Form 540 2EZ California Resident Income Tax Return Ftb Ca 2020

What is the Form 540 2EZ California Resident Income Tax Return Ftb Ca

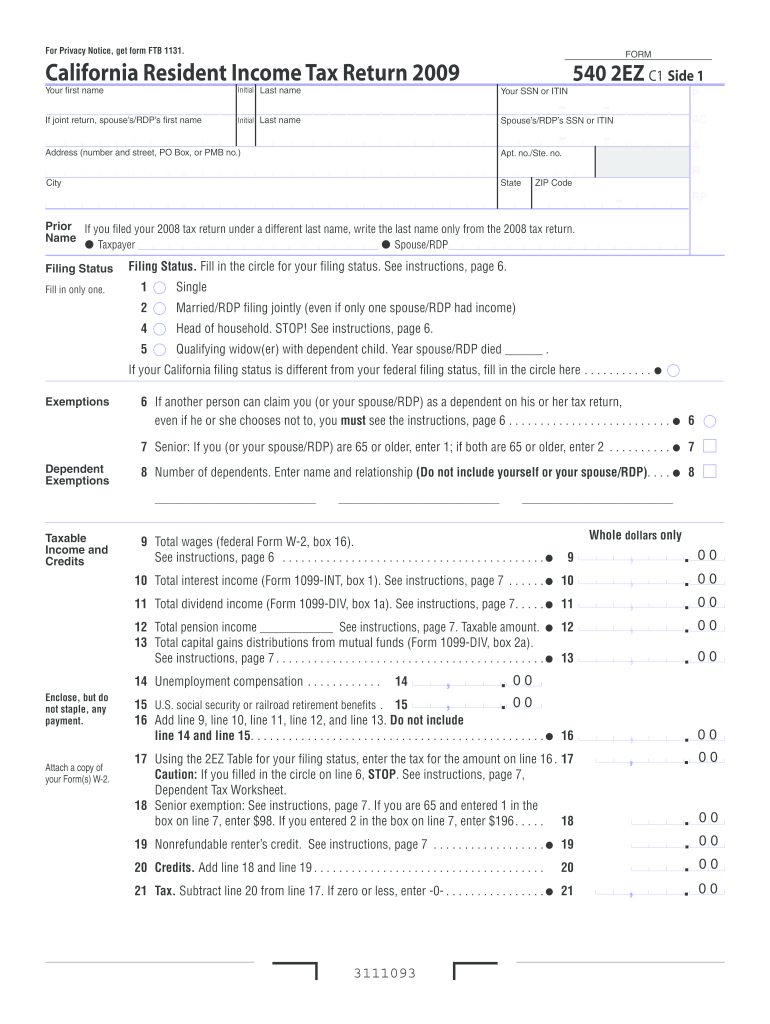

The Form 540 2EZ is a simplified version of the California Resident Income Tax Return designed for taxpayers with straightforward financial situations. It is primarily intended for individuals who are filing their state taxes and meet specific eligibility criteria, such as having a total income below a certain threshold and not claiming numerous deductions or credits. This form allows for a more streamlined filing process, making it easier for residents to comply with California tax laws.

How to use the Form 540 2EZ California Resident Income Tax Return Ftb Ca

Using the Form 540 2EZ involves several straightforward steps. First, ensure you meet the eligibility requirements to use this form. Next, gather all necessary financial documents, including W-2s and any other income statements. Fill out the form by entering your personal information, income details, and any applicable credits. After completing the form, review it for accuracy before submitting it to the California Franchise Tax Board (FTB).

Steps to complete the Form 540 2EZ California Resident Income Tax Return Ftb Ca

Completing the Form 540 2EZ involves a systematic approach:

- Gather all necessary documents, including income statements and any other relevant financial records.

- Fill in your personal details, such as your name, address, and Social Security number.

- Report your total income from all sources.

- Claim any applicable credits and deductions, if eligible.

- Calculate your total tax owed or refund due.

- Sign and date the form before submission.

Key elements of the Form 540 2EZ California Resident Income Tax Return Ftb Ca

The Form 540 2EZ includes several key elements that are essential for accurate tax filing. These elements comprise personal information, income details, tax calculations, and signature lines. It simplifies the reporting process by allowing taxpayers to focus on the most relevant information without the complexity found in longer forms. Understanding these elements is crucial for ensuring compliance and maximizing potential refunds.

Eligibility Criteria

To qualify for using the Form 540 2EZ, taxpayers must meet specific eligibility criteria. These criteria typically include having a total income below a designated limit, not having dependents, and not claiming certain tax credits that require more detailed reporting. Understanding these requirements helps ensure that taxpayers choose the appropriate form for their situation.

Form Submission Methods (Online / Mail / In-Person)

The Form 540 2EZ can be submitted through various methods. Taxpayers have the option to file online using the California FTB's e-file system, which is often the fastest and most efficient method. Alternatively, individuals can mail their completed forms to the appropriate FTB address. In-person submissions are also possible at designated FTB offices, providing flexibility based on individual preferences.

Quick guide on how to complete 2009 form 540 2ez california resident income tax return ftb ca

Accomplish Form 540 2EZ California Resident Income Tax Return Ftb Ca effortlessly on any gadget

Digital document management has become increasingly favored by companies and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to access the necessary form and securely retain it online. airSlate SignNow supplies you with all the tools required to create, modify, and electronically sign your documents swiftly without any holdups. Handle Form 540 2EZ California Resident Income Tax Return Ftb Ca on any device with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

Steps to modify and electronically sign Form 540 2EZ California Resident Income Tax Return Ftb Ca with ease

- Locate Form 540 2EZ California Resident Income Tax Return Ftb Ca and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or obscure sensitive information using tools specifically designed by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Select how you wish to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate the worries of misplaced or lost documents, exhausting form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Modify and electronically sign Form 540 2EZ California Resident Income Tax Return Ftb Ca and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2009 form 540 2ez california resident income tax return ftb ca

Create this form in 5 minutes!

How to create an eSignature for the 2009 form 540 2ez california resident income tax return ftb ca

The way to create an eSignature for your PDF document online

The way to create an eSignature for your PDF document in Google Chrome

The best way to make an electronic signature for signing PDFs in Gmail

The way to create an eSignature from your smart phone

The best way to generate an electronic signature for a PDF document on iOS

The way to create an eSignature for a PDF file on Android OS

People also ask

-

What is the Form 540 2EZ California Resident Income Tax Return Ftb Ca?

The Form 540 2EZ California Resident Income Tax Return Ftb Ca is a simplified tax return designed for eligible California residents. It allows for a quicker filing process for those with straightforward tax situations, typically involving single or joint filers with no dependents.

-

How do I complete the Form 540 2EZ California Resident Income Tax Return Ftb Ca?

Completing the Form 540 2EZ California Resident Income Tax Return Ftb Ca can be done by following the instructions provided by the California Franchise Tax Board. You must gather necessary income statements and deductions, fill out the form, and ensure accuracy to avoid delays in processing.

-

What are the benefits of using airSlate SignNow for filing the Form 540 2EZ California Resident Income Tax Return Ftb Ca?

Using airSlate SignNow provides a streamlined way to eSign and submit your Form 540 2EZ California Resident Income Tax Return Ftb Ca. Our platform makes it easy to manage documents securely, signNowly reducing time in preparation and ensuring compliance with electronic filing requirements.

-

Is there a cost associated with using airSlate SignNow to file the Form 540 2EZ California Resident Income Tax Return Ftb Ca?

Yes, airSlate SignNow offers various pricing plans that cater to different needs for document management and eSignature solutions. Our competitive pricing ensures you get a cost-effective solution to manage your Form 540 2EZ California Resident Income Tax Return Ftb Ca efficiently.

-

Can I integrate airSlate SignNow with other applications for filing my Form 540 2EZ California Resident Income Tax Return Ftb Ca?

Absolutely! airSlate SignNow supports integrations with popular applications, which can streamline the process of preparing and filing your Form 540 2EZ California Resident Income Tax Return Ftb Ca. Our integrations allow you to connect with accounting and tax prep software for enhanced convenience.

-

How does airSlate SignNow ensure the security of my Form 540 2EZ California Resident Income Tax Return Ftb Ca?

airSlate SignNow employs robust security measures, including encryption and secure cloud storage, to protect your Form 540 2EZ California Resident Income Tax Return Ftb Ca and other sensitive documents. Your data safety is our top priority, ensuring it remains confidential and secure.

-

Can I track the status of my Form 540 2EZ California Resident Income Tax Return Ftb Ca with airSlate SignNow?

Yes, airSlate SignNow offers features that allow you to track the status of your Form 540 2EZ California Resident Income Tax Return Ftb Ca. You can receive real-time updates on document signing and submission, providing clarity and transparency throughout the filing process.

Get more for Form 540 2EZ California Resident Income Tax Return Ftb Ca

- Crowley rodeo entry fees form

- City of fremont business license form

- Sunnyvale alarm permit form

- Team shirt order form

- Poker run sponsorship lake wateree powerboat association form

- Sign permit application 7 15 13 doc form

- Property owner e mail check if new form

- Permitting forms ampamp documents miamibuilding permitsgreenacres floridacity of gulfport florida building permit

Find out other Form 540 2EZ California Resident Income Tax Return Ftb Ca

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure

- How Can I Sign Indiana Government POA

- Sign Maryland Government Quitclaim Deed Safe

- Sign Louisiana Government Warranty Deed Easy

- Sign Government Presentation Massachusetts Secure

- How Can I Sign Louisiana Government Quitclaim Deed

- Help Me With Sign Michigan Government LLC Operating Agreement

- How Do I Sign Minnesota Government Quitclaim Deed

- Sign Minnesota Government Affidavit Of Heirship Simple

- Sign Missouri Government Promissory Note Template Fast

- Can I Sign Missouri Government Promissory Note Template

- Sign Nevada Government Promissory Note Template Simple

- How To Sign New Mexico Government Warranty Deed

- Help Me With Sign North Dakota Government Quitclaim Deed

- Sign Oregon Government Last Will And Testament Mobile