About Form 1120 POL, U S Income Tax Return for Certain 2020

Understanding Form 1120 POL

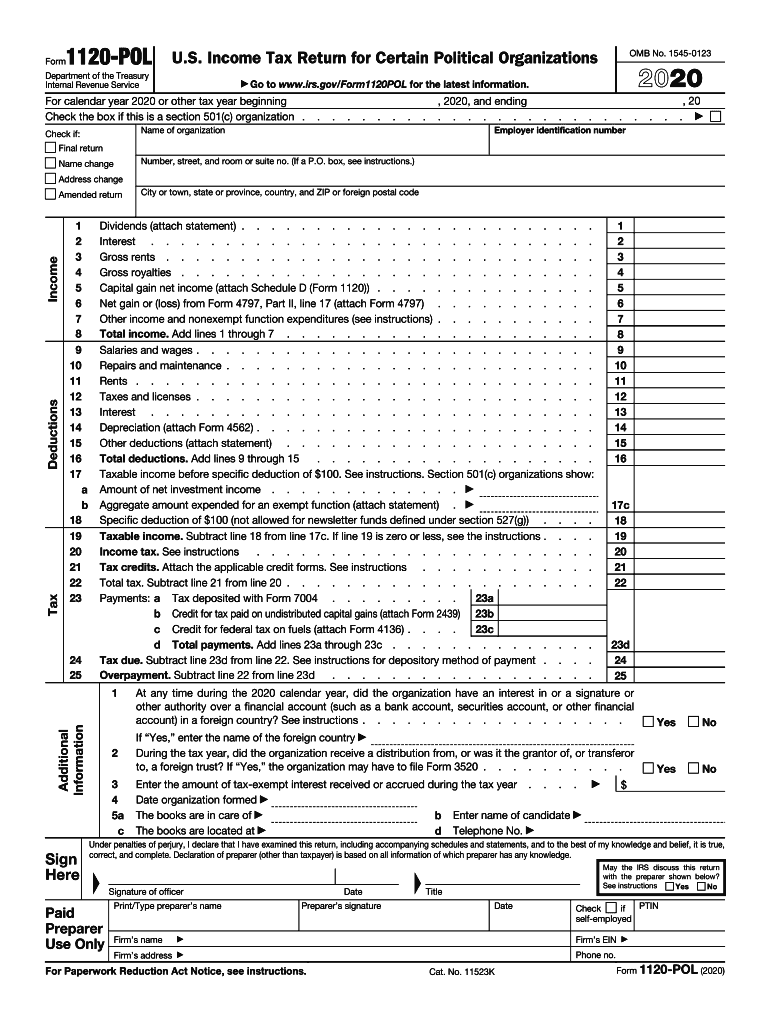

The Form 1120 POL, officially known as the U.S. Income Tax Return for Certain Political Organizations, is designed for specific tax-exempt organizations. This form allows these organizations to report their income, deductions, and tax liability. It is essential for political organizations that are classified under section 527 of the Internal Revenue Code. The primary purpose of Form 1120 POL is to ensure compliance with federal tax laws while allowing these organizations to maintain their tax-exempt status.

Steps to Complete Form 1120 POL

Completing Form 1120 POL involves several key steps to ensure accurate reporting. Begin by gathering all necessary financial information, including income sources and expenditures. Next, fill out the form by entering the organization's name, address, and Employer Identification Number (EIN). Report all income received during the tax year, including contributions and other receipts. After detailing the income, list allowable deductions, such as operating expenses and contributions made to other organizations. Finally, calculate the tax liability, if applicable, and sign the form to certify its accuracy.

Filing Deadlines for Form 1120 POL

Timely filing of Form 1120 POL is crucial to avoid penalties. The due date for this form is typically the 15th day of the fifth month after the end of the organization's tax year. For organizations operating on a calendar year, this means the form is due by May 15. If additional time is needed, organizations can file for an extension, which provides an additional six months to submit the form. However, it is important to note that any taxes owed are still due by the original deadline to avoid interest and penalties.

IRS Guidelines for Form 1120 POL

The IRS provides specific guidelines for completing and filing Form 1120 POL. Organizations must ensure that they meet the eligibility criteria for using this form, which includes being a political organization as defined by the IRS. Additionally, the form must be completed accurately, as errors can lead to delays or penalties. Organizations should also keep detailed records of all financial transactions and ensure compliance with federal regulations regarding political contributions and expenditures.

Digital Submission Methods for Form 1120 POL

Form 1120 POL can be submitted electronically or via traditional mail. Electronic filing is encouraged as it allows for faster processing and confirmation of receipt. Organizations can use IRS-approved e-file providers to submit their forms online. If opting for paper filing, the completed form should be mailed to the appropriate IRS address, which varies based on the organization's location. It is advisable to send the form via certified mail to ensure it is tracked and received by the IRS.

Penalties for Non-Compliance with Form 1120 POL

Failure to file Form 1120 POL on time or inaccuracies in the form can result in penalties imposed by the IRS. Late filing penalties can accumulate quickly, and organizations may face additional fines for underreporting income or failing to disclose required information. It is essential for organizations to understand these risks and ensure compliance to maintain their tax-exempt status and avoid financial repercussions.

Quick guide on how to complete about form 1120 pol us income tax return for certain

Complete About Form 1120 POL, U S Income Tax Return For Certain effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed papers, allowing you to locate the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage About Form 1120 POL, U S Income Tax Return For Certain on any device with airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to alter and eSign About Form 1120 POL, U S Income Tax Return For Certain with ease

- Obtain About Form 1120 POL, U S Income Tax Return For Certain and click on Get Form to begin.

- Use the tools we provide to complete your document.

- Emphasize relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you want to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign About Form 1120 POL, U S Income Tax Return For Certain and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct about form 1120 pol us income tax return for certain

Create this form in 5 minutes!

How to create an eSignature for the about form 1120 pol us income tax return for certain

The best way to generate an eSignature for your PDF file in the online mode

The best way to generate an eSignature for your PDF file in Chrome

How to make an eSignature for putting it on PDFs in Gmail

The best way to create an electronic signature right from your smartphone

How to create an electronic signature for a PDF file on iOS devices

The best way to create an electronic signature for a PDF on Android

People also ask

-

What is the role of the 1120 pol IRS form in business taxation?

The 1120 pol IRS form is used by political organizations to report income and expenses for tax purposes. Filing this form is essential for compliance and transparency in the financial activities of a political entity, helping to avoid penalties.

-

How can airSlate SignNow help with filing the 1120 pol IRS form?

AirSlate SignNow streamlines the process of preparing and filing the 1120 pol IRS form by allowing you to eSign documents quickly and securely. With a user-friendly interface, you can easily manage and send necessary documents without hassle.

-

What features does airSlate SignNow offer for handling the 1120 pol IRS form?

AirSlate SignNow provides essential features such as document templates, secure eSigning, and automated workflows to simplify the preparation of the 1120 pol IRS form. These tools help ensure that your documents are compliant and submitted accurately.

-

Is airSlate SignNow cost-effective for managing the 1120 pol IRS form?

Yes, airSlate SignNow is a cost-effective solution for managing the 1120 pol IRS form. Our pricing plans are designed to fit various budgets, making it accessible for organizations of all sizes while providing robust features to enhance document management.

-

What benefits does airSlate SignNow provide for eSigning the 1120 pol IRS form?

With airSlate SignNow, you can enjoy the benefits of secure and fast eSigning for the 1120 pol IRS form. This eliminates the need for printing, scanning, and mailing, allowing you to complete the process efficiently and maintain records seamlessly.

-

Can airSlate SignNow integrate with other applications while filing the 1120 pol IRS form?

Yes, airSlate SignNow offers robust integrations with various applications, like cloud storage services and accounting software, which can facilitate the filing of the 1120 pol IRS form. This interoperability enhances your workflow and keeps your processes organized.

-

How can I ensure compliance when filing the 1120 pol IRS form using airSlate SignNow?

AirSlate SignNow helps ensure compliance while filing the 1120 pol IRS form by providing legally binding eSignatures and maintaining a complete audit trail of document transactions. This feature is especially important for political organizations that must adhere to strict regulatory standards.

Get more for About Form 1120 POL, U S Income Tax Return For Certain

- Wyoming organizer form

- Postnuptial agreements package wyoming form

- Letters of recommendation package wyoming form

- Wyoming construction or mechanics lien package individual wyoming form

- Wyoming construction or mechanics lien package corporation or llc wyoming form

- Storage business package wyoming form

- Child care services package wyoming form

- Wyoming seller 497432657 form

Find out other About Form 1120 POL, U S Income Tax Return For Certain

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word