Form 109 2019

What is the Form 109

The Form 109 is a tax document used in the United States to report various types of income and financial information to the Internal Revenue Service (IRS). It is essential for individuals and businesses to accurately complete this form to ensure compliance with federal tax regulations. The Form 109 serves as a record of income received, such as interest, dividends, or other payments, and is typically issued by financial institutions or employers. Understanding the purpose and requirements of the Form 109 is crucial for proper tax filing and reporting.

How to use the Form 109

Using the Form 109 involves several steps to ensure that all necessary information is accurately reported. First, gather all relevant documentation that reflects your income for the tax year. This may include W-2s, 1099s, or other financial statements. Next, fill out the Form 109 with precise details, including your personal information, the income amounts, and any applicable deductions. After completing the form, review it thoroughly for accuracy before submitting it to the IRS. It is important to retain a copy for your records, as it may be needed for future reference or audits.

Steps to complete the Form 109

Completing the Form 109 requires careful attention to detail. Follow these steps for a successful submission:

- Gather all necessary documents, including income statements and previous tax returns.

- Fill in your personal information, such as your name, address, and Social Security number.

- Report all sources of income, ensuring that each amount is accurately recorded.

- Include any applicable deductions or credits that may apply to your situation.

- Double-check all entries for accuracy and completeness.

- Sign and date the form before submission.

Legal use of the Form 109

The legal use of the Form 109 is governed by IRS regulations. To be considered valid, the form must be completed accurately and submitted within the designated deadlines. Electronic submissions are accepted, provided that they comply with eSignature laws and regulations. It is essential to ensure that all reported income is legitimate and that any deductions claimed are supported by appropriate documentation. Failure to comply with these requirements can result in penalties or legal repercussions.

Filing Deadlines / Important Dates

Filing deadlines for the Form 109 are crucial for taxpayers to avoid penalties. Typically, the form must be submitted by April fifteenth of the following tax year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is advisable to check the IRS website for any updates or changes to these deadlines, as they can vary from year to year. Keeping track of important dates ensures timely filing and compliance with tax obligations.

Examples of using the Form 109

There are various scenarios in which the Form 109 is utilized. For instance, a freelance graphic designer may receive a Form 109-NEC from a client for services rendered. Similarly, a retiree may receive a Form 1099-R for distributions from a retirement plan. Each of these examples illustrates the importance of accurately reporting income received throughout the year. Understanding how to use the Form 109 in different contexts can help individuals and businesses maintain compliance and avoid issues with the IRS.

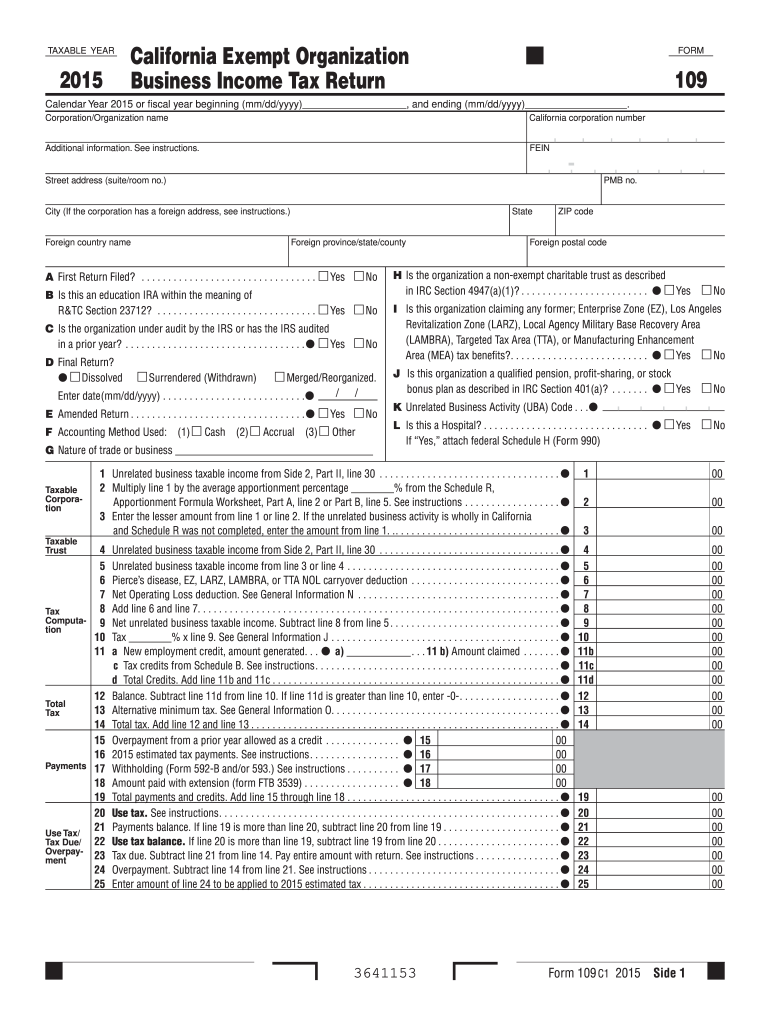

Quick guide on how to complete 2015 form 109

Effortlessly Prepare Form 109 on Any Device

Online document administration has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, as you can easily locate the appropriate form and securely archive it online. airSlate SignNow equips you with all the tools necessary to generate, modify, and electronically sign your documents promptly without delays. Manage Form 109 on any device with the airSlate SignNow applications available for Android or iOS and enhance any document-centric process today.

How to Modify and Electronically Sign Form 109 with Ease

- Find Form 109 and click on Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Emphasize important sections of the documents or redact sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or mislaid files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management requirements in just a few clicks from any device of your choice. Modify and electronically sign Form 109 and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2015 form 109

Create this form in 5 minutes!

How to create an eSignature for the 2015 form 109

The best way to make an electronic signature for a PDF file online

The best way to make an electronic signature for a PDF file in Google Chrome

The best way to create an electronic signature for signing PDFs in Gmail

The way to create an electronic signature from your mobile device

How to generate an eSignature for a PDF file on iOS

The way to create an electronic signature for a PDF file on Android devices

People also ask

-

What is Form 109 and how does it relate to airSlate SignNow?

Form 109 refers to a series of IRS tax forms used to report various information. With airSlate SignNow, you can easily eSign and send Form 109 documents, ensuring compliance and accuracy in your tax reporting.

-

How can airSlate SignNow improve the management of Form 109?

airSlate SignNow offers a streamlined solution for managing Form 109, allowing businesses to create, sign, and send these documents electronically. This efficient process minimizes errors and speeds up the filing process, making it easier to meet deadlines.

-

Is there a cost associated with using airSlate SignNow for Form 109?

Yes, airSlate SignNow offers various pricing plans tailored to fit different business needs. Choosing the right plan can help you optimize your document management processes for Form 109 and ensure you only pay for the features you require.

-

What features does airSlate SignNow offer for handling Form 109?

airSlate SignNow provides features like customizable templates, secure eSigning, and document tracking specifically for Form 109. These tools enhance the accuracy and organization of your tax documents, making compliance stress-free.

-

Can I integrate airSlate SignNow with other software for Form 109 preparation?

Absolutely! airSlate SignNow seamlessly integrates with various accounting and tax software, allowing you to import and manage Form 109 data efficiently. This integration streamlines your workflow and improves overall productivity.

-

How does using airSlate SignNow for Form 109 benefit my business?

Using airSlate SignNow to manage Form 109 offers several benefits, including increased efficiency, reduced paperwork, and enhanced security. It allows your team to digitize tax processes, saving time and resources while ensuring compliance.

-

Is airSlate SignNow user-friendly for those unfamiliar with Form 109?

Yes, airSlate SignNow is designed with user experience in mind, making it easy for those unfamiliar with Form 109 to navigate. Our intuitive interface ensures that users can quickly learn how to create, sign, and send documents with confidence.

Get more for Form 109

Find out other Form 109

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement