Summary of Federal Form 1099R Statements Tax Ny 2020

What is the Summary Of Federal Form 1099R Statements Tax Ny

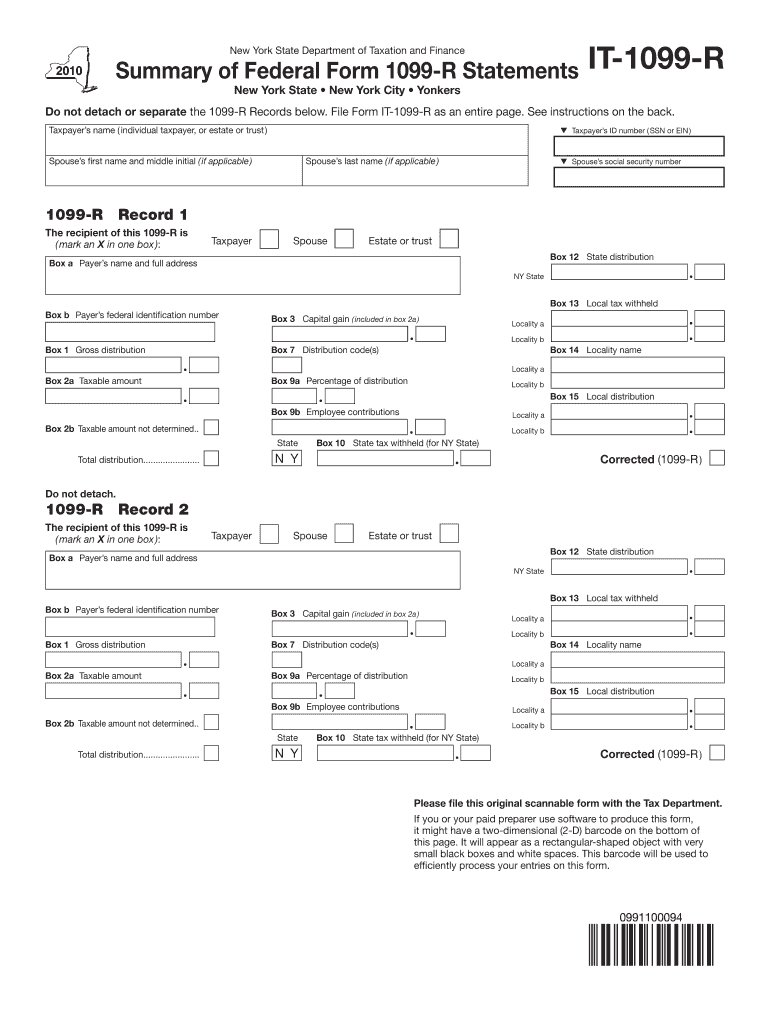

The Summary of Federal Form 1099-R Statements Tax NY is a tax document that reports distributions from pensions, annuities, retirement plans, or other similar sources. This form is crucial for individuals who receive retirement income, as it provides essential information for filing state and federal taxes. It includes details such as the total amount distributed, the taxable amount, and any federal income tax withheld. Understanding this form is vital for accurate tax reporting and compliance with IRS regulations.

How to use the Summary Of Federal Form 1099R Statements Tax Ny

Using the Summary of Federal Form 1099-R Statements Tax NY involves several steps. First, individuals should review the information on the form to ensure accuracy. This includes checking the payer's details, the recipient's information, and the amounts reported. Next, the form should be used to complete tax returns, ensuring that the reported distributions are accurately reflected in both state and federal filings. Keeping a copy for personal records is also advisable for future reference or in case of audits.

Steps to complete the Summary Of Federal Form 1099R Statements Tax Ny

Completing the Summary of Federal Form 1099-R Statements Tax NY requires careful attention to detail. Follow these steps:

- Gather all necessary documentation related to retirement distributions.

- Fill in the recipient's name, address, and taxpayer identification number accurately.

- Report the total distribution amount in the appropriate box.

- Indicate the taxable amount and any federal tax withheld.

- Review the form for any errors before submission.

Once completed, the form can be submitted electronically or via mail, depending on the requirements.

IRS Guidelines

The IRS provides specific guidelines for completing and filing the Summary of Federal Form 1099-R. It is essential to adhere to these guidelines to avoid penalties. Key points include:

- Ensure accurate reporting of all distributions and withholdings.

- File the form by the IRS deadline to avoid late fees.

- Use the correct version of the form for the tax year in question.

Consulting the IRS website or a tax professional can provide additional clarity on compliance and reporting requirements.

Filing Deadlines / Important Dates

Filing deadlines for the Summary of Federal Form 1099-R are critical to ensure compliance. Typically, the form must be sent to recipients by January 31 of the following year. Additionally, the IRS requires that the form be filed by the end of February if submitting by paper or by the end of March if filing electronically. Keeping track of these dates is essential to avoid penalties and ensure timely processing of tax returns.

Penalties for Non-Compliance

Failing to comply with the requirements for the Summary of Federal Form 1099-R can result in significant penalties. These may include:

- Fines for late filing or failure to file.

- Additional taxes owed due to incorrect reporting.

- Potential audits by the IRS, leading to further complications.

It is important to understand these penalties to ensure accurate and timely compliance with tax obligations.

Quick guide on how to complete summary of federal form 1099r statements tax ny

Effortlessly Prepare Summary Of Federal Form 1099R Statements Tax Ny on Any Device

Digital document management has gained traction among businesses and individuals. It offers an excellent environmentally friendly alternative to conventional printed and signed documents, as you can access the correct form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly and without delays. Manage Summary Of Federal Form 1099R Statements Tax Ny on any device using the airSlate SignNow Android or iOS applications and simplify any document-related procedure today.

The easiest method to modify and electronically sign Summary Of Federal Form 1099R Statements Tax Ny effortlessly

- Find Summary Of Federal Form 1099R Statements Tax Ny and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools provided by airSlate SignNow explicitly for that purpose.

- Create your signature with the Sign tool, which takes moments and carries the same legal validity as a traditional handwritten signature.

- Review the details and then click on the Done button to save your changes.

- Choose your preferred delivery method for the form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets all your document management requirements in just a few clicks from your chosen device. Edit and electronically sign Summary Of Federal Form 1099R Statements Tax Ny to ensure exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct summary of federal form 1099r statements tax ny

Create this form in 5 minutes!

How to create an eSignature for the summary of federal form 1099r statements tax ny

The best way to create an electronic signature for a PDF document in the online mode

The best way to create an electronic signature for a PDF document in Chrome

How to generate an eSignature for putting it on PDFs in Gmail

The best way to generate an eSignature from your mobile device

The way to create an eSignature for a PDF document on iOS devices

The best way to generate an eSignature for a PDF file on Android devices

People also ask

-

What is the Summary Of Federal Form 1099R Statements Tax Ny used for?

The Summary Of Federal Form 1099R Statements Tax Ny is used to report distributions from pensions, annuities, retirement plans, or IRAs to the state tax authorities. This summary helps ensure compliance with state tax regulations and provides important financial information for both taxpayers and tax preparers.

-

How can airSlate SignNow assist with the Summary Of Federal Form 1099R Statements Tax Ny?

airSlate SignNow offers an efficient and secure platform for sending and eSigning documents, including the Summary Of Federal Form 1099R Statements Tax Ny. By streamlining the document workflow, you can easily manage your tax documents and ensure timely submissions, reducing the risk of errors or delays.

-

Is airSlate SignNow cost-effective for managing tax documents?

Yes, airSlate SignNow is a cost-effective solution for managing tax documents like the Summary Of Federal Form 1099R Statements Tax Ny. With affordable pricing plans, you can save on printing and mailing costs while improving your document management efficiency.

-

What features does airSlate SignNow offer for tax statement management?

airSlate SignNow provides features like templates for the Summary Of Federal Form 1099R Statements Tax Ny, automated reminders, and real-time tracking. These functionalities enhance efficiency, ensuring that important tax documents are signed and sent promptly.

-

Can airSlate SignNow integrate with other accounting software for tax purposes?

Yes, airSlate SignNow can integrate seamlessly with various accounting software to simplify the management of the Summary Of Federal Form 1099R Statements Tax Ny. This integration allows for easy data transfer and helps maintain accurate financial records, ensuring compliance with tax requirements.

-

What benefits can businesses expect from using airSlate SignNow for tax documents?

Businesses using airSlate SignNow for the Summary Of Federal Form 1099R Statements Tax Ny can expect increased productivity, reduced turnaround times, and improved document security. The user-friendly interface makes it easy for employees to manage their tax paperwork efficiently.

-

Are there any templates available for the Summary Of Federal Form 1099R Statements Tax Ny?

Yes, airSlate SignNow offers pre-designed templates for the Summary Of Federal Form 1099R Statements Tax Ny to simplify the document creation process. These templates can be customized to meet specific business needs, ensuring compliance and accuracy in reporting.

Get more for Summary Of Federal Form 1099R Statements Tax Ny

- Federal registervol 71 no 20tuesday january 31 nhtsa nhtsa form

- Hyperglycemia high blood glucoseada american diabetes associdiabetesamerican dental associationhyperglycemia high blood form

- Facility request form

- Bakery special order form

- Form 818b post tensioned slab on grade

- Standard service contract template form

- Standard vendor contract template form

- Standard work contract template form

Find out other Summary Of Federal Form 1099R Statements Tax Ny

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter