Instructions for Form 8582 Internal Revenue Service 2022

What is the Instructions for Form 8582?

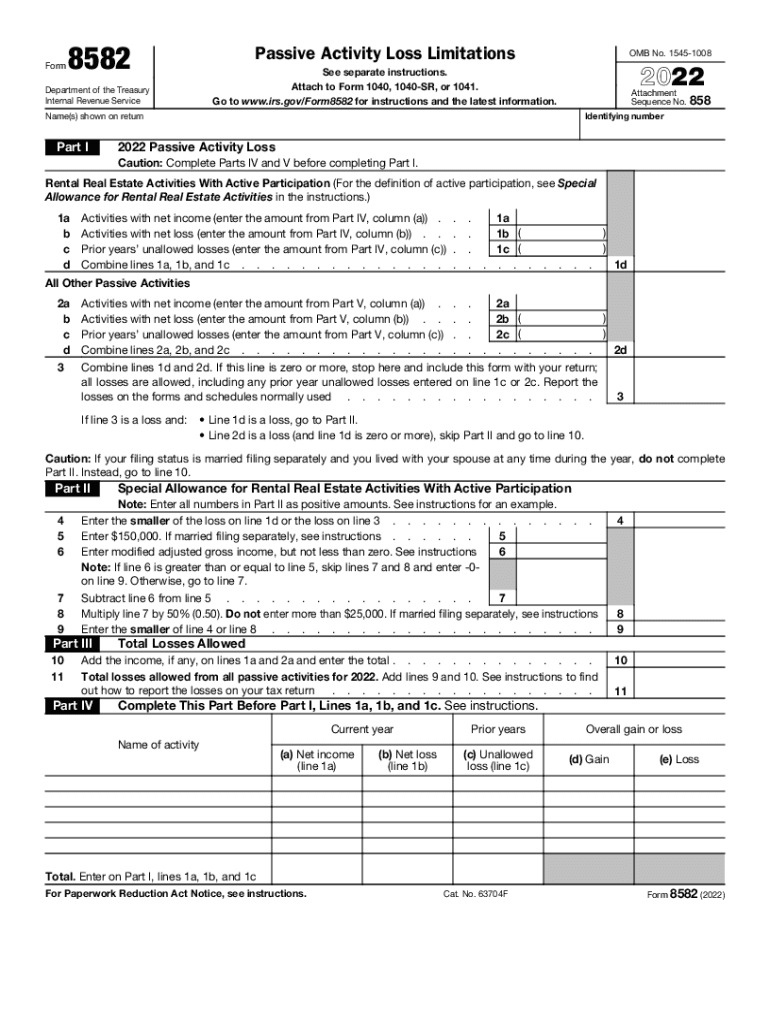

The Instructions for Form 8582, issued by the Internal Revenue Service (IRS), provide essential guidelines for taxpayers who need to report passive activity losses and credits. This form is particularly relevant for individuals and entities involved in rental real estate or other passive activities. Understanding these instructions is crucial for accurately completing the form and ensuring compliance with IRS regulations.

Form 8582 is used to calculate the allowable passive activity losses that can offset income from other sources. It includes detailed sections that outline the types of income and losses that qualify as passive, as well as the limitations that apply. These instructions also clarify how to handle special cases, such as those involving real estate professionals or taxpayers who have suspended losses from previous years.

Steps to Complete the Instructions for Form 8582

Completing the Instructions for Form 8582 involves several key steps that ensure accurate reporting of passive activity losses. First, gather all relevant financial documents, including income statements and records of expenses related to passive activities. Next, review the instructions carefully to identify which sections apply to your specific situation.

Begin filling out the form by entering your passive income and losses. Follow the guidance provided in the instructions for calculating any allowable losses and ensure that you account for any limitations that may apply. Finally, double-check all entries for accuracy before submitting the form to the IRS, either electronically or by mail.

Key Elements of the Instructions for Form 8582

The Instructions for Form 8582 include several key elements that are vital for taxpayers. These elements encompass definitions of passive activities, guidelines for determining material participation, and rules for the treatment of suspended losses. Additionally, the instructions outline the necessary calculations to determine the allowable passive activity loss for the tax year.

Another important aspect is the explanation of how to report passive activity credits, including any applicable limitations. The instructions also provide examples to illustrate common scenarios, helping taxpayers understand how to apply the rules to their individual situations.

Filing Deadlines / Important Dates

Filing deadlines for Form 8582 align with the overall tax filing deadlines set by the IRS. Typically, individual taxpayers must file their tax returns by April 15 of the following year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is essential to keep track of these dates to avoid penalties for late filing.

For taxpayers who require additional time, an extension can be requested, allowing for a six-month extension to file. However, it is important to note that this extension does not apply to any taxes owed, which must still be paid by the original deadline to avoid interest and penalties.

Legal Use of the Instructions for Form 8582

The legal use of the Instructions for Form 8582 is grounded in compliance with IRS regulations. Taxpayers must adhere to the guidelines provided to ensure that their reporting of passive activity losses is accurate and compliant with federal tax laws. Failure to follow these instructions can result in incorrect filings, which may lead to audits, penalties, or other legal consequences.

Moreover, understanding the legal implications of passive activity loss limitations is critical for taxpayers, especially those involved in real estate or other investment activities. By following the instructions carefully, taxpayers can protect themselves from legal issues and ensure that they are maximizing their allowable deductions.

Examples of Using the Instructions for Form 8582

Examples provided in the Instructions for Form 8582 illustrate how to apply the rules in real-world scenarios. For instance, a taxpayer who rents out a property may use the instructions to determine whether their rental activity qualifies as passive and how to calculate any losses incurred during the tax year.

Another example may involve a taxpayer who is a real estate professional. The instructions clarify how these individuals can qualify for exceptions to the passive activity loss rules, allowing them to deduct losses against other income. These examples serve as practical guides, helping taxpayers navigate the complexities of passive activity reporting.

Quick guide on how to complete instructions for form 8582 2022internal revenue service

Effortlessly Prepare Instructions For Form 8582 Internal Revenue Service on Any Device

The management of online documents has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents promptly without waiting. Manage Instructions For Form 8582 Internal Revenue Service on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to Modify and eSign Instructions For Form 8582 Internal Revenue Service with Ease

- Locate Instructions For Form 8582 Internal Revenue Service and click Get Form to begin.

- Use the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or conceal sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature with the Sign tool, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Review all information carefully and click on the Done button to save your modifications.

- Select how you wish to share your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form browsing, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Adjust and eSign Instructions For Form 8582 Internal Revenue Service while ensuring excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct instructions for form 8582 2022internal revenue service

Create this form in 5 minutes!

People also ask

-

What is the 2021 passive latest feature of airSlate SignNow?

The 2021 passive latest feature of airSlate SignNow includes advanced eSignature capabilities that streamline the document signing process. This ensures that users can send, sign, and manage documents effortlessly, allowing for a more efficient workflow. It reflects our commitment to providing innovative solutions that meet the evolving needs of businesses.

-

How much does airSlate SignNow cost in 2021?

In 2021, airSlate SignNow offers competitive pricing plans to fit various business needs. The latest pricing options can provide substantial savings while ensuring access to all essential features. Visit our pricing page for the detailed breakdown of plans and any ongoing promotions in 2021.

-

What are the benefits of using airSlate SignNow's 2021 passive latest tools?

Using the 2021 passive latest tools from airSlate SignNow increases efficiency and saves time by automating the signing process. Users benefit from reduced paper usage and enhanced tracking capabilities, allowing for better document management. This leads to smoother operations and improved customer experiences.

-

Can I integrate airSlate SignNow with other applications in 2021?

Absolutely! The 2021 passive latest version of airSlate SignNow supports a variety of integrations with popular applications such as Google Drive, Salesforce, and Zapier. This flexibility makes it easier for businesses to incorporate eSignature solutions into their existing workflows, enhancing productivity.

-

Is airSlate SignNow secure for digital signatures in 2021?

Yes, airSlate SignNow prioritizes security, employing industry-standard encryption and compliance measures. In 2021, you can trust that your documents are protected while using the latest features for digital signatures. Security certifications further reinforce our commitment to safeguarding your data.

-

How does airSlate SignNow improve collaboration in 2021?

The 2021 passive latest features of airSlate SignNow facilitate better collaboration by allowing multiple users to review and sign documents simultaneously. This real-time collaboration reduces the turnaround time and enhances team productivity. Access to shared documents improves communication and reduces delays.

-

What type of support does airSlate SignNow provide to users in 2021?

In 2021, airSlate SignNow offers comprehensive customer support through various channels, including live chat, email, and phone. Our support team is dedicated to assisting users with any inquiries they may have regarding the latest features. We aim to ensure you get the most out of your airSlate SignNow experience.

Get more for Instructions For Form 8582 Internal Revenue Service

- Bill of sale in connection with sale of business by individual or corporate seller new york form

- Order discontinuation of treatment new york form

- Petition family offense form

- Ny disposition form

- New york form 497321505

- New york case form

- Office lease agreement new york form

- Commercial sublease new york form

Find out other Instructions For Form 8582 Internal Revenue Service

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT