Form 1120 2016

What is the Form 1120

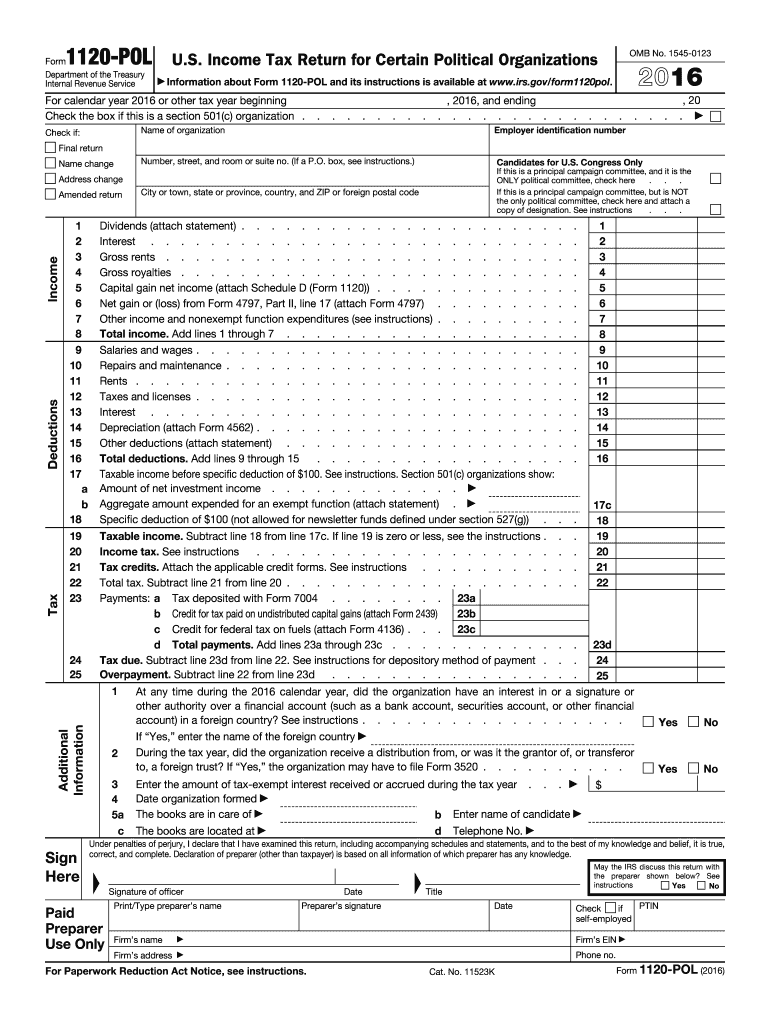

The Form 1120 is the U.S. Corporation Income Tax Return, used by corporations to report their income, gains, losses, deductions, and credits. This form is essential for C corporations, which are separate legal entities from their owners. By filing Form 1120, corporations fulfill their tax obligations to the Internal Revenue Service (IRS). The form captures vital financial information, including total income, taxable income, and tax liability, which helps determine the corporation's tax responsibilities.

Steps to complete the Form 1120

Completing the Form 1120 involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements and expense reports. Next, accurately fill out the form, starting with basic information such as the corporation's name, address, and Employer Identification Number (EIN). Then, detail the corporation's income and deductions in the appropriate sections. Finally, calculate the tax liability and ensure all figures are correct before submitting the form to the IRS.

Filing Deadlines / Important Dates

Corporations must adhere to specific deadlines when filing Form 1120. Generally, the due date for filing is the fifteenth day of the fourth month following the end of the corporation's tax year. For corporations operating on a calendar year, this means the form is due by April 15. If the due date falls on a weekend or holiday, the deadline is extended to the next business day. Corporations can also apply for a six-month extension, but this does not extend the time to pay any taxes owed.

Legal use of the Form 1120

Form 1120 is legally binding when completed accurately and submitted on time. To ensure compliance, corporations must follow IRS guidelines and maintain proper documentation to support the figures reported on the form. This includes keeping records of income, expenses, and any deductions claimed. Failure to comply with filing requirements can result in penalties, interest, and potential legal issues. Utilizing a reliable digital solution can enhance the security and legality of the submission process.

Form Submission Methods (Online / Mail / In-Person)

Corporations have several options for submitting Form 1120. The form can be filed electronically through the IRS e-file system, which is the preferred method for many businesses due to its speed and efficiency. Alternatively, corporations can mail a paper copy of the form to the appropriate IRS address based on their location. In-person submissions are generally not available for Form 1120, but businesses can seek assistance from tax professionals if needed. It's important to choose a submission method that aligns with the corporation's needs and ensures timely filing.

Key elements of the Form 1120

Understanding the key elements of Form 1120 is crucial for accurate completion. The form includes sections for reporting income, such as gross receipts and sales, as well as deductions for business expenses. Additionally, it requires corporations to disclose tax credits and other relevant financial information. Each section must be completed with precision, as inaccuracies can lead to delays in processing or potential audits. Familiarity with these elements helps ensure that all necessary information is reported correctly.

Quick guide on how to complete 2016 form 1120

Complete Form 1120 seamlessly on any device

Online document administration has gained popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, as you can locate the appropriate form and securely store it online. airSlate SignNow provides all the features you require to create, modify, and electronically sign your documents swiftly without delays. Handle Form 1120 on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

The easiest way to modify and electronically sign Form 1120 effortlessly

- Locate Form 1120 and click on Get Form to initiate.

- Utilize the tools we offer to submit your document.

- Emphasize signNow sections of the documents or redact sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Generate your signature with the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to send your document, whether by email, text (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your choice. Edit and electronically sign Form 1120 and ensure outstanding communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2016 form 1120

Create this form in 5 minutes!

How to create an eSignature for the 2016 form 1120

How to create an eSignature for the 2016 Form 1120 in the online mode

How to create an eSignature for the 2016 Form 1120 in Google Chrome

How to make an electronic signature for putting it on the 2016 Form 1120 in Gmail

How to make an eSignature for the 2016 Form 1120 straight from your smart phone

How to create an electronic signature for the 2016 Form 1120 on iOS

How to make an eSignature for the 2016 Form 1120 on Android

People also ask

-

What is Form 1120 and why is it important for businesses?

Form 1120 is the U.S. Corporation Income Tax Return that corporations must file annually. It's crucial for businesses as it reports income, gains, losses, deductions, and credits, impacting tax liabilities. By properly managing Form 1120, companies can ensure compliance with IRS regulations and optimize their tax positions.

-

How can airSlate SignNow help with the Form 1120 filing process?

airSlate SignNow streamlines the document management for Form 1120 by allowing businesses to easily collect eSignatures on necessary documents. This ensures that all required signatures are obtained promptly, reducing delays in the filing process. The platform's user-friendly interface makes it easy to prepare and send Form 1120 and related documents.

-

Is there a cost associated with using airSlate SignNow for Form 1120 processing?

Yes, airSlate SignNow offers various pricing plans to cater to different business needs, including options for handling Form 1120. These plans provide access to essential features for document signing and management at competitive rates. Investing in airSlate SignNow can save time and reduce costs associated with traditional document processing.

-

What features does airSlate SignNow offer for managing Form 1120 documents?

airSlate SignNow provides features such as customizable templates for Form 1120, eSignature capabilities, and secure document storage. These tools help businesses efficiently prepare and manage their tax documents. Additionally, the platform allows for easy tracking of the signing process, ensuring all parties are informed.

-

Can I integrate airSlate SignNow with my existing accounting software for Form 1120?

Absolutely! airSlate SignNow offers integrations with popular accounting software, making it easy to manage Form 1120 alongside your financial data. This seamless integration ensures that all necessary information is readily available when completing your tax forms, enhancing accuracy and efficiency.

-

How does airSlate SignNow ensure the security of Form 1120 documents?

Security is a top priority for airSlate SignNow, which employs advanced encryption standards to protect your Form 1120 and other documents. The platform also includes features such as secure user authentication and audit trails, ensuring that sensitive tax information remains safe and compliant with regulations.

-

What are the benefits of using airSlate SignNow for eSigning Form 1120?

Using airSlate SignNow for eSigning Form 1120 offers signNow benefits, including faster turnaround times and improved document accuracy. The platform eliminates the need for physical signatures, reducing delays and enhancing workflow efficiency. Additionally, eSigning is more eco-friendly, aligning with modern business practices.

Get more for Form 1120

- Candidate for graduation form stcc

- Residential claim for food and medicine spoilage 2007 form

- Form 3626

- Commercial real estate lease proposal form

- Calpers service retirement application form

- Auction estimate form

- Apple gift card generator form

- Aid 502 2 usaid records management exit checklist for employees form

Find out other Form 1120

- Electronic signature Real Estate Document Utah Safe

- Electronic signature Oregon Police Living Will Now

- Electronic signature Pennsylvania Police Executive Summary Template Free

- Electronic signature Pennsylvania Police Forbearance Agreement Fast

- How Do I Electronic signature Pennsylvania Police Forbearance Agreement

- How Can I Electronic signature Pennsylvania Police Forbearance Agreement

- Electronic signature Washington Real Estate Purchase Order Template Mobile

- Electronic signature West Virginia Real Estate Last Will And Testament Online

- Electronic signature Texas Police Lease Termination Letter Safe

- How To Electronic signature Texas Police Stock Certificate

- How Can I Electronic signature Wyoming Real Estate Quitclaim Deed

- Electronic signature Virginia Police Quitclaim Deed Secure

- How Can I Electronic signature West Virginia Police Letter Of Intent

- How Do I Electronic signature Washington Police Promissory Note Template

- Electronic signature Wisconsin Police Permission Slip Free

- Electronic signature Minnesota Sports Limited Power Of Attorney Fast

- Electronic signature Alabama Courts Quitclaim Deed Safe

- How To Electronic signature Alabama Courts Stock Certificate

- Can I Electronic signature Arkansas Courts Operating Agreement

- How Do I Electronic signature Georgia Courts Agreement