8582 Form 2014

What is the 8582 Form

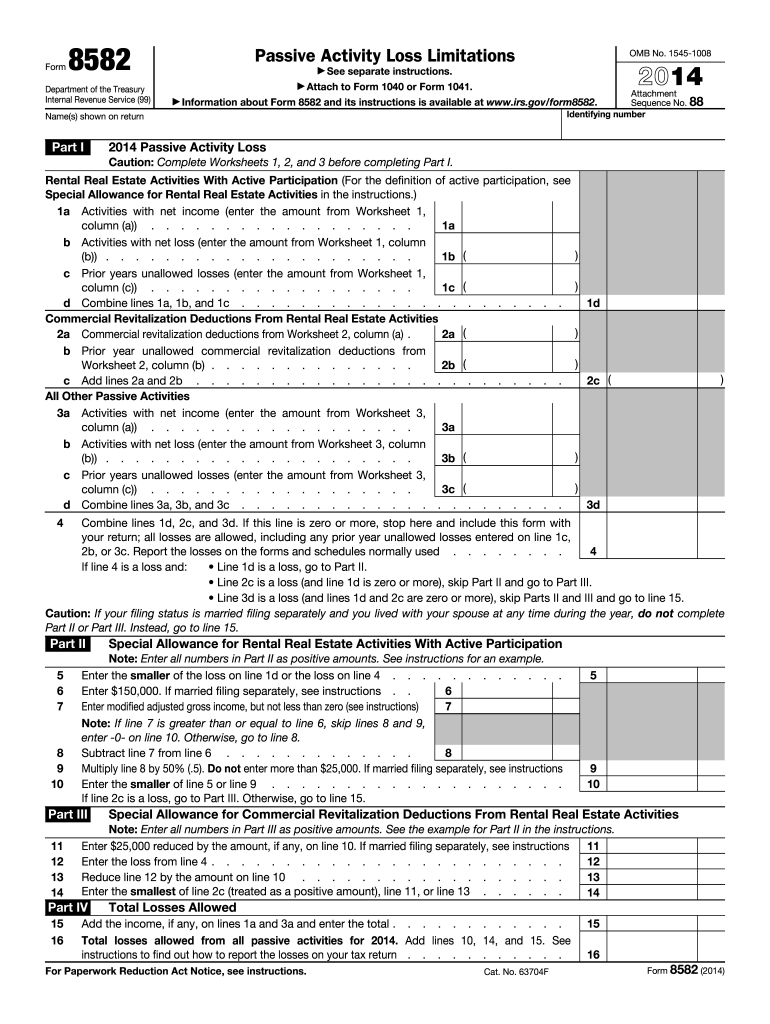

The 8582 Form, officially known as the Passive Activity Loss Limitations form, is used by taxpayers to report passive activity losses and credits. This form is essential for individuals and entities that have investments in passive activities, such as rental real estate or limited partnerships. The IRS requires this form to determine how much of a passive loss can be deducted against non-passive income, ensuring compliance with tax regulations.

How to use the 8582 Form

To effectively use the 8582 Form, taxpayers must first gather all relevant financial information regarding their passive activities. This includes income, losses, and any credits associated with these activities. The form requires detailed reporting of each passive activity, including the total income and losses incurred. Taxpayers must calculate the allowable losses and credits based on IRS guidelines, ensuring that they adhere to the passive activity loss rules. Proper completion of this form can help maximize tax benefits while maintaining compliance with IRS regulations.

Steps to complete the 8582 Form

Completing the 8582 Form involves several key steps:

- Gather all necessary documentation related to passive activities, including income statements and loss records.

- Fill out the identification section, including your name, Social Security number, and tax year.

- List each passive activity separately, providing details such as income, losses, and credits.

- Calculate the total passive losses and determine the allowable losses based on IRS rules.

- Review the completed form for accuracy and ensure all calculations are correct.

- Submit the form along with your tax return, either electronically or by mail.

Legal use of the 8582 Form

The legal use of the 8582 Form is governed by IRS regulations concerning passive activities. To ensure that the form is legally binding, it is crucial to provide accurate information and adhere to all relevant tax laws. E-signatures are accepted for electronically filed forms, provided they comply with the Electronic Signatures in Global and National Commerce Act (ESIGN). This ensures that the form maintains its legal validity when submitted electronically.

Filing Deadlines / Important Dates

Filing deadlines for the 8582 Form align with the overall tax return deadlines. Typically, individual taxpayers must submit their forms by April fifteenth of the following tax year. If additional time is needed, taxpayers can file for an extension, which typically extends the deadline to October fifteenth. It is important to stay informed about any changes to deadlines, as they can vary based on specific circumstances or IRS announcements.

Who Issues the Form

The 8582 Form is issued by the Internal Revenue Service (IRS), the federal agency responsible for tax collection and enforcement in the United States. The IRS provides the form and accompanying instructions on its official website, ensuring that taxpayers have access to the most current version and guidance for completion. It is essential for taxpayers to use the latest version of the form to ensure compliance with current tax laws.

Quick guide on how to complete 2014 8582 form

Effortlessly prepare 8582 Form on any device

Web-based document administration has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed paperwork, as you can access the appropriate form and securely store it online. airSlate SignNow equips you with all the features necessary to create, modify, and electronically sign your documents swiftly without delays. Manage 8582 Form on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

Steps to alter and electronically sign 8582 Form effortlessly

- Acquire 8582 Form and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize essential sections of your documents or obscure sensitive information with tools that airSlate SignNow supplies specifically for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method to submit your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that require reprinting new document copies. airSlate SignNow meets your document management requirements with just a few clicks from any device of your choice. Modify and electronically sign 8582 Form to ensure clear communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2014 8582 form

Create this form in 5 minutes!

How to create an eSignature for the 2014 8582 form

The way to make an electronic signature for your PDF document in the online mode

The way to make an electronic signature for your PDF document in Chrome

The best way to make an electronic signature for putting it on PDFs in Gmail

The way to make an eSignature from your mobile device

The way to generate an electronic signature for a PDF document on iOS devices

The way to make an eSignature for a PDF file on Android devices

People also ask

-

What is the 8582 Form and how is it used?

The 8582 Form is a tax form used to report passive activity losses and credits. Businesses often need to fill out this form to ensure compliance with IRS regulations when claiming losses from passive activities, such as rental real estate. Using airSlate SignNow, you can easily eSign and manage your 8582 Form efficiently.

-

How can airSlate SignNow help with the 8582 Form?

airSlate SignNow provides an intuitive platform for eSigning and sending the 8582 Form securely. With our solution, you can streamline the process of completing and submitting your 8582 Form, reducing time spent on paperwork and ensuring that your documents are legally binding.

-

Is there a cost associated with using airSlate SignNow for the 8582 Form?

Yes, airSlate SignNow offers various pricing plans tailored to your business needs, which include features for eSigning documents such as the 8582 Form. Our plans are designed to be cost-effective, giving you flexibility in managing your documents without breaking the bank.

-

What features does airSlate SignNow offer for the 8582 Form?

airSlate SignNow offers a range of features for the 8582 Form, including customizable templates, secure eSigning, and document tracking. These features simplify the process of preparing and submitting your 8582 Form, ensuring you have everything you need at your fingertips.

-

Can I integrate airSlate SignNow with other software for the 8582 Form?

Absolutely! airSlate SignNow can be integrated with various business applications, allowing you to manage your 8582 Form alongside other important documents. This integration capability enhances your workflow and keeps all your essential tools in one place.

-

What are the benefits of using airSlate SignNow for the 8582 Form?

Using airSlate SignNow for the 8582 Form provides numerous benefits, including increased efficiency, enhanced security, and a user-friendly interface. Our platform helps reduce errors and speeds up the signing process, making it easier to stay compliant with tax regulations.

-

Is airSlate SignNow secure for handling the 8582 Form?

Yes, airSlate SignNow prioritizes security, ensuring that your 8582 Form and other documents are protected with industry-leading encryption. Our platform complies with strict data protection regulations, giving you peace of mind when managing sensitive information.

Get more for 8582 Form

Find out other 8582 Form

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form