540 Form 2019

What is the 540 Form

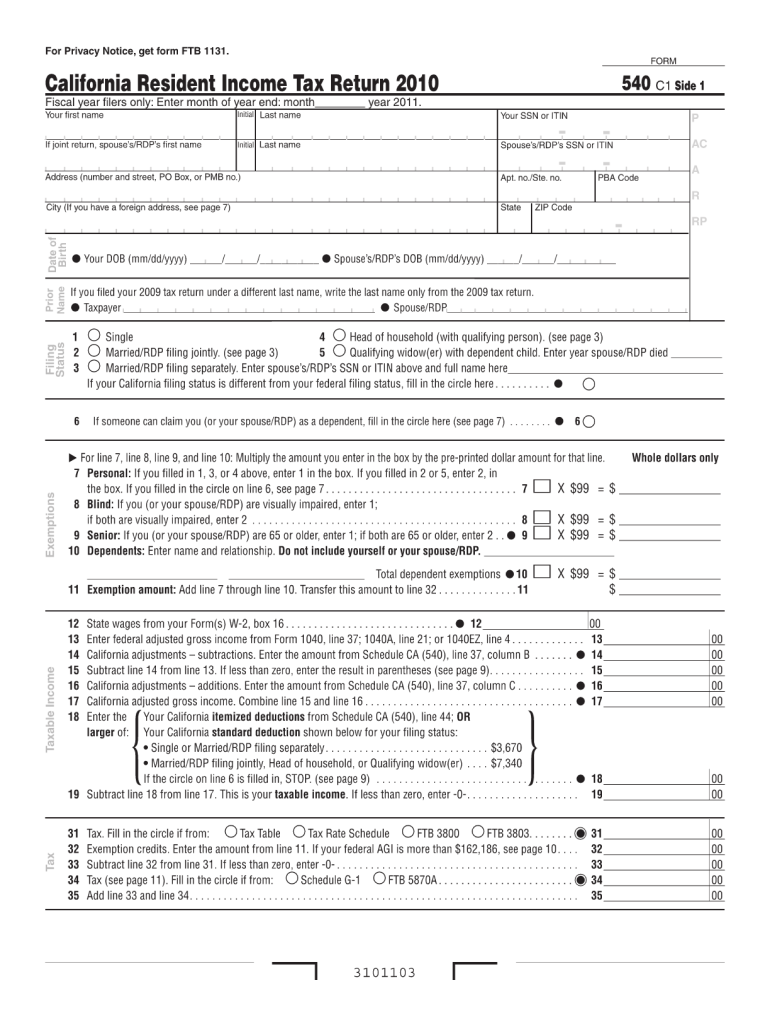

The 540 Form is a tax return document used by residents of California to report their annual income and calculate their state tax liability. This form is essential for individuals who are required to file a state income tax return. It encompasses various income sources, deductions, and credits that can affect the overall tax calculation. Understanding the purpose of the 540 Form is crucial for compliance with state tax laws and for ensuring that taxpayers accurately report their financial information.

How to use the 540 Form

Using the 540 Form involves several steps to ensure that all necessary information is accurately reported. Taxpayers must gather their income statements, such as W-2s and 1099s, along with any documentation for deductions and credits. The form is designed to guide users through the process of entering their income, calculating taxes owed, and claiming any applicable credits. It is important to follow the instructions carefully to avoid errors that could lead to delays in processing or potential penalties.

Steps to complete the 540 Form

Completing the 540 Form requires a systematic approach:

- Gather all necessary documents, including income statements and receipts for deductions.

- Begin by entering personal information, such as name, address, and Social Security number.

- Report all sources of income, ensuring that all figures are accurate and match the documentation.

- Calculate adjustments to income and apply any deductions or credits for which you qualify.

- Complete the tax calculation section, determining the total tax owed or refund due.

- Review the completed form for accuracy before signing and dating it.

Legal use of the 540 Form

The 540 Form must be completed in accordance with California tax laws to be considered legally valid. This includes ensuring that all information provided is truthful and complete. Filing the form by the designated deadlines is also crucial to avoid penalties. The form serves as an official record of income and tax liability, which may be reviewed by the California Franchise Tax Board. Proper use of the form helps maintain compliance with state regulations and can protect taxpayers from legal issues.

Filing Deadlines / Important Dates

Filing deadlines for the 540 Form are critical to ensure timely compliance with state tax obligations. Typically, the deadline for filing is April 15 of each year, coinciding with the federal tax filing deadline. However, if this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be aware of any extensions available and the importance of filing for an extension if they cannot meet the deadline. Keeping track of these dates can help avoid late fees and penalties.

Required Documents

To complete the 540 Form accurately, taxpayers need to gather several key documents:

- W-2 forms from employers reporting wages and taxes withheld.

- 1099 forms for additional income, such as freelance work or interest earned.

- Documentation for deductions, including mortgage interest statements and medical expenses.

- Records of any tax credits claimed, such as education credits or energy efficiency credits.

Having these documents readily available simplifies the filing process and ensures that all income and deductions are accurately reported.

Form Submission Methods

The 540 Form can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online submission through the California Franchise Tax Board's e-file system, which is often the fastest method.

- Mailing a paper copy of the completed form to the appropriate address specified by the Franchise Tax Board.

- In-person submission at designated tax offices, which may be available during tax season.

Choosing the right submission method can impact the processing time and the speed at which any potential refunds are received.

Quick guide on how to complete 540 form 2010

Effortlessly Complete 540 Form on Any Device

The management of online documents has gained signNow traction among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Manage 540 Form on any platform using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The Easiest Way to Edit and Electronically Sign 540 Form with Ease

- Obtain 540 Form and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of your documents or conceal sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes only a few seconds and carries the same legal validity as a conventional ink signature.

- Review all the details and click the Done button to save your changes.

- Choose how you wish to share your form, whether via email, text message (SMS), an invitation link, or by downloading it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Edit and electronically sign 540 Form and ensure exceptional communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 540 form 2010

Create this form in 5 minutes!

How to create an eSignature for the 540 form 2010

The best way to make an electronic signature for a PDF online

The best way to make an electronic signature for a PDF in Google Chrome

The best way to create an eSignature for signing PDFs in Gmail

How to create an electronic signature from your smartphone

How to generate an eSignature for a PDF on iOS

How to create an electronic signature for a PDF file on Android

People also ask

-

What is a 540 Form and how is it used?

The 540 Form is a California income tax return form that individuals use to report their earnings and calculate their tax liability. It is crucial for taxpayers in California to accurately complete this form to avoid penalties and ensure compliance with state tax laws.

-

Can I use airSlate SignNow to eSign my 540 Form?

Yes, airSlate SignNow allows users to easily eSign their 540 Form online, ensuring a smooth and efficient signing process. With its user-friendly interface, you can securely upload, edit, and send your tax documents without hassle.

-

Is airSlate SignNow's pricing affordable for small businesses filing a 540 Form?

Absolutely! airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes, including small businesses needing to file their 540 Form. Our cost-effective solution ensures you get the best value while leveraging advanced eSigning features.

-

What features does airSlate SignNow provide for managing the 540 Form?

airSlate SignNow offers a variety of features for managing your 540 Form, including document templates, cloud storage, and real-time tracking. This streamlines the signing process and enhances collaboration among your team members.

-

Are there integrations available with airSlate SignNow for handling the 540 Form?

Yes, airSlate SignNow integrates with various tools and software that can enhance your filing of the 540 Form. These integrations help businesses seamlessly manage their documents, ensuring that tax compliance is streamlined.

-

What are the benefits of using airSlate SignNow for the 540 Form?

Using airSlate SignNow for your 540 Form provides numerous benefits, including enhanced security for your sensitive information, faster turnaround times for eSigning, and fewer errors compared to traditional methods. It's a reliable solution that boosts productivity.

-

Is it safe to eSign my 540 Form with airSlate SignNow?

Absolutely! airSlate SignNow uses advanced encryption and security protocols to protect your 540 Form and other sensitive documents. You can eSign with confidence knowing that your information is secure and compliant with legal standards.

Get more for 540 Form

Find out other 540 Form

- Sign Montana Finance & Tax Accounting LLC Operating Agreement Computer

- How Can I Sign Montana Finance & Tax Accounting Residential Lease Agreement

- Sign Montana Finance & Tax Accounting Residential Lease Agreement Safe

- How To Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Help Me With Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Sign Nebraska Finance & Tax Accounting Business Letter Template Online

- Sign Rhode Island Finance & Tax Accounting Cease And Desist Letter Computer

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure

- How Can I Sign Indiana Government POA

- Sign Maryland Government Quitclaim Deed Safe

- Sign Louisiana Government Warranty Deed Easy

- Sign Government Presentation Massachusetts Secure