8582 Form 2015

What is the 8582 Form

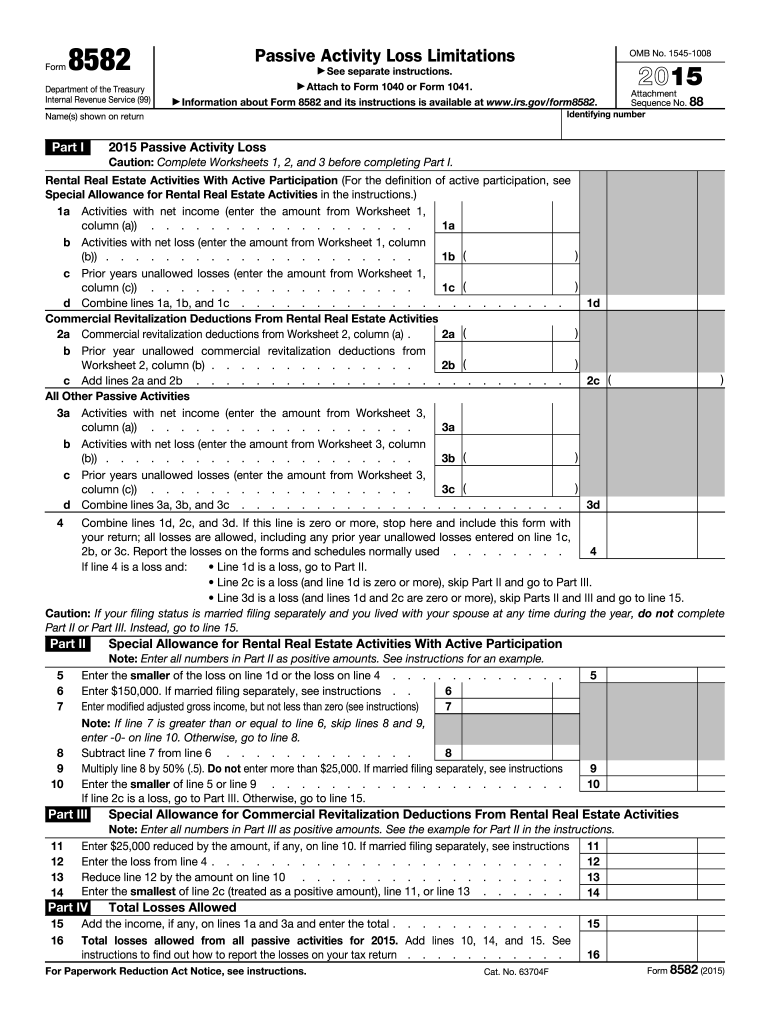

The 8582 Form, officially known as the Passive Activity Loss Limitations, is a tax form used by individuals and entities to report passive activity losses and determine the allowable deductions against non-passive income. This form is primarily utilized by taxpayers who have investments in rental real estate or other passive activities. Understanding the nuances of this form is essential for accurate tax reporting and compliance with IRS regulations.

How to use the 8582 Form

To effectively use the 8582 Form, taxpayers must first gather all relevant information regarding their passive activities. This includes income, losses, and any prior year unallowed losses. The form requires taxpayers to categorize their activities and calculate the allowable losses that can offset other income. Completing the form accurately ensures that taxpayers do not miss out on potential deductions while remaining compliant with IRS guidelines.

Steps to complete the 8582 Form

Completing the 8582 Form involves several key steps:

- Gather all necessary documentation related to passive activities.

- Identify and categorize each passive activity on the form.

- Calculate the total income and losses for each activity.

- Determine the allowable losses based on IRS rules.

- Complete the form by entering the calculated figures in the appropriate sections.

- Review the form for accuracy before submission.

Legal use of the 8582 Form

The legal use of the 8582 Form is governed by IRS regulations that dictate how passive activity losses can be reported and utilized. Taxpayers must adhere to these regulations to ensure that their deductions are valid. Proper completion and submission of the form not only help in minimizing tax liabilities but also protect taxpayers from potential audits or penalties related to improper reporting.

Filing Deadlines / Important Dates

Filing deadlines for the 8582 Form align with the standard tax return deadlines. Typically, individual taxpayers must submit their forms by April 15 of the tax year. If additional time is needed, taxpayers can file for an extension, which typically extends the deadline to October 15. It is crucial to be aware of these dates to avoid any late filing penalties.

Required Documents

To complete the 8582 Form accurately, taxpayers should prepare the following documents:

- Records of all passive income and losses.

- Prior year tax returns, if applicable.

- Documentation of any real estate investments.

- Statements from partnerships or S corporations, if involved.

Who Issues the Form

The 8582 Form is issued by the Internal Revenue Service (IRS), which is the federal agency responsible for tax collection and tax law enforcement in the United States. Taxpayers can obtain the form directly from the IRS website or through tax preparation software that includes IRS forms.

Quick guide on how to complete 2015 8582 form

Complete 8582 Form effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to access the necessary form and securely save it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents promptly without any holdups. Manage 8582 Form on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign 8582 Form without stress

- Obtain 8582 Form and then click Get Form to begin.

- Utilize the features we provide to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the information and then click on the Done button to save your modifications.

- Select your preferred method to send your form, via email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or mistakes that require reprinting new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you choose. Modify and eSign 8582 Form and ensure exceptional communication throughout the document preparation process using airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2015 8582 form

Create this form in 5 minutes!

How to create an eSignature for the 2015 8582 form

The best way to make an electronic signature for your PDF file in the online mode

The best way to make an electronic signature for your PDF file in Chrome

The best way to make an eSignature for putting it on PDFs in Gmail

The best way to generate an eSignature from your smartphone

How to generate an electronic signature for a PDF file on iOS devices

The best way to generate an eSignature for a PDF file on Android

People also ask

-

What is the 8582 Form and how can airSlate SignNow help with it?

The 8582 Form is a critical document used for reporting passive activity losses and credits. With airSlate SignNow, you can easily manage, send, and eSign your 8582 Form, ensuring compliance and accuracy while saving time and reducing paper usage.

-

Is airSlate SignNow suitable for managing the 8582 Form?

Yes, airSlate SignNow is specifically designed to handle various documents, including the 8582 Form. Our platform allows you to securely eSign and streamline the submission process, making it perfect for both individuals and businesses.

-

What features does airSlate SignNow offer for the 8582 Form?

airSlate SignNow offers features such as customizable templates, secure cloud storage, and real-time tracking for your 8582 Form. These tools enhance your efficiency and ensure that all your documents are handled securely and professionally.

-

How much does it cost to use airSlate SignNow for the 8582 Form?

airSlate SignNow offers flexible pricing plans that cater to different needs and budgets. You can start with a free trial to explore our features for the 8582 Form, and our paid plans provide additional functionalities to enhance your document management experience.

-

Can I integrate airSlate SignNow with other software for the 8582 Form?

Absolutely! airSlate SignNow supports various integrations with popular software solutions, allowing you to seamlessly manage your 8582 Form alongside other applications. This connectivity helps streamline your workflow and enhances productivity.

-

What are the benefits of using airSlate SignNow for the 8582 Form?

Using airSlate SignNow for your 8582 Form offers numerous benefits, including expedited processing times, improved accuracy, and enhanced security. Our platform simplifies the signing process while ensuring that your documents remain confidential and compliant.

-

Is airSlate SignNow compliant with regulations for the 8582 Form?

Yes, airSlate SignNow is designed to comply with necessary regulations for the 8582 Form. Our platform utilizes advanced security protocols to protect your data and ensure that all transactions adhere to legal standards.

Get more for 8582 Form

Find out other 8582 Form

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form