Irs Tax Forms 2011

What is the IRS Tax Forms

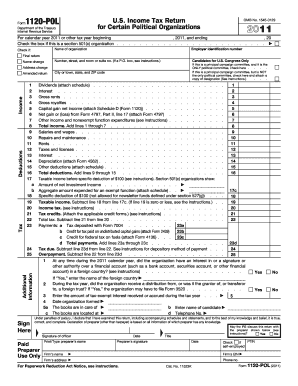

The IRS tax forms are official documents used by individuals and businesses in the United States to report income, calculate taxes owed, and claim deductions or credits. These forms are essential for compliance with federal tax laws and are required for filing annual tax returns. The most commonly used forms include the Form 1040 for individual income tax returns, the W-2 for wage and tax statements, and the 1099 series for various types of income. Each form serves a specific purpose and must be filled out accurately to ensure proper tax processing.

How to Obtain the IRS Tax Forms

Obtaining IRS tax forms is a straightforward process. Individuals can access most forms online through the IRS website, where they can download and print them for free. Additionally, tax forms are available at various locations, including libraries, post offices, and IRS offices. For those who prefer to receive forms by mail, the IRS provides an option to order forms directly through their website or by calling their toll-free number. It is important to ensure that the correct version of the form is obtained, as tax laws and forms may change annually.

Steps to Complete the IRS Tax Forms

Completing IRS tax forms involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including W-2s, 1099s, and receipts for deductions. Next, carefully read the instructions for the specific form being completed, as they provide essential guidance on how to fill out the form correctly. Enter personal information, income details, and any applicable deductions or credits. After completing the form, review it thoroughly for errors before signing and dating it. Finally, submit the form by the appropriate deadline, either electronically or by mail.

Legal Use of the IRS Tax Forms

The legal use of IRS tax forms is crucial for compliance with U.S. tax laws. These forms must be filled out truthfully and accurately, as providing false information can lead to penalties or legal consequences. The IRS requires that all taxpayers maintain records supporting the information reported on their tax forms for at least three years. Additionally, e-filing options are available, which provide a secure method of submitting forms electronically while ensuring compliance with the Electronic Signatures in Global and National Commerce (ESIGN) Act.

Filing Deadlines / Important Dates

Filing deadlines for IRS tax forms are critical to avoid penalties and interest on unpaid taxes. Typically, individual tax returns are due on April 15 each year. If this date falls on a weekend or holiday, the deadline is extended to the next business day. Extensions may be requested, allowing for additional time to file, but any taxes owed must still be paid by the original deadline to avoid penalties. It is essential to stay informed about any changes to deadlines, as these can vary based on specific circumstances or legislation.

Form Submission Methods (Online / Mail / In-Person)

IRS tax forms can be submitted through various methods, providing flexibility for taxpayers. The most common method is electronic filing (e-filing), which allows individuals to submit their forms online through authorized software or tax professionals. This method is often faster and more secure. Alternatively, forms can be mailed directly to the IRS, with specific addresses designated for different types of forms. In-person submission is also an option at local IRS offices, where assistance may be available for those needing help with the forms. Each method has its own requirements and processing times, so it is important to choose the one that best fits individual needs.

Quick guide on how to complete irs tax forms 2011

Finish Irs Tax Forms easily on any device

Online document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides you with all the resources required to create, modify, and electronically sign your documents swiftly without delays. Manage Irs Tax Forms on any device using airSlate SignNow Android or iOS applications and simplify your document-related processes today.

The simplest way to modify and electronically sign Irs Tax Forms effortlessly

- Locate Irs Tax Forms and click on Get Form to begin.

- Utilize the tools available to complete your form.

- Highlight important sections of your documents or obscure sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign function, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method of delivering your form, whether by email, SMS, invitation link, or downloading it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Modify and electronically sign Irs Tax Forms and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs tax forms 2011

Create this form in 5 minutes!

How to create an eSignature for the irs tax forms 2011

How to generate an electronic signature for your PDF document in the online mode

How to generate an electronic signature for your PDF document in Chrome

The way to make an electronic signature for putting it on PDFs in Gmail

How to generate an electronic signature straight from your mobile device

How to make an electronic signature for a PDF document on iOS devices

How to generate an electronic signature for a PDF document on Android devices

People also ask

-

What are IRS Tax Forms and why do I need them?

IRS Tax Forms are official documents used to report income, expenses, and other financial information to the Internal Revenue Service. They are essential for individuals and businesses to comply with federal tax regulations. Using airSlate SignNow, you can easily eSign and send these forms securely, ensuring timely submission and compliance with IRS requirements.

-

How can airSlate SignNow help me manage IRS Tax Forms?

airSlate SignNow simplifies the management of IRS Tax Forms by allowing you to create, send, and eSign documents quickly and securely. With its user-friendly interface, you can streamline the process of filling out and submitting tax forms, reducing the risk of errors and improving efficiency for your business.

-

Is airSlate SignNow cost-effective for handling IRS Tax Forms?

Yes, airSlate SignNow offers a cost-effective solution for managing IRS Tax Forms. With various pricing plans available, you can choose one that fits your budget while enjoying features that simplify document signing and management, making it an excellent investment for your business.

-

What features does airSlate SignNow offer for IRS Tax Forms?

airSlate SignNow provides numerous features tailored for IRS Tax Forms, including customizable templates, automated workflows, and secure cloud storage. These features help you efficiently prepare, eSign, and store your tax forms, ensuring you have everything you need in one convenient place.

-

Can I integrate airSlate SignNow with other software for IRS Tax Forms?

Absolutely! airSlate SignNow easily integrates with various software applications, allowing you to connect your existing tools for a seamless workflow. This means you can manage your IRS Tax Forms alongside your other business applications, enhancing productivity and efficiency.

-

How secure is airSlate SignNow for sending IRS Tax Forms?

Security is a top priority at airSlate SignNow. We use advanced encryption and secure servers to protect your IRS Tax Forms and sensitive information during transmission and storage. You can confidently send and manage your tax forms knowing they are safe and compliant with industry standards.

-

Can I track the status of my IRS Tax Forms with airSlate SignNow?

Yes, airSlate SignNow offers tracking capabilities that allow you to monitor the status of your IRS Tax Forms. You can see when documents are sent, viewed, and signed, giving you peace of mind and ensuring that your forms are processed in a timely manner.

Get more for Irs Tax Forms

Find out other Irs Tax Forms

- eSignature Delaware Finance & Tax Accounting Job Description Template Fast

- How To eSignature Kentucky Government Warranty Deed

- eSignature Mississippi Government Limited Power Of Attorney Myself

- Can I eSignature South Dakota Doctors Lease Agreement Form

- eSignature New Hampshire Government Bill Of Lading Fast

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer