St809 2020

What is the ST-809?

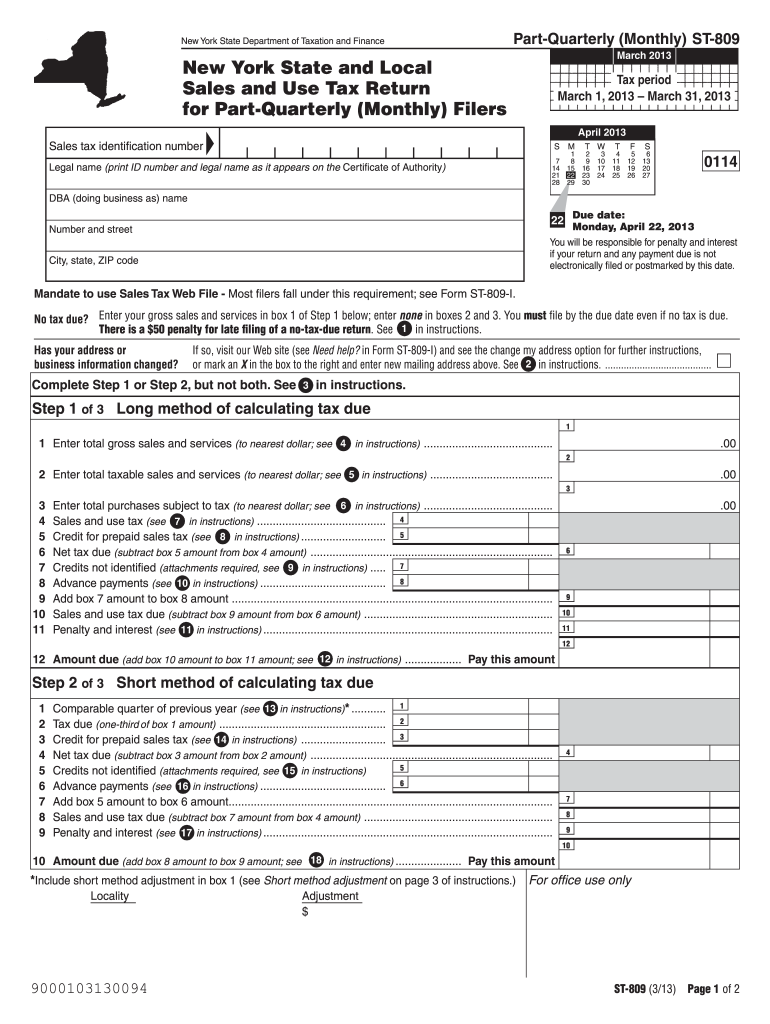

The ST-809 form is a crucial document used in various business transactions, particularly in the state of New York. It serves as a sales tax exemption certificate, allowing eligible organizations to make tax-exempt purchases. This form is typically utilized by non-profit organizations, government entities, and certain educational institutions. Understanding the purpose of the ST-809 is essential for businesses looking to comply with tax regulations while maximizing their financial resources.

How to Obtain the ST-809

To obtain the ST-809 form, individuals or organizations can visit the official New York State Department of Taxation and Finance website. The form is available for download in a fillable PDF format, making it easy to complete electronically. It is important to ensure that the form is filled out accurately to avoid any delays in processing. Additionally, organizations may need to provide supporting documentation to validate their eligibility for tax exemption.

Steps to Complete the ST-809

Completing the ST-809 form involves several key steps:

- Begin by entering the name and address of the purchaser, ensuring all details are accurate.

- Indicate the type of organization applying for the exemption, such as a non-profit or government entity.

- Provide the reason for the exemption, citing the relevant tax laws.

- Sign and date the form to certify the information provided is true and accurate.

Once completed, the form should be submitted to the vendor from whom the purchase is being made to ensure the tax exemption is applied correctly.

Legal Use of the ST-809

The ST-809 form is legally binding when filled out and submitted correctly. It must be used in accordance with New York State tax laws, which outline the eligibility criteria for tax exemption. Misuse of the form, such as submitting it without proper justification, can lead to penalties. Therefore, it is crucial for organizations to understand their eligibility and ensure compliance with all applicable regulations when utilizing the ST-809.

Key Elements of the ST-809

Several key elements define the ST-809 form:

- Purchaser Information: Accurate details about the organization claiming the exemption.

- Type of Exemption: Specification of the nature of the organization and the reason for the exemption.

- Signature: A valid signature from an authorized representative of the organization, confirming the information's accuracy.

These elements are essential for the form's validity and must be completed with care to ensure compliance with tax regulations.

Examples of Using the ST-809

Organizations often use the ST-809 form in various scenarios, such as:

- A non-profit organization purchasing supplies for an event, ensuring they do not incur sales tax.

- A government agency acquiring equipment for public service, utilizing the exemption to reduce costs.

- An educational institution purchasing materials for student use, allowing them to allocate funds more effectively.

These examples illustrate the practical applications of the ST-809, highlighting its importance in facilitating tax-exempt purchases for eligible entities.

Quick guide on how to complete st809

Effortlessly complete St809 on any device

Managing documents online has gained popularity among organizations and individuals alike. It serves as an excellent eco-friendly substitute for traditional printed and signed documents, as you can easily locate the required form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Handle St809 on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to edit and eSign St809 with ease

- Locate St809 and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight pertinent sections of your documents or redact sensitive information using tools specifically provided by airSlate SignNow for this purpose.

- Create your eSignature with the Sign feature, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or errors necessitating the printing of new document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device of your choice. Edit and eSign St809 and guarantee outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct st809

Create this form in 5 minutes!

How to create an eSignature for the st809

The way to generate an eSignature for a PDF in the online mode

The way to generate an eSignature for a PDF in Chrome

How to create an eSignature for putting it on PDFs in Gmail

The best way to generate an eSignature right from your smart phone

The way to create an eSignature for a PDF on iOS devices

The best way to generate an eSignature for a PDF on Android OS

People also ask

-

What is st809 and how does it work with airSlate SignNow?

The st809 is a unique document template within airSlate SignNow designed to streamline eSigning. It simplifies the process of sending and signing documents electronically, allowing businesses to enhance their workflow efficiently. By using st809, users can ensure that all necessary information is collected and validated seamlessly.

-

How much does airSlate SignNow with st809 cost?

Pricing for airSlate SignNow including the st809 document template varies depending on the plan selected. We offer competitive pricing tiers to suit different business needs, ensuring affordability while providing comprehensive features. For specific pricing details, visit our pricing page or contact our sales team directly.

-

What features does the st809 template offer?

The st809 template within airSlate SignNow includes customizable fields, automated workflows, and secure electronic signatures. These features ensure that your documents meet compliance standards while also being user-friendly. Additionally, st809 enhances collaboration by allowing multiple parties to sign and fill out documents effortlessly.

-

Can I integrate st809 with other applications?

Yes, airSlate SignNow supports integration with various applications including CRM and document management systems. The st809 template can be seamlessly integrated into existing workflows to improve efficiency. This capability allows users to connect their favorite tools and utilize st809 as part of a cohesive system.

-

What are the benefits of using airSlate SignNow with st809?

Using airSlate SignNow with the st809 template provides numerous benefits, including faster document turnaround times and enhanced customer satisfaction. It minimizes paper usage, contributing to a more sustainable business model. Furthermore, st809 helps eliminate errors, ensuring a smooth signing process for all parties involved.

-

Is it easy to use the st809 document template?

Absolutely! The st809 document template is designed for simplicity and ease of use. With its intuitive interface, users can easily create, customize, and send documents for signatures without needing extensive training or technical expertise.

-

What industries commonly use st809 with airSlate SignNow?

The st809 template is used across various industries including real estate, healthcare, and education. Businesses in these sectors appreciate the streamlined processes offered by airSlate SignNow, particularly when dealing with contracts, consent forms, and other critical documents. The flexibility of st809 adapts to various needs across these industries.

Get more for St809

Find out other St809

- eSign Wyoming Shareholder Agreement Template Safe

- eSign Kentucky Strategic Alliance Agreement Secure

- Can I eSign Alaska Equipment Rental Agreement Template

- eSign Michigan Equipment Rental Agreement Template Later

- Help Me With eSignature Washington IOU

- eSign Indiana Home Improvement Contract Myself

- eSign North Dakota Architectural Proposal Template Online

- How To eSignature Alabama Mechanic's Lien

- Can I eSign Alabama Car Insurance Quotation Form

- eSign Florida Car Insurance Quotation Form Mobile

- eSign Louisiana Car Insurance Quotation Form Online

- Can I eSign Massachusetts Car Insurance Quotation Form

- eSign Michigan Car Insurance Quotation Form Online

- eSign Michigan Car Insurance Quotation Form Mobile

- eSignature Massachusetts Mechanic's Lien Online

- eSignature Massachusetts Mechanic's Lien Free

- eSign Ohio Car Insurance Quotation Form Mobile

- eSign North Dakota Car Insurance Quotation Form Online

- eSign Pennsylvania Car Insurance Quotation Form Mobile

- eSignature Nevada Mechanic's Lien Myself