Form 1120 W 2013

What is the Form 1120 W

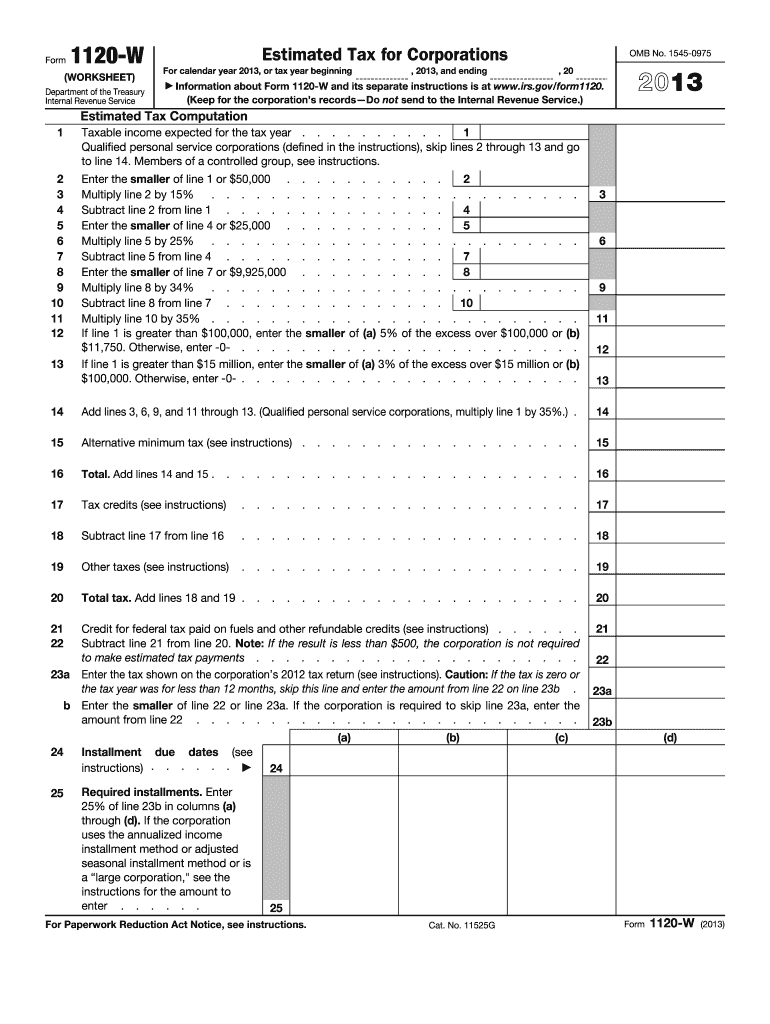

The Form 1120 W is a tax form used by corporations in the United States to calculate their estimated tax payments. This form is essential for businesses that expect to owe tax of five hundred dollars or more when they file their annual return. It helps corporations determine their tax liability based on expected income, deductions, and credits. By using Form 1120 W, corporations can avoid underpayment penalties and ensure they meet their tax obligations throughout the year.

How to use the Form 1120 W

Using Form 1120 W involves several steps that ensure accurate tax reporting. First, corporations need to estimate their taxable income for the year. This estimation includes projected revenue and allowable deductions. Next, businesses calculate their estimated tax liability based on the current corporate tax rate. The form requires corporations to report their expected income and deductions for each quarter, allowing them to make timely payments. Finally, once the calculations are complete, the estimated tax payments can be submitted to the IRS according to the specified deadlines.

Steps to complete the Form 1120 W

Completing Form 1120 W requires careful attention to detail. Here are the steps involved:

- Gather financial records, including income statements and expense reports.

- Estimate your total income for the year, considering all sources of revenue.

- Identify all deductible expenses and credits you anticipate claiming.

- Calculate your estimated tax liability using the corporate tax rate applicable for the year.

- Fill out the form, ensuring all sections are completed accurately.

- Review the form for errors and ensure all calculations are correct.

- Submit the completed form to the IRS along with any required payments.

Legal use of the Form 1120 W

The legal use of Form 1120 W is governed by IRS regulations. To be valid, the form must be completed accurately and submitted by the specified deadlines. Corporations must ensure that all estimates are reasonable and based on sound financial projections. Failure to comply with IRS guidelines can result in penalties, including fines for underpayment or late payment of estimated taxes. It is essential for businesses to maintain accurate records and documentation to support their estimates and calculations.

Filing Deadlines / Important Dates

Corporations must adhere to specific filing deadlines when submitting Form 1120 W. Generally, the estimated tax payments are due quarterly, with deadlines typically falling on the fifteenth day of the fourth, sixth, ninth, and twelfth months of the tax year. For example, if a corporation's tax year aligns with the calendar year, the deadlines would be April 15, June 15, September 15, and December 15. Staying informed about these deadlines is crucial to avoid penalties and ensure compliance with tax obligations.

Form Submission Methods (Online / Mail / In-Person)

Form 1120 W can be submitted to the IRS through various methods. Corporations have the option to file electronically using IRS e-file services, which is often the fastest and most efficient method. Alternatively, businesses can mail a paper copy of the form to the appropriate IRS address based on their location. In-person submissions are generally not common for tax forms, but corporations can visit local IRS offices for assistance if needed. Regardless of the submission method, it is important to keep a copy of the filed form for your records.

Quick guide on how to complete form 1120 w 2013

Effortlessly prepare Form 1120 W on any device

Digital document management has become increasingly favored by organizations and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can easily locate the necessary form and securely keep it online. airSlate SignNow equips you with all the tools required to swiftly create, modify, and electronically sign your documents without delays. Manage Form 1120 W on any device using the airSlate SignNow apps for Android or iOS, and enhance any document-driven process today.

The simplest way to edit and eSign Form 1120 W with ease

- Find Form 1120 W and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or redact sensitive information using tools specifically designed by airSlate SignNow for this purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal authority as a traditional wet ink signature.

- Review the details and click on the Done button to save your updates.

- Choose how you wish to share your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and eSign Form 1120 W and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 1120 w 2013

Create this form in 5 minutes!

How to create an eSignature for the form 1120 w 2013

The way to create an electronic signature for a PDF document in the online mode

The way to create an electronic signature for a PDF document in Chrome

How to generate an eSignature for putting it on PDFs in Gmail

The way to make an eSignature from your mobile device

The best way to create an eSignature for a PDF document on iOS devices

The way to make an eSignature for a PDF file on Android devices

People also ask

-

What is Form 1120 W and who needs it?

Form 1120 W is a tax form used by corporations to request an extension of time to file their corporate income tax return. Businesses that anticipate needing more time to prepare their taxes may utilize Form 1120 W to avoid late filing penalties, allowing for better accuracy and compliance.

-

How can airSlate SignNow assist with Form 1120 W submissions?

airSlate SignNow provides a seamless solution for electronically signing and sending Form 1120 W. This ensures that your form is completed accurately and efficiently, allowing businesses to meet tax deadlines without the hassle of manual processes.

-

What features does airSlate SignNow offer for tax document management like Form 1120 W?

airSlate SignNow offers features like document templates, electronic signatures, and secure storage for all your tax-related documents, including Form 1120 W. These features enhance the efficiency of managing your tax forms by streamlining workflows and ensuring document security.

-

Is there a cost associated with using airSlate SignNow for Form 1120 W?

Yes, airSlate SignNow offers various pricing plans based on features and user needs. You can choose a plan that best fits your business size and complexity, making it a cost-effective solution for managing documents like Form 1120 W.

-

Can I integrate airSlate SignNow with other software for Form 1120 W processing?

Absolutely! airSlate SignNow integrates smoothly with popular accounting and tax software, enhancing your workflow when processing Form 1120 W. This integration helps reduce errors and saves time by automatically syncing your data across platforms.

-

What are the benefits of using airSlate SignNow for Form 1120 W?

Using airSlate SignNow for Form 1120 W simplifies the signing process and signNowly reduces turnaround time. You can complete, sign, and manage your tax documents from any device, making the filing process more convenient and efficient.

-

Is airSlate SignNow secure for handling sensitive forms like Form 1120 W?

Yes, airSlate SignNow prioritizes the security of your documents. It utilizes advanced encryption and compliance measures to protect sensitive information contained in Form 1120 W, giving you peace of mind while managing your tax documents.

Get more for Form 1120 W

Find out other Form 1120 W

- eSign West Virginia Education Resignation Letter Secure

- eSign Education PDF Wyoming Mobile

- Can I eSign Nebraska Finance & Tax Accounting Business Plan Template

- eSign Nebraska Finance & Tax Accounting Business Letter Template Online

- eSign Nevada Finance & Tax Accounting Resignation Letter Simple

- eSign Arkansas Government Affidavit Of Heirship Easy

- eSign California Government LLC Operating Agreement Computer

- eSign Oklahoma Finance & Tax Accounting Executive Summary Template Computer

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself

- eSign Finance & Tax Accounting Form Texas Now

- eSign Vermont Finance & Tax Accounting Emergency Contact Form Simple

- eSign Delaware Government Stock Certificate Secure

- Can I eSign Vermont Finance & Tax Accounting Emergency Contact Form

- eSign Washington Finance & Tax Accounting Emergency Contact Form Safe

- How To eSign Georgia Government Claim

- How Do I eSign Hawaii Government Contract

- eSign Hawaii Government Contract Now

- Help Me With eSign Hawaii Government Contract

- eSign Hawaii Government Contract Later

- Help Me With eSign California Healthcare / Medical Lease Agreement