8938 Form 2013

What is the 8938 Form

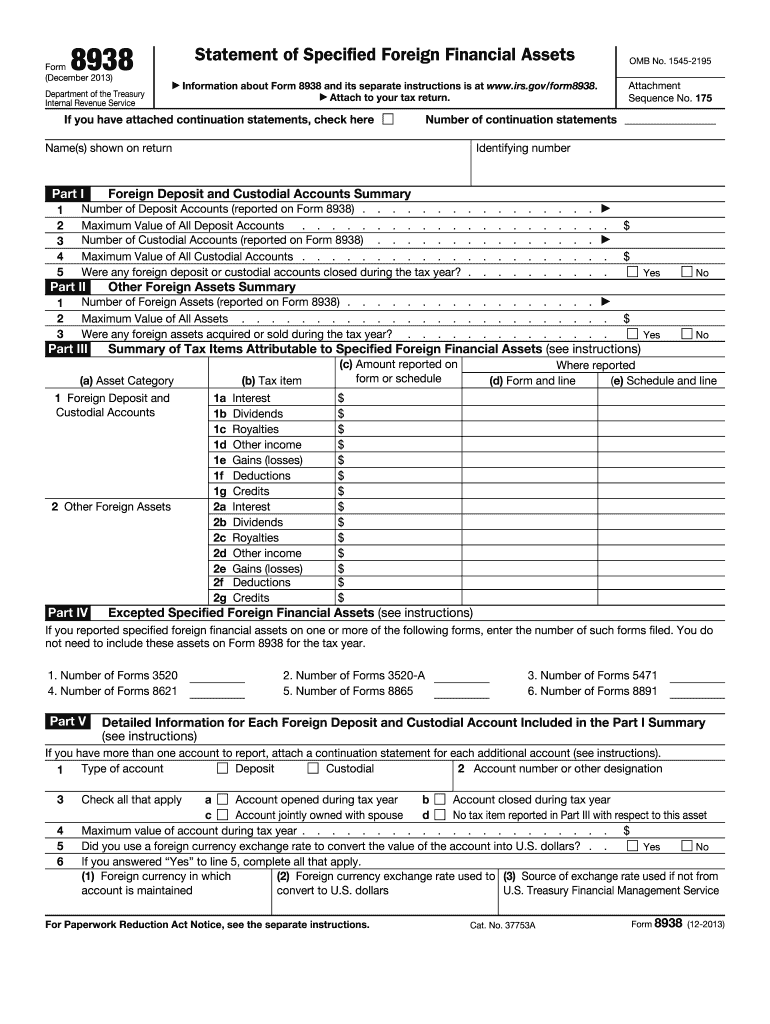

The 8938 Form, officially known as the Statement of Specified Foreign Financial Assets, is a tax form required by the Internal Revenue Service (IRS) for certain U.S. taxpayers. It is used to report specified foreign financial assets if the total value exceeds certain thresholds. This form is part of the IRS's efforts to combat tax evasion and ensure compliance with U.S. tax laws regarding foreign assets. Taxpayers must include information about foreign bank accounts, stocks, and other financial assets held outside the United States.

How to use the 8938 Form

Using the 8938 Form involves accurately reporting your foreign financial assets to the IRS. Taxpayers must first determine if they meet the reporting threshold based on their filing status and whether they are living in the U.S. or abroad. Once the threshold is established, the taxpayer should gather all relevant information about their foreign assets, including account numbers, financial institutions, and the maximum value of each asset during the tax year. The completed form is then submitted with the taxpayer's annual income tax return.

Steps to complete the 8938 Form

Completing the 8938 Form requires careful attention to detail. Follow these steps:

- Determine if you are required to file the form based on your total foreign assets.

- Gather necessary information about each specified foreign financial asset.

- Fill out the form, ensuring all sections are completed accurately.

- Review the form for any errors or omissions.

- Submit the form along with your annual tax return by the specified deadline.

Legal use of the 8938 Form

The legal use of the 8938 Form is governed by U.S. tax laws, which require certain taxpayers to disclose foreign financial assets. This requirement is part of the Foreign Account Tax Compliance Act (FATCA), aimed at preventing tax evasion. Failure to file the form when required can lead to significant penalties, so it is crucial for taxpayers to understand their obligations and ensure compliance.

Filing Deadlines / Important Dates

The filing deadline for the 8938 Form generally aligns with the due date of the individual income tax return, which is typically April 15. However, if you file for an extension, the deadline may be extended to October 15. It is important to stay informed about any changes to deadlines, as these can vary from year to year.

Penalties for Non-Compliance

Non-compliance with the requirements of the 8938 Form can result in substantial penalties. The IRS imposes a penalty of $10,000 for failing to file the form, with additional penalties accruing for continued failure to file after receiving a notice from the IRS. In some cases, taxpayers may also face criminal charges for willful failure to report foreign financial assets.

Quick guide on how to complete 2013 8938 form

Prepare 8938 Form effortlessly on any gadget

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow provides all the resources you require to generate, alter, and eSign your documents swiftly without delays. Handle 8938 Form on any gadget using the airSlate SignNow Android or iOS applications and enhance any document-related task today.

The easiest way to modify and eSign 8938 Form without hassle

- Find 8938 Form and then click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or mislaid files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Revise and eSign 8938 Form while ensuring exceptional communication at every step of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2013 8938 form

Create this form in 5 minutes!

How to create an eSignature for the 2013 8938 form

The way to make an eSignature for your PDF file in the online mode

The way to make an eSignature for your PDF file in Chrome

The way to make an eSignature for putting it on PDFs in Gmail

How to make an electronic signature straight from your smartphone

The way to make an electronic signature for a PDF file on iOS devices

How to make an electronic signature for a PDF document on Android

People also ask

-

What is the 8938 Form and why is it important?

The 8938 Form is a crucial IRS tax form used to report specified foreign financial assets. It’s important for U.S. taxpayers living abroad or holding foreign accounts to ensure compliance with tax laws to avoid hefty penalties.

-

How can airSlate SignNow help with the 8938 Form?

airSlate SignNow simplifies the process of filling out and signing the 8938 Form electronically. By using our platform, you can streamline document management, ensuring that the submission of the 8938 Form is efficient and secure.

-

What features does airSlate SignNow offer for dealing with the 8938 Form?

airSlate SignNow offers features like e-signatures, document templates, and automated workflows specifically useful for handling the 8938 Form. These tools make it easy to create and manage necessary tax documentation quickly.

-

Is airSlate SignNow cost-effective for filing the 8938 Form?

Yes, airSlate SignNow provides a cost-effective solution for businesses and individuals needing to file the 8938 Form. With various pricing plans available, users can choose an option that fits their budget while still accessing essential features.

-

How does airSlate SignNow ensure the security of my 8938 Form data?

Security is a top priority at airSlate SignNow. We employ encryption and compliance with regulatory standards to protect your sensitive 8938 Form data, ensuring secure storage and transmission.

-

Can I integrate airSlate SignNow with other software for my 8938 Form needs?

Absolutely! airSlate SignNow allows seamless integrations with popular platforms like Google Drive, Salesforce, and more, making it easy to manage your 8938 Form alongside your existing tools and workflows.

-

How do I get started with airSlate SignNow for the 8938 Form?

Getting started is easy! Simply sign up for an airSlate SignNow account, explore our user-friendly interface, and start creating, signing, and managing your 8938 Form and other documents in no time.

Get more for 8938 Form

- Asonet form

- Canadian patients kaleida healthbuffalo ny form

- Dhs referral form

- Get address phone numbers and directions for lemed form

- If you need assistance please contact the nyl annuity service center at 1 800 762 6212 or your representative form

- 7661 tel 402 form

- Deus ex the fall cheat codesanynywuxazas scoopit form

- The collaborative for children and families health home ccf form

Find out other 8938 Form

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe

- How To Sign Kansas Insurance Rental Lease Agreement

- How Can I Sign Kansas Lawers Promissory Note Template

- Sign Kentucky Lawers Living Will Free

- Sign Kentucky Lawers LLC Operating Agreement Mobile

- Sign Louisiana Lawers Quitclaim Deed Now

- Sign Massachusetts Lawers Quitclaim Deed Later

- Sign Michigan Lawers Rental Application Easy

- Sign Maine Insurance Quitclaim Deed Free

- Sign Montana Lawers LLC Operating Agreement Free

- Sign Montana Lawers LLC Operating Agreement Fast

- Can I Sign Nevada Lawers Letter Of Intent

- Sign Minnesota Insurance Residential Lease Agreement Fast

- How Do I Sign Ohio Lawers LLC Operating Agreement

- Sign Oregon Lawers Limited Power Of Attorney Simple

- Sign Oregon Lawers POA Online

- Sign Mississippi Insurance POA Fast