Irs 8582 Form 2016

What is the Irs 8582 Form

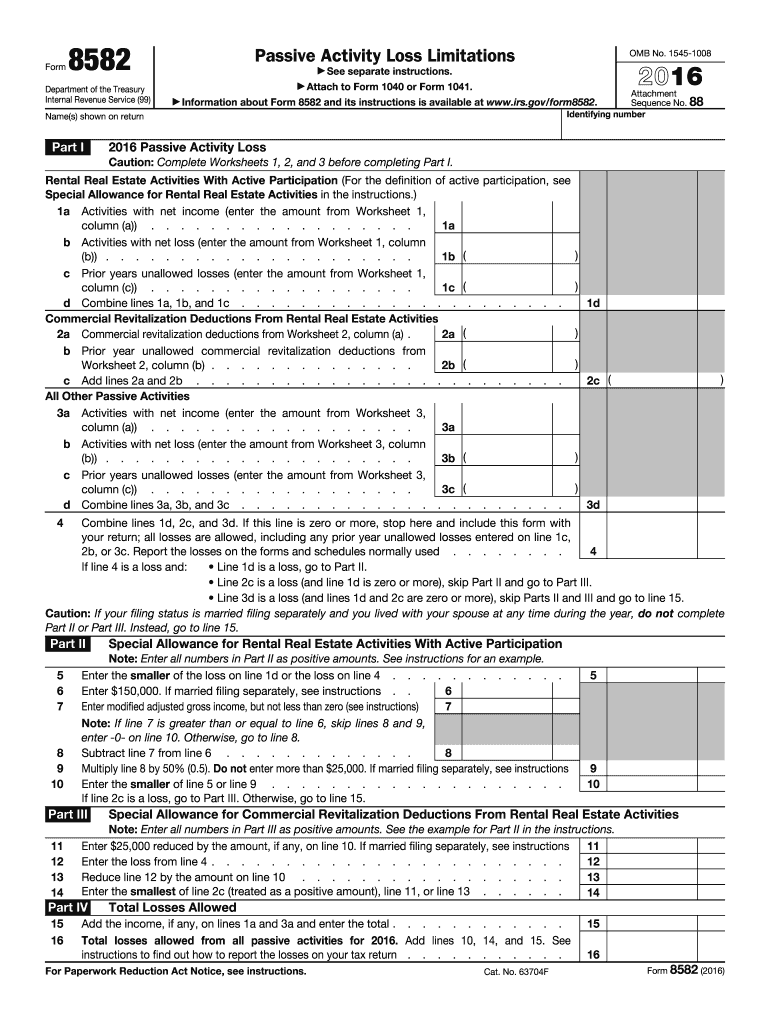

The Irs 8582 Form, also known as the Passive Activity Loss Limitations form, is a tax document used by individuals and entities to report passive activity losses and credits. This form is essential for taxpayers who have rental real estate activities or other passive investments, as it helps determine the extent to which these losses can offset non-passive income. Understanding the Irs 8582 Form is crucial for accurate tax reporting and compliance with IRS regulations.

How to use the Irs 8582 Form

Using the Irs 8582 Form involves several key steps. Taxpayers must first gather all relevant information regarding their passive activities, including income and losses from rental properties or other investments. Next, they should carefully fill out the form, ensuring that all sections are completed accurately. The form requires details about each passive activity, including the type of activity, the income generated, and any losses incurred. Once completed, the form must be submitted along with the taxpayer's income tax return.

Steps to complete the Irs 8582 Form

Completing the Irs 8582 Form involves a systematic approach:

- Gather all necessary documentation related to passive activities.

- Identify and list each passive activity on the form.

- Calculate the total income and losses for each activity.

- Complete the required sections of the form, ensuring accuracy.

- Review the form for any errors or omissions.

- Submit the completed form with your tax return.

Key elements of the Irs 8582 Form

The Irs 8582 Form consists of several key elements that taxpayers must understand:

- Passive Activity Income: This includes income generated from rental properties and other passive investments.

- Passive Activity Losses: Losses that can be claimed against passive income, subject to limitations.

- Special Allowance: Certain taxpayers may qualify for a special allowance that allows them to deduct losses against non-passive income.

- At-Risk Limitations: Taxpayers must consider at-risk rules when determining the deductibility of losses.

Filing Deadlines / Important Dates

Filing deadlines for the Irs 8582 Form align with the overall tax return deadlines. Generally, individual taxpayers must file their federal income tax returns by April 15 of each year. If additional time is needed, taxpayers can file for an extension, which typically extends the deadline to October 15. It is important to ensure that the Irs 8582 Form is submitted by these deadlines to avoid penalties and interest on unpaid taxes.

Penalties for Non-Compliance

Failure to comply with the requirements of the Irs 8582 Form can result in significant penalties. Taxpayers who do not report passive activity losses correctly may face additional taxes, interest, and penalties from the IRS. It is essential to ensure that all information is accurate and complete to avoid these consequences. Consulting with a tax professional can help mitigate risks associated with non-compliance.

Quick guide on how to complete irs 2016 8582 form

Simplify Irs 8582 Form effortlessly on any gadget

Digital document management has increasingly gained traction among organizations and individuals. It serves as an excellent environmentally friendly alternative to traditional printed and signed paperwork, enabling you to find the correct template and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents promptly without delays. Manage Irs 8582 Form on any gadget with airSlate SignNow Android or iOS applications and streamline any document-based task today.

The easiest way to modify and electronically sign Irs 8582 Form with ease

- Obtain Irs 8582 Form and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important parts of the documents or obscure sensitive information using the tools that airSlate SignNow provides specifically for this purpose.

- Create your electronic signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Irs 8582 Form and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs 2016 8582 form

Create this form in 5 minutes!

How to create an eSignature for the irs 2016 8582 form

How to create an eSignature for your Irs 2016 8582 Form online

How to create an electronic signature for your Irs 2016 8582 Form in Google Chrome

How to make an eSignature for putting it on the Irs 2016 8582 Form in Gmail

How to make an electronic signature for the Irs 2016 8582 Form from your mobile device

How to make an electronic signature for the Irs 2016 8582 Form on iOS devices

How to make an electronic signature for the Irs 2016 8582 Form on Android devices

People also ask

-

What is the Irs 8582 Form and why is it important?

The Irs 8582 Form is a tax form used to calculate passive activity losses and credit limitations. It's essential for taxpayers who participate in passive activities to ensure compliance with IRS regulations and accurately report income. Understanding the Irs 8582 Form can help you avoid mistakes that could lead to penalties.

-

How can airSlate SignNow help with the Irs 8582 Form?

airSlate SignNow simplifies the process of preparing the Irs 8582 Form by allowing users to upload, fill out, and eSign documents quickly and securely. Our platform ensures that all necessary information is captured accurately, reducing the potential for errors. With airSlate SignNow, managing your Irs 8582 Form becomes a hassle-free experience.

-

What features does airSlate SignNow offer for handling tax forms like the Irs 8582 Form?

airSlate SignNow offers essential features such as customizable templates, secure document storage, and eSignature capabilities which streamline the handling of the Irs 8582 Form. Users can collaborate in real-time, track changes, and manage workflows efficiently. These features enhance productivity and organization, making tax preparation easier.

-

Is there a cost associated with using airSlate SignNow for the Irs 8582 Form?

Yes, airSlate SignNow offers various pricing plans tailored to suit different business needs, ensuring you get value for your investment in managing the Irs 8582 Form. Our cost-effective solutions provide access to necessary features without breaking your budget. You can choose a plan that best fits your usage and business requirements.

-

Are there any integrations available to assist with the Irs 8582 Form?

Absolutely! airSlate SignNow integrates with various third-party applications, including popular accounting software, to help streamline the process of preparing the Irs 8582 Form. These integrations enhance efficiency, allowing users to sync data and access documents easily. This connectivity ensures a smoother workflow for tax preparation.

-

Can I track the status of my Irs 8582 Form using airSlate SignNow?

Yes, airSlate SignNow provides tracking features that allow you to monitor the status of your Irs 8582 Form. You’ll receive notifications when documents are viewed, signed, or completed, ensuring you stay informed throughout the process. This transparency helps manage signings efficiently and meets deadlines comfortably.

-

Is it safe to use airSlate SignNow for sensitive documents like the Irs 8582 Form?

Yes, security is a top priority at airSlate SignNow. We implement advanced encryption protocols and secure cloud storage to protect your sensitive documents, including the Irs 8582 Form. You can trust that your information will be safeguarded against unauthorized access and data bsignNowes.

Get more for Irs 8582 Form

- Ir002 form

- Ndoi 901 form

- Nevada check up form

- Nevada personalized license form

- Adult dnr form nevada

- Application for extension of time water nv form

- How to apply varaince nevada health form

- Form h c 1 health care contributions worksheet and form w h t 4 36 quarterly withholding reconciliation and required

Find out other Irs 8582 Form

- How Can I Electronic signature Alabama Legal PDF

- How To Electronic signature Alaska Legal Document

- Help Me With Electronic signature Arkansas Legal PDF

- How Can I Electronic signature Arkansas Legal Document

- How Can I Electronic signature California Legal PDF

- Can I Electronic signature Utah High Tech PDF

- How Do I Electronic signature Connecticut Legal Document

- How To Electronic signature Delaware Legal Document

- How Can I Electronic signature Georgia Legal Word

- How Do I Electronic signature Alaska Life Sciences Word

- How Can I Electronic signature Alabama Life Sciences Document

- How Do I Electronic signature Idaho Legal Form

- Help Me With Electronic signature Arizona Life Sciences PDF

- Can I Electronic signature Colorado Non-Profit Form

- How To Electronic signature Indiana Legal Form

- How To Electronic signature Illinois Non-Profit Document

- Can I Electronic signature Kentucky Legal Document

- Help Me With Electronic signature New Jersey Non-Profit PDF

- Can I Electronic signature New Jersey Non-Profit Document

- Help Me With Electronic signature Michigan Legal Presentation