Form 8938 2016

What is the Form 8938

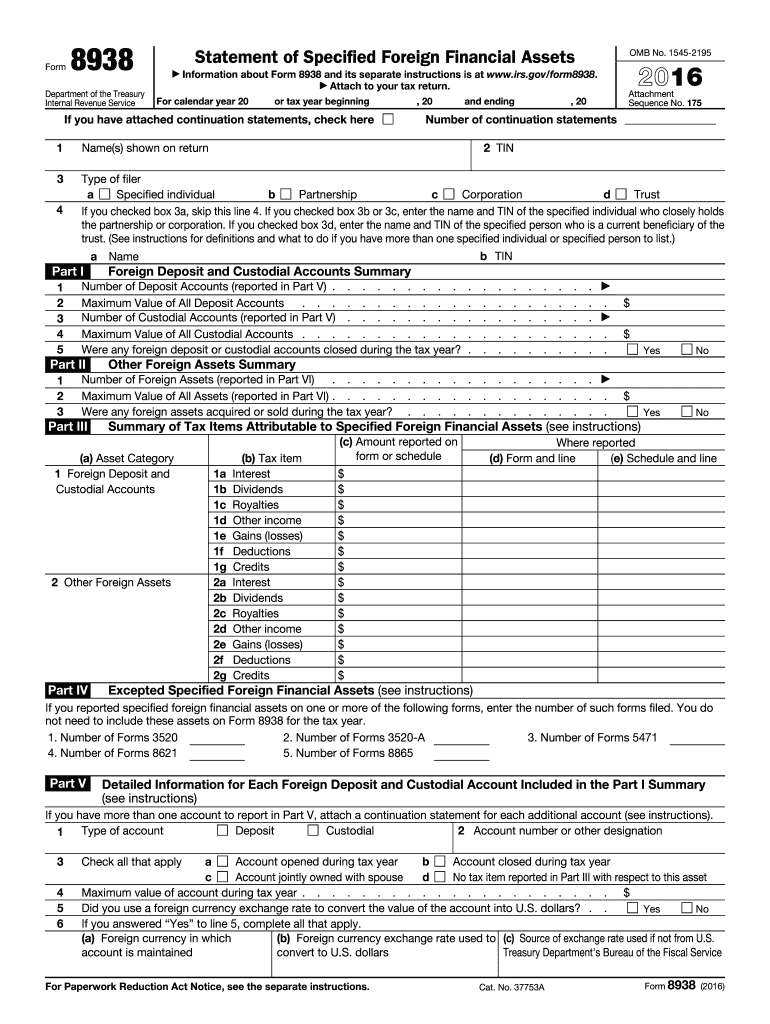

The Form 8938, officially known as the Statement of Specified Foreign Financial Assets, is a tax form required by the Internal Revenue Service (IRS) for certain U.S. taxpayers. This form is used to report specified foreign financial assets if the total value exceeds certain thresholds. Taxpayers must disclose various types of assets, including foreign bank accounts, stocks, and other financial instruments held outside the United States. The purpose of the form is to ensure compliance with U.S. tax laws and to combat tax evasion through foreign financial accounts.

How to use the Form 8938

Using the Form 8938 involves several steps to ensure accurate reporting of foreign financial assets. Taxpayers must first determine their filing requirement based on their total asset values. Once the requirement is established, individuals should gather necessary information about their foreign assets, including account numbers, financial institutions, and the maximum value of each asset during the reporting year. After compiling this information, taxpayers can fill out the form, ensuring they provide accurate and complete details to avoid penalties.

Steps to complete the Form 8938

Completing the Form 8938 involves a systematic approach to ensure all required information is reported correctly. Here are the key steps:

- Determine if you are required to file based on your asset thresholds.

- Gather information about your specified foreign financial assets.

- Fill out the form, including personal information and details about each asset.

- Review the completed form for accuracy and completeness.

- Submit the form with your annual tax return.

Legal use of the Form 8938

The legal use of the Form 8938 is governed by U.S. tax laws, specifically the Foreign Account Tax Compliance Act (FATCA). This form must be filed by U.S. taxpayers who meet the asset thresholds, ensuring compliance with IRS regulations. Failure to file can result in significant penalties, including fines and interest on unpaid taxes. It is crucial for taxpayers to understand their obligations under FATCA and ensure that they use the form correctly to report their foreign financial assets.

Filing Deadlines / Important Dates

Filing deadlines for the Form 8938 align with the annual tax return due date. Typically, this means the form is due on April 15 for most taxpayers. However, if you file for an extension, you may have until October 15 to submit your tax return and Form 8938. It is important to keep track of these dates to avoid late filing penalties and ensure compliance with IRS regulations.

Penalties for Non-Compliance

Non-compliance with the filing requirements of Form 8938 can lead to severe penalties. The IRS imposes a penalty of $10,000 for failing to file the form when required. Additionally, if the failure continues for more than 90 days after the IRS sends a notice, an additional penalty of $10,000 may apply for each 30-day period of non-compliance. In extreme cases, the IRS may impose a penalty of up to 40% of the underreported tax liability, emphasizing the importance of timely and accurate filing.

Quick guide on how to complete 2016 form 8938

Complete Form 8938 effortlessly on any device

Online document administration has gained popularity among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, as you can obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Manage Form 8938 on any device with airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to modify and eSign Form 8938 with ease

- Obtain Form 8938 and click on Get Form to begin.

- Utilize the tools we offer to finish your document.

- Highlight signNow sections of your documents or obscure sensitive information with tools provided by airSlate SignNow specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all information and click on the Done button to save your changes.

- Choose how you'd like to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Form 8938 and ensure seamless communication at any stage of your form completion process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2016 form 8938

Create this form in 5 minutes!

How to create an eSignature for the 2016 form 8938

How to generate an eSignature for your 2016 Form 8938 online

How to create an electronic signature for the 2016 Form 8938 in Google Chrome

How to make an eSignature for putting it on the 2016 Form 8938 in Gmail

How to make an electronic signature for the 2016 Form 8938 straight from your smartphone

How to generate an eSignature for the 2016 Form 8938 on iOS

How to generate an electronic signature for the 2016 Form 8938 on Android OS

People also ask

-

What is Form 8938 and why is it important?

Form 8938 is a tax form used by U.S. taxpayers to report specified foreign financial assets. It is critical for compliance with the IRS reporting requirements, as failure to file can result in signNow penalties. Understanding Form 8938 is essential for anyone with foreign investments.

-

How can airSlate SignNow help with Form 8938 submissions?

airSlate SignNow streamlines the process of preparing and signing Form 8938 by allowing users to create, send, and eSign documents securely. The platform simplifies managing signatures and ensures that your Form 8938 submissions are completed quickly and accurately. This way, you can focus on your financial reporting rather than paperwork.

-

What features does airSlate SignNow offer for handling Form 8938?

With airSlate SignNow, you get features like customizable templates, real-time tracking, and secure cloud storage for your Form 8938. The platform allows you to collaborate seamlessly with others, ensuring that all necessary parties can review and sign the document without hassle. Additionally, eSignatures are legally binding and accepted by the IRS.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers various pricing tiers to accommodate different business needs. Plans include features suitable for individual users and businesses needing to manage forms like Form 8938 effectively. You can choose a plan that best fits your needs and budget while enjoying the benefits of efficient document management.

-

Can airSlate SignNow integrate with other software for tax reporting?

Yes, airSlate SignNow offers integrations with various accounting and tax software programs to streamline your Form 8938 reporting process. This allows you to manage and submit your financial documents seamlessly. Integrations enhance the efficiency of your workflow, making tax reporting quicker and more accurate.

-

Is the platform secure for sensitive documents like Form 8938?

Absolutely. airSlate SignNow employs advanced security measures, including encryption and multi-factor authentication, to ensure that your documents, such as Form 8938, remain safe. We prioritize data protection because we understand the sensitivity of the information involved in tax reporting.

-

How user-friendly is the airSlate SignNow platform for first-time users preparing Form 8938?

airSlate SignNow is designed with user-friendliness in mind, making it easy for first-time users to prepare and eSign Form 8938. The intuitive interface guides users through the document creation and signing process, minimizing the learning curve. Additional resources and customer support are available to assist you whenever needed.

Get more for Form 8938

- Form rd 3550 28

- Fns 252 application form

- Behavioral assessment template form

- Arnel rentallease application form

- Provider request for course approvals for seminars cdph ca form

- Disneyland resort magic music days application form

- International importexport request form mazda

- Entrance conference form entrance conference form

Find out other Form 8938

- How To eSign Arizona Course Evaluation Form

- How To eSign California Course Evaluation Form

- How To eSign Florida Course Evaluation Form

- How To eSign Hawaii Course Evaluation Form

- How To eSign Illinois Course Evaluation Form

- eSign Hawaii Application for University Free

- eSign Hawaii Application for University Secure

- eSign Hawaii Medical Power of Attorney Template Free

- eSign Washington Nanny Contract Template Free

- eSignature Ohio Guaranty Agreement Myself

- eSignature California Bank Loan Proposal Template Now

- Can I eSign Indiana Medical History

- eSign Idaho Emergency Contract Form Myself

- eSign Hawaii General Patient Information Fast

- Help Me With eSign Rhode Island Accident Medical Claim Form

- eSignature Colorado Demand for Payment Letter Mobile

- eSignature Colorado Demand for Payment Letter Secure

- eSign Delaware Shareholder Agreement Template Now

- eSign Wyoming Shareholder Agreement Template Safe

- eSign Kentucky Strategic Alliance Agreement Secure