It214 Form 2020

What is the It214 Form

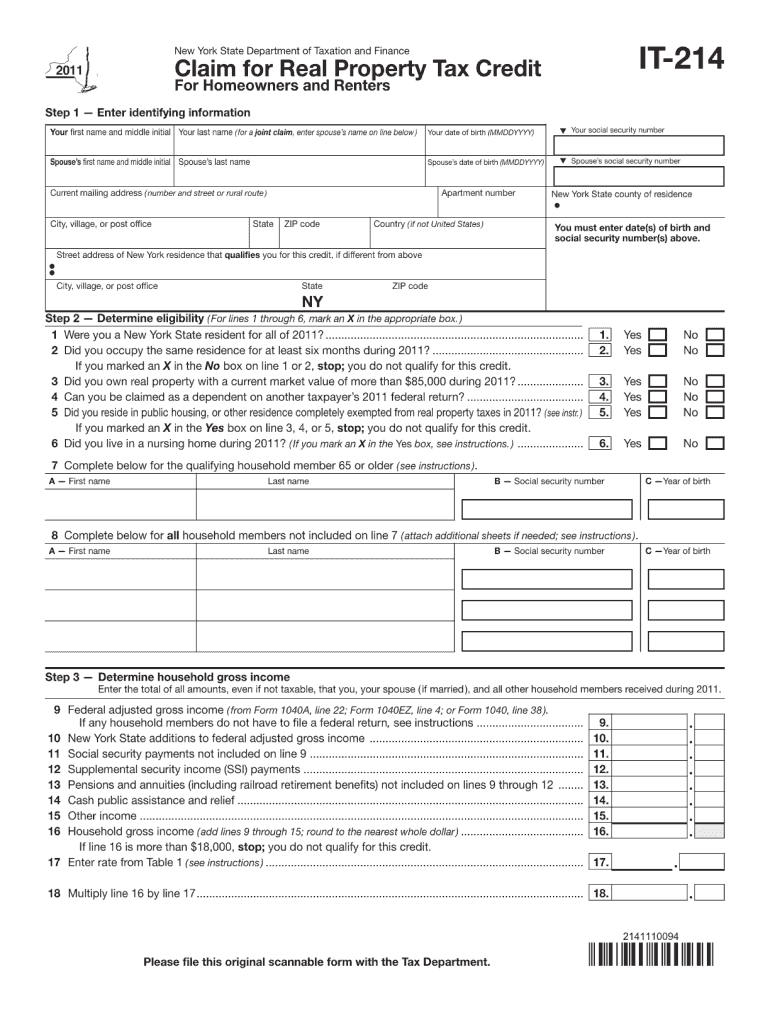

The It214 Form is a tax document used in the United States, specifically for claiming certain tax credits and deductions. It is often utilized by individuals and families to report eligibility for benefits related to property tax exemptions or credits. Understanding the purpose of this form is essential for taxpayers seeking to maximize their tax benefits.

How to use the It214 Form

Using the It214 Form involves several steps to ensure accurate completion and submission. Taxpayers should first gather all necessary documentation, such as income statements and property information. Once all relevant data is collected, the form can be filled out, ensuring that all sections are completed accurately. After filling out the form, it should be submitted according to the guidelines set by the relevant state tax authority.

Steps to complete the It214 Form

Completing the It214 Form requires careful attention to detail. Here are the steps to follow:

- Gather required documents, including proof of income and property ownership.

- Fill out personal information, including your name, address, and Social Security number.

- Provide details about the property for which you are claiming the credit.

- Calculate the eligible credit amount based on the instructions provided.

- Review the completed form for accuracy before submission.

Legal use of the It214 Form

The legal use of the It214 Form is governed by state tax laws. It is important for taxpayers to understand that submitting this form accurately is crucial for compliance. Misrepresentation or errors could lead to penalties or denial of claimed benefits. Therefore, ensuring that all information is truthful and complete is essential for legal compliance.

Key elements of the It214 Form

The It214 Form contains several key elements that must be accurately reported. These include:

- Taxpayer identification information, such as name and Social Security number.

- Details about the property, including address and type of property.

- Income information to determine eligibility for credits.

- Calculation of the credit amount being claimed.

Filing Deadlines / Important Dates

Filing deadlines for the It214 Form vary by state and are typically aligned with the overall tax filing deadlines. It is crucial for taxpayers to be aware of these dates to avoid late penalties. Generally, the form must be submitted by the tax filing deadline, which is usually April fifteenth for most taxpayers. Checking with local tax authorities for specific deadlines is recommended.

Eligibility Criteria

Eligibility for using the It214 Form often depends on several factors, including income level, property ownership status, and specific state regulations. Taxpayers must meet these criteria to qualify for the credits or deductions being claimed. It is advisable to review the eligibility requirements carefully before completing the form to ensure compliance and maximize potential benefits.

Quick guide on how to complete it214 2011 form

Complete It214 Form effortlessly on any device

Online document administration has surged in popularity among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, as you can locate the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Handle It214 Form on any platform with airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to edit and eSign It214 Form without hassle

- Locate It214 Form and click Get Form to begin.

- Use the tools we provide to complete your document.

- Emphasize important sections of the documents or conceal sensitive information with tools that airSlate SignNow offers specifically for such tasks.

- Create your signature with the Sign feature, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and then click the Done button to save your modifications.

- Select how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign It214 Form and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct it214 2011 form

Create this form in 5 minutes!

How to create an eSignature for the it214 2011 form

The way to generate an eSignature for your PDF file online

The way to generate an eSignature for your PDF file in Google Chrome

How to make an eSignature for signing PDFs in Gmail

The best way to generate an eSignature straight from your mobile device

The way to create an electronic signature for a PDF file on iOS

The best way to generate an eSignature for a PDF document on Android devices

People also ask

-

What is the It214 Form?

The It214 Form, also known as the New York City resident income tax return, is a document used by residents to report their income and calculate their tax liability. It is an essential form for individuals living in New York City, ensuring compliance with local tax regulations.

-

How can I fill out the It214 Form using airSlate SignNow?

With airSlate SignNow, you can easily fill out the It214 Form digitally. Our platform provides tools to annotate, sign, and share documents securely, making the process simple and efficient.

-

Is airSlate SignNow a cost-effective solution for managing the It214 Form?

Yes, airSlate SignNow offers a cost-effective solution for managing the It214 Form and other documents. Our pricing plans are designed to accommodate businesses of all sizes, providing value through our comprehensive eSignature and document management features.

-

What are the key features of airSlate SignNow for the It214 Form?

Key features of airSlate SignNow for the It214 Form include electronic signatures, document templates, and real-time collaboration. These features streamline the completion of your tax form and enhance overall productivity.

-

How does airSlate SignNow enhance the security of my It214 Form?

airSlate SignNow prioritizes your security with bank-level encryption and secure cloud storage. This ensures that your It214 Form and other sensitive documents are protected against unauthorized access.

-

Can I integrate airSlate SignNow with other applications for managing the It214 Form?

Yes, airSlate SignNow easily integrates with various applications like Google Drive and Dropbox, allowing you to manage your It214 Form efficiently. This integration helps streamline your workflow and keep all your documents organized.

-

What are the benefits of using airSlate SignNow for tax forms like the It214 Form?

Using airSlate SignNow for tax forms like the It214 Form allows for quicker processing and improved accuracy. The platform minimizes errors by enabling users to fill out and sign documents electronically, saving you time and reducing stress during tax season.

Get more for It214 Form

Find out other It214 Form

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy

- How To Electronic signature Nevada Acknowledgement Letter

- Electronic signature New Jersey Acknowledgement Letter Free

- Can I eSignature Oregon Direct Deposit Enrollment Form

- Electronic signature Colorado Attorney Approval Later

- How To Electronic signature Alabama Unlimited Power of Attorney

- Electronic signature Arizona Unlimited Power of Attorney Easy

- Can I Electronic signature California Retainer Agreement Template

- How Can I Electronic signature Missouri Unlimited Power of Attorney

- Electronic signature Montana Unlimited Power of Attorney Secure

- Electronic signature Missouri Unlimited Power of Attorney Fast

- Electronic signature Ohio Unlimited Power of Attorney Easy

- How Can I Electronic signature Oklahoma Unlimited Power of Attorney