Sc1040 Staples Form 2019

What is the Sc1040 Staples Form

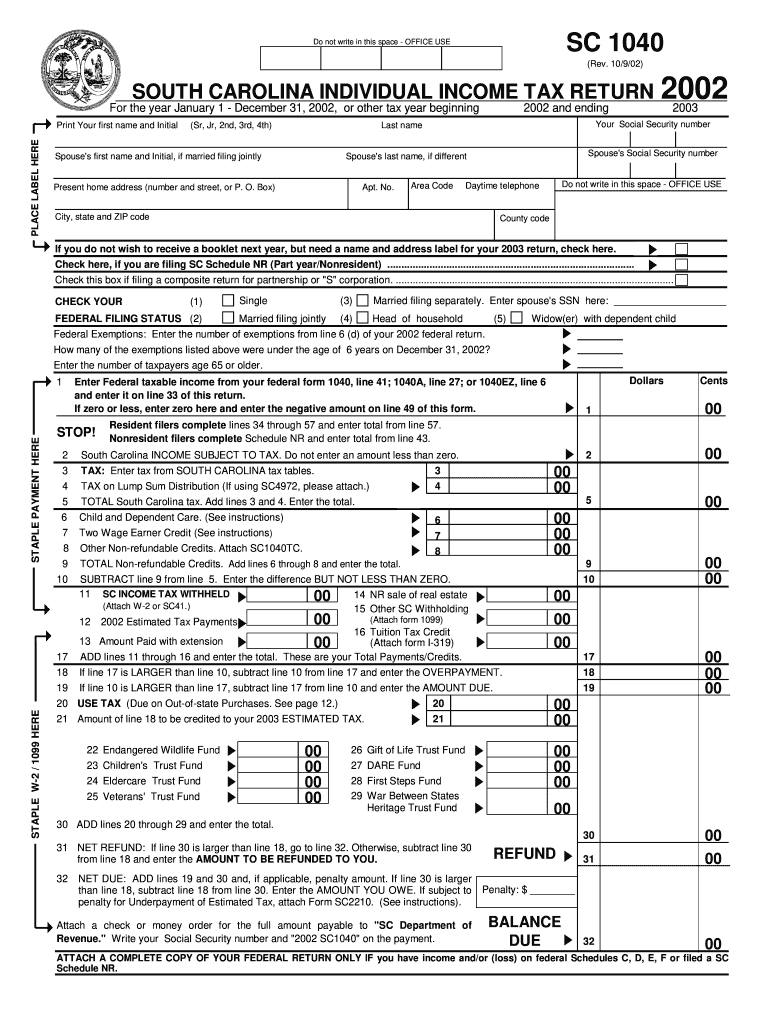

The Sc1040 Staples Form is a tax document used primarily by individuals and businesses in the United States to report income, claim deductions, and calculate tax liability. This form is essential for ensuring compliance with federal tax regulations. It allows taxpayers to provide detailed information regarding their financial activities during the tax year, including wages, interest, dividends, and other sources of income. Understanding the purpose of this form is crucial for accurate tax reporting and avoiding potential penalties.

How to use the Sc1040 Staples Form

Using the Sc1040 Staples Form involves several key steps that ensure accurate completion and submission. First, gather all necessary financial documents, such as W-2s, 1099s, and other income statements. Next, carefully fill out the form by entering your personal information, income details, and any applicable deductions or credits. It is important to double-check all entries for accuracy. Once completed, the form can be submitted electronically or by mail, depending on your preference and the specific requirements of the IRS.

Steps to complete the Sc1040 Staples Form

Completing the Sc1040 Staples Form requires a systematic approach to ensure all information is accurately reported. Follow these steps:

- Gather all necessary documents, including income statements and previous tax returns.

- Fill in your personal information, such as name, address, and Social Security number.

- Report all sources of income, including wages, self-employment income, and investment earnings.

- Claim eligible deductions and credits to reduce your taxable income.

- Review the completed form for any errors or omissions.

- Submit the form electronically or print and mail it to the appropriate IRS address.

Legal use of the Sc1040 Staples Form

The Sc1040 Staples Form is legally recognized as a valid document for tax reporting in the United States. To ensure its legal standing, it must be completed accurately and submitted within the designated deadlines. Additionally, electronic signatures on the form are permissible under the ESIGN Act, provided that the signer has consented to use electronic records. Maintaining compliance with IRS regulations is essential to avoid penalties and ensure that the form is accepted without issues.

Filing Deadlines / Important Dates

Filing deadlines for the Sc1040 Staples Form are crucial for taxpayers to meet to avoid penalties. Typically, the deadline for submitting this form is April fifteenth of each year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be aware of any extensions that may be available, allowing additional time to file. Keeping track of these important dates helps ensure timely compliance with tax obligations.

Required Documents

To complete the Sc1040 Staples Form accurately, several documents are required. These may include:

- W-2 forms from employers, detailing wages and tax withholdings.

- 1099 forms for any freelance or contract work.

- Records of other income sources, such as interest or dividends.

- Receipts and documentation for deductions, such as medical expenses or charitable contributions.

- Previous year’s tax return for reference.

Form Submission Methods (Online / Mail / In-Person)

The Sc1040 Staples Form can be submitted through various methods, providing flexibility for taxpayers. The most common submission methods include:

- Online submission through the IRS e-file system, which is secure and efficient.

- Mailing a printed copy of the form to the appropriate IRS address, ensuring it is postmarked by the deadline.

- In-person submission at designated IRS offices, although this option may require an appointment.

Quick guide on how to complete sc1040 staples 2002 form

Manage Sc1040 Staples Form effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the tools needed to create, edit, and electronically sign your documents promptly without any delays. Handle Sc1040 Staples Form on any device using airSlate SignNow's Android or iOS applications and streamline any document-related procedure today.

How to alter and electronically sign Sc1040 Staples Form with ease

- Find Sc1040 Staples Form and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of the documents or obscure sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Choose your preferred method to submit your form, via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form hunting, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from a device of your choosing. Modify and electronically sign Sc1040 Staples Form and ensure effective communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct sc1040 staples 2002 form

Create this form in 5 minutes!

How to create an eSignature for the sc1040 staples 2002 form

The best way to create an electronic signature for a PDF in the online mode

The best way to create an electronic signature for a PDF in Chrome

How to create an eSignature for putting it on PDFs in Gmail

The best way to generate an eSignature right from your smart phone

The way to create an eSignature for a PDF on iOS devices

The best way to generate an eSignature for a PDF on Android OS

People also ask

-

What is the Sc1040 Staples Form and why is it important?

The Sc1040 Staples Form is a crucial document used for tax filing purposes. It provides taxpayers with essential information required for filing their state income tax returns accurately. Utilizing the Sc1040 Staples Form ensures compliance and can help in avoiding penalties.

-

How can airSlate SignNow help with the Sc1040 Staples Form?

airSlate SignNow simplifies the process of completing and eSigning the Sc1040 Staples Form. With our platform, users can quickly fill out, save, and securely send their documents electronically, streamlining tax filing and reducing paperwork hassle.

-

Is there a cost associated with using airSlate SignNow for the Sc1040 Staples Form?

Yes, airSlate SignNow offers competitive pricing options that cater to various business needs. You can select from different plans based on the number of users and features required for managing documents, including the Sc1040 Staples Form.

-

What are the key features of airSlate SignNow in relation to the Sc1040 Staples Form?

AirSlate SignNow provides features such as customizable templates, secure cloud storage, and real-time tracking for the Sc1040 Staples Form. Additionally, our platform supports various file formats, making it easy to integrate different documents into your workflow.

-

Is it easy to integrate airSlate SignNow with other applications when using the Sc1040 Staples Form?

Absolutely! airSlate SignNow offers seamless integration with a wide range of applications, allowing you to work easily with the Sc1040 Staples Form alongside your existing tools. This enhances productivity and streamlines your document management processes.

-

Can I store the completed Sc1040 Staples Form securely in airSlate SignNow?

Yes, airSlate SignNow ensures that all your documents, including the completed Sc1040 Staples Form, are stored securely. Our platform employs high-level security measures, including encryption, to protect your sensitive information.

-

What benefits can I expect from using airSlate SignNow for the Sc1040 Staples Form?

Using airSlate SignNow for the Sc1040 Staples Form provides signNow benefits, such as saving time, reducing paper waste, and improving accuracy in your tax filings. Additionally, the eSigning feature allows for quick approvals and enhances collaboration.

Get more for Sc1040 Staples Form

Find out other Sc1040 Staples Form

- How To eSignature South Carolina Real estate document

- eSignature Florida Real estate investment proposal template Free

- How To eSignature Utah Real estate forms

- How Do I eSignature Washington Real estate investment proposal template

- Can I eSignature Kentucky Performance Contract

- eSignature Nevada Performance Contract Safe

- eSignature California Franchise Contract Secure

- How To eSignature Colorado Sponsorship Proposal Template

- eSignature Alabama Distributor Agreement Template Secure

- eSignature California Distributor Agreement Template Later

- eSignature Vermont General Power of Attorney Template Easy

- eSignature Michigan Startup Cost Estimate Simple

- eSignature New Hampshire Invoice for Services (Standard Format) Computer

- eSignature Arkansas Non-Compete Agreement Later

- Can I eSignature Arizona Non-Compete Agreement

- How Do I eSignature New Jersey Non-Compete Agreement

- eSignature Tennessee Non-Compete Agreement Myself

- How To eSignature Colorado LLC Operating Agreement

- Help Me With eSignature North Carolina LLC Operating Agreement

- eSignature Oregon LLC Operating Agreement Online