Instructions for Form 8938 Internal Revenue Service 2021-2026

What is Form 8938?

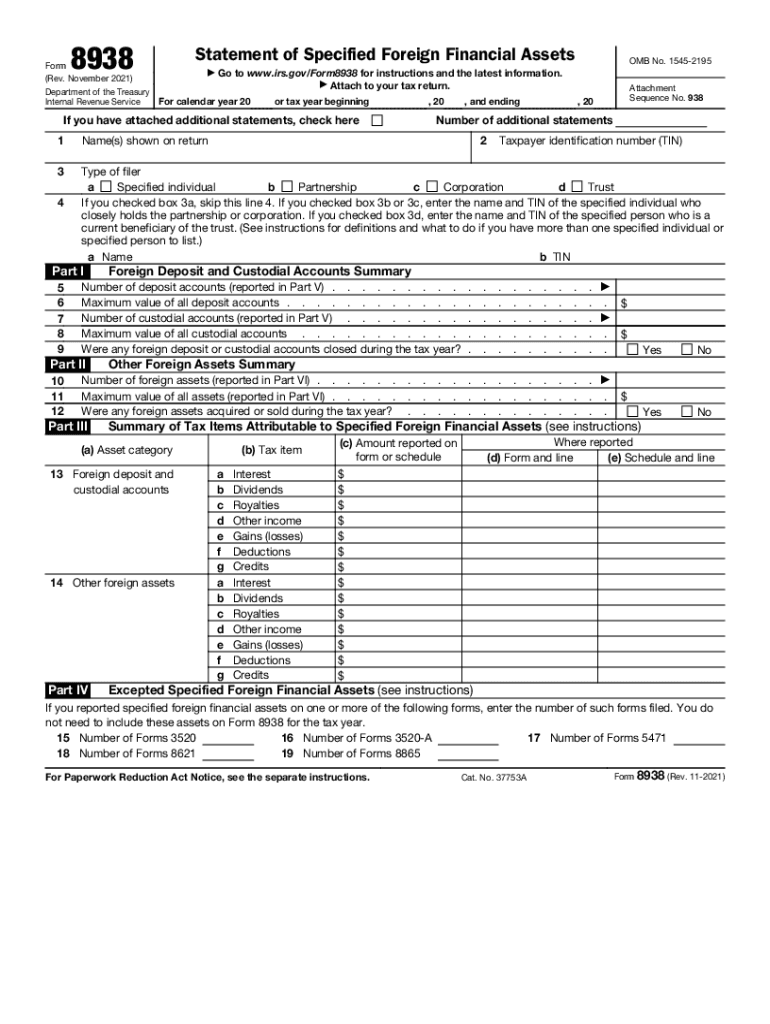

The IRS Form 8938, also known as the Statement of Specified Foreign Financial Assets, is a tax form used by certain U.S. taxpayers to report their specified foreign financial assets. This form is a part of the Foreign Account Tax Compliance Act (FATCA) requirements and is designed to ensure compliance with U.S. tax laws regarding foreign assets. Taxpayers must file this form if they have an interest in specified foreign assets that exceed certain thresholds, which vary based on filing status and residency. The form requires detailed information about the foreign assets, including account numbers, the maximum value during the year, and the type of asset held.

Filing Requirements for Form 8938

To determine if you need to file Form 8938, consider the following criteria:

- Filing status: You must be a specified individual, which includes U.S. citizens, resident aliens, and certain non-resident aliens.

- Asset thresholds: The reporting thresholds differ based on whether you live in the U.S. or abroad. For instance, if you are a single filer residing in the U.S., you must file if your specified foreign assets exceed $50,000 on the last day of the tax year or $75,000 at any time during the year.

- Types of assets: Specified foreign financial assets include foreign bank accounts, foreign stocks, and securities, as well as interests in foreign partnerships and trusts.

Steps to Complete Form 8938

Completing Form 8938 involves several key steps:

- Gather necessary information about your specified foreign financial assets, including account numbers, financial institution names, and maximum values during the tax year.

- Complete the form by entering your personal information, including your name, address, and taxpayer identification number.

- Report each specified foreign asset in the appropriate sections, ensuring accuracy in values and descriptions.

- Sign and date the form, affirming that the information provided is true and complete.

- Submit the form along with your annual tax return or as a separate document if required.

Legal Use of Form 8938

Form 8938 is legally binding when filed correctly and in accordance with IRS regulations. It is essential to ensure that all information is complete and accurate to avoid potential penalties. The form serves as an important tool for the IRS to track foreign financial assets and ensure compliance with U.S. tax laws. Failure to file Form 8938 when required can lead to significant penalties, including fines and interest on unpaid taxes.

Penalties for Non-Compliance

Non-compliance with Form 8938 filing requirements can result in severe penalties. If you fail to file the form when required, you may face a penalty of $10,000. Additionally, if the IRS determines that your failure to file was intentional, you could incur further penalties of up to $50,000. It is crucial to understand the filing requirements and ensure timely submission to avoid these consequences.

Obtaining Form 8938

Form 8938 can be obtained directly from the IRS website. It is available as a downloadable PDF that you can print and fill out. Additionally, the instructions for completing the form are often included, providing guidance on how to report your specified foreign financial assets accurately. Ensure that you are using the most current version of the form to comply with the latest IRS regulations.

Quick guide on how to complete instructions for form 8938 2018internal revenue service

Effortlessly Prepare Instructions For Form 8938 Internal Revenue Service on Any Device

Digital document management has become increasingly favored by companies and individuals alike. It offers an ideal sustainable alternative to traditional printed and signed documents, allowing you to access the appropriate form and securely store it online. airSlate SignNow provides all the necessary tools to swiftly create, edit, and electronically sign your documents without delays. Handle Instructions For Form 8938 Internal Revenue Service on any device using the airSlate SignNow apps for Android or iOS, and simplify your document-related processes today.

The easiest way to edit and electronically sign Instructions For Form 8938 Internal Revenue Service effortlessly

- Locate Instructions For Form 8938 Internal Revenue Service and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or conceal sensitive information using the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal value as a conventional ink signature.

- Review all the details and click the Done button to save your changes.

- Select how you want to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, exhausting form searches, or mistakes requiring new document copies. airSlate SignNow addresses all your needs in document management with just a few clicks from any device you prefer. Edit and electronically sign Instructions For Form 8938 Internal Revenue Service, ensuring effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct instructions for form 8938 2018internal revenue service

Create this form in 5 minutes!

How to create an eSignature for the instructions for form 8938 2018internal revenue service

The way to make an electronic signature for a PDF in the online mode

The way to make an electronic signature for a PDF in Chrome

The best way to create an e-signature for putting it on PDFs in Gmail

How to generate an electronic signature from your smart phone

The way to generate an e-signature for a PDF on iOS devices

How to generate an electronic signature for a PDF file on Android OS

People also ask

-

What is Form 8938 and why is it important?

Form 8938 is a tax form required by the IRS for specified individuals to report their foreign financial assets. It is crucial for compliance with U.S. tax laws and helps avoid potential penalties. Understanding how to properly complete and submit Form 8938 can signNowly ease the filing process.

-

How does airSlate SignNow help with Form 8938 submissions?

airSlate SignNow simplifies the process of signing documents, including Form 8938, by allowing users to eSign electronically. This streamlined process saves time and ensures that your form is submitted quickly and securely. With our user-friendly interface, you can effortlessly manage your tax documents.

-

Is airSlate SignNow a cost-effective solution for signing Form 8938?

Yes, airSlate SignNow offers a variety of pricing plans tailored to meet different business needs, making it a cost-effective solution for signing Form 8938 and other documents. By providing value through easy eSigning and document management, our platform can enhance your workflow without breaking the bank.

-

What features does airSlate SignNow offer for managing Form 8938?

airSlate SignNow provides advanced features such as templates, bulk sending, and automated workflows specifically for managing forms like Form 8938. These features allow users to customize the eSigning experience and maintain an organized repository of essential documents, improving overall efficiency.

-

Can I integrate airSlate SignNow with other software to handle Form 8938?

Absolutely! airSlate SignNow can easily integrate with various applications such as CRM and accounting software, enhancing your ability to handle Form 8938 alongside other business processes. These integrations eliminate data silos and promote seamless document management across platforms.

-

What are the benefits of using airSlate SignNow for Form 8938?

Using airSlate SignNow for Form 8938 offers numerous benefits including efficient document handling, reduced turnaround times, and enhanced security for sensitive information. The ability to track document status and receive notifications ensures you never miss an important deadline again.

-

Is airSlate SignNow compliant with regulations for submitting Form 8938?

Yes, airSlate SignNow complies with all applicable regulations to ensure that eSigned documents, including Form 8938, are legally valid. Our platform employs strong encryption and authentication measures to protect user data and maintain compliance with industry standards.

Get more for Instructions For Form 8938 Internal Revenue Service

Find out other Instructions For Form 8938 Internal Revenue Service

- Help Me With Sign Michigan Government LLC Operating Agreement

- How Do I Sign Minnesota Government Quitclaim Deed

- Sign Minnesota Government Affidavit Of Heirship Simple

- Sign Missouri Government Promissory Note Template Fast

- Can I Sign Missouri Government Promissory Note Template

- Sign Nevada Government Promissory Note Template Simple

- How To Sign New Mexico Government Warranty Deed

- Help Me With Sign North Dakota Government Quitclaim Deed

- Sign Oregon Government Last Will And Testament Mobile

- Sign South Carolina Government Purchase Order Template Simple

- Help Me With Sign Pennsylvania Government Notice To Quit

- Sign Tennessee Government Residential Lease Agreement Fast

- Sign Texas Government Job Offer Free

- Sign Alabama Healthcare / Medical LLC Operating Agreement Online

- Sign Alabama Healthcare / Medical Quitclaim Deed Mobile

- Can I Sign Alabama Healthcare / Medical Quitclaim Deed

- Sign Utah Government Month To Month Lease Myself

- Can I Sign Texas Government Limited Power Of Attorney

- Sign Arkansas Healthcare / Medical Living Will Free

- Sign Arkansas Healthcare / Medical Bill Of Lading Later