8582 Form 2012

What is the 8582 Form

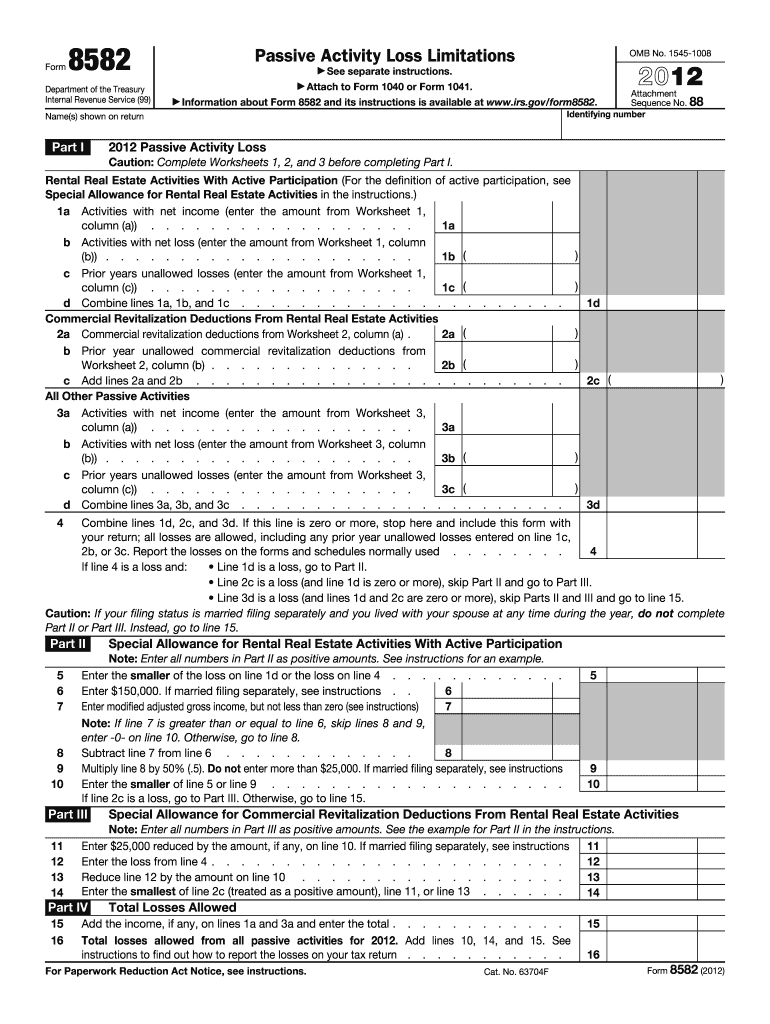

The 8582 Form is a tax document used by individuals and businesses in the United States to report passive activity losses and credits. This form is particularly relevant for taxpayers who have investments in rental properties or other passive activities. The IRS requires this form to ensure that taxpayers accurately report their income and losses, adhering to the rules governing passive activities. Understanding the purpose and requirements of the 8582 Form is essential for compliance with tax regulations.

How to use the 8582 Form

Using the 8582 Form involves several steps to ensure accurate reporting of passive activity losses. First, gather all relevant financial documents, including income statements from passive activities. Next, fill out the form by providing details about each passive activity, including income, losses, and credits. It is crucial to follow the IRS instructions carefully to avoid errors. Once completed, the form must be submitted along with your tax return to the IRS by the designated filing deadline.

Steps to complete the 8582 Form

Completing the 8582 Form requires attention to detail. Follow these steps for accurate submission:

- Gather necessary documents related to your passive activities.

- Begin filling out the form by entering your personal information at the top.

- List each passive activity separately, detailing income, losses, and credits.

- Calculate the total passive losses and determine any limitations based on your income.

- Review the form for accuracy and completeness before submission.

Legal use of the 8582 Form

The legal use of the 8582 Form is governed by IRS regulations that outline how passive activity losses can be reported. It is essential to comply with these regulations to avoid penalties. The form must be filled out correctly to ensure that any losses claimed are legitimate and supported by documentation. Failure to use the form legally can result in audits or additional tax liabilities.

Filing Deadlines / Important Dates

Filing deadlines for the 8582 Form align with the overall tax return deadlines. Typically, individual taxpayers must submit their forms by April 15 of the tax year. If you are unable to meet this deadline, you may file for an extension, but it is important to note that the extension applies to the tax return, not the payment of any taxes owed. Staying informed about these deadlines helps avoid penalties and interest charges.

IRS Guidelines

The IRS provides specific guidelines for completing the 8582 Form, which are crucial for ensuring compliance. These guidelines include instructions on how to report income, losses, and any applicable credits. Taxpayers should refer to the latest IRS publications related to passive activities and the 8582 Form for detailed information. Adhering to these guidelines helps ensure that all reported information is accurate and meets IRS standards.

Quick guide on how to complete 2012 8582 form

Effortlessly Prepare 8582 Form on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and electronically sign your documents swiftly without any holdups. Manage 8582 Form on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

The Easiest Way to Modify and Electronically Sign 8582 Form with Ease

- Locate 8582 Form and click Get Form to begin.

- Utilize the tools provided to complete your form.

- Highlight important sections of the documents or redact sensitive details using the tools that airSlate SignNow specifically supplies for this purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the information carefully and click the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form hunts, or errors requiring the printing of new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you prefer. Modify and electronically sign 8582 Form, ensuring excellent communication at every phase of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2012 8582 form

Create this form in 5 minutes!

How to create an eSignature for the 2012 8582 form

The best way to make an eSignature for a PDF file online

The best way to make an eSignature for a PDF file in Google Chrome

The way to create an electronic signature for signing PDFs in Gmail

How to generate an eSignature straight from your mobile device

How to make an eSignature for a PDF file on iOS

How to generate an eSignature for a PDF document on Android devices

People also ask

-

What is the 8582 Form and how can airSlate SignNow help with it?

The 8582 Form is used to report passive activity losses and credits. With airSlate SignNow, businesses can easily eSign and send the 8582 Form securely, ensuring compliance and efficiency in handling important tax documents.

-

Is airSlate SignNow a cost-effective solution for managing the 8582 Form?

Yes, airSlate SignNow offers a cost-effective solution for managing the 8582 Form and other documents. Our pricing plans are designed to fit various business needs, allowing you to streamline document management without breaking the bank.

-

What features does airSlate SignNow provide for the 8582 Form?

airSlate SignNow offers features like customizable templates, electronic signatures, and secure document storage specifically for managing the 8582 Form. These features ensure that you can complete and send your forms quickly and securely.

-

Can I integrate airSlate SignNow with other platforms for the 8582 Form?

Absolutely! airSlate SignNow integrates seamlessly with various platforms such as Google Drive, Salesforce, and more, allowing you to manage the 8582 Form within your existing workflow effortlessly.

-

How secure is the 8582 Form when using airSlate SignNow?

Security is a top priority at airSlate SignNow. The 8582 Form and other documents are protected with advanced encryption and secure access controls, ensuring that your sensitive information remains confidential.

-

How does airSlate SignNow simplify the process of sending the 8582 Form?

airSlate SignNow simplifies the process of sending the 8582 Form by allowing you to create, edit, and eSign documents online. This eliminates the need for printing and scanning, making it faster and more efficient.

-

Can I track the status of my 8582 Form using airSlate SignNow?

Yes, airSlate SignNow provides tracking features that allow you to monitor the status of your 8582 Form. You will receive notifications when the document is viewed and signed, ensuring you stay updated throughout the process.

Get more for 8582 Form

- Nc public school benefits ampamp employment policy manual form

- Authorization for release of information unitedhealthcare inc

- False or incomplete information given on this form may result in

- Be sure you your husband or wife and all children who live with you between 18 and 26 form

- Appl02doc application form for current program

- Campuswide id form

- Laguardia community college office of the registrar form

- To be eligible to apply for core privileges in otolaryngology the initial applicant must meet the form

Find out other 8582 Form

- Electronic signature Kentucky Business Operations Quitclaim Deed Mobile

- Electronic signature Pennsylvania Car Dealer POA Later

- Electronic signature Louisiana Business Operations Last Will And Testament Myself

- Electronic signature South Dakota Car Dealer Quitclaim Deed Myself

- Help Me With Electronic signature South Dakota Car Dealer Quitclaim Deed

- Electronic signature South Dakota Car Dealer Affidavit Of Heirship Free

- Electronic signature Texas Car Dealer Purchase Order Template Online

- Electronic signature Texas Car Dealer Purchase Order Template Fast

- Electronic signature Maryland Business Operations NDA Myself

- Electronic signature Washington Car Dealer Letter Of Intent Computer

- Electronic signature Virginia Car Dealer IOU Fast

- How To Electronic signature Virginia Car Dealer Medical History

- Electronic signature Virginia Car Dealer Separation Agreement Simple

- Electronic signature Wisconsin Car Dealer Contract Simple

- Electronic signature Wyoming Car Dealer Lease Agreement Template Computer

- How Do I Electronic signature Mississippi Business Operations Rental Application

- Electronic signature Missouri Business Operations Business Plan Template Easy

- Electronic signature Missouri Business Operations Stock Certificate Now

- Electronic signature Alabama Charity Promissory Note Template Computer

- Electronic signature Colorado Charity Promissory Note Template Simple