Form 8582 Passive Activity Loss Limitations 2020

What is the Form 8582 Passive Activity Loss Limitations

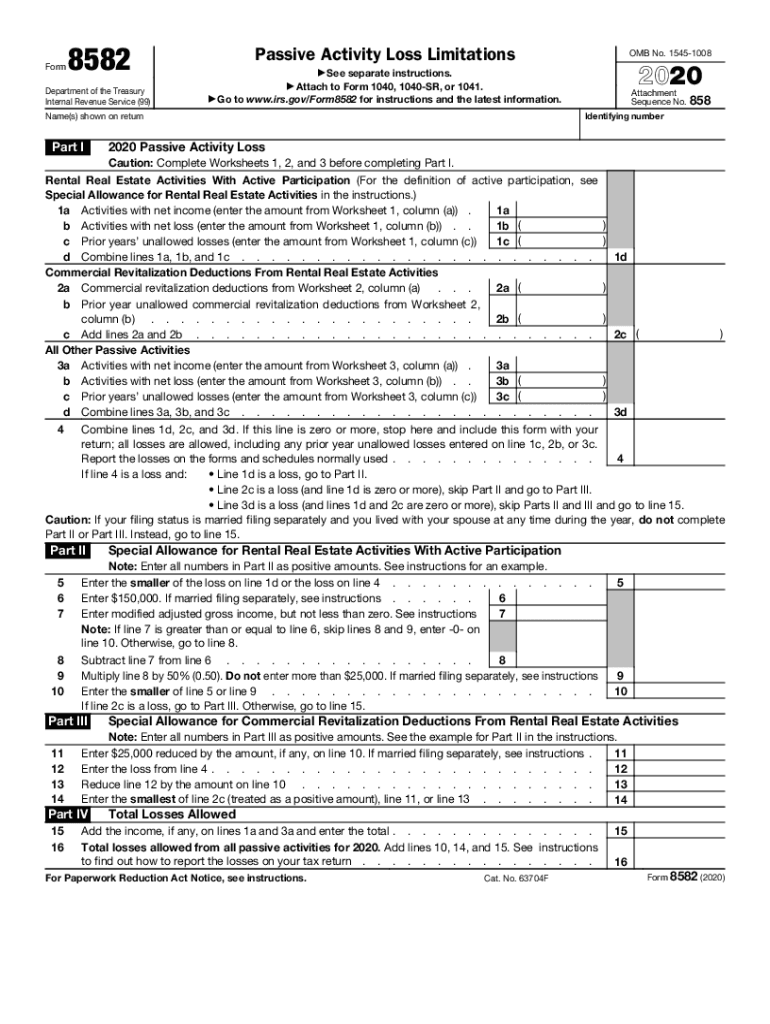

The Form 8582 is used by taxpayers to report passive activity loss limitations. This form is essential for individuals, partnerships, and corporations that have passive activities, which are generally defined as business activities in which the taxpayer does not materially participate. The IRS requires this form to ensure that losses from these activities are correctly calculated and that taxpayers do not offset non-passive income with passive losses beyond the allowable limits.

How to use the Form 8582 Passive Activity Loss Limitations

To effectively use the Form 8582, taxpayers must first determine their passive activities and the associated income or losses. The form requires detailed information about each passive activity, including income, losses, and any prior year unallowed losses. Taxpayers should follow the instructions carefully, ensuring that they accurately report their passive income and losses to comply with IRS regulations.

Steps to complete the Form 8582 Passive Activity Loss Limitations

Completing the Form 8582 involves several key steps:

- Gather all relevant financial information related to passive activities.

- List each passive activity and its corresponding income and losses on the form.

- Calculate the total passive losses and determine the allowable losses based on IRS guidelines.

- Complete the necessary sections of the form, ensuring all calculations are accurate.

- Review the form for completeness and accuracy before submission.

IRS Guidelines

The IRS provides specific guidelines for using the Form 8582, which include instructions on how to calculate passive activity losses and the limits on these losses. Taxpayers must be aware of the rules regarding material participation, as this determines whether an activity is considered passive. The IRS guidelines also outline what constitutes allowable losses and how to carry forward unallowed losses to future tax years.

Filing Deadlines / Important Dates

Taxpayers must adhere to specific filing deadlines for the Form 8582. Generally, the form is due on the same date as the taxpayer's income tax return. For most individuals, this means the form should be filed by April 15 of the following year. However, if an extension is filed, the deadline may be extended to October 15. It is crucial to stay informed about these dates to avoid penalties.

Penalties for Non-Compliance

Failure to comply with the IRS requirements regarding the Form 8582 can result in significant penalties. Taxpayers may face fines for inaccuracies or for failing to file the form altogether. Additionally, unreported passive losses may lead to an audit, further complicating a taxpayer's financial situation. It is essential to ensure that the form is completed accurately and submitted on time to avoid these potential consequences.

Quick guide on how to complete 2020 form 8582 passive activity loss limitations

Complete Form 8582 Passive Activity Loss Limitations effortlessly on any device

Online document management has become increasingly favored by organizations and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents since you can locate the necessary form and securely save it online. airSlate SignNow provides you with all the resources required to create, alter, and electronically sign your documents swiftly without any holdups. Manage Form 8582 Passive Activity Loss Limitations on any platform with airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to modify and electronically sign Form 8582 Passive Activity Loss Limitations with ease

- Locate Form 8582 Passive Activity Loss Limitations and then click Get Form to begin.

- Make use of the tools we offer to complete your form.

- Emphasize relevant parts of your documents or obscure sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate the hassle of missing or lost files, the painstaking process of form searches, or errors that necessitate the printing of new document duplicates. airSlate SignNow efficiently addresses your document management needs in just a few clicks from any device you choose. Modify and eSign Form 8582 Passive Activity Loss Limitations and ensure outstanding communication at all stages of the form development procedure with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 form 8582 passive activity loss limitations

Create this form in 5 minutes!

How to create an eSignature for the 2020 form 8582 passive activity loss limitations

The way to create an electronic signature for a PDF online

The way to create an electronic signature for a PDF in Google Chrome

How to create an eSignature for signing PDFs in Gmail

The best way to make an eSignature right from your smartphone

The best way to create an eSignature for a PDF on iOS

The best way to make an eSignature for a PDF on Android

People also ask

-

What is the 8582 form and how is it used?

The 8582 form refers to the Passive Activity Loss Limitations form required by the IRS. It is used to report passive losses and income from activities such as rental properties. By accurately completing the 8582 form, taxpayers can ensure compliance while maximizing their potential deductions.

-

How can airSlate SignNow help me with the 8582 form?

airSlate SignNow provides a user-friendly platform for electronically signing and sending your 8582 form. With its intuitive interface, you can easily upload, sign, and share your documents securely, streamlining the process and saving time.

-

Is there a cost associated with using airSlate SignNow for the 8582 form?

Yes, airSlate SignNow offers various pricing plans to cater to different user needs. While the basic features include free options, advanced functionalities for processing the 8582 form and other documents may require a subscription. Check our pricing page for details.

-

What features does airSlate SignNow offer for managing the 8582 form?

airSlate SignNow includes features such as customizable templates, secure eSignatures, and document tracking that are ideal for handling the 8582 form. These tools enhance your workflow, ensuring that you can efficiently manage and file your tax-related documents.

-

Can I access my signed 8582 form from multiple devices?

Absolutely! airSlate SignNow allows you to access your signed 8582 form from any device with internet connectivity. This flexibility ensures that you can manage your documents on the go, making it easy to stay organized and compliant.

-

Does airSlate SignNow integrate with other software for managing the 8582 form?

Yes, airSlate SignNow integrates seamlessly with popular business applications and cloud storage services. This means you can easily import and export your 8582 form along with other financial documents, enhancing collaboration and efficiency.

-

What benefits does using eSignature for the 8582 form provide?

Using eSignature for the 8582 form ensures quicker turnaround times and enhances security compared to traditional methods. This digital approach reduces the risk of document loss and provides a clear audit trail, helping you manage your tax filings more effectively.

Get more for Form 8582 Passive Activity Loss Limitations

Find out other Form 8582 Passive Activity Loss Limitations

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy

- How To Electronic signature Nevada Acknowledgement Letter

- Electronic signature New Jersey Acknowledgement Letter Free

- Can I eSignature Oregon Direct Deposit Enrollment Form

- Electronic signature Colorado Attorney Approval Later

- How To Electronic signature Alabama Unlimited Power of Attorney

- Electronic signature Arizona Unlimited Power of Attorney Easy

- Can I Electronic signature California Retainer Agreement Template