Electronic signature Form for Procurement Online

Make the most out of your eSignature workflows with airSlate SignNow

Extensive suite of eSignature tools

Robust integration and API capabilities

Advanced security and compliance

Various collaboration tools

Enjoyable and stress-free signing experience

Extensive support

Keep your eSignature workflows on track

Our user reviews speak for themselves

Advantages of utilizing an electronic signature form

In the current digital era, employing an electronic signature form is vital for optimizing document handling and boosting business productivity. airSlate SignNow provides an intuitive platform that enables organizations to send, sign, and oversee documents effortlessly. This guide will lead you through the straightforward steps to utilize airSlate SignNow for your electronic signature requirements.

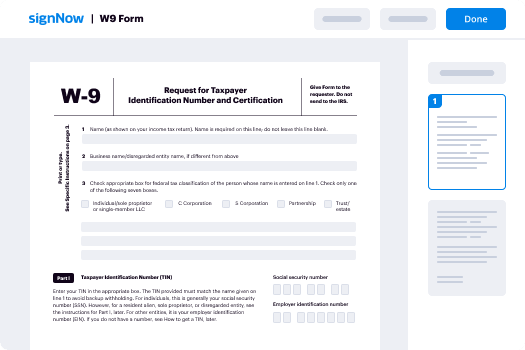

Step-by-step guide for utilizing an electronic signature form with airSlate SignNow

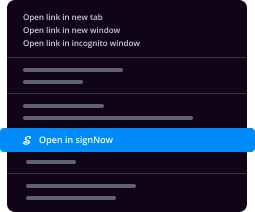

- Launch your web browser and go to the airSlate SignNow homepage.

- Set up a free trial account or log into your current account.

- Choose the document you want to sign or send for signatures and upload it.

- If you intend to use this document regularly, convert it into a reusable template.

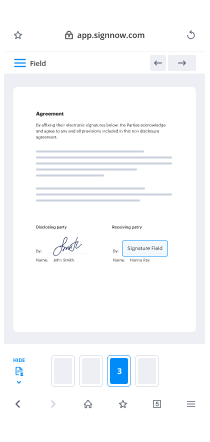

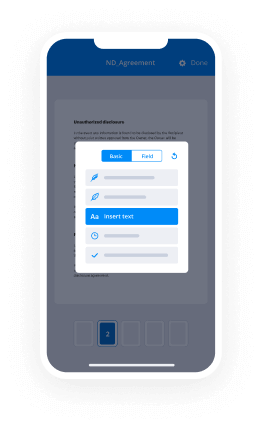

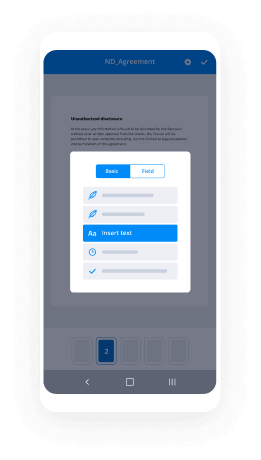

- Open your uploaded file and tailor it by adding fillable fields or inserting necessary details.

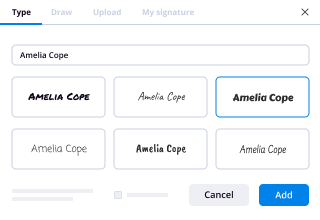

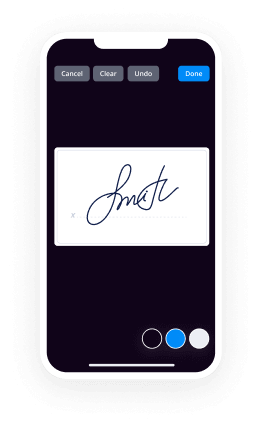

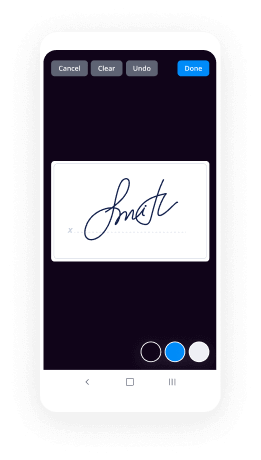

- Include your signature and specify signature fields for other signers.

- Click 'Continue' to complete and send the invitation for e-signature.

By adhering to these uncomplicated steps, you can efficiently manage your documents and signatures with airSlate SignNow. Its extensive features and user-friendly interface make it a signNow asset for any organization.

Don't pass up the chance to improve your document management workflow. Begin your free trial today and discover the advantages of airSlate SignNow firsthand!

How it works

Rate your experience

-

Best ROI. Our customers achieve an average 7x ROI within the first six months.

-

Scales with your use cases. From SMBs to mid-market, airSlate SignNow delivers results for businesses of all sizes.

-

Intuitive UI and API. Sign and send documents from your apps in minutes.

A smarter way to work: —how to industry sign banking integrate

FAQs

-

What is an electronic signature form and how does it work?

An electronic signature form is a digital version of a traditional paper form that allows users to sign documents electronically. This form streamlines the signing process by enabling users to add their signatures using a mouse, touchscreen, or stylus. With airSlate SignNow, you can create, send, and manage these forms easily, ensuring a fast and secure signing experience.

-

How much does it cost to use airSlate SignNow for electronic signature forms?

airSlate SignNow offers competitive pricing plans tailored to meet the needs of businesses of all sizes. You can choose from a variety of subscription options that provide access to features like unlimited electronic signature forms and document templates. For specific pricing details and to find the best plan for your needs, visit our pricing page.

-

What features does airSlate SignNow offer for electronic signature forms?

airSlate SignNow provides a range of features for electronic signature forms, including customizable templates, automated workflows, and real-time tracking of document status. Additionally, users can collect payments directly through the forms and integrate with various third-party applications for enhanced functionality. This makes it a versatile tool for businesses looking to simplify their document signing processes.

-

Is airSlate SignNow compliant with electronic signature laws?

Yes, airSlate SignNow is compliant with major electronic signature laws, including the ESIGN Act and eIDAS regulations in Europe. This ensures that your electronic signature forms are legally binding and recognized in various jurisdictions. Our commitment to compliance helps you confidently manage your documents without legal concerns.

-

Can I integrate airSlate SignNow with other software applications?

Absolutely! airSlate SignNow offers seamless integrations with a variety of software applications, including CRMs, cloud storage services, and productivity tools. This allows you to streamline your workflow by connecting your electronic signature forms with the tools you already use, enhancing efficiency and productivity.

-

What benefits can businesses expect from using electronic signature forms?

Using electronic signature forms can signNowly reduce turnaround times for document signing, leading to faster transaction completion. Additionally, they help cut costs associated with printing and mailing physical documents. With airSlate SignNow, businesses also benefit from improved organization and tracking of documents, ensuring a smoother signing experience.

-

How secure are electronic signature forms created with airSlate SignNow?

Security is a top priority at airSlate SignNow. Our electronic signature forms utilize advanced encryption and authentication methods to protect sensitive data. Each signed document is securely stored and easily accessible, providing peace of mind that your information is safe and compliant with industry standards.

-

What are electronic signatures used for?

The ETA does not contain a prescribed definition of what would be an ‘electronic signature’. Therefore, an electronic signature may take the form of an image of an individual’s handwritten signature, a typed name or a digital signature. There may be other forms as well. For example, the courts have held that a name appearing at the bottom of an email in normal typeface is a valid electronic signature.Section 9 of the ETA sets out three requirements for an electronic signature, being identification, reliability and consent:Identification is a question of fact, as the recipient must be able to identify the person signing (however, no formal verification of identity is required), and confirm that the person signing intends to be bound by the information communicated.Reliability is objectively determined by considering all the relevant circumstances and the purpose for which the electronic signature is required.Consent requires the counterparty to the document being electronically signed to agree to the signing party signing the document electronically. The case law demonstrates that this requirement is unlikely to require anything more than the counterparty using the chosen electronic mechanism, or engaging with the electronic execution process.To know more about Electronic signature visit at Digital Signature Devices, Software, Electronic Pads

-

Is electronic signature legally binding in India?

Yes, e-signatures are legally valid in India. In fact, e-signatures have been recognized by the Indian law, with the passage of the Information Technology Act in year 2000.As per the IT Act, two types of signatures have the same legal status as handwritten signatures. These primarily include:(i) Digital Signatures: In this case, the signer is issued a long-term (1 to 2 year) certificate based digital ID stored on a USB token that can be used along with a personal PIN to sign a document.Note: Previously, the signer was issued a long-term (1 to 2 year) certificate based digital ID stored on a USB token that could be used along with a personal PIN to sign a document digitally. Now with Aadhaar, that complicated procedure isn’t required anymore. You can simply use signNow’s Aadhaar eSign to create a digital signature on the fly using your Aadhaar ID(ii) Electronic signatures: These electronic signatures combine Aadhaar identity number with an electronic Know-Your-Customer (eKYC) method (which includes sending an One-Time-Passcode to the mobile number linked to the Aadhaar card for verification)These Aadhaar based e-signatures and digital signatures are valid as long as they satisfy these conditions:(i) Electronic signatures must be uniquely linked to the person signing the document. (in the case of Aadhaar based signatures, they are linked by the unique Aadhaar ID)(ii) At the time if signing, the signatory must have control over the data used to generate the electronic signature (for eg: they should be able to directly affix the electronic signature to the document)(iii) There should be an audit trail of the steps taken during the signing the process(iv) In the case of digital signatures, signer certificates must be issued by signNowing Authority recognized by the Controller of signNowing Authorities appointed under the IT Act.Few of the exceptional cases in which documents cannot be signed electronically and must be executed using traditional handwritten signatures include:(i) Negotiable instruments such as a bill of exchange or a promissory note(ii) Powers of attorney(iii) Trust deeds(iv) Wills and any other testamentary disposition(v) Real-estate contracts such as leases or sales agreements.If you are looking to get legally compliant electronic signatures on contracts, invoices, quotes etc., try signNow, India’s first Aadhaar eSign solution that offers a complete fill-and-sign functionality with business workflows. Thus allowing users to finish their documents in one go.Here’s an informative ebook that will give you a brief overview of everything you need to know about electronic signature laws in some of the largest economies around the world: The Complete Guide to Electronic Signature Laws

-

Now that recreational marijuana is legal in California, what is the easiest way for me to procure some?

I’m a big proponent of decriminalized cannabis, or the same status it had in 1936, prior to the year that Congress passed the 1937 Marihuana Tax Act.Prop. 64, or AUMA, has flaws, no doubt, flaws that my friend, the cannabis barrister said should be hammered out prior to the law passing, and I still remain hopeful that some of its issues can still get resolved someday.I certainly hope that all the kinks can get worked out. And I certainly hope that family farms and small time growers will be protected by the time the waiting period is over, or whatever it is they call that period of time in between now and when they open the floodgates for Big Corporations to come in and slaughter established yet smaller farms, and family farms.Did you know you can only grow six plants at a time per residence, not per patient. That means if I’m renting a room and am growing my six, and then someone else moves in and wants to grow, then we each get to grow three plants.Traveling with more than one ounce can get you popped. People are still getting arrested for nonviolent possession. Sadly, cannabis was not decriminalized, or even legalized as much as tobacco or alcohol have been.

-

What industries must use electronic signature software?

Any industry involving a large amount of paperwork make use electronic signatures. In other words, all industries make use of electronic signatures because all of them have piles of paperwork to handle. Some examples of such industries include financial, life science, healthcare and pharmaceutical industries.Industries such as the pharmaceutical industry, have a number of licenses and other paperwork that they have to handle and keep track of. It can be a tedious task to perform such cumbersome paper processes. Therefore, e-signatures can facilitate an organisation in keeping a track of all this paperwork, by signing electronically.Healthcare industries usually involve time-sensitive documents, which need to be urgently completed. But, it can take days in case of the traditional wet ink paper signatures for the documents to signNow the signer and back, if the parties are geographically scattered. But with electronic signatures, that is not the case. Geographical barriers do not play a role. Documents which earlier needed days to be completed, can now be signed and sent back within minutes, in the click of a button. Furthermore, it takes a long time to bring assets under management. The time taken by the signing process, if wet ink paper signatures are used, may even further delay the process. But by using electronic signatures, the whole process can speed up.Apart from these, there are many paper prone industries which require huge amount of paperwork and with the use of electronic signatures they can make their everyday processes smoother and more efficient.

-

What is the term cashless society, What are the benefits and can it be a reality in India?

TL;DR (Too Long; Didn’t Read):Cashless society can be a reality in India. Yes, it can happen right now! To make it happen, the government should take measures like this:Slowly reduce the withdrawal limit at the ATMs and banks in phases from the current ₹4,500/day to a reasonable amount, say, ₹1,000/dayClassifying transactions into PIN and No-PIN. The sum of all No-PIN transactions cannot exceed ₹1,000/dayPromoting a widespread use of innovative, cheap and secure Debit/Credit card readersGovernment incentives encouraging transition towards cashless societyAre you still wondering if these measures can help our country?If so, then you should definitely read the whole answer down below!Is there any country which has gone completely cashless?In a cashless society, when we go get coffee, buy some groceries or pay house rent, we use Debit / Credit card , online payment or any of the other cashless payment methods instead of Physical cash.Though, by definition, Cashless society replaces physical cash with modern cashless payment methods, there is no country which has gone 100% cashless. Sweden is leading the way towards a cashless society with cash transactions account for 2% of the value of all payments made in last year.How will a cashless society help our country?Tax Evasion: When all payments are made electronically, they can be easily audited. This would be a great problem to money launderers and tax evadersReduction in Crime: By going cashless, as there will be less cash in circulation, criminal activities like Real estate fraud, Smuggling, Fake currency, Terrorist activities etc will be greatly reduced.Security and Convenience: In Sweden, electronic payment advocates claim that there has been less crime reported as there is no cash to steal at banks and ATM’s. In addition to security, cashless transactions in future will be seamless and convenient for customers with no delays and queues.Why is it important for India at this moment?The demonetisation move by PM Modi is bold and important to curtail parallel economy. Though this move helps to bring out the black money and puts a break to the fake money racket, I feel that it’s a temporary measure to curb black money.If the maximum withdrawal limit increases from ₹4000/day to the previous ₹40,000/day , we will eventually be able to stash enough money. The people who resort to illegal black money transactions will be back to their routine and try to evade tax like they have been doing. Unless the government takes immediate measures to help people move towards a cashless society, the immense efforts by the people and their suffering will go in vain. Recently PM Modi urged the nation to become a cashless society which signifies its importance.Sounds great! But how to make India a cashless society?Demonetisation can bring signNow progress in the expansion of the financial system and cashless payment methods.How feasible are these cashless payment methods in India?Cashless payment methods like Digital wallets[1] (Paytm, Android Pay etc) require smartphones. But smartphone penetration is still less than 30% of the total population. So it will take years for our country to adopt to such payment methods. In India, apart from DD, Cheque etc.,the likely option is to go for Card-based payment. This is due to reasonably large penetration of Debit or Credit cards compared to smartphone penetration.As per RBI’s latest press release[2]Number of Debit cards is 700 millionNumber of Credit cards is 25 millionTotal bank accounts in 2015 was 1,170 millionThough the number of cards total to 725 million, ONLY 6% of the value of card transactions are used at PoS machines and 94% of the value is used for cash withdrawal at ATMs. The reason for these contrasting numbers might be because of the slow card transaction process, lack of awareness or security concerns ( theft / fraudulent transactions ) among consumers. Besides, many mom-and-pop shops and kirana shops, try to save the processing fee by refusing to accept card-based payments.How can we make use of the highly penetrated Debit/Credit card base as a primary instrument in making India a cashless society?Classifying transactions into PIN and No-PIN, based on type of authenticationThough the PIN-based (with/without Signature) authentication creates a sense of security among users, it is inconvenient and a prolonged process. To overcome this problem, transactions can be classified into PIN and No-PIN. PIN or Signature for authentication are required only when the transaction amount exceeds a certain limit, say, ₹1,000 per transaction. All the transactions below this limit would not require any authentication and are termed as No-PIN transactions[3]. By doing this, day-to-day payments of low value can be made seamless. In addition to this, the sum of all the No-PIN transactions on that particular day should not exceed the limit. Though the concept of No-PIN seems insecure, the cumulative limit on these transactions will ensure protection against fraudulent activities. Any such activity within the threshold amount needs to be insured by the financial institutions.For example, buying a smartphone worth ₹8,000 in a retail outlet using a Debit/Credit card requires PIN-based authentication and buying fruits and vegetables worth ₹300 will come under No-PIN transaction. Now if you lose your card and someone takes advantage of the No-PIN method, he will only be able to use up to ₹700. This amount can be insured by your bank upon reporting the lost card.Promoting a widespread use of innovative, cheap and secure Debit/Credit card readersAt the seller end, we need PoS terminals to accept card payments from consumers. But procuring a PoS machine from banks is a lengthy process. The banks also charge a commission based on the turnover. The government should make it easy for retailers to acquire these card readers. In addition to the traditional card readers, the government should encourage innovative alternatives which are cheap, secure and easy to procure such as Square Card reader, which is popular in the US.Square lets you accept all major Debit / Credit cards in a seamless way like this.Government incentives encouraging transition towards cashless societyIn order to encourage card-based payments, the Indian government has unveiled plans to cut transaction costs for electronic payments to pull more people into the formal economy and boost public revenue. One proposal is to offer sales tax rebates of 1 to 2 percentage points to merchants who report at least half of their transactions through online payments. Consumers could get an income tax rebate for electronic payment of a proportion of their expenses. Read more at: Modi government plans cashless coup with tax incentives on electronic paymentsReducing the withdrawal limit at ATMs and banks in phases from ₹40,000/day to a reasonable amount, say, ₹1,000/dayNormally, people tend to withdraw money from ATMs for most of the day-to-day payments. In order to urge society to move towards cashless, it is important to reduce the cash withdrawal limit to an acceptable amount.Illicit real estate trading, Hawala operators, Election campaigns, Fake NGOs etc., rely on cash transactions involving huge amounts. When there is a strict cash withdrawal regulation, it will take ages for people to accumulate cash and encourage such illegal activities. This will drastically reduce the black money circulation and put an end to the parallel economy.Limitations of our proposed solution:It will not be hassle free if people are not properly educated about this solutionDeploying huge number of card reader machines is a herculean taskProviding Internet access in every single part of country amidst shortage of electricityAre there any problems with cashless economy?[4]Citizens can’t do a bank run during an economic crisis. Cash is an important safeguard against economic volatility. At times of distress, when the confidence in the banking system erodes, citizens are likely to withdraw cash in large numbers and hold it in its physical form. On balance, there seems to be an optimal mix of digital payments and cash that should be in existence in an economy to stave off the consequences of a cashless society.Future scope:In future, the smartphones base is expected to grow and signNow 100% penetration. As the government works on pushing card-based payments, it should encourage private companies to develop secure and easy mobile based cashless payments. There might be a wider signNow for NFC-based smartphones with fingerprint authentication in future. This will make the transactions even more secure and convenient.Footnotes[1] Digital Wallets: Intro to Apple Pay, Chase Pay, Walmart Pay, and More[2] https://rbi.org.in/scripts/BS_Pr...[3] RBI Willing to Relax PIN, OTP Requirements for Sub-Rs. 2,000 Transactions[4] We are trying to become a cashless society — but is that a great idea?

-

Where can we use class 2 and class 3 digital signature certificates?

Click here for Digital Signature CertificateDigital signature certificates or DSC are required for filing income tax returns, company filings, import export clearance and e-tenders.A Digital Signature is the equivalent of a physical signature in electronic format, as it establishes the identity of the sender of an electronic document in the Internet. Digital Signatures are used in India for online transactions such as Income Tax E-Filing, Company or LLP Incorporation, Filing Annual Return, E-Tenders, etc., There are three types of Digital Signatures, Class I, Class II and Class III Digital Signature. Class I type of Digital Signatures are only used for securing email communication. Class II type of Digital Signatures are used for Company or LLP Incorporation, IT Return E-Filing, Obtaining DIN or DPIN, and filing other forms with the Ministry of Corporate Affairs and Income Tax Department. Class III type Digital Signatures are used mainly for E-Tendering and for participating in E-Auctions. Digital Signatures come in the form of a USB E-Token, wherein the Digital Signature Certificate is stored in a USB Drive and can be accessed through a computer to sign documents electronically.With E-Return filing becoming mandatory for Income Tax Assesses with an income of over Rs.5 lakhs per annum, the requirement and prevalence of Digital Signatures has increased manifold. IndiaFilings can help you obtain your Digital Signature hassle-free online. IndiaFilings is a Registered Partner of SIFY and E-Mudhra.Class II Digital Signatures are used for Income Tax E-Filing, Company or LLP Incorporation, Annual Return Filing, etc., Class II Digital Signatures are required to file documents electronically with the Ministry of Corporate Affairs and Income Tax Department.Difference between Class 2 and Class 3 Digital Signature CertificatesIn this day and age of technology, physical signatures are increasingly being converted to digital media for security reasons. Digital Signature Certificates, (DSC) are simply the electronic equivalent of physical or paper certificates such as identity proofs, driver�s licenses, passports or PAN cards. These certificates can prove to be helpful for many online transactions that require digital proof of identities and to receive and send information on the web safely.Organizations and firms, today require digital signature certificate to better facilitate communication and transactions between them and the Ministry of Corporate Affairs. For companies that have a turnover of more than INR 60 Lakhs have to apply for these certifications mandatorily, and it is considered a legally admissible instrument. Besides, it is always wise to get a digital signature as it offers a high level of security for online transactions by ensuring absolute privacy of the information exchanged. These certificates can also be useful for encrypting information that only the intended recipient can have access to. You can digitally sign information to assure the recipient that it has not been changed in transit, and also verify your identity as the sender of the message.There are two main types of Digital Signature Certificates � Class 2 Certificates and Class 3 Digital Signature Certificate. A Class 2 Digital Signature Certificate is used by individuals and is available for download after verification based on a trusted and pre-verified database. A Class 3 Digital Signature Certificate, on the other hand, is of the highest level as it is issued only after the registrant�s identity verification has been carried out by a Registration Authority.Class 2 Digital Signature Certificates are generally used for filing documents Income Tax, Registrar of Companies and VAT, whereas Class 3 Digital Signature Certificates are needed for e-tendering, which is a procurement process that is conducted online. The aspects where this comes into play include: � Contract download� Evaluation of tenders (May or may not involve e-auctions)� Supplier registration/expression of interest� Submission of bid documentThe Ministry of Company Affairs, Government of India (GoI) has initiated MCA21 program, for easy and secure access to its services in a manner that best suits the businesses and citizens. The MCA21 application is designed to support Class 2 & 3 Digital Signature Certificates (DSC) issued by licensed signNowing Authority under Controller of signNowing Authorities.

-

What is the difference between class 2 and class 2B digital signature?

Class 2 Digital Signature Certificate can be issued to individual or an authorized individual on the behalf of any organization. Class 2 Digital Signature Certificate is available for download after verification based on a trusted and pre-verified databaseWhereas Class 2B Digital signature certificates are issued to Organization for various purposes. Class 2B digital signatures for organization is personal certificate that provides second highest level of assurance within the RCAI hierarchy setup by CCA (Controller of signNowing Authorities) in India which is mainly used for e tender filing, E Procurement, E Bidding, Bank Auction and Document Signing.

-

What is the procedure to register a startup company in India and how much will it cost?

These are four major steps required to register a start up company in india :Acquiring Digital Signature Certificate(DSC)Acquiring Director Identification Number(DIN)Document required for a DIN :A. Identity Proof (Any one of the following) PAN CardDriving LicensePassportVoter ID CardOthers (to be specified)B. Residence Proof (Any one of the following)Driving LicensePassportVoter ID CardTelephone BillRation CardElectricity BillBank StatementOthers (to be specified)Filing an e-Form or New user registrationIncorporate the company Once your company has been incorporated you can open a Current account in any of the leading banks for carrying out your operations. You will need to submit a copy of Certificate of Incorporation and Memorandum of Association along with Borad resolution to open the bank account.Then you need to apply for TAN and PAN for the Company If your services are in Software related area you can apply for STPI license which will give you certain benefits like Company need not pay tax for 5 years, there will be no import or expurty duty levied on software/hardware,You will get office spaces at lower rates at STPI units. These are few of the benefits of becoming an STPI member.All this you can do on your own or you can outsource these to professional auditor. We did it through Auditor and it took almost three weeks (Upto Step 7 excluding STPI) and all charges(excluding sTPI) would approximately cost you Rs.25,000.

-

Is ARN number also known as GST number in India?

ARN is just an Acknowledgment Number.ARN is Application Reference Number.It is an acknowledgement that you have submitted all the needful documents Govt sought for the GST Registration…. and is issued against a Provisional ID Number that Govt issued to all Indirect Tax payer….. suo-moto, sometime starting Jan 2017.Once the papers submitted are validated by the Tax Directorate, the Tax-payer would be issued the Final GST Number. Owing to the Volume of Registrations, currently the Govt is issuing only the ARN Number (against your Provisional ID Number). Issuance of the final GST Number, in my personal estimate, could take up to another six months.Provisional ID Number was PAN based, whereas the ARN Number is a serial number (based on the date and place of registration). Final GST Number may as well be PAN based. But, this obviously is my personal speculation.

Trusted esignature solution— what our customers are saying

Get legally-binding signatures now!

Frequently asked questions

How do i add an electronic signature to a word document?

How to use electronic signature paint?

What program allows electronic signature?

Get more for Electronic signature Form for Procurement Online

- Can I eSign Washington lease agreement

- Can I eSign Alabama Non disclosure agreement sample

- eSign California Non disclosure agreement sample Now

- eSign Pennsylvania Mutual non-disclosure agreement Now

- Help Me With eSign Utah Non disclosure agreement sample

- How Can I eSign Minnesota Partnership agreements

- eSign Pennsylvania Property management lease agreement Secure

- eSign Hawaii Rental agreement for house Fast

Find out other Electronic signature Form for Procurement Online

- Granting report on fundingdue on or before decemb form

- Public swimming pool and spa inspection report princegeorgescountymd form

- Abc quick guide overview of nc abc laws rules and form

- Oklahoma absentee ballot application ok gov form

- G tube feeding treatment authorization form

- Deacon nomination form

- Order cancellation amp return authorization bformb johnny dang amp co

- Minor visitor application amp background invest authorization vadoc virginia form

- Historic preservation project review cover form

- Doc 8 rev form

- Report form wisconsin department of corrections

- Fourteenth annual basketball tournament form

- Medication release form 239166236

- Pencil gram order form to

- Wallingford police department form

- Language and communication plan ct form

- Release of records hjms simsbury public schools form

- Language amp communication plan for ct form

- State of connecticutdepartment of emergency servi form

- Home education annual evaluation broward k12 fl form