8582 Form 2013

What is the 8582 Form

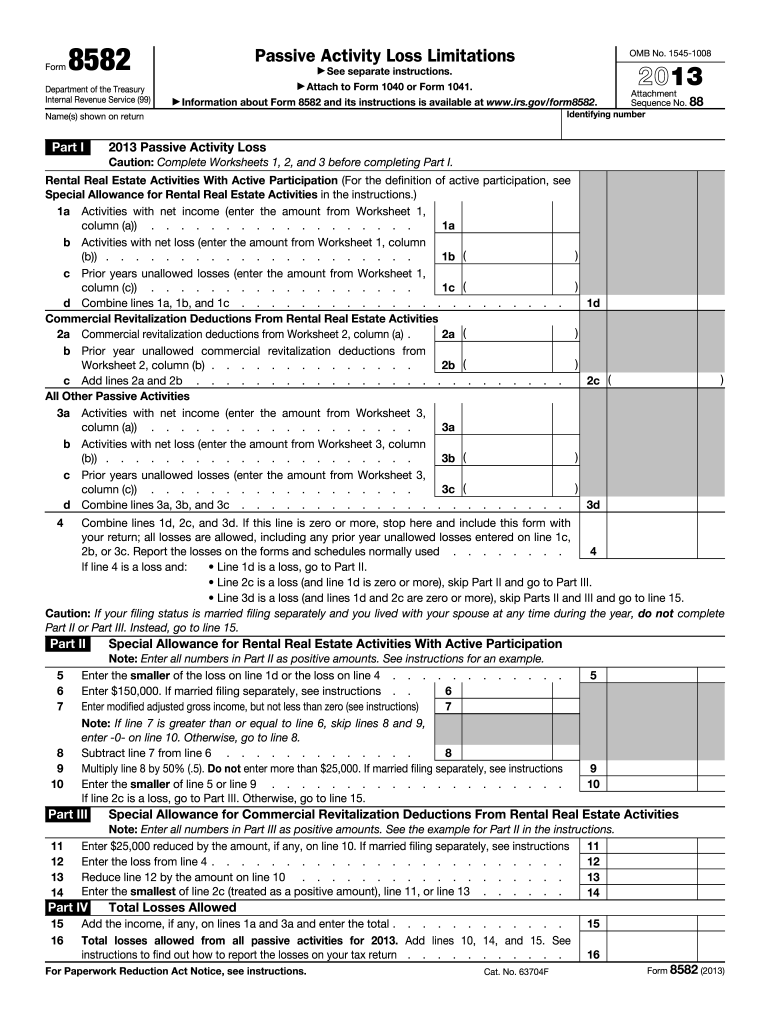

The 8582 Form, officially known as the Passive Activity Loss Limitations form, is utilized by taxpayers to report passive activity losses and determine the allowable deductions for those losses. This form is essential for individuals and entities that have passive activities, which generally include rental properties and businesses in which the taxpayer does not materially participate. Understanding the purpose of the 8582 Form is crucial for accurate tax reporting and compliance with IRS regulations.

How to use the 8582 Form

Using the 8582 Form involves a systematic approach to ensure all passive activities are reported correctly. Taxpayers must first gather information about their passive activities, including income, losses, and any prior year unallowed losses. The form requires detailed reporting of each activity, including the type of activity, income generated, and losses incurred. It is important to follow the instructions provided by the IRS to ensure proper completion and submission of the form.

Steps to complete the 8582 Form

Completing the 8582 Form involves several key steps:

- Gather all relevant financial documents related to your passive activities.

- Identify each passive activity and determine the income and losses associated with it.

- Fill out the form by entering the required information for each activity in the designated sections.

- Calculate the allowable passive activity loss and any carryover losses from previous years.

- Review the completed form for accuracy before submission.

Legal use of the 8582 Form

The legal use of the 8582 Form is governed by IRS guidelines, which dictate how passive activity losses can be reported and deducted. Taxpayers must ensure they comply with these regulations to avoid penalties. The form serves as a declaration of passive activity losses and is essential for maintaining transparency and adherence to tax laws. Proper use of the form can also protect taxpayers in the event of an audit.

Filing Deadlines / Important Dates

Filing deadlines for the 8582 Form align with the overall tax return deadlines. Generally, individual taxpayers must submit their forms by April 15 of the following tax year. If an extension is filed, the deadline can be extended to October 15. It is important to keep track of these dates to ensure timely submission and avoid potential penalties for late filing.

Required Documents

To accurately complete the 8582 Form, taxpayers should prepare several key documents:

- Income statements from passive activities.

- Records of expenses associated with passive activities.

- Prior year tax returns, especially if there are carryover losses.

- Any relevant documentation supporting the classification of activities as passive.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the 8582 Form. These guidelines include instructions on how to classify activities, calculate losses, and determine the allowable deductions. Familiarity with these guidelines is essential for ensuring compliance and maximizing potential tax benefits. Taxpayers should refer to the IRS instructions for the most current and detailed information regarding the form.

Quick guide on how to complete 2013 8582 form

Complete 8582 Form effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed documents since you can acquire the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents quickly without any delays. Handle 8582 Form on any platform with airSlate SignNow Android or iOS applications and simplify any document-centered activity today.

The easiest method to modify and eSign 8582 Form seamlessly

- Obtain 8582 Form and select Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or redact sensitive information using tools that airSlate SignNow specifically offers for this purpose.

- Generate your eSignature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method for sending your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that require reprinting new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from a device of your choice. Modify and eSign 8582 Form and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2013 8582 form

Create this form in 5 minutes!

How to create an eSignature for the 2013 8582 form

How to create an eSignature for a PDF in the online mode

How to create an eSignature for a PDF in Chrome

The best way to create an eSignature for putting it on PDFs in Gmail

The best way to create an electronic signature from your smart phone

How to generate an eSignature for a PDF on iOS devices

The best way to create an electronic signature for a PDF file on Android OS

People also ask

-

What is the 8582 Form and why do I need to use it?

The 8582 Form is an essential document for reporting passive activity losses and credits. Understanding how to accurately complete the 8582 Form is vital for compliance with tax regulations. Using airSlate SignNow can simplify the signing and submission process for your 8582 Form.

-

How can airSlate SignNow help me with my 8582 Form?

airSlate SignNow streamlines the eSigning process for your 8582 Form, allowing you to quickly send and receive signatures. With our intuitive platform, you can easily manage multiple signers and track the status of your document. This ensures that your 8582 Form is completed efficiently and accurately.

-

What are the pricing options for using airSlate SignNow for the 8582 Form?

Our pricing for airSlate SignNow is competitive and designed to fit various business needs, including frequent use of documents like the 8582 Form. We offer flexible subscription plans, and you can choose between monthly or annual billing. Additionally, we provide a free trial for you to explore our features before committing.

-

Are there any integrations available with airSlate SignNow for managing the 8582 Form?

Yes, airSlate SignNow offers various integrations with popular tools and software that can enhance the management of your 8582 Form. This includes integrations with CRM systems, cloud storage solutions, and productivity applications. These integrations streamline your workflow and help you efficiently handle your documents.

-

Is airSlate SignNow secure for submitting confidential 8582 Forms?

Absolutely! airSlate SignNow prioritizes security and uses advanced encryption methods to protect your data, including sensitive 8582 Forms. Our platform complies with industry regulations to ensure that your documents remain confidential and secure throughout the signing process.

-

Can I customize my 8582 Form using airSlate SignNow?

Yes, airSlate SignNow allows you to customize your 8582 Form with your branding elements, such as logos and color schemes. You can also add fields and modify the layout to suit your specific needs. This customization ensures that your 8582 Form aligns with your business identity.

-

What features does airSlate SignNow offer for my 8582 Form?

airSlate SignNow includes several features that enhance the eSigning experience for your 8582 Form, such as in-person signing, templates, and automated reminders. These tools help ensure that your documents are signed promptly and correctly, improving overall efficiency in your workflow.

Get more for 8582 Form

Find out other 8582 Form

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile

- Electronic signature California Car Dealer Rental Lease Agreement Fast

- Electronic signature Connecticut Car Dealer Lease Agreement Now

- Electronic signature Connecticut Car Dealer Warranty Deed Computer

- Electronic signature New Mexico Banking Job Offer Online

- How Can I Electronic signature Delaware Car Dealer Purchase Order Template

- How To Electronic signature Delaware Car Dealer Lease Template

- Electronic signature North Carolina Banking Claim Secure

- Electronic signature North Carolina Banking Separation Agreement Online

- How Can I Electronic signature Iowa Car Dealer Promissory Note Template

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Myself

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Fast