Sc1041 Form 2019

What is the Sc1041 Form

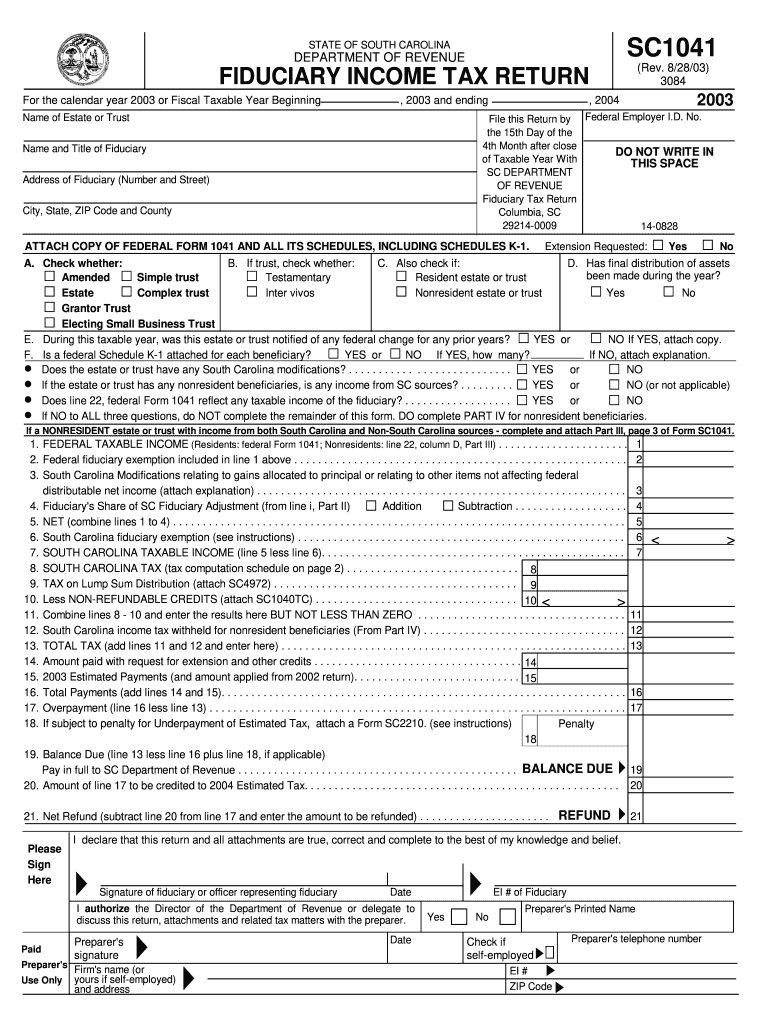

The Sc1041 Form is a tax document used primarily for reporting income, deductions, and credits related to estates and trusts in the United States. This form is essential for fiduciaries who manage the financial affairs of a decedent's estate or a trust. It helps ensure that the income generated by the estate or trust is accurately reported to the Internal Revenue Service (IRS) and that any taxes owed are properly calculated and submitted.

How to use the Sc1041 Form

Using the Sc1041 Form involves several key steps. First, gather all necessary financial information related to the estate or trust, including income, expenses, and deductions. Next, carefully fill out the form, ensuring that all entries are accurate and complete. It is important to follow IRS guidelines to avoid errors that could lead to penalties. After completing the form, review it thoroughly before submission to ensure all information is correct.

Steps to complete the Sc1041 Form

Completing the Sc1041 Form requires a systematic approach. Start by entering the basic information about the estate or trust, including the name, address, and taxpayer identification number. Then, report the income generated by the estate or trust in the relevant sections. Deduct any allowable expenses and calculate the taxable income. Finally, sign and date the form, and ensure that all required attachments are included before submission.

Legal use of the Sc1041 Form

The Sc1041 Form is legally binding when completed and submitted according to IRS regulations. To ensure its validity, it must be signed by the fiduciary responsible for managing the estate or trust. Additionally, the form must be filed by the appropriate deadlines to avoid penalties. Adhering to the legal requirements surrounding the Sc1041 Form helps maintain compliance with federal tax laws.

Filing Deadlines / Important Dates

Filing deadlines for the Sc1041 Form are crucial for compliance. Generally, the form must be filed by the 15th day of the fourth month following the close of the estate's or trust's tax year. For estates and trusts operating on a calendar year, this means the form is typically due by April 15. It is important to be aware of these dates to avoid late filing penalties and interest charges.

Required Documents

When preparing to file the Sc1041 Form, certain documents are necessary. These may include financial statements, records of income and expenses, and any supporting documentation for deductions claimed. Additionally, copies of prior tax returns for the estate or trust may be required. Having these documents organized will facilitate the completion of the form and ensure accuracy in reporting.

Who Issues the Form

The Sc1041 Form is issued by the Internal Revenue Service (IRS), which is the federal agency responsible for tax collection and enforcement in the United States. The IRS provides the form along with instructions on how to complete it, ensuring that fiduciaries have the necessary resources to fulfill their tax obligations effectively.

Quick guide on how to complete sc1041 2003 form

Complete Sc1041 Form seamlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to easily locate the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Handle Sc1041 Form on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to alter and eSign Sc1041 Form effortlessly

- Find Sc1041 Form and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes moments and holds the same legal standing as a traditional wet ink signature.

- Verify all the information and click on the Done button to save your changes.

- Choose how you’d like to send your form: via email, text message (SMS), invite link, or download it to your computer.

Eliminate missing or lost files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from a device of your choice. Alter and eSign Sc1041 Form to ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct sc1041 2003 form

Create this form in 5 minutes!

How to create an eSignature for the sc1041 2003 form

How to create an electronic signature for your PDF document in the online mode

How to create an electronic signature for your PDF document in Chrome

How to make an electronic signature for putting it on PDFs in Gmail

How to create an electronic signature right from your mobile device

How to create an electronic signature for a PDF document on iOS devices

How to create an electronic signature for a PDF on Android devices

People also ask

-

What is the SC1041 Form?

The SC1041 Form is a tax-related document used for reporting income from estates or trusts. By utilizing the SC1041 Form, users can ensure proper compliance with tax regulations and streamline their reporting process. It’s important for individuals managing estates to understand this form's requirements.

-

How does airSlate SignNow help with the SC1041 Form?

airSlate SignNow simplifies the process of signing and managing the SC1041 Form. With our intuitive eSignature solution, you can easily send the SC1041 Form for signatures, ensuring timely compliance and reducing paperwork hassles. Plus, our platform allows for secure storage and retrieval of important documents.

-

Is there a free trial available for airSlate SignNow when working with the SC1041 Form?

Yes, airSlate SignNow offers a free trial that allows you to explore all our features, including those for managing the SC1041 Form. You can test our eSigning capabilities and document management tools risk-free for a limited time, ensuring you find the best solution for your needs.

-

What features does airSlate SignNow offer for the SC1041 Form?

airSlate SignNow provides a range of features for the SC1041 Form, such as templates, automated workflows, and real-time tracking of document status. Our solution enables users to customize their SC1041 Form experience while maintaining compliance and ensuring clarity in communications. These features signNowly enhance efficiency and reduce errors.

-

Can the SC1041 Form be integrated with other software using airSlate SignNow?

Absolutely, airSlate SignNow supports integrations with various software applications, allowing for seamless connectivity with your existing systems. By integrating with payroll, accounting, or tax software, you can efficiently manage your SC1041 Form alongside other financial documents. This helps streamline your entire financial process.

-

What are the benefits of using airSlate SignNow for the SC1041 Form?

Using airSlate SignNow for the SC1041 Form offers numerous benefits, including enhanced security, ease of use, and signNow time savings. Our platform ensures that your documents are securely stored and easily accessible. Additionally, the streamlined eSigning process enables quick turnaround, making compliance easier.

-

Is airSlate SignNow suitable for small businesses handling the SC1041 Form?

Yes, airSlate SignNow is an ideal solution for small businesses that need to manage the SC1041 Form efficiently. Our cost-effective pricing structure and easy-to-use interface cater to businesses of all sizes, ensuring they can handle tax documentation with ease. Small business owners can benefit from our tools to stay compliant and organized.

Get more for Sc1041 Form

Find out other Sc1041 Form

- Can I eSign North Carolina Courts Limited Power Of Attorney

- eSign North Dakota Courts Quitclaim Deed Safe

- How To eSign Rhode Island Sports Quitclaim Deed

- Help Me With eSign Oregon Courts LLC Operating Agreement

- eSign North Dakota Police Rental Lease Agreement Now

- eSign Tennessee Courts Living Will Simple

- eSign Utah Courts Last Will And Testament Free

- eSign Ohio Police LLC Operating Agreement Mobile

- eSign Virginia Courts Business Plan Template Secure

- How To eSign West Virginia Courts Confidentiality Agreement

- eSign Wyoming Courts Quitclaim Deed Simple

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure

- eSignature California Banking Warranty Deed Later