Irs Form 8938 2018

What is the IRS Form 8938?

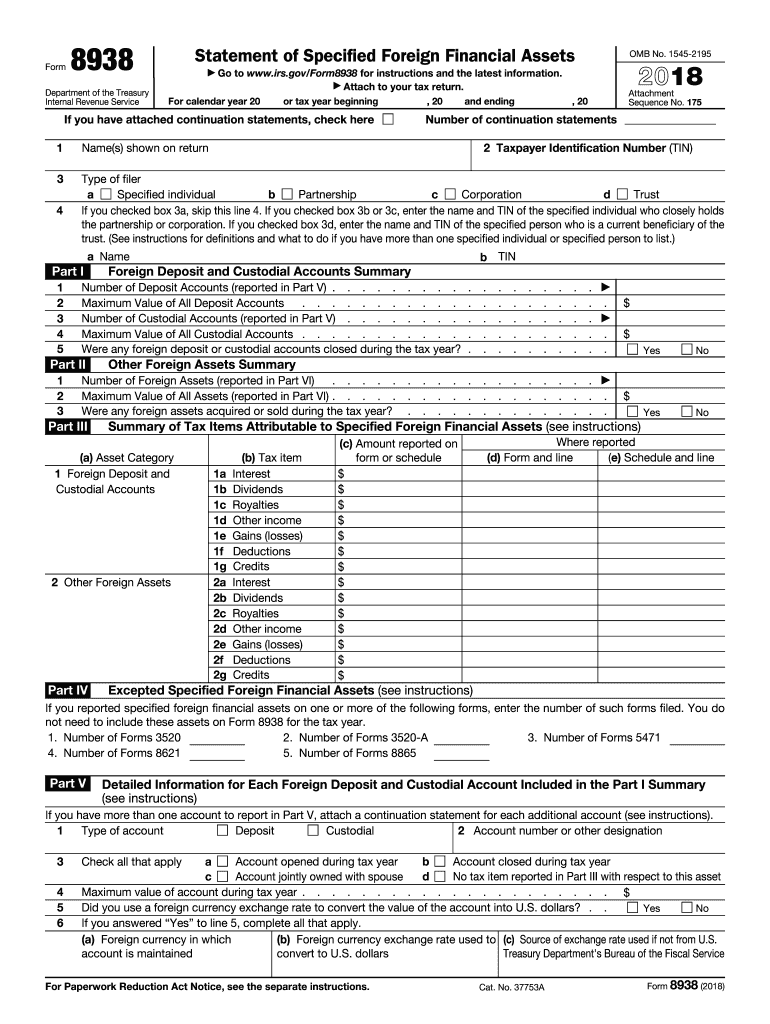

The IRS Form 8938, also known as the Statement of Specified Foreign Financial Assets, is a tax form required by the Internal Revenue Service (IRS) for certain U.S. taxpayers. This form is used to report specified foreign financial assets, which may include foreign bank accounts, stocks, securities, and other financial instruments. Taxpayers who meet specific criteria must file this form to disclose their foreign financial interests, ensuring compliance with U.S. tax laws.

How to Obtain the IRS Form 8938

The IRS Form 8938 can be obtained directly from the IRS website. It is available as a downloadable PDF, which allows users to print the form for completion. Additionally, tax preparation software often includes the form, enabling users to fill it out electronically. Ensure that you are using the correct version for the tax year you are filing, such as the 2016 Form 8938.

Steps to Complete the IRS Form 8938

Completing the IRS Form 8938 involves several steps:

- Gather necessary information about your foreign financial assets, including account numbers and values.

- Complete the identification section with your personal information, including your name, address, and taxpayer identification number.

- Fill out the details of your specified foreign financial assets in the appropriate sections of the form.

- Attach any required continuation sheets if you have more assets than can be reported on the main form.

- Review the completed form for accuracy before submission.

Key Elements of the IRS Form 8938

The IRS Form 8938 includes several key elements that must be accurately reported:

- Personal Information: This includes your name, address, and taxpayer identification number.

- Asset Information: Details about each specified foreign financial asset, including type, value, and account numbers.

- Continuation Sheet: If necessary, use the continuation sheet to report additional assets beyond the main form's capacity.

Filing Deadlines / Important Dates

The filing deadline for the IRS Form 8938 generally aligns with your annual tax return due date. For most taxpayers, this is April 15. However, if you file for an extension, the deadline may be extended to October 15. It is crucial to adhere to these deadlines to avoid penalties for late filing.

Penalties for Non-Compliance

Failing to file the IRS Form 8938 when required can result in significant penalties. The IRS imposes a penalty of $10,000 for failing to disclose foreign financial assets. If the failure continues for more than 90 days after the IRS notifies you, an additional penalty of $10,000 may be assessed for each 30-day period of non-compliance. It is important to ensure timely and accurate filing to avoid these penalties.

Quick guide on how to complete form 8938 2018 2019

Discover the simplest method to complete and endorse your Irs Form 8938

Are you still spending time generating your official documents on paper instead of online? airSlate SignNow provides a superior approach to complete and endorse your Irs Form 8938 and similar forms for public services. Our advanced electronic signature platform equips you with all the tools necessary to process documents swiftly and in compliance with legal standards - robust PDF editing, management, protection, signing, and sharing functionalities, all available through an easy-to-use interface.

Only a few steps are needed to finalize and endorse your Irs Form 8938:

- Upload the editable template to the editor by clicking the Get Form button.

- Verify what information you must include in your Irs Form 8938.

- Navigate through the fields using the Next option to ensure nothing is overlooked.

- Utilize Text, Check, and Cross tools to populate the blanks with your information.

- Update the content with Text boxes or Images from the top toolbar.

- Emphasize what is important or Obscure fields that are no longer relevant.

- Click on Sign to generate a legally enforceable electronic signature using any method you prefer.

- Add the Date next to your signature and conclude your work with the Done button.

Store your finalized Irs Form 8938 in the Documents folder within your profile, download it, or export it to your preferred cloud storage. Our platform also provides adaptable form sharing. There’s no need to print your forms when you need to submit them to the appropriate public office - do it via email, fax, or by requesting USPS “snail mail” delivery from your account. Give it a try now!

Create this form in 5 minutes or less

Find and fill out the correct form 8938 2018 2019

FAQs

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

How do I fill out a CLAT 2019 application form?

Hi thereFirst of all, let me tell you some important points:CLAT 2019 has gone OFFLINE this yearBut the application forms for CLAT 2019 have to be filled ONLINEThe payment of the application fees also should be made onlineNow, kindly note the important dates:Note the details regarding the application fees:Here, if you want the Previous Year Question papers, Rs.500 would be added to the application fees.Apart from this, there would be bank transaction charges added to the application fees.The application fees is non-refundable.Note one important point here that before you fill the application form, check for your eligibility.To know the complete details of filling the application form along with other information like the eligibility - in terms of age, educational qualification, list of NLUs participating and the seats offered under each category, CLAT Reservation policies, CLAT exam pattern, marking scheme, syllabus, important documents required to be kept ready before filling the form, kindly go to the link below:How to fill CLAT 2019 Application form? Registration OPEN | All you need to knowTo know how to prepare for one of the very important section of CLAT exam, GK and Current Affairs, kindly go to the link below:How to prepare GK & Current Affairs for CLAT 2019To practice, daily MCQs on Current Affairs, kindly go to the link below:#CLAT2019 | #AILET2019 | #DULLB2019 | GK and Current Affairs Series: 5 in 10 Series: Day 12For any other queries, kindly write to us at mailateasyway@gmail.comThanks & Regards!

-

How do I fill out the IIFT 2018 application form?

Hi!IIFT MBA (IB) Application Form 2018 – The last date to submit the Application Form of IIFT 2018 has been extended. As per the initial notice, the last date to submit the application form was September 08, 2017. However, now the candidates may submit it untill September 15, 2017. The exam date for IIFT 2018 has also been shifted to December 03, 2017. The candidates will only be issued the admit card, if they will submit IIFT application form and fee in the prescribed format. Before filling the IIFT application form, the candidates must check the eligibility criteria because ineligible candidates will not be granted admission. The application fee for candidates is Rs. 1550, however, the candidates belonging to SC/STPWD category only need to pay Rs. 775. Check procedure to submit IIFT Application Form 2018, fee details and more information from the article below.Latest – Last date to submit IIFT application form extended until September 15, 2017.IIFT 2018 Application FormThe application form of IIFT MBA 2018 has only be released online, on http://tedu.iift.ac.in. The candidates must submit it before the laps of the deadline, which can be checked from the table below.Application form released onJuly 25, 2017Last date to submit Application form(for national candidates)September 08, 2017 September 15, 2017Last date to submit the application form(by Foreign National and NRI)February 15, 2018IIFT MBA IB entrance exam will be held onNovember 26, 2017 December 03, 2017IIFT 2018 Application FeeThe candidates should take note of the application fee before submitting the application form. The fee amount is as given below and along with it, the medium to submit the fee are also mentioned.Fee amount for IIFT 2018 Application Form is as given below:General/OBC candidatesRs 1550SC/ST/PH candidatesRs 775Foreign National/NRI/Children of NRI candidatesUS$ 80 (INR Rs. 4500)The medium to submit the application fee of IIFT 2018 is as below:Credit CardsDebit Cards (VISA/Master)Demand Draft (DD)Candidates who will submit the application fee via Demand Draft will be required to submit a DD, in favour of Indian Institute of Foreign Trade, payable at New Delhi.Procedure to Submit IIFT MBA Application Form 2018Thank you & Have a nice day! :)

Create this form in 5 minutes!

How to create an eSignature for the form 8938 2018 2019

How to generate an eSignature for the Form 8938 2018 2019 online

How to generate an eSignature for the Form 8938 2018 2019 in Chrome

How to generate an eSignature for signing the Form 8938 2018 2019 in Gmail

How to make an electronic signature for the Form 8938 2018 2019 right from your smart phone

How to make an electronic signature for the Form 8938 2018 2019 on iOS

How to generate an electronic signature for the Form 8938 2018 2019 on Android devices

People also ask

-

What is Form 8938 for the year 2016?

Form 8938 for the year 2016 is a tax form used by U.S. taxpayers to report specified foreign financial assets. This form is required to be filed if the total value of those assets exceeds certain thresholds. It helps the IRS enforce compliance with tax laws pertaining to international assets.

-

How can airSlate SignNow help with Form 8938 2016?

airSlate SignNow streamlines the process of handling Form 8938 2016 by allowing users to electronically sign and send this essential document securely. Our platform ensures that you can manage your tax documentation efficiently while adhering to compliance regulations. This method saves time and simplifies record-keeping.

-

What are the pricing options for using airSlate SignNow with Form 8938 2016?

airSlate SignNow offers various pricing plans tailored to different business needs, starting from a free trial to premium options. These plans include features that make handling Form 8938 2016 seamless and cost-effective. You can choose a package that suits your requirement, enhancing your eSignature experience.

-

Are there any special features in airSlate SignNow for Form 8938 2016?

Yes, airSlate SignNow provides advanced features such as template creation and document tracking for Form 8938 2016. Users can benefit from secure signing workflows, reducing the risk of errors and ensuring that all necessary data is included. This improves the overall efficiency of handling important tax documents.

-

Is airSlate SignNow compliant with IRS regulations for Form 8938 2016?

Absolutely, airSlate SignNow is fully compliant with IRS regulations for electronic signatures, including for Form 8938 2016. We adhere to the latest standards to ensure that your documents are legally binding and secure. This compliance helps you avoid potential issues with the IRS.

-

Can airSlate SignNow integrate with other software for Form 8938 2016 filing?

Yes, airSlate SignNow integrates seamlessly with various accounting and financial software that can facilitate the filing of Form 8938 2016. This integration allows businesses to streamline their tax preparation processes. You can easily manage and store your documentation for a more organized workflow.

-

What are the benefits of using airSlate SignNow for Form 8938 2016?

Using airSlate SignNow for Form 8938 2016 offers enhanced security, faster processing, and improved accuracy in document handling. It eliminates the need for physical paperwork, allowing for a more efficient tax filing process. Our platform is designed to empower businesses to focus more on their operations than on paperwork.

Get more for Irs Form 8938

Find out other Irs Form 8938

- Help Me With eSignature Wisconsin Pet Custody Agreement

- eSign Virginia Stock Transfer Form Template Easy

- How To eSign Colorado Payment Agreement Template

- eSign Louisiana Promissory Note Template Mobile

- Can I eSign Michigan Promissory Note Template

- eSign Hawaii Football Registration Form Secure

- eSign Hawaii Football Registration Form Fast

- eSignature Hawaii Affidavit of Domicile Fast

- Can I eSignature West Virginia Affidavit of Domicile

- eSignature Wyoming Affidavit of Domicile Online

- eSign Montana Safety Contract Safe

- How To eSign Arizona Course Evaluation Form

- How To eSign California Course Evaluation Form

- How To eSign Florida Course Evaluation Form

- How To eSign Hawaii Course Evaluation Form

- How To eSign Illinois Course Evaluation Form

- eSign Hawaii Application for University Free

- eSign Hawaii Application for University Secure

- eSign Hawaii Medical Power of Attorney Template Free

- eSign Washington Nanny Contract Template Free