8938 Form 2012

What is the 8938 Form

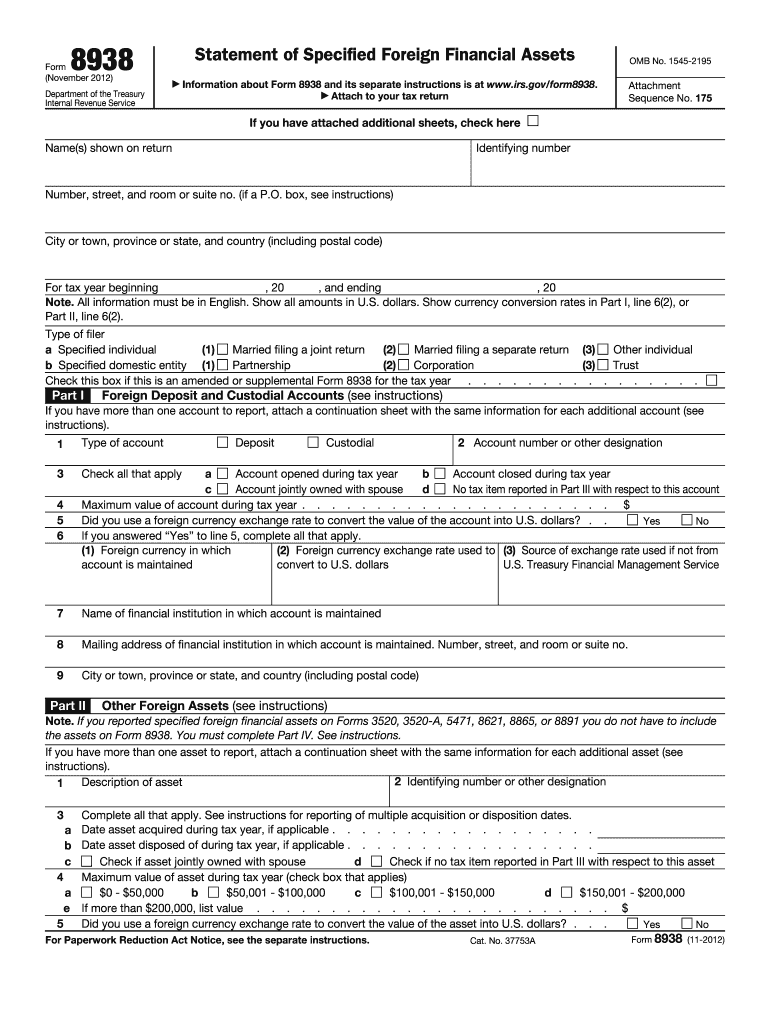

The 8938 Form, officially known as the Statement of Specified Foreign Financial Assets, is a tax form required by the Internal Revenue Service (IRS) for certain U.S. taxpayers. This form is used to report specified foreign financial assets if the total value exceeds certain thresholds. These assets can include foreign bank accounts, stocks, securities, and other financial instruments held outside the United States. The 8938 Form is part of the IRS's efforts to combat tax evasion and ensure compliance with U.S. tax laws regarding foreign assets.

How to use the 8938 Form

Using the 8938 Form involves several steps to ensure accurate reporting of foreign financial assets. First, determine if you meet the filing requirements based on your residency status and the total value of your foreign assets. If required to file, gather all necessary documentation, including account statements and asset valuations. Complete the form by providing detailed information about each specified foreign financial asset, including the name of the institution, account numbers, and asset values. After completing the form, it must be submitted along with your annual tax return to the IRS.

Steps to complete the 8938 Form

Completing the 8938 Form requires careful attention to detail. Follow these steps:

- Determine filing requirement: Assess if your foreign financial assets exceed the reporting thresholds.

- Gather documentation: Collect all relevant statements and valuations of your foreign assets.

- Fill out the form: Provide accurate information for each asset, including type, value, and institution details.

- Review your entries: Double-check for accuracy and completeness to avoid potential issues with the IRS.

- Submit the form: File the completed 8938 Form with your annual tax return.

Legal use of the 8938 Form

The legal use of the 8938 Form is crucial for compliance with U.S. tax laws. Filing this form is mandatory for specified individuals who meet the asset thresholds. Failure to file can result in significant penalties, including fines and interest on unpaid taxes. The form must be completed accurately to ensure that all foreign financial assets are reported correctly. It is important to understand the legal implications of the form and to seek professional assistance if needed to ensure compliance.

Filing Deadlines / Important Dates

The filing deadlines for the 8938 Form align with the annual tax return deadlines. Typically, the form must be submitted by April fifteenth, although extensions may be available. If you file for an extension on your tax return, the 8938 Form is also extended to October fifteenth. It is essential to keep track of these dates to avoid late filing penalties and ensure that all required information is submitted on time.

Penalties for Non-Compliance

Non-compliance with the filing requirements of the 8938 Form can lead to severe penalties. The IRS imposes a penalty of $10,000 for failing to file the form when required. Additionally, if the failure continues for more than ninety days after the IRS notifies the taxpayer, an additional penalty of $10,000 may apply for each thirty-day period of non-compliance. In extreme cases, criminal charges may be pursued for willful failure to report foreign financial assets.

Quick guide on how to complete 2012 8938 form

Effortlessly Prepare 8938 Form on Any Device

Managing documents online has become increasingly favored by businesses and individuals alike. It offers an excellent eco-friendly option compared to traditional printed and signed documents, as you can access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly and efficiently. Handle 8938 Form on any device using the airSlate SignNow apps for Android or iOS and streamline any document-related process today.

Edit and eSign 8938 Form with Ease

- Find 8938 Form and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive information using the tools specifically designed by airSlate SignNow.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the information and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign 8938 Form and ensure outstanding communication at every stage of the form preparation workflow with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2012 8938 form

Create this form in 5 minutes!

How to create an eSignature for the 2012 8938 form

How to make an electronic signature for a PDF document in the online mode

How to make an electronic signature for a PDF document in Chrome

The best way to generate an eSignature for putting it on PDFs in Gmail

The way to make an electronic signature straight from your mobile device

The best way to generate an eSignature for a PDF document on iOS devices

The way to make an electronic signature for a PDF document on Android devices

People also ask

-

What is the 8938 Form and why is it necessary?

The 8938 Form, also known as the Statement of Specified Foreign Financial Assets, is a tax form required by the IRS for U.S. taxpayers with certain foreign assets. Filing this form is essential to comply with U.S. tax laws and avoid penalties. Proper filing can help ensure that all international assets are reported accurately.

-

How can I fill out the 8938 Form using airSlate SignNow?

You can fill out the 8938 Form using airSlate SignNow's user-friendly platform that allows you to upload, edit, and sign documents digitally. Our easy-to-use tools help streamline the process, ensuring you can complete your 8938 Form quickly and efficiently. Plus, you can access your documents anytime, anywhere.

-

What features does airSlate SignNow offer for managing the 8938 Form?

airSlate SignNow offers a variety of features to manage the 8938 Form effectively, including customizable templates, eSignature capabilities, and secure document storage. These tools enhance collaboration and streamline the filing process, ensuring your 8938 Form is error-free and submitted on time. Enjoy a seamless digital experience for all your document needs.

-

Is there a cost associated with using airSlate SignNow for the 8938 Form?

Yes, airSlate SignNow offers cost-effective pricing plans that cater to businesses of all sizes. Our subscription plans include access to all necessary features for efficiently managing the 8938 Form and other documents. You can choose a plan that fits your needs and budget, allowing you to focus on your paperwork without breaking the bank.

-

What are the benefits of using airSlate SignNow for the 8938 Form?

Using airSlate SignNow for the 8938 Form provides numerous benefits, including increased efficiency, enhanced security, and reduced paperwork. With our platform, you can ensure compliance with IRS regulations while enjoying easy access to your forms. Additionally, our eSignature feature allows for quicker approvals and processing.

-

Can I integrate airSlate SignNow with other software for processing the 8938 Form?

Absolutely! airSlate SignNow offers seamless integrations with popular business applications, allowing you to streamline your workflow for the 8938 Form. By connecting our platform with your existing tools, you can automate processes and improve overall efficiency in managing your financial documents.

-

Is customer support available for filling out the 8938 Form?

Yes, airSlate SignNow provides dedicated customer support to assist you with any questions related to filling out the 8938 Form. Our knowledgeable team is available to guide you through the process and address any concerns you may have. With reliable support, you can have peace of mind while working on your tax forms.

Get more for 8938 Form

Find out other 8938 Form

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy