1120 POL U S Income Tax Return for Certain Political 2021

What is the 1120 POL U S Income Tax Return For Certain Political

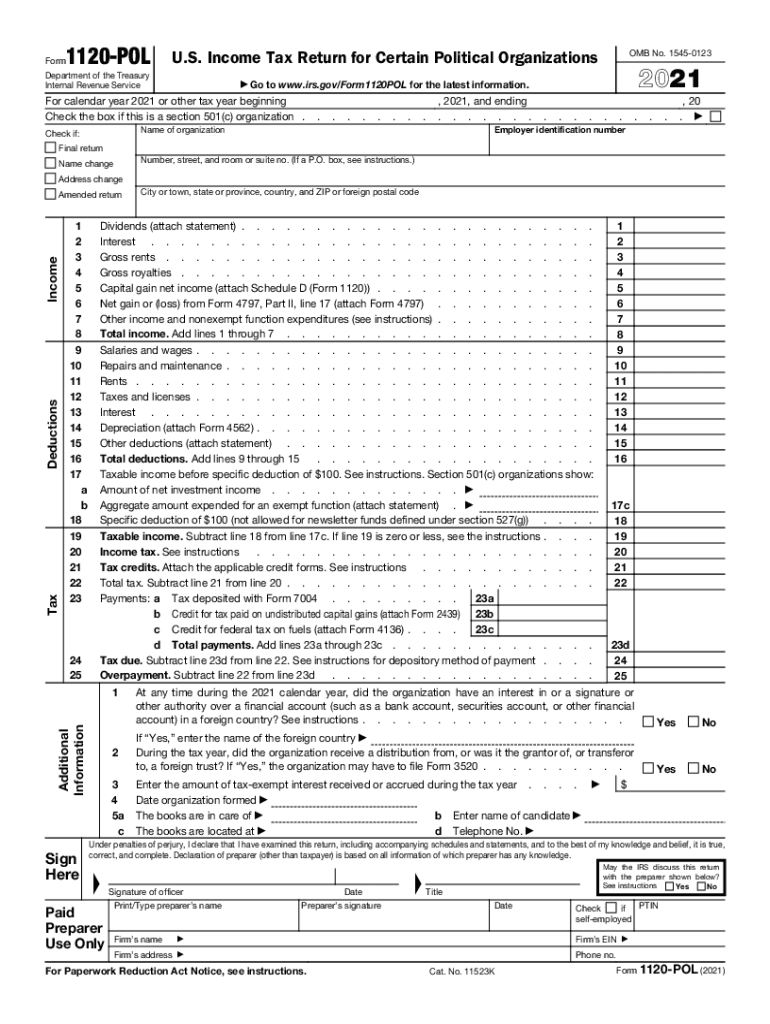

The 1120 POL U S Income Tax Return is specifically designed for political organizations that are subject to taxation under U.S. law. This form is utilized by organizations that primarily engage in political activities and are classified as political organizations by the Internal Revenue Service (IRS). The primary purpose of the form is to report income, deductions, and tax liability, ensuring compliance with federal tax regulations. Political organizations must file this form if they have taxable income, which typically includes contributions that exceed certain thresholds or income from non-exempt activities.

How to use the 1120 POL U S Income Tax Return For Certain Political

Using the 1120 POL involves several key steps to ensure accurate reporting. First, gather all necessary financial records, including income statements, receipts, and expense documentation. Next, complete the form by providing details regarding the organization’s income, deductions, and any applicable credits. It is essential to follow the IRS guidelines closely to avoid errors. After completing the form, review it for accuracy and ensure all required signatures are included. Finally, submit the form either electronically or via mail, depending on the preferred submission method.

Steps to complete the 1120 POL U S Income Tax Return For Certain Political

Completing the 1120 POL requires a systematic approach:

- Gather Documentation: Collect all relevant financial documents, including income sources and expenses.

- Fill Out the Form: Accurately enter information regarding income, deductions, and any other required details.

- Calculate Tax Liability: Use the provided instructions to determine any taxes owed based on the reported income.

- Review the Form: Check for completeness and accuracy, ensuring all necessary signatures are present.

- Submit the Form: File the completed form electronically or by mail, adhering to the IRS submission guidelines.

Legal use of the 1120 POL U S Income Tax Return For Certain Political

The legal use of the 1120 POL is critical for maintaining compliance with federal tax laws. Political organizations must file this form to report their financial activities accurately. Failure to do so can result in penalties and loss of tax-exempt status. The form must be completed in accordance with IRS regulations, ensuring that all income and expenses are reported correctly. Legal guidelines dictate that organizations must keep thorough records to support the information reported on the form, which may be subject to IRS review.

Filing Deadlines / Important Dates

Filing deadlines for the 1120 POL are crucial for compliance. Generally, the form is due on the 15th day of the fifth month after the end of the organization’s tax year. For organizations operating on a calendar year, this typically falls on May 15. If the deadline falls on a weekend or holiday, the due date is extended to the next business day. Organizations may request an extension, but it is important to file the extension request before the original deadline to avoid penalties.

Required Documents

To complete the 1120 POL, several documents are necessary:

- Income Statements: Records of all income received during the tax year.

- Expense Receipts: Documentation of all expenses incurred by the organization.

- Previous Tax Returns: Copies of prior year returns may be helpful for consistency.

- Bank Statements: To verify income and expenses reported on the form.

Quick guide on how to complete 1120 pol u s income tax return for certain political

Complete 1120 POL U S Income Tax Return For Certain Political effortlessly on any device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Handle 1120 POL U S Income Tax Return For Certain Political on any platform using airSlate SignNow's Android or iOS applications and enhance your document-centric processes today.

How to modify and electronically sign 1120 POL U S Income Tax Return For Certain Political with ease

- Locate 1120 POL U S Income Tax Return For Certain Political and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or conceal sensitive information using tools that airSlate SignNow offers specifically for this purpose.

- Create your electronic signature using the Sign feature, which takes just seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to submit your form, whether via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Update and electronically sign 1120 POL U S Income Tax Return For Certain Political and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1120 pol u s income tax return for certain political

Create this form in 5 minutes!

How to create an eSignature for the 1120 pol u s income tax return for certain political

How to create an electronic signature for a PDF file online

How to create an electronic signature for a PDF file in Google Chrome

How to create an electronic signature for signing PDFs in Gmail

The best way to create an e-signature right from your mobile device

How to create an e-signature for a PDF file on iOS

The best way to create an e-signature for a PDF on Android devices

People also ask

-

What is airSlate SignNow and how can it help my business with pol?

airSlate SignNow is a powerful eSignature and document management solution that allows businesses to send and eSign documents efficiently. With its user-friendly interface and robust features, it helps streamline workflows and reduce the time spent on document processes, making it an ideal choice for companies looking to improve their pol.

-

How does airSlate SignNow ensure the security of documents in pol transactions?

airSlate SignNow applies industry-standard security measures, including encryption and secure data storage, to protect documents involved in pol transactions. This ensures that your sensitive information remains confidential and secure throughout the entire signing process.

-

What pricing plans are available for airSlate SignNow tailored to pol needs?

airSlate SignNow offers a variety of pricing plans designed to meet the needs of businesses of all sizes. Each plan includes features that support pol transactions, allowing users to choose the best solution based on their specific requirements and budget.

-

Can airSlate SignNow integrate with other tools and software for managing pol?

Yes, airSlate SignNow integrates seamlessly with a wide range of tools and software, enhancing its functionality for managing pol. Popular integrations include CRM systems, cloud storage platforms, and project management tools, providing users with a comprehensive solution.

-

What are the key features of airSlate SignNow that support effective pol management?

The key features of airSlate SignNow that support pol management include a user-friendly document editor, automated workflows, and customizable templates. These features empower users to create, send, and manage documents efficiently, ensuring a smooth experience during pol.

-

Is airSlate SignNow suitable for small businesses looking to improve their pol processes?

Absolutely! airSlate SignNow is specifically designed to cater to businesses of all sizes, including small businesses. Its cost-effective solution enables small companies to manage pol effectively without compromising on quality or functionality.

-

What benefits can my business expect from using airSlate SignNow for pol?

By using airSlate SignNow for pol, your business can expect faster document turnaround times, improved accuracy in signing processes, and increased productivity across teams. These benefits contribute to overall business efficiency and customer satisfaction.

Get more for 1120 POL U S Income Tax Return For Certain Political

- Lease purchase agreements package colorado form

- Satisfaction cancellation or release of mortgage package colorado form

- Colorado premarital 497300686 form

- Painting contractor package colorado form

- Framing contractor package colorado form

- Foundation contractor package colorado form

- Plumbing contractor package colorado form

- Brick mason contractor package colorado form

Find out other 1120 POL U S Income Tax Return For Certain Political

- How Do I eSign Maryland Non-Profit Word

- Help Me With eSign New Jersey Legal PDF

- How To eSign New York Legal Form

- How Can I eSign North Carolina Non-Profit Document

- How To eSign Vermont Non-Profit Presentation

- How Do I eSign Hawaii Orthodontists PDF

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document

- How To eSign Hawaii Plumbing Presentation

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word