Form 540 Instructions 2019

What is the Form 540 Instructions

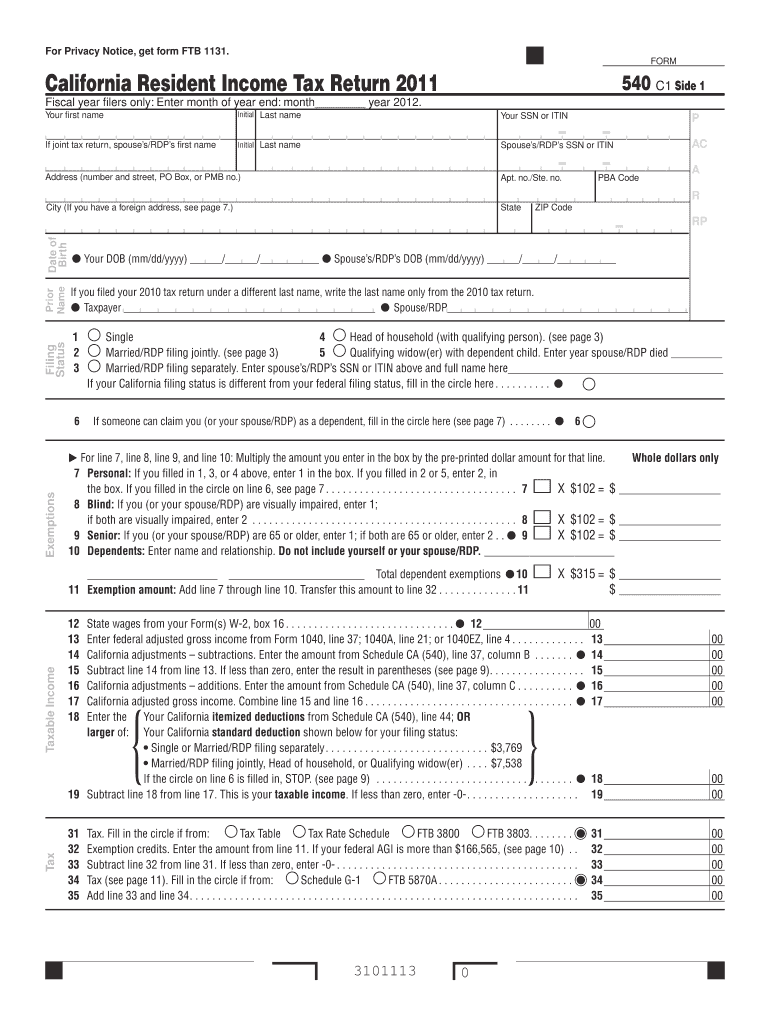

The Form 540 instructions provide detailed guidance for individuals filing their California state income tax returns using the CA 540 form. This form is primarily for residents of California and is essential for reporting income, calculating tax liabilities, and claiming any applicable credits or deductions. Understanding the instructions is crucial for ensuring compliance with state tax laws and for maximizing potential refunds or minimizing tax obligations.

Steps to Complete the Form 540 Instructions

Completing the CA 540 form involves several key steps:

- Gather necessary documents, including W-2s, 1099s, and any other income statements.

- Determine your filing status, which can affect your tax rate and eligibility for certain credits.

- Report all sources of income accurately, including wages, interest, and dividends.

- Calculate adjustments to income, such as contributions to retirement accounts or student loan interest.

- Claim deductions and credits, ensuring you meet the eligibility criteria for each.

- Review your calculations for accuracy before signing and dating the form.

Required Documents

When preparing to fill out the CA 540 form, it is essential to have the following documents ready:

- W-2 forms from employers

- 1099 forms for any freelance or contract work

- Records of other income, such as rental income or investment earnings

- Documentation for deductions, like mortgage interest statements or medical expenses

- Tax identification numbers for dependents

Form Submission Methods

The CA 540 form can be submitted in several ways, providing flexibility for taxpayers:

- Online: File electronically through the California Franchise Tax Board's website or authorized e-filing services.

- By Mail: Print the completed form and send it to the appropriate address based on your location and whether you are expecting a refund or owe taxes.

- In-Person: Visit a local tax office or community center that offers tax assistance for direct submission.

Filing Deadlines / Important Dates

Being aware of filing deadlines is crucial to avoid penalties. For the CA 540 form, the standard deadline is typically April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. Extensions may be available, but it is important to file any necessary forms to avoid late fees.

Legal Use of the Form 540 Instructions

The CA 540 form and its instructions are legally binding documents required for compliance with California tax laws. Proper use of these instructions ensures that taxpayers accurately report their income and calculate their tax liabilities. Failing to adhere to the guidelines may result in penalties, audits, or other legal consequences. It is essential to use the most current version of the form and instructions, as tax laws can change annually.

Quick guide on how to complete 2016 form 540 instructions

Complete Form 540 Instructions effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an excellent environmentally friendly substitute for traditional printed and signed paperwork, as you can locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents quickly without delays. Manage Form 540 Instructions on any device with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and eSign Form 540 Instructions with ease

- Locate Form 540 Instructions and click Get Form to begin.

- Utilize the provided tools to complete your form.

- Highlight important sections of the documents or obscure sensitive information using the tools that airSlate SignNow specifically provides for such purposes.

- Create your eSignature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional handwritten signature.

- Review the details and then click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, or invite link, or download it to your computer.

Forget about lost or damaged documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from your preferred device. Edit and eSign Form 540 Instructions and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2016 form 540 instructions

Create this form in 5 minutes!

How to create an eSignature for the 2016 form 540 instructions

The best way to generate an electronic signature for your PDF file online

The best way to generate an electronic signature for your PDF file in Google Chrome

The way to make an eSignature for signing PDFs in Gmail

The way to make an electronic signature from your mobile device

The way to make an electronic signature for a PDF file on iOS

The way to make an electronic signature for a PDF file on Android devices

People also ask

-

What is the ca 540 form?

The CA 540 form is a state income tax return used by California residents to report their income, deductions, and credits. This form allows taxpayers to calculate their state tax liability for a given year and ensure compliance with California tax laws.

-

How does airSlate SignNow help with the ca 540 form?

airSlate SignNow streamlines the process of completing and signing the CA 540 form by providing an easy-to-use digital platform. Our eSigning solution allows you to fill out the form electronically and collect signatures securely, making the tax filing process more efficient.

-

Is airSlate SignNow compliant with California tax regulations when handling the ca 540 form?

Yes, airSlate SignNow is designed to comply with California state regulations, ensuring that the handling of the CA 540 form meets legal requirements. Our platform incorporates robust security measures to protect sensitive information throughout the eSigning process.

-

What are the pricing options for using airSlate SignNow with the ca 540 form?

airSlate SignNow offers competitive pricing plans that are designed to be budget-friendly for businesses of all sizes. You can choose from different subscription tiers based on your usage needs, making it a cost-effective solution for managing the CA 540 form and other documents.

-

Can I integrate airSlate SignNow with other tools for the ca 540 form?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, allowing you to link your workflow and enhance productivity while managing the CA 540 form. Whether using CRM systems, cloud storage or productivity tools, our integrations meet diverse business needs.

-

Are there any benefits to using airSlate SignNow for the ca 540 form over traditional methods?

Using airSlate SignNow for the CA 540 form offers numerous benefits, including time savings, increased security, and easier document management. ESigning eliminates the hassle of printing, scanning, and mailing, making the entire process faster and more efficient.

-

What features does airSlate SignNow offer for the ca 540 form?

airSlate SignNow includes features such as templates, automated reminders, and real-time tracking that can simplify the completion of the CA 540 form. These features help users stay organized and ensure timely submission without the usual paperwork hassles.

Get more for Form 540 Instructions

Find out other Form 540 Instructions

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online

- Can I Sign Oklahoma Doctors LLC Operating Agreement

- Sign South Dakota Doctors LLC Operating Agreement Safe

- Sign Texas Doctors Moving Checklist Now

- Sign Texas Doctors Residential Lease Agreement Fast

- Sign Texas Doctors Emergency Contact Form Free

- Sign Utah Doctors Lease Agreement Form Mobile

- Sign Virginia Doctors Contract Safe

- Sign West Virginia Doctors Rental Lease Agreement Free

- Sign Alabama Education Quitclaim Deed Online

- Sign Georgia Education Business Plan Template Now

- Sign Louisiana Education Business Plan Template Mobile