About Form 1120 POL, U S Income Tax Return for CertainFederal Form 1120 POL U S Income Tax Return for CertainForm1120 POL U S in 2022

Understanding Form 1120 POL

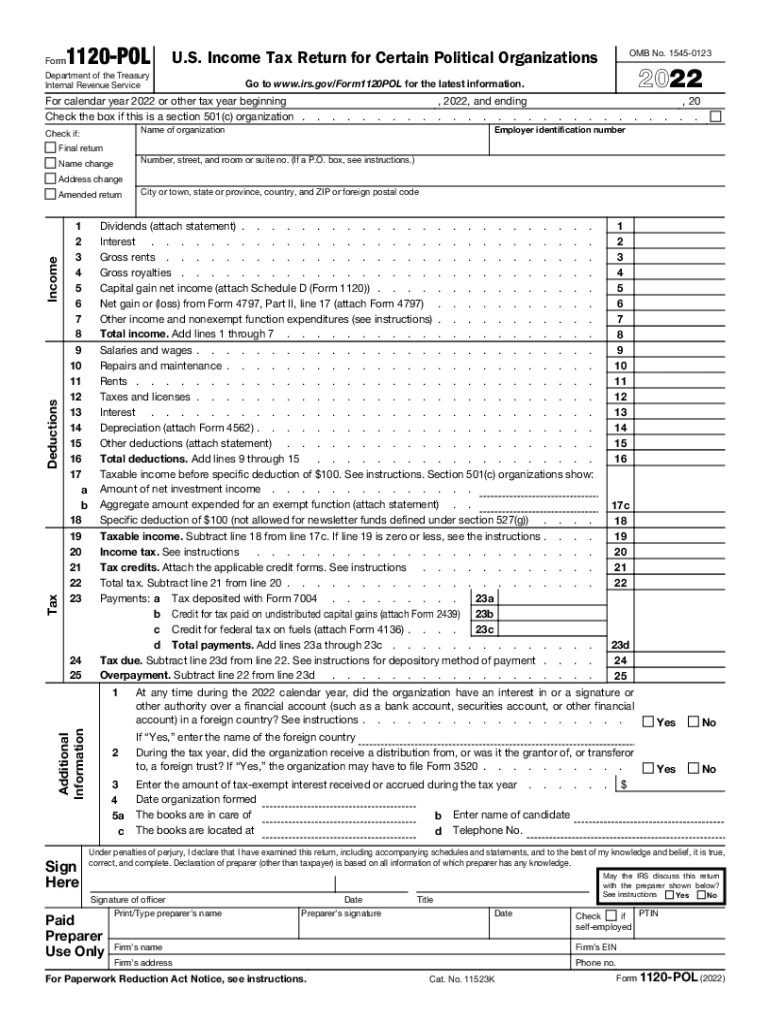

The 2018 Form 1120 POL is a U.S. income tax return specifically designed for certain political organizations. This form is used to report income, deductions, and tax liability for organizations that qualify under the Internal Revenue Code. Political organizations that engage in activities such as campaigning or fundraising must file this form to ensure compliance with federal tax regulations.

Steps to Complete the 2018 Form 1120 POL

Completing the 2018 Form 1120 POL involves several key steps:

- Gather necessary documentation, including financial statements and records of income and expenses.

- Fill out the form accurately, ensuring all required fields are completed.

- Calculate the total income and allowable deductions to determine the tax liability.

- Review the completed form for accuracy and ensure compliance with IRS guidelines.

- Submit the form by the designated deadline, either electronically or via mail.

Filing Deadlines for Form 1120 POL

The filing deadline for the 2018 Form 1120 POL is typically the 15th day of the fifth month after the end of the organization’s tax year. For organizations operating on a calendar year basis, this means the form is due on May 15, 2019. It is important to adhere to this timeline to avoid penalties and ensure compliance.

Legal Use of Form 1120 POL

Form 1120 POL is legally binding and must be filed in accordance with IRS regulations. It is crucial for political organizations to maintain accurate records and report their financial activities transparently. Failure to comply with the filing requirements can result in penalties, including fines and loss of tax-exempt status.

Required Documents for Filing

When preparing to file the 2018 Form 1120 POL, organizations should have the following documents ready:

- Financial statements that detail income and expenses.

- Records of contributions and expenditures related to political activities.

- Previous tax returns, if applicable, to ensure consistency and accuracy.

Form Submission Methods

The 2018 Form 1120 POL can be submitted in several ways:

- Electronically through the IRS e-file system for faster processing.

- By mail, ensuring the form is sent to the correct IRS address for political organizations.

- In-person at designated IRS offices, if necessary.

Quick guide on how to complete about form 1120 pol us income tax return for certainfederal form 1120 pol us income tax return for certainform1120 pol us

Complete About Form 1120 POL, U S Income Tax Return For CertainFederal Form 1120 POL U S Income Tax Return For CertainForm1120 POL U S In effortlessly on any device

Online document management has gained popularity among organizations and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the resources needed to create, modify, and eSign your documents swiftly without delays. Manage About Form 1120 POL, U S Income Tax Return For CertainFederal Form 1120 POL U S Income Tax Return For CertainForm1120 POL U S In on any device with airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

How to modify and eSign About Form 1120 POL, U S Income Tax Return For CertainFederal Form 1120 POL U S Income Tax Return For CertainForm1120 POL U S In without effort

- Obtain About Form 1120 POL, U S Income Tax Return For CertainFederal Form 1120 POL U S Income Tax Return For CertainForm1120 POL U S In and click Get Form to begin.

- Make use of the tools available to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information using tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to finalize your changes.

- Choose your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choosing. Modify and eSign About Form 1120 POL, U S Income Tax Return For CertainFederal Form 1120 POL U S Income Tax Return For CertainForm1120 POL U S In and guarantee effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct about form 1120 pol us income tax return for certainfederal form 1120 pol us income tax return for certainform1120 pol us

Create this form in 5 minutes!

How to create an eSignature for the about form 1120 pol us income tax return for certainfederal form 1120 pol us income tax return for certainform1120 pol us

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2018 form 1120 and why is it important?

The 2018 form 1120 is crucial for U.S. corporations as it reports their income, gains, losses, deductions, and credits. Filing this form is essential to ensure compliance with IRS regulations and to determine tax liabilities accurately.

-

How can airSlate SignNow help with the 2018 form 1120?

airSlate SignNow simplifies the process of submitting the 2018 form 1120 by allowing users to prepare, send, and eSign the document effortlessly. This streamlines the tax filing process and ensures that all necessary signatures are captured.

-

Is airSlate SignNow safe for handling the 2018 form 1120?

Yes, airSlate SignNow prioritizes security and complies with industry standards to safeguard your documents. When handling sensitive forms like the 2018 form 1120, you can trust our encrypted platform to keep your information confidential.

-

What features does airSlate SignNow offer for the 2018 form 1120?

airSlate SignNow provides several features suitable for the 2018 form 1120, including customizable templates, automated reminders, and real-time tracking of document status. These features enhance efficiency and accuracy when managing tax documents.

-

How much does it cost to use airSlate SignNow for the 2018 form 1120?

airSlate SignNow offers various pricing plans that cater to different business needs, starting with a free trial. The costs are competitive, providing a cost-effective solution for businesses needing to eSign and manage their 2018 form 1120.

-

Can airSlate SignNow integrate with other tools for filing the 2018 form 1120?

Yes, airSlate SignNow offers integrations with popular accounting and financial software that can assist in preparing the 2018 form 1120. These integrations ensure a seamless transition between document management and financial reporting.

-

What benefits does eSigning the 2018 form 1120 provide?

eSigning the 2018 form 1120 expedites the filing process by eliminating the need for physical signatures and paper trails. This not only saves time but also enhances accuracy and allows for quick modifications without delays.

Get more for About Form 1120 POL, U S Income Tax Return For CertainFederal Form 1120 POL U S Income Tax Return For CertainForm1120 POL U S In

Find out other About Form 1120 POL, U S Income Tax Return For CertainFederal Form 1120 POL U S Income Tax Return For CertainForm1120 POL U S In

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure