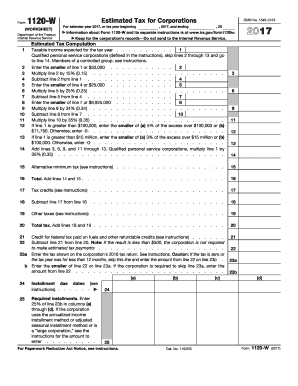

Irs 1120 W Form 2017

What is the Irs 1120 W Form

The Irs 1120 W Form is a tax document used by corporations to calculate their estimated tax payments. This form is essential for corporations that expect to owe tax of $500 or more when they file their return. It allows businesses to report their expected income, deductions, and credits for the year, ensuring they meet their tax obligations throughout the year rather than in a lump sum at tax time.

How to use the Irs 1120 W Form

To effectively use the Irs 1120 W Form, corporations must follow a few key steps. First, gather all necessary financial information, including expected income and deductible expenses. Next, complete the form by entering the required information in the appropriate fields. Corporations should ensure that they accurately estimate their tax liability to avoid underpayment or overpayment. Finally, submit the completed form to the IRS according to the specified deadlines to ensure compliance.

Steps to complete the Irs 1120 W Form

Completing the Irs 1120 W Form involves several important steps:

- Gather financial records, including income statements and expense reports.

- Fill in the corporation's name, address, and Employer Identification Number (EIN) at the top of the form.

- Estimate the total income for the year and enter it in the designated section.

- Calculate the expected deductions and credits, entering these amounts accurately.

- Determine the estimated tax liability based on the information provided.

- Sign and date the form before submission.

Legal use of the Irs 1120 W Form

The legal use of the Irs 1120 W Form requires adherence to IRS guidelines. Corporations must ensure that the information provided is accurate and reflects their financial situation. Submitting a completed form is a legal obligation for corporations that meet the income threshold. Failure to comply with these requirements may result in penalties or interest charges on unpaid taxes.

Filing Deadlines / Important Dates

Corporations must be aware of specific deadlines associated with the Irs 1120 W Form. Generally, estimated tax payments are due quarterly, with deadlines falling on the fifteenth day of April, June, September, and December. It is crucial for businesses to mark these dates on their calendars to avoid late fees and penalties. Additionally, the final return for the tax year is typically due on the fifteenth day of the fourth month following the end of the corporation's fiscal year.

Form Submission Methods (Online / Mail / In-Person)

The Irs 1120 W Form can be submitted through various methods. Corporations may choose to file online using IRS e-file services, which offer a secure and efficient way to submit forms. Alternatively, businesses can mail the completed form to the appropriate IRS address, ensuring it is postmarked by the due date. In-person submissions are generally not available for this form, making online or mail submissions the most practical options.

Quick guide on how to complete irs 1120 w 2017 form

Uncover the most efficient method to complete and endorse your Irs 1120 W Form

Are you still spending time on creating your official documents in paper format instead of online? airSlate SignNow offers a superior approach to complete and endorse your Irs 1120 W Form and associated forms for public services. Our intelligent eSignature solution equips you with all the necessary tools to handle paperwork swiftly and according to official standards - robust PDF editing, management, safeguarding, signing, and sharing capabilities are all available within an intuitive interface.

Only a few steps are required to successfully complete and endorse your Irs 1120 W Form:

- Import the editable template into the editor using the Get Form button.

- Verify the information you need to provide in your Irs 1120 W Form.

- Move between the fields using the Next option to ensure nothing is overlooked.

- Utilize Text, Check, and Cross tools to fill in the forms with your information.

- Enhance the content with Text boxes or Images from the upper toolbar.

- Emphasize what is essential or Redact fields that are no longer relevant.

- Select Sign to create a legally valid eSignature using any method you prefer.

- Include the Date next to your signature and finalize your task with the Done button.

Store your finalized Irs 1120 W Form in the Documents section of your profile, download it, or transfer it to your preferred cloud storage. Our solution also offers versatile form sharing options. There’s no requirement to print your templates to send them to the appropriate public office - you can do this via email, fax, or by requesting a USPS “snail mail” delivery from your account. Try it out now!

Create this form in 5 minutes or less

Find and fill out the correct irs 1120 w 2017 form

FAQs

-

What are the good ways to fill out 1120 form if my business is inactive?

While you might not have been “active” throughout the year, by filing a “no activity” return you may be throwing away potential deductions! Most businesses (even unprofitable ones) will have some form of expenses – think tax prep fees, taxes, filing fees, home office, phone, etc. Don’t miss out on your chance to preserve these valuable deductions. You can carry these forward to more profitable years by using the Net Operating Loss Carry-forward rules. But you must report them to take advantage of this break. If you honestly did not have any expenses or income during the tax year, simply file form 1120 by the due date (no later than 2 and one half months after the close of the business tax year – March 15 for calendar year businesses). Complete sections A-E on the front page of the return and make sure you sign the bottom – that’s it!

-

Why can't I find the 2017 IRS form 1120?

Insufficient searching skills?Try this link. > https://www.irs.gov/pub/irs-prio...

-

How should one fill out Form 1120 for a company with no activity and no income and that has not issued shares?

You put all zeros in for revenue and expenses. Even though the corporation has not formally issued shares, someone or several individuals or entities own the common stock of the corporation and you need to report anyone who owns more than 20% of the corporation.

-

How do I fill out a 1120 tax report?

If you are not sophisticated with taxes, DON'T try this form. You can get yourself in a lot of trouble. Get a good CPA or EA. The time and effort it will take you to figure this thing out is not worth it. If you value your time at more than the minimum wage, you will save time and money by hiring a professional.

-

How can I fill out an IRS form 8379?

Form 8379, the Injured Spouse declaration, is used to ensure that a spouse’s share of a refund from a joint tax return is not used by the IRS as an offset to pay a tax obligation of the other spouse.Before you file this, make sure that you know the difference between this and the Innocent Spouse declaration, Form 8857. You use Form 8379 when your spouse owes money for a legally enforeceable tax debt (such as a student loan which is in default) for which you are not jointly liable. You use Form 8857 when you want to be released from tax liability for an understatement of tax that resulted from actions taken by your spouse of which you had no knowledge, and had no reason to know.As the other answers have specified, you follow the Instructions for Form 8379 (11/2016) on the IRS Web site to actually fill it out.

-

Which IRS forms do US expats need to fill out?

That would depend on their personal situation, but should they actually have a full financial life in another country including investments, pensions, mortgages, insurance policies, a small business, multiple bank accounts…The reporting alone can be bankrupting, and that is before you get on to actual taxes that are punitive toward foreign finances owned by a US citizen and god help you if you make mistake because penalties appear designed to bankrupt you.US citizens globally are renouncing citizenship for good reason.This is extracted from a letter sent by the James Bopp law firm to Chairman Mark Meadows of the subcommittee of government operations regarding the difficulty faced by US citizens who try to live else where.“ FATCA is forcing Americans abroad into a set of circumstances where they must renounce their U.S. citizenship to survive.For example, suppose you have a married couple living in Washington DC. One works as a lobbyist for an NGO and has a defined benefits pensions. The other is self employed in a lobby firm, working under an LLC. According to the IRS filing requirements, it would take about 15 hours and $280 to complete their yearly filings. Should they under report income, any penalties would be a percentage of their unreported tax burden. The worst case is a 20% civil fraud penalty.Compare the same couple with one different fact. They moved to Australia because the NGO reassigned the wife to Sydney. The husband, likewise, moves his business overseas. They open a bank account, contribute to the mandatory Australian retirement fund, purchase a house with a mortgage and get a life insurance policy on both of them.These are now their new filing requirements:• Form 8938• Form 3520-A• Form 3520• Form 5471 (to be filed by the husbands new Australian corporation where he is self employed)• Form 720 Excise Tax.• FinCEN Form 114The burden that was 15 hours now goes up to• 57.2 hours for Form 720,• 54.20 hours for Form 3520,• 61.22 Hours for Form 3520-A.• 50 hours estimate for Form 5471For a total of 226.99 hours (according to the IRS’s own time estimates) not including time to file the FBAR.The penalties for innocent misfiling or non filings for the above foreign reporting forms for the couple are up to $50,000, per year. It is likely that the foreign income exclusion and foreign tax credit will negate any actual tax due to the IRS. So each year, there is a lurking $50,000 penalty for getting something technically wrong on a form, yet there would be no additional tax due to the US treasury.”

-

What is the IRS form W-10 and how is it correctly filled out?

While you may have never heard of IRS Form W-10, you will if you’re currently paying or planning to pay someone to care for a child, dependent, or spouse? If you are, then you may qualify to claim what’s called the Child and Dependent Care credit on your federal income tax return. To claim this credit, your care provider must fill out a W-10. You may also need to fill out the form if you receive benefits from an employer sponsored dependent care plan.It’s certainly worth it to see if you qualify (and for this we recommend that you consult with a tax professional). The child and dependent care credit can be up to 35 percent of qualifying expenses, depending on adjusted gross income. For 2011, filers may use up to $3,000 of expenses paid in a year for one qualifying individual or $6,000 for two or more qualifying individuals. (When it comes time to figure your qualifying expenses, remember that they must be reduced by the amount of any dependent care benefits provided by your employer, if those benefits were deducted or excluded from your income.)Do You Qualify for the Credit?To see if you need to have your care provider fill out a W-10, first determine if you qualify for the credit for child and dependent care expenses. To qualify, the care must have been provided for one or more qualifying persons, generally a dependent child age 12 or younger when the care was provided. Certain other individuals, spouses and those who are incapable of self-care, may also be considered qualifying persons. (Note: each qualifying individual must be listed on your tax return.)Remember also that the amount you can claim as a credit is reduced as your income rises. According to the Tax Policy Center, “Families with income below $15,000 qualify for the 35 percent credit. That rate falls by 1 percentage point for each additional $2,000 of income (or part thereof) until it signNowes 20 percent for families with income of $43,000 or more.”Next, consider why the care was provided. To qualify, the person (or couple, if married and filing jointly) claiming the credit must have sought care so they could work or search for employment. Further, the individual or couple filing must be considered earned income earners. Wages, salaries, tips, other taxable employee compensation, and net earnings from self-employment all qualify individuals as having earned income. For married filers, one spouse may be considered as having earned income if they were a full-time student, or if they were unable to care for themselves.Who did you pay for care? Qualifying funds spent for care cannot be paid to a filer’s spouse, a dependent of the filer, or to the filer’s child, unless that child will signNow age 19 or older by the end of the year. (The rule for payments to the filer’s child does not change, even if the child is not the filer’s dependent.) Filers must identify care providers on their tax return.There are just a few more qualifying details. To qualify, filing status must be single, married filing jointly, head of household or qualifying widow(er) with a dependent child. The qualifying person must have lived with the person filing for over one half of the year. There are exceptions, for the birth or death of a qualifying person, and for children of divorced or separated parents.IRS Form W-10So, if you meet those criteria, then its time to make sure your care provider fills out a W-10. The form is simple to fill out, requiring only the provider’s name, address, signature and taxpayer identification number (usually their social security number). The form is only for your records; details about the provider will come when you fill out form 2441 for Child and Dependent Care Expenses.Source: The Child and Dependent Care Credit and IRS W-10 Form

-

How do I fill out the CAT Application Form 2017?

CAT 2017 registration opened on August 9, 2017 will close on September 20 at 5PM. CAT online registration form and application form is a single document divided in 5 pages and is to be completed online. The 1st part of CAT online registration form requires your personal details. After completing your online registration, IIMs will send you CAT 2017 registration ID. With this unique ID, you will login to online registration form which will also contain application form and registration form.CAT Registration and application form will require you to fill up your academic details, uploading of photograph, signature and requires category certificates as per the IIMs prescribed format for CAT registration. CAT online application form 2017 consists of programme details on all the 20 IIMs. Candidates have to tick by clicking on the relevant programmes of the IIMs for which they wish to attend the personal Interview Process.

Create this form in 5 minutes!

How to create an eSignature for the irs 1120 w 2017 form

How to create an electronic signature for the Irs 1120 W 2017 Form online

How to create an eSignature for the Irs 1120 W 2017 Form in Google Chrome

How to make an electronic signature for signing the Irs 1120 W 2017 Form in Gmail

How to make an electronic signature for the Irs 1120 W 2017 Form right from your mobile device

How to make an eSignature for the Irs 1120 W 2017 Form on iOS

How to make an eSignature for the Irs 1120 W 2017 Form on Android devices

People also ask

-

What is the Irs 1120 W Form and why do I need it?

The Irs 1120 W Form is a key document used by corporations to calculate estimated tax payments. It is essential for ensuring compliance with federal tax obligations. By using the Irs 1120 W Form accurately, businesses can avoid penalties and manage their cash flow effectively.

-

How can airSlate SignNow help with the Irs 1120 W Form?

airSlate SignNow simplifies the process of preparing and signing the Irs 1120 W Form electronically. Our platform allows you to easily upload your documents, send them for eSignature, and store them securely. With airSlate SignNow, you can complete your tax paperwork efficiently and with confidence.

-

Is there a cost associated with using airSlate SignNow for the Irs 1120 W Form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Our pricing is competitive and designed to provide value for the features you receive, including ease of use for documents like the Irs 1120 W Form. You can choose a plan that best fits your requirements and budget.

-

What features does airSlate SignNow offer for managing the Irs 1120 W Form?

airSlate SignNow provides a range of features tailored for managing the Irs 1120 W Form. This includes customizable templates, automated reminders for deadlines, and secure cloud storage for easy access. These tools enhance your productivity and ensure that your documents are handled efficiently.

-

Can I integrate airSlate SignNow with other software for the Irs 1120 W Form?

Absolutely! airSlate SignNow integrates seamlessly with various applications that can help you manage the Irs 1120 W Form. Whether it's accounting software or document management systems, our integrations streamline your workflow and improve collaboration.

-

How secure is my information when using airSlate SignNow for the Irs 1120 W Form?

Security is a top priority at airSlate SignNow. When using our platform to handle the Irs 1120 W Form, your data is protected with industry-leading encryption and compliance standards. This ensures that your sensitive information remains confidential and secure.

-

Can I track the status of my Irs 1120 W Form with airSlate SignNow?

Yes, you can easily track the status of your Irs 1120 W Form with airSlate SignNow. Our platform provides real-time updates on document activity, so you can see when it’s been viewed, signed, or completed. This feature helps you stay informed and manage deadlines effectively.

Get more for Irs 1120 W Form

- Gms claim form printable

- Hcidla forms

- Subpoena for deposition records only winnebago county circuit form

- Personal representativeamp39s deed testate rootsweb form

- Red bull pdf form

- Authorization to use or disclose protected health information phi sonora quest

- In witness whereof the parties enter into this contract mihs form

- Standard rent agreement template form

Find out other Irs 1120 W Form

- eSign Massachusetts Basic rental agreement or residential lease Now

- How To eSign Delaware Business partnership agreement

- How Do I eSign Massachusetts Business partnership agreement

- Can I eSign Georgia Business purchase agreement

- How Can I eSign Idaho Business purchase agreement

- How To eSign Hawaii Employee confidentiality agreement

- eSign Idaho Generic lease agreement Online

- eSign Pennsylvania Generic lease agreement Free

- eSign Kentucky Home rental agreement Free

- How Can I eSign Iowa House rental lease agreement

- eSign Florida Land lease agreement Fast

- eSign Louisiana Land lease agreement Secure

- How Do I eSign Mississippi Land lease agreement

- eSign Connecticut Landlord tenant lease agreement Now

- eSign Georgia Landlord tenant lease agreement Safe

- Can I eSign Utah Landlord lease agreement

- How Do I eSign Kansas Landlord tenant lease agreement

- How Can I eSign Massachusetts Landlord tenant lease agreement

- eSign Missouri Landlord tenant lease agreement Secure

- eSign Rhode Island Landlord tenant lease agreement Later