Jurisdictions that Impose a Local Income or Earnings Tax on Maryland Residents Form 2019

What is the Jurisdictions That Impose A Local Income Or Earnings Tax On Maryland Residents Form

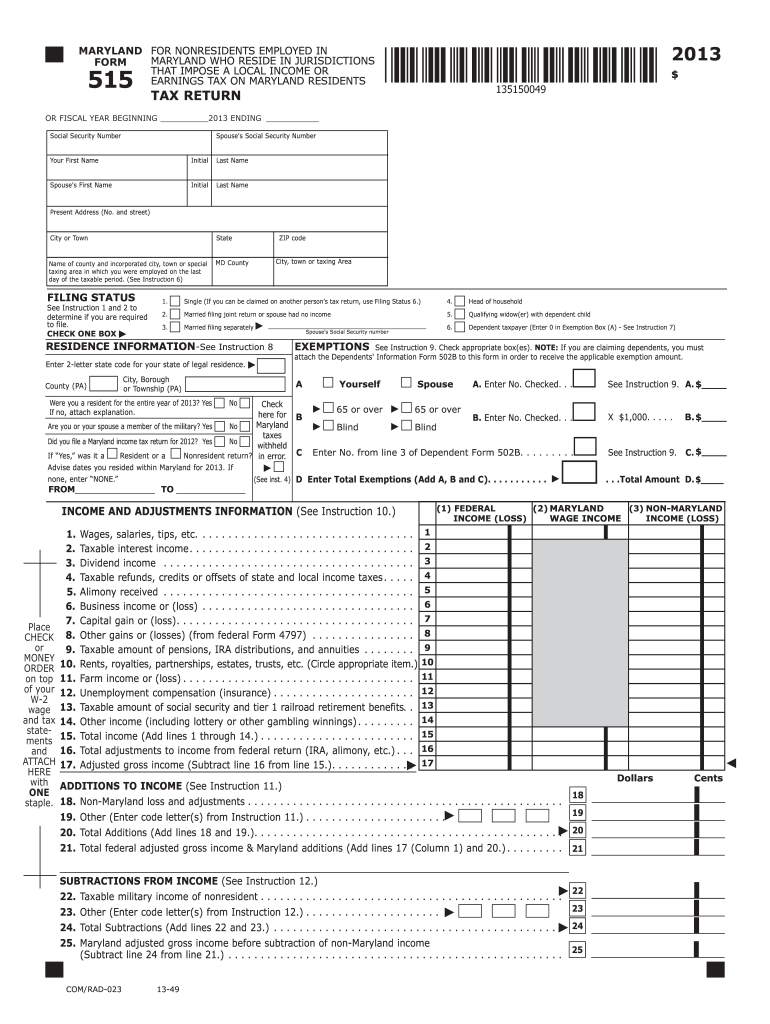

The Jurisdictions That Impose A Local Income Or Earnings Tax On Maryland Residents Form is a crucial document for residents of Maryland who may be subject to local income taxes. This form helps individuals report their earnings and determine their tax obligations based on the specific local jurisdictions they reside in. Local income taxes can vary significantly, and understanding the requirements of this form is essential for accurate tax reporting.

How to use the Jurisdictions That Impose A Local Income Or Earnings Tax On Maryland Residents Form

Using the Jurisdictions That Impose A Local Income Or Earnings Tax On Maryland Residents Form involves several steps. First, gather all necessary financial documents, including W-2 forms and other income statements. Next, identify the local jurisdictions that apply to your residence. Complete the form by accurately entering your income details, ensuring that you adhere to any specific instructions provided for your locality. Once completed, the form can be submitted according to the guidelines set by your local tax authority.

Steps to complete the Jurisdictions That Impose A Local Income Or Earnings Tax On Maryland Residents Form

Completing the Jurisdictions That Impose A Local Income Or Earnings Tax On Maryland Residents Form requires attention to detail. Follow these steps:

- Gather your income documentation, including W-2s and 1099s.

- Identify your local jurisdiction's tax rates and regulations.

- Fill out the form, ensuring all income is reported accurately.

- Review the form for any errors or omissions.

- Submit the form via the method prescribed by your local tax authority.

Legal use of the Jurisdictions That Impose A Local Income Or Earnings Tax On Maryland Residents Form

The Jurisdictions That Impose A Local Income Or Earnings Tax On Maryland Residents Form must be completed in compliance with local tax laws. It serves as an official document that can be used to assess tax liabilities and ensure compliance with local tax regulations. Accurate completion and submission of this form are essential to avoid penalties and ensure that residents fulfill their legal obligations regarding local income taxes.

Key elements of the Jurisdictions That Impose A Local Income Or Earnings Tax On Maryland Residents Form

Key elements of the Jurisdictions That Impose A Local Income Or Earnings Tax On Maryland Residents Form include:

- Personal identification information, such as name and address.

- Details of income earned, including wages and other earnings.

- Specific local jurisdiction information, including tax rates.

- Signature and date to certify the accuracy of the information provided.

Filing Deadlines / Important Dates

Filing deadlines for the Jurisdictions That Impose A Local Income Or Earnings Tax On Maryland Residents Form vary by jurisdiction. It is essential to check with your local tax authority for specific dates. Typically, local income tax forms are due on the same date as federal tax returns, which is usually April fifteenth. However, some jurisdictions may have different deadlines, so staying informed is crucial to avoid late penalties.

Quick guide on how to complete jurisdictions that impose a local income or earnings tax on maryland residents 2013 form

Complete Jurisdictions That Impose A Local Income Or Earnings Tax On Maryland Residents Form effortlessly on any device

Managing documents online has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can obtain the correct format and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents swiftly without delays. Handle Jurisdictions That Impose A Local Income Or Earnings Tax On Maryland Residents Form on any platform with airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest way to modify and eSign Jurisdictions That Impose A Local Income Or Earnings Tax On Maryland Residents Form effortlessly

- Obtain Jurisdictions That Impose A Local Income Or Earnings Tax On Maryland Residents Form and then click Get Form to begin.

- Make use of the tools we offer to complete your form.

- Highlight signNow sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Select how you want to send your form, via email, SMS, invite link, or download it to your computer.

Forget about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Edit and eSign Jurisdictions That Impose A Local Income Or Earnings Tax On Maryland Residents Form and guarantee outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct jurisdictions that impose a local income or earnings tax on maryland residents 2013 form

Create this form in 5 minutes!

How to create an eSignature for the jurisdictions that impose a local income or earnings tax on maryland residents 2013 form

The way to generate an eSignature for your PDF file online

The way to generate an eSignature for your PDF file in Google Chrome

How to make an eSignature for signing PDFs in Gmail

The best way to generate an eSignature straight from your mobile device

The way to create an electronic signature for a PDF file on iOS

The best way to generate an eSignature for a PDF document on Android devices

People also ask

-

What are the jurisdictions that impose a local income or earnings tax on Maryland residents?

The jurisdictions that impose a local income or earnings tax on Maryland residents include various counties and cities in Maryland. These local taxes can vary signNowly depending on where you reside. It's important to check specific rates for each jurisdiction, which can impact your overall tax obligations.

-

How can airSlate SignNow help with local income tax forms?

airSlate SignNow simplifies the process of preparing and signing local income tax forms, including the 'Jurisdictions That Impose A Local Income Or Earnings Tax On Maryland Residents Form.' Our platform allows users to securely eSign documents, ensuring quick and efficient submission to the relevant authorities.

-

Is there a cost associated with using airSlate SignNow for tax-related documents?

Yes, airSlate SignNow offers various pricing plans tailored to meet the needs of individuals and businesses. Whether you are preparing the 'Jurisdictions That Impose A Local Income Or Earnings Tax On Maryland Residents Form' or other documents, you can choose a plan that best fits your budget and usage needs.

-

What features does airSlate SignNow offer for document signing?

airSlate SignNow offers a range of features including electronic signatures, document templates, audit trails, and integrations with popular applications. These features streamline the signing process for forms like the 'Jurisdictions That Impose A Local Income Or Earnings Tax On Maryland Residents Form,' enhancing both security and efficiency.

-

Can airSlate SignNow integrate with other software for smoother workflow?

Yes, airSlate SignNow can seamlessly integrate with various software systems, including CRMs and accounting tools. This integration allows users to manage documents such as the 'Jurisdictions That Impose A Local Income Or Earnings Tax On Maryland Residents Form' directly within their existing workflows, reducing the need for manual data entry and speeding up the process.

-

How secure is the signing process with airSlate SignNow?

The signing process with airSlate SignNow is highly secure, utilizing advanced encryption technologies to protect your documents. This level of security is especially important when dealing with tax documents like the 'Jurisdictions That Impose A Local Income Or Earnings Tax On Maryland Residents Form,' ensuring that your sensitive information remains confidential.

-

Is there a mobile version of airSlate SignNow for on-the-go access?

Yes, airSlate SignNow offers a mobile app that allows users to manage and sign documents anywhere, anytime. This is particularly useful for individuals needing to complete the 'Jurisdictions That Impose A Local Income Or Earnings Tax On Maryland Residents Form' while on the go.

Get more for Jurisdictions That Impose A Local Income Or Earnings Tax On Maryland Residents Form

Find out other Jurisdictions That Impose A Local Income Or Earnings Tax On Maryland Residents Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors