Form 8938 2014

What is the Form 8938

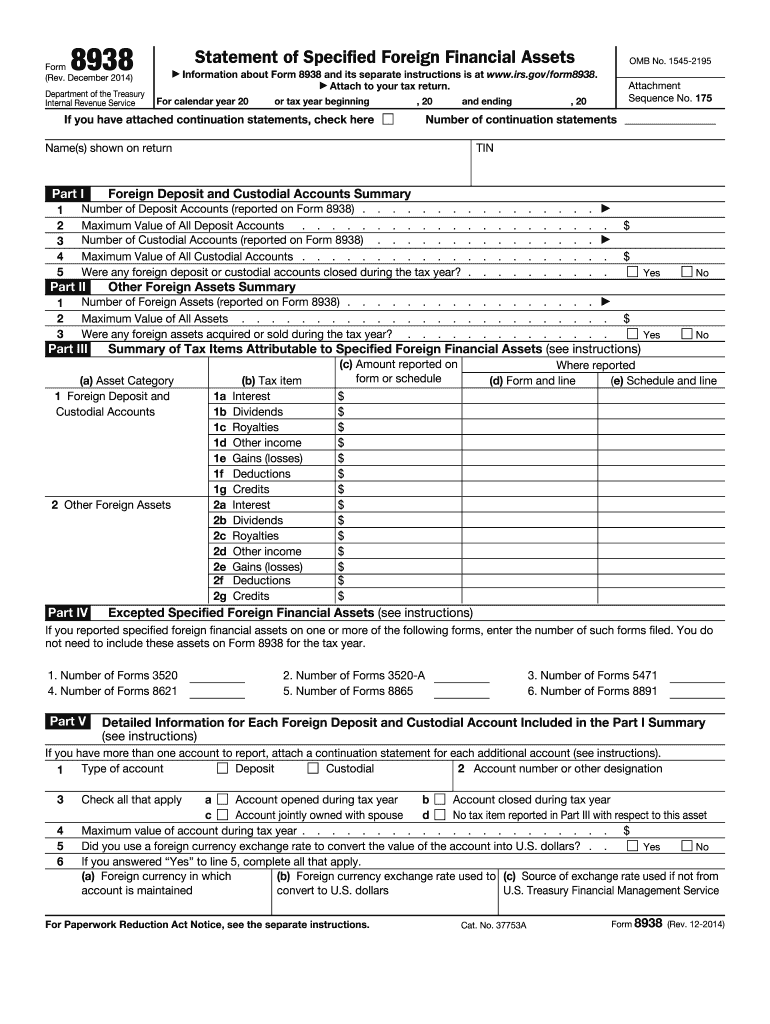

The Form 8938, officially known as the Statement of Specified Foreign Financial Assets, is a tax form required by the Internal Revenue Service (IRS) for certain U.S. taxpayers. This form is designed to report specified foreign financial assets, which may include foreign bank accounts, investment accounts, and other foreign financial interests. Taxpayers must file this form if their foreign financial assets exceed certain thresholds, which vary based on filing status and residency. Understanding the requirements of Form 8938 is crucial for compliance with U.S. tax laws.

How to use the Form 8938

Using Form 8938 involves accurately reporting your specified foreign financial assets to the IRS. To begin, gather all necessary information regarding your foreign accounts and assets, including account numbers, financial institutions' names, and the maximum value of each asset during the tax year. You will need to fill out the form with this information, ensuring that you meet the reporting thresholds. It is essential to keep detailed records of your foreign financial assets, as the IRS may require documentation to support your claims. Properly completing this form helps you avoid penalties for non-compliance.

Steps to complete the Form 8938

Completing Form 8938 involves several key steps:

- Determine if you are required to file based on your foreign financial assets.

- Gather information about your specified foreign financial assets, including account details and maximum values.

- Fill out the form accurately, ensuring that all required fields are completed.

- Review the form for accuracy and completeness before submission.

- File the form with your annual tax return, ensuring it is submitted by the IRS deadline.

Following these steps carefully can help ensure that you meet your tax obligations regarding foreign financial assets.

Legal use of the Form 8938

The legal use of Form 8938 is governed by U.S. tax laws, specifically the Foreign Account Tax Compliance Act (FATCA). This form must be filed by U.S. taxpayers who meet specific criteria regarding foreign financial assets. Failure to file can result in significant penalties. The IRS considers the information reported on Form 8938 as part of your overall tax compliance, and it is essential to ensure that all details are accurate and complete to avoid legal repercussions.

Filing Deadlines / Important Dates

Form 8938 must be filed along with your annual income tax return, typically due on April 15. If you file for an extension, the deadline for submitting Form 8938 extends to October 15. It is crucial to be aware of these deadlines to avoid late filing penalties. Additionally, if you have foreign financial assets, you may need to comply with other reporting requirements, such as the Foreign Bank Account Report (FBAR), which has its own deadlines.

Penalties for Non-Compliance

Non-compliance with Form 8938 filing requirements can lead to substantial penalties. If you fail to file the form when required, the IRS may impose a penalty of up to $10,000. Continued failure to file can result in additional penalties of $10,000 for each 30-day period after the IRS notifies you of the failure to file. In severe cases, criminal charges may apply for willful neglect. Therefore, it is essential to understand your obligations regarding Form 8938 to avoid these consequences.

Quick guide on how to complete 2014 form 8938

Complete Form 8938 effortlessly on any device

Digital document management has become favored by businesses and individuals alike. It offers an excellent eco-friendly substitute to traditional printed and signed paperwork, as you can easily locate the correct form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without hindrances. Manage Form 8938 across any platform with airSlate SignNow Android or iOS applications and enhance any document-focused workflow today.

The simplest way to adjust and eSign Form 8938 effortlessly

- Obtain Form 8938 and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Point out important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate reprinting new document copies. airSlate SignNow addresses all your requirements in document management in just a few clicks from a device of your choice. Adjust and eSign Form 8938 and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2014 form 8938

Create this form in 5 minutes!

How to create an eSignature for the 2014 form 8938

How to generate an eSignature for a PDF file in the online mode

How to generate an eSignature for a PDF file in Chrome

How to create an electronic signature for putting it on PDFs in Gmail

The way to make an eSignature from your smartphone

The best way to create an eSignature for a PDF file on iOS devices

The way to make an eSignature for a PDF file on Android

People also ask

-

What is Form 8938 and why do I need it?

Form 8938 is an IRS form that U.S. taxpayers must file to report specified foreign financial assets. It's essential for compliance with the Foreign Account Tax Compliance Act (FATCA), helping to avoid hefty penalties. Understanding how to properly complete Form 8938 is crucial for anyone with overseas financial interests.

-

How can airSlate SignNow help with filing Form 8938?

Using airSlate SignNow, you can easily eSign and send Form 8938 digitally, streamlining your filing process. Our secure platform ensures your sensitive information is protected while allowing for quick collaboration with tax professionals. This simplifies your tax preparation and ensures compliance with IRS requirements.

-

What features does airSlate SignNow offer for managing Form 8938?

airSlate SignNow offers a range of features to assist with managing Form 8938, including customizable templates and secure storage options. You can track the signing process in real-time and receive notifications when your form is signed. These features enhance efficiency and ensure you stay organized throughout tax season.

-

Is airSlate SignNow suitable for small businesses filing Form 8938?

Absolutely! airSlate SignNow is a cost-effective solution designed to cater to businesses of all sizes, including small businesses needing to file Form 8938. Our platform simplifies document management and eSigning, making it easier for small business owners to remain compliant without the hassle.

-

Can I integrate airSlate SignNow with other software for Form 8938 management?

Yes, airSlate SignNow seamlessly integrates with various software tools, enhancing your ability to manage Form 8938 efficiently. Whether you use accounting software or tax preparation tools, our integrations ensure that your workflow remains uninterrupted. This connectivity streamlines the entire process of filing your form.

-

What are the benefits of using airSlate SignNow for Form 8938?

The primary benefits of using airSlate SignNow for Form 8938 include ease of use, security, and cost savings. Our platform allows you to prepare, sign, and send your form without the need for physical paperwork, reducing clutter and enhancing efficiency. Additionally, our competitive pricing ensures you get the best value for your eSigning needs.

-

How secure is my information when using airSlate SignNow to file Form 8938?

Security is a top priority at airSlate SignNow. When you use our platform to manage Form 8938, your information is encrypted and stored securely, ensuring that your sensitive financial data remains protected. We comply with industry standards to give you peace of mind when eSigning and sharing documents.

Get more for Form 8938

Find out other Form 8938

- How Can I Electronic signature Hawaii Courts Purchase Order Template

- How To Electronic signature Indiana Courts Cease And Desist Letter

- How Can I Electronic signature New Jersey Sports Purchase Order Template

- How Can I Electronic signature Louisiana Courts LLC Operating Agreement

- How To Electronic signature Massachusetts Courts Stock Certificate

- Electronic signature Mississippi Courts Promissory Note Template Online

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe

- Electronic signature Oklahoma Sports RFP Fast

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement