Instructions for Form 1120 W Internal Revenue IRS 2014

What is the Instructions for Form 1120 W Internal Revenue IRS

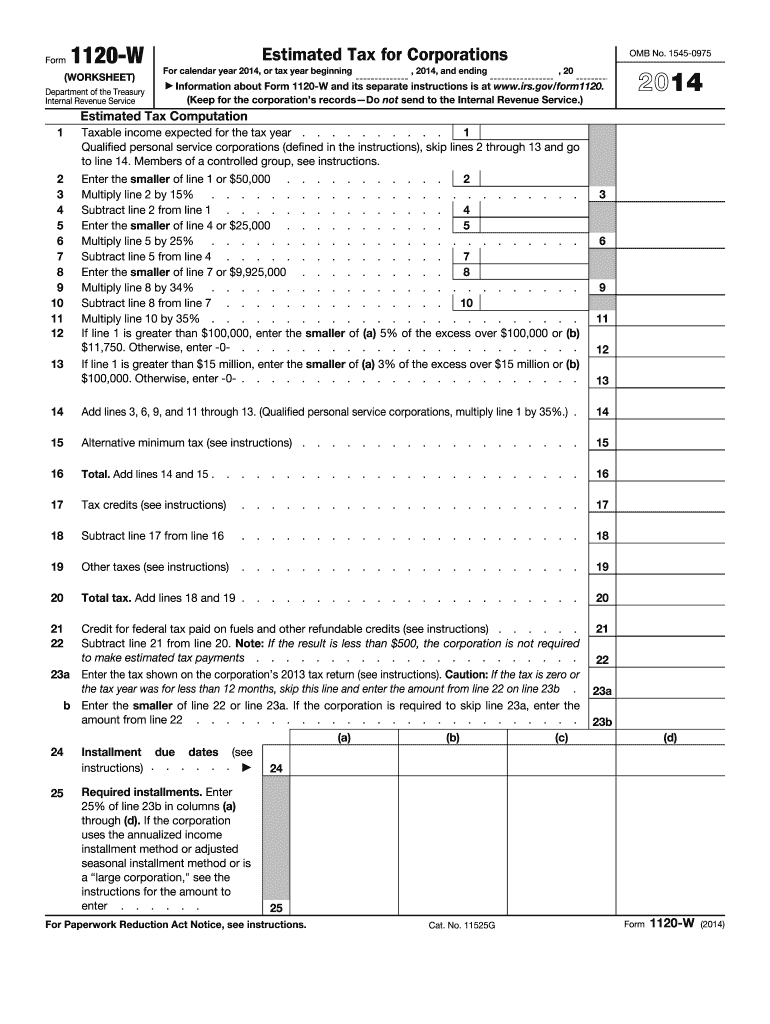

The Instructions for Form 1120 W provide detailed guidance for corporations filing their estimated tax payments with the Internal Revenue Service (IRS). This form is essential for corporations to calculate their estimated tax liability for the year. The instructions outline the necessary steps, eligibility criteria, and specific calculations required to ensure compliance with federal tax regulations.

Steps to Complete the Instructions for Form 1120 W Internal Revenue IRS

Completing the Instructions for Form 1120 W involves several key steps:

- Gather financial data, including revenue and expenses, to accurately estimate tax liability.

- Review the eligibility criteria to ensure your corporation qualifies for filing Form 1120 W.

- Follow the step-by-step calculations provided in the instructions to determine the estimated tax amount.

- Complete the form by entering the calculated amounts in the appropriate fields.

- Review the completed form for accuracy before submission.

Legal Use of the Instructions for Form 1120 W Internal Revenue IRS

The legal use of the Instructions for Form 1120 W is crucial for ensuring that corporations meet their tax obligations. Properly following the instructions helps avoid penalties associated with incorrect filings. The IRS recognizes electronic signatures as valid, provided that the signing process complies with the relevant eSignature laws, ensuring that the document is legally binding.

Filing Deadlines / Important Dates

Corporations must adhere to specific filing deadlines when submitting Form 1120 W. Typically, estimated tax payments are due quarterly, with deadlines falling on the fifteenth day of the fourth, sixth, ninth, and twelfth months of the tax year. It is essential for corporations to mark these dates on their calendars to avoid late fees and penalties.

Form Submission Methods (Online / Mail / In-Person)

Corporations have several options for submitting Form 1120 W. The form can be filed electronically through the IRS e-file system, which is often the fastest method. Alternatively, corporations may choose to mail the completed form to the appropriate IRS address or submit it in person at a local IRS office. Each method has its own processing times and considerations, so corporations should choose the one that best fits their needs.

Required Documents

To complete the Instructions for Form 1120 W, corporations need to gather several documents, including:

- Financial statements detailing income and expenses.

- Prior year tax returns for reference.

- Any relevant schedules or forms that support the estimated tax calculations.

Having these documents ready will streamline the completion process and help ensure accuracy in the submitted form.

Quick guide on how to complete instructions for form 1120 w 2019internal revenue irs

Finish Instructions For Form 1120 W Internal Revenue IRS effortlessly on any device

Web-based document management has become prevalent among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, as you can obtain the necessary form and securely save it online. airSlate SignNow provides you with all the tools you need to create, alter, and eSign your documents quickly and without delays. Manage Instructions For Form 1120 W Internal Revenue IRS on any platform with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to modify and eSign Instructions For Form 1120 W Internal Revenue IRS with ease

- Locate Instructions For Form 1120 W Internal Revenue IRS and click on Get Form to initiate the process.

- Make use of the tools we offer to finalize your document.

- Emphasize pertinent sections of the documents or black out sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Review the details and press the Done button to save your changes.

- Select how you would like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form hunting, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Revise and eSign Instructions For Form 1120 W Internal Revenue IRS and guarantee excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct instructions for form 1120 w 2019internal revenue irs

Create this form in 5 minutes!

How to create an eSignature for the instructions for form 1120 w 2019internal revenue irs

The best way to make an eSignature for your PDF online

The best way to make an eSignature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

The way to generate an electronic signature from your smartphone

How to make an electronic signature for a PDF on iOS

The way to generate an electronic signature for a PDF file on Android

People also ask

-

What are the Instructions For Form 1120 W Internal Revenue IRS?

The Instructions For Form 1120 W Internal Revenue IRS guide you through the process of filing corporate income tax returns. These instructions help you determine your estimated tax payments for the year and provide clarity on various tax laws affecting corporations.

-

How can airSlate SignNow assist with filling out the Instructions For Form 1120 W Internal Revenue IRS?

airSlate SignNow offers a user-friendly interface that allows you to easily fill out and eSign the Instructions For Form 1120 W Internal Revenue IRS. Our platform simplifies document preparation and ensures compliance with IRS regulations for your corporate filings.

-

Is airSlate SignNow cost-effective for managing tax documents like Instructions For Form 1120 W Internal Revenue IRS?

Yes, airSlate SignNow is a cost-effective solution for managing tax documents, including the Instructions For Form 1120 W Internal Revenue IRS. Our pricing plans are designed to fit businesses of all sizes, ensuring you have the tools you need without breaking the bank.

-

What features does airSlate SignNow offer for document management related to the Instructions For Form 1120 W Internal Revenue IRS?

airSlate SignNow provides features like eSigning, document templates, real-time collaboration, and secure cloud storage. These features streamline the process of preparing the Instructions For Form 1120 W Internal Revenue IRS, making it easier for businesses to stay organized and compliant.

-

Can I integrate airSlate SignNow with other software to manage the Instructions For Form 1120 W Internal Revenue IRS?

Absolutely! airSlate SignNow integrates with various software platforms, enhancing your ability to manage the Instructions For Form 1120 W Internal Revenue IRS and other documents. This ensures a seamless workflow, allowing you to connect financial tools and digital forms effortlessly.

-

What are the benefits of using airSlate SignNow for the Instructions For Form 1120 W Internal Revenue IRS?

Using airSlate SignNow for the Instructions For Form 1120 W Internal Revenue IRS offers numerous benefits, including improved efficiency, reduced paperwork, and enhanced compliance. Our platform allows you to execute documents quickly and securely, helping to simplify your tax filing process.

-

How secure is airSlate SignNow when handling sensitive documents like the Instructions For Form 1120 W Internal Revenue IRS?

airSlate SignNow prioritizes security, utilizing advanced encryption and compliance with industry standards to protect sensitive documents like the Instructions For Form 1120 W Internal Revenue IRS. You can trust that your data is in safe hands while you focus on your business.

Get more for Instructions For Form 1120 W Internal Revenue IRS

- Letter from tenant to landlord containing notice that doors are broken and demand repair iowa form

- Iowa broken form

- Letter from tenant to landlord with demand that landlord repair plumbing problem iowa form

- Letter from tenant to landlord containing notice that heater is broken unsafe or inadequate and demand for immediate remedy iowa form

- Letter from tenant to landlord with demand that landlord repair unsafe or broken lights or wiring iowa form

- Letter from tenant to landlord with demand that landlord repair floors stairs or railings iowa form

- Letter from tenant to landlord with demand that landlord remove garbage and vermin from premises iowa form

- Letter from tenant to landlord with demand that landlord provide proper outdoor garbage receptacles iowa form

Find out other Instructions For Form 1120 W Internal Revenue IRS

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe

- eSignature Washington Real Estate Lease Agreement Form Mobile

- How Can I eSignature New York Sports Executive Summary Template

- eSignature Arkansas Courts LLC Operating Agreement Now

- How Do I eSignature Arizona Courts Moving Checklist

- eSignature Wyoming Real Estate Quitclaim Deed Myself

- eSignature Wyoming Real Estate Lease Agreement Template Online

- How Can I eSignature Delaware Courts Stock Certificate

- How Can I eSignature Georgia Courts Quitclaim Deed

- Help Me With eSignature Florida Courts Affidavit Of Heirship

- Electronic signature Alabama Banking RFP Online

- eSignature Iowa Courts Quitclaim Deed Now

- eSignature Kentucky Courts Moving Checklist Online

- eSignature Louisiana Courts Cease And Desist Letter Online