Sc1041 Form 2019

What is the Sc1041 Form

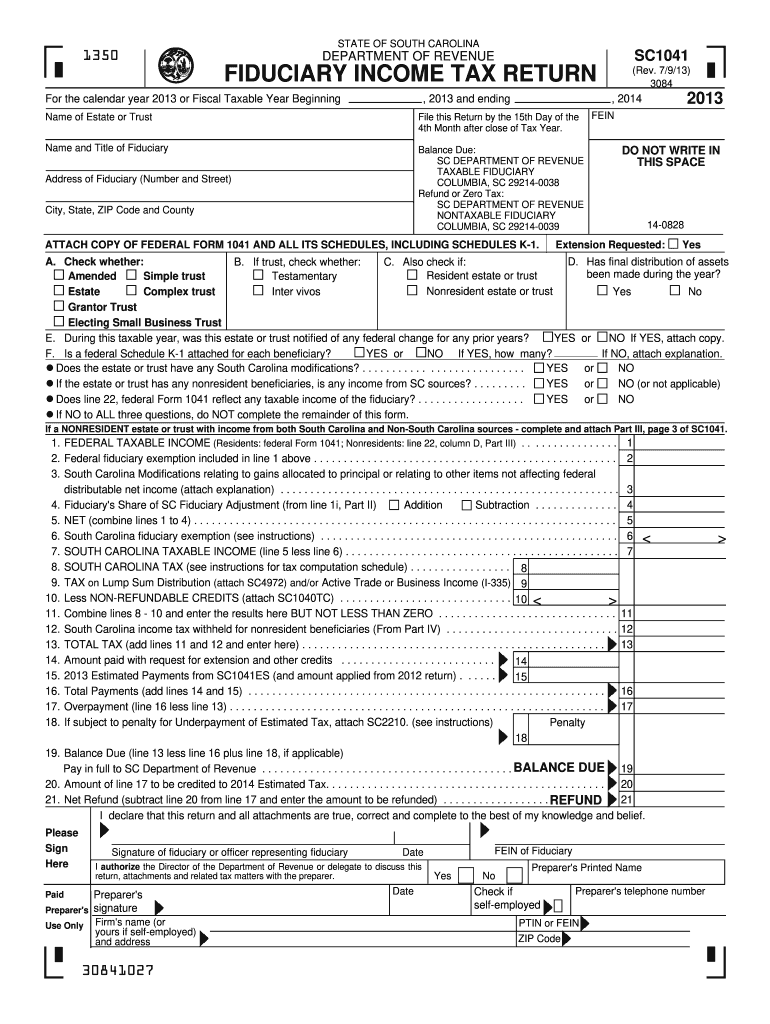

The Sc1041 Form is a tax document used in the United States for reporting income generated by estates and trusts. This form allows fiduciaries to report the income, deductions, and credits of the estate or trust, ensuring compliance with federal tax regulations. It is essential for accurately calculating the tax liability associated with the income earned during the tax year. Understanding the purpose and requirements of the Sc1041 Form is crucial for fiduciaries managing estates or trusts.

Steps to complete the Sc1041 Form

Completing the Sc1041 Form involves several key steps that ensure accuracy and compliance. First, gather all necessary financial documents related to the estate or trust, including income statements, expense records, and previous tax returns. Next, fill out the form by providing detailed information about the income earned, deductions claimed, and any distributions made to beneficiaries. It is important to review the form for accuracy and completeness before submission. Finally, ensure that you sign and date the form, as an unsigned form may be considered invalid.

How to obtain the Sc1041 Form

The Sc1041 Form can be obtained from the Internal Revenue Service (IRS) website or through tax preparation software that includes IRS forms. It is advisable to download the most recent version to ensure compliance with current tax laws. Additionally, tax professionals can provide assistance in obtaining and completing the form, especially for those unfamiliar with tax regulations.

Legal use of the Sc1041 Form

The Sc1041 Form is legally binding when completed and submitted according to IRS regulations. To ensure its legal validity, the form must be filled out accurately, reflecting all income and deductions associated with the estate or trust. Furthermore, the fiduciary must sign the form, affirming the truthfulness of the information provided. Compliance with federal tax laws is essential to avoid penalties and ensure that the estate or trust meets its tax obligations.

Filing Deadlines / Important Dates

Filing deadlines for the Sc1041 Form are typically aligned with the tax year of the estate or trust. Generally, the form must be filed by the fifteenth day of the fourth month following the close of the tax year. For estates and trusts operating on a calendar year, this means the form is due by April fifteenth. It is crucial to be aware of these deadlines to avoid late filing penalties and ensure timely compliance with tax obligations.

Key elements of the Sc1041 Form

The Sc1041 Form contains several key elements that are essential for accurate reporting. These elements include sections for reporting income from various sources, such as interest, dividends, and capital gains. Additionally, the form includes areas for claiming deductions related to expenses incurred by the estate or trust. Understanding these components is vital for fiduciaries to ensure that all relevant financial information is reported correctly, thereby minimizing tax liability.

Examples of using the Sc1041 Form

Examples of using the Sc1041 Form can illustrate its practical applications. For instance, if an estate generates rental income, the fiduciary must report this income on the form, along with any associated expenses, such as property management fees or maintenance costs. Another example includes reporting capital gains from the sale of estate assets. These examples highlight the importance of accurately documenting all financial activities related to the estate or trust on the Sc1041 Form.

Quick guide on how to complete sc1041 2013 form

Effortlessly Prepare Sc1041 Form on Any Device

Digital document management has become increasingly popular among organizations and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools you need to create, modify, and electronically sign your documents quickly without any holdups. Manage Sc1041 Form on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centered process today.

How to Modify and Electronically Sign Sc1041 Form with Ease

- Locate Sc1041 Form and click on Get Form to begin.

- Utilize the tools provided to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review all the details and click the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form navigation, or errors that necessitate reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Sc1041 Form and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct sc1041 2013 form

Create this form in 5 minutes!

How to create an eSignature for the sc1041 2013 form

How to create an electronic signature for your PDF in the online mode

How to create an electronic signature for your PDF in Chrome

How to generate an electronic signature for putting it on PDFs in Gmail

How to create an eSignature straight from your smart phone

How to create an electronic signature for a PDF on iOS devices

How to create an eSignature for a PDF document on Android OS

People also ask

-

What is the SC1041 Form and why is it important?

The SC1041 Form is a crucial document used for reporting specific tax-related information in South Carolina. Businesses use this form to ensure compliance with state tax regulations, making it essential for accurate reporting and avoiding penalties.

-

How can airSlate SignNow help me with the SC1041 Form?

airSlate SignNow allows users to easily create, send, and eSign the SC1041 Form digitally. This platform streamlines the process, ensuring you can manage important documents efficiently without the hassle of traditional paperwork.

-

What features does airSlate SignNow offer for managing documents like the SC1041 Form?

airSlate SignNow offers features such as customizable templates, secure eSignature options, and automated workflows. These tools simplify the management of documents like the SC1041 Form, making it easier to ensure everything is filled out correctly and submitted on time.

-

Is airSlate SignNow cost-effective for businesses needing to file the SC1041 Form?

Yes, airSlate SignNow provides a cost-effective solution for businesses requiring to file the SC1041 Form. With various pricing plans available, you can choose an option that fits your budget while gaining access to powerful document management tools.

-

Can I integrate airSlate SignNow with other software for the SC1041 Form?

Absolutely! airSlate SignNow offers integrations with numerous third-party applications, allowing seamless data transfer and management of the SC1041 Form. This ensures that your workflow remains efficient and organized irrespective of the tools you already use.

-

What are the security measures in place when using airSlate SignNow for the SC1041 Form?

When using airSlate SignNow for the SC1041 Form, your data is protected with industry-standard encryption and secure storage. Their platform prioritizes security, ensuring that sensitive information remains confidential and secure throughout the signing process.

-

How long does it take to get the SC1041 Form signed through airSlate SignNow?

Using airSlate SignNow signNowly speeds up the signing process for the SC1041 Form. Most transactions can be completed within minutes, allowing you to submit your documents without delay.

Get more for Sc1041 Form

- Santa contract form

- Orientation packet template form

- Application for notary public commission cnmi office of the oagcnmi form

- Staff record form fill and sign printable template onlineus legal

- Wisconsin and child support form

- Building inspection report licensed child care centers dcf f cfs2344 e form

- Jamaica social investment fund form

- Httpsapply07 grants govapplyformsschemas

Find out other Sc1041 Form

- How Can I Electronic signature Massachusetts Sports Presentation

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word

- How To Electronic signature Colorado Courts Form

- How To Electronic signature Colorado Courts Presentation

- Can I Electronic signature Connecticut Courts PPT

- Can I Electronic signature Delaware Courts Document

- How Do I Electronic signature Illinois Courts Document

- How To Electronic signature Missouri Courts Word

- How Can I Electronic signature New Jersey Courts Document

- How Can I Electronic signature New Jersey Courts Document

- Can I Electronic signature Oregon Sports Form

- How To Electronic signature New York Courts Document

- How Can I Electronic signature Oklahoma Courts PDF

- How Do I Electronic signature South Dakota Courts Document

- Can I Electronic signature South Dakota Sports Presentation

- How To Electronic signature Utah Courts Document

- Can I Electronic signature West Virginia Courts PPT

- Send Sign PDF Free