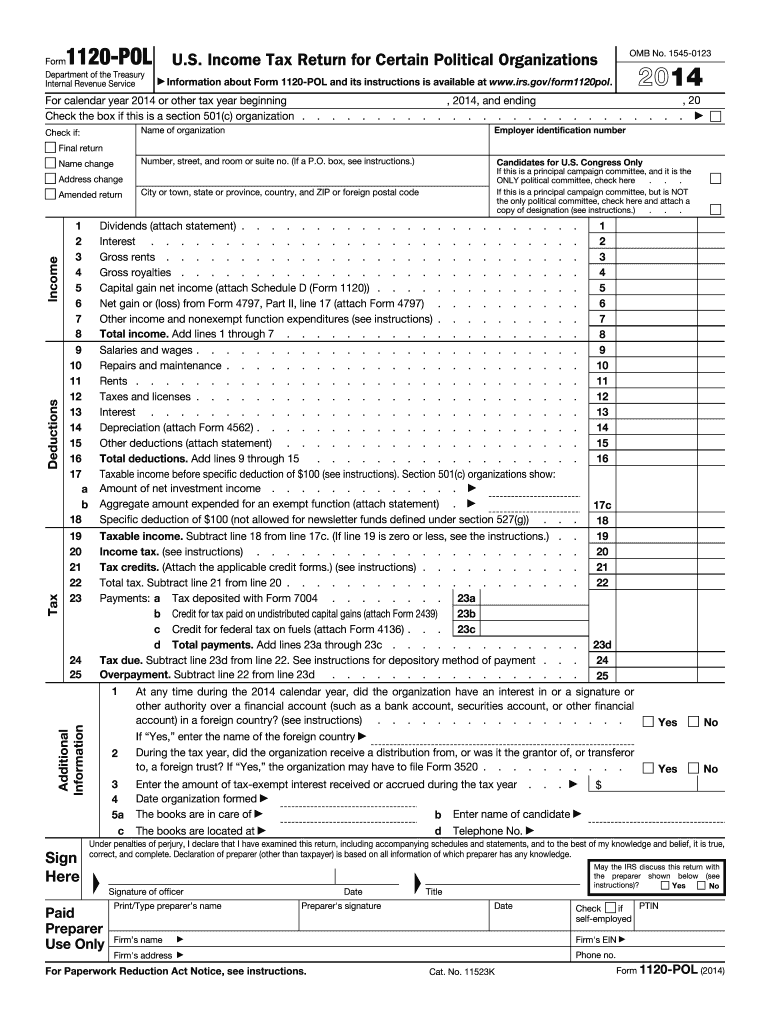

The Form 1120 is the U.S. Corporation Income Tax Return used by corporations to report their income, gains, losses, deductions, and credits. This form is essential for corporations operating in the United States, as it enables them to calculate their federal income tax liability. Corporations must file this form annually, regardless of whether they owe any tax. Understanding the purpose and requirements of Form 1120 is crucial for compliance with IRS regulations.

How to use the Form 1120

Using Form 1120 involves several key steps. First, gather all necessary financial information, including income statements and balance sheets. Next, fill out the form accurately, ensuring that all income and deductions are reported correctly. After completing the form, review it for accuracy and completeness. Finally, submit the form to the IRS by the designated deadline. Utilizing digital tools can simplify this process, making it easier to fill out and eSign the document securely.

Steps to complete the Form 1120

Completing Form 1120 requires careful attention to detail. Follow these steps:

- Gather financial records, including income and expense statements.

- Fill out the identification section, including the corporation's name, address, and Employer Identification Number (EIN).

- Report total income, including sales, dividends, and interest.

- Deduct allowable expenses, such as salaries, rent, and utilities.

- Calculate the taxable income by subtracting total deductions from total income.

- Determine the tax liability using the applicable corporate tax rate.

- Sign and date the form before submission.

Legal use of the Form 1120

Form 1120 is legally binding when completed and submitted in accordance with IRS regulations. To ensure its legal validity, corporations must adhere to the guidelines set forth by the IRS, including accurate reporting and timely submission. Utilizing a reliable eSignature solution can enhance the legal standing of the document, as it provides verification and compliance with electronic signature laws.

Filing Deadlines / Important Dates

Corporations must be aware of the filing deadlines for Form 1120 to avoid penalties. Generally, the due date for filing is the fifteenth day of the fourth month following the end of the corporation's tax year. For corporations operating on a calendar year, this means the deadline is April 15. If the due date falls on a weekend or holiday, the deadline is extended to the next business day. Corporations can also apply for an extension, which allows for an additional six months to file the form.

Form Submission Methods (Online / Mail / In-Person)

Form 1120 can be submitted to the IRS through various methods. Corporations have the option to file electronically using approved e-filing software, which can streamline the process and reduce errors. Alternatively, the form can be mailed to the appropriate IRS address based on the corporation's location. In-person submission is generally not an option for Form 1120, as the IRS encourages electronic filing for efficiency and security.

Quick guide on how to complete 2014 form 1120

Manage Form 1120 seamlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an excellent eco-friendly substitute to traditional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to produce, amend, and electronically sign your files quickly without interruptions. Handle Form 1120 on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

Simple steps to modify and electronically sign Form 1120 with ease

- Find Form 1120 and click Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize important sections of your documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes just seconds and holds the same legal authority as a conventional wet ink signature.

- Review the information and click the Done button to save your edits.

- Choose your preferred method to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you select. Modify and electronically sign Form 1120 and ensure outstanding communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2014 form 1120

Create this form in 5 minutes!

How to create an eSignature for the 2014 form 1120

The best way to create an electronic signature for a PDF online

The best way to create an electronic signature for a PDF in Google Chrome

How to create an eSignature for signing PDFs in Gmail

How to generate an eSignature right from your smartphone

The way to create an eSignature for a PDF on iOS

How to generate an eSignature for a PDF on Android

People also ask

-

What is Form 1120 and why is it important for businesses?

Form 1120 is the U.S. Corporation Income Tax Return that corporations must file annually with the IRS. It is crucial for businesses as it reports income, gains, losses, deductions, and credits, determining the corporation's tax liability. Using airSlate SignNow, you can easily eSign and submit Form 1120, streamlining your tax filing process.

-

How can airSlate SignNow help me with my Form 1120 filings?

airSlate SignNow simplifies the process of completing and signing Form 1120 by allowing you to eSign documents securely and efficiently. Our platform provides templates and features that ensure your Form 1120 is filled out accurately and submitted on time. Plus, you can track the status of your documents to avoid any delays.

-

Is there a cost associated with using airSlate SignNow for Form 1120 submissions?

Yes, airSlate SignNow offers various pricing plans to cater to different business needs. While there is a cost for using our eSigning features, many users find that the time and resources saved when filing Form 1120 make it a cost-effective solution. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for managing Form 1120 documents?

airSlate SignNow provides a range of features for managing Form 1120 documents, including customizable templates, secure eSigning, document tracking, and cloud storage. These features make it easy to gather signatures and maintain compliance while filing Form 1120. You can also collaborate with team members seamlessly.

-

Can I integrate airSlate SignNow with other software for Form 1120 processing?

Absolutely! airSlate SignNow integrates with popular accounting and business software, making it easy to manage your Form 1120 documents alongside other financial tasks. Whether you use QuickBooks, Xero, or any other tool, our platform ensures a smooth workflow for your tax filings.

-

What benefits does airSlate SignNow provide for eSigning Form 1120?

Using airSlate SignNow for eSigning Form 1120 offers numerous benefits, including enhanced security, faster turnaround times, and reduced paperwork. Our platform ensures that your Form 1120 is signed and submitted quickly, helping you avoid late filing penalties. Additionally, the audit trail feature provides proof of signing, ensuring compliance.

-

Is airSlate SignNow compliant with the regulations for filing Form 1120?

Yes, airSlate SignNow is designed to comply with the regulations governing electronic signatures and document submissions, including those relevant to Form 1120. Our platform adheres to industry standards for security and authentication, ensuring that your eSigned documents are legally binding and compliant with IRS requirements.

Get more for Form 1120

- Contractors questionnaire form

- 104th security forces squadron contractor entry authority list form

- Contract form impressive pups

- Template bid form 2242010xlsm pogue construction

- Subcontractor prequalification checklist form

- Extra work ticket form

- Workers comp exemption form

- Allegation of other facts the dismissal of the claims against philip form

Find out other Form 1120

- How To Electronic signature Indiana Sports RFP

- How Can I Electronic signature Indiana Sports RFP

- Electronic signature South Dakota Real Estate Quitclaim Deed Now

- Electronic signature South Dakota Real Estate Quitclaim Deed Safe

- Electronic signature Indiana Sports Forbearance Agreement Myself

- Help Me With Electronic signature Nevada Police Living Will

- Electronic signature Real Estate Document Utah Safe

- Electronic signature Oregon Police Living Will Now

- Electronic signature Pennsylvania Police Executive Summary Template Free

- Electronic signature Pennsylvania Police Forbearance Agreement Fast

- How Do I Electronic signature Pennsylvania Police Forbearance Agreement

- How Can I Electronic signature Pennsylvania Police Forbearance Agreement

- Electronic signature Washington Real Estate Purchase Order Template Mobile

- Electronic signature West Virginia Real Estate Last Will And Testament Online

- Electronic signature Texas Police Lease Termination Letter Safe

- How To Electronic signature Texas Police Stock Certificate

- How Can I Electronic signature Wyoming Real Estate Quitclaim Deed

- Electronic signature Virginia Police Quitclaim Deed Secure

- How Can I Electronic signature West Virginia Police Letter Of Intent

- How Do I Electronic signature Washington Police Promissory Note Template