Form 1120 W 2016

What is the Form 1120 W

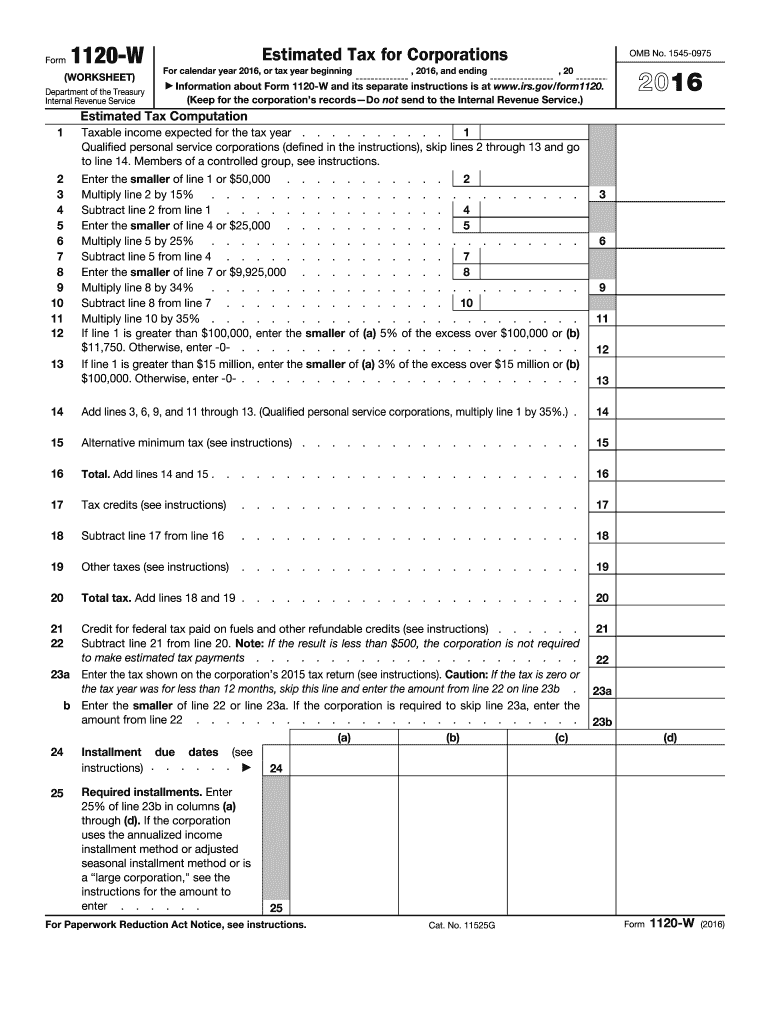

The Form 1120 W is a tax form used by corporations in the United States to calculate their estimated tax payments. This form is essential for corporations that expect to owe tax of five hundred dollars or more when they file their annual return. It allows businesses to report their expected income, deductions, and credits for the tax year, helping them manage their tax liabilities effectively.

How to use the Form 1120 W

To use the Form 1120 W, businesses must first estimate their taxable income for the year. This includes all sources of revenue minus allowable deductions. Once the estimated income is determined, the corporation can calculate its estimated tax liability based on the current corporate tax rates. The form guides users through reporting these figures accurately, ensuring compliance with IRS regulations.

Steps to complete the Form 1120 W

Completing the Form 1120 W involves several steps:

- Gather all necessary financial documents, including income statements and expense records.

- Estimate total income for the year and determine allowable deductions.

- Calculate the estimated tax liability using the appropriate tax rates.

- Fill out the form by entering the estimated figures in the designated sections.

- Review the completed form for accuracy before submission.

Filing Deadlines / Important Dates

Corporations must file the Form 1120 W by the 15th day of the fourth month following the end of their tax year. For example, for a corporation with a calendar year-end of December 31, the deadline would be April 15 of the following year. It is crucial to adhere to these deadlines to avoid penalties and interest on unpaid taxes.

Form Submission Methods (Online / Mail / In-Person)

The Form 1120 W can be submitted through various methods. Corporations have the option to file electronically using the IRS e-file system, which is often faster and more efficient. Alternatively, businesses can mail a paper copy of the form to the appropriate IRS address. In-person submission is generally not available for tax forms, as the IRS encourages electronic filing for quicker processing.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the Form 1120 W. These guidelines include instructions on how to estimate income and deductions, as well as details on the required attachments. It is essential for corporations to follow these guidelines closely to ensure compliance and to avoid potential issues with their tax filings.

Quick guide on how to complete form 1120 w 2016

Discover the most efficient method to complete and sign your Form 1120 W

Are you still spending time preparing your official documents on paper instead of online? airSlate SignNow offers a superior way to finish and sign your Form 1120 W and associated forms for public services. Our intelligent electronic signature solution provides everything necessary to handle paperwork swiftly and in compliance with official standards - comprehensive PDF editing, management, security, signing, and sharing tools are readily available within an intuitive interface.

Only a few steps are required to finalize and sign your Form 1120 W:

- Upload the editable template to the editor using the Get Form button.

- Verify what information needs to be included in your Form 1120 W.

- Move between the fields with the Next option to ensure nothing is overlooked.

- Employ Text, Check, and Cross functions to fill in the blanks with your information.

- Modify the content with Text boxes or Images from the upper toolbar.

- Emphasize the important aspects or Blackout sections that are no longer relevant.

- Select Sign to create a legally binding electronic signature using your preferred method.

- Add the Date next to your signature and conclude your task by clicking the Done button.

Store your completed Form 1120 W in the Documents folder within your profile, download it, or upload it to your chosen cloud storage. Our service also allows versatile form sharing. There’s no need to print your forms when submitting them to the appropriate public office - you can do it via email, fax, or by requesting USPS “snail mail” delivery from your account. Give it a shot today!

Create this form in 5 minutes or less

Find and fill out the correct form 1120 w 2016

FAQs

-

What are the good ways to fill out 1120 form if my business is inactive?

While you might not have been “active” throughout the year, by filing a “no activity” return you may be throwing away potential deductions! Most businesses (even unprofitable ones) will have some form of expenses – think tax prep fees, taxes, filing fees, home office, phone, etc. Don’t miss out on your chance to preserve these valuable deductions. You can carry these forward to more profitable years by using the Net Operating Loss Carry-forward rules. But you must report them to take advantage of this break. If you honestly did not have any expenses or income during the tax year, simply file form 1120 by the due date (no later than 2 and one half months after the close of the business tax year – March 15 for calendar year businesses). Complete sections A-E on the front page of the return and make sure you sign the bottom – that’s it!

-

How should one fill out Form 1120 for a company with no activity and no income and that has not issued shares?

You put all zeros in for revenue and expenses. Even though the corporation has not formally issued shares, someone or several individuals or entities own the common stock of the corporation and you need to report anyone who owns more than 20% of the corporation.

-

How do I fill out a 1120 tax report?

If you are not sophisticated with taxes, DON'T try this form. You can get yourself in a lot of trouble. Get a good CPA or EA. The time and effort it will take you to figure this thing out is not worth it. If you value your time at more than the minimum wage, you will save time and money by hiring a professional.

-

How do I fill out 2016 ITR form?

First of all you must know about all of your sources of income. In Indian Income Tax Act there are multiple forms for different types of sources of Income. If you have only salary & other source of income you can fill ITR-1 by registering your PAN on e-Filing Home Page, Income Tax Department, Government of India after registration you have to login & select option fill ITR online in this case you have to select ITR-1 for salary, house property & other source income.if you have income from business & profession and not maintaining books & also not mandatory to prepare books & total turnover in business less than 1 Crores & want to show profit more than 8% & if you are a professional and not required to make books want to show profit more than 50% of receipts than you can use online quick e-filling form ITR-4S i.s. for presumptive business income.for other source of income there are several forms according to source of income download Excel utility or JAVA utility form e-Filing Home Page, Income Tax Department, Government of India fill & upload after login to your account.Prerequisite before E-filling.Last year return copy (if available)Bank Account number with IFSC Code.Form 16/16A (if Available)Saving Details / Deduction Slips LIC,PPF, etc.Interest Statement from Banks or OthersProfit & Loss Account, Balance Sheet, Tax Audit Report only if filling ITR-4, ITR-5, ITR-6, ITR-7.hope this will help you in case any query please let me know.

-

When do I have to learn how to fill out a W-2 form?

Form W-2 is an obligatory form to be completed by every employer. Form W-2 doesn’t have to be filled out by the employee. It is given to inform the employee about the amount of his annual income and taxes withheld from it.You can find a lot of information here: http://bit.ly/2NjjlJi

-

How should I fill this contract form "Signed this... day of..., 2016"?

I agree that you need to have the document translated to your native language or read to you by an interpreter.

-

Can I fill out the SSC CHSL 2017 form while waiting for the 2016 results?

Yes you can.By now you should have started preparing also.We motivate students to crack govt exams while working.Join our YouTube channel SSC PATHSHALA and enjoy learning like never before.Classroom Program for English Mains: Classroom Program for English Mains - YouTube

-

How do I fill out a W-4 form?

The main thing you need to put on your W-4 besides your name, address and social security number is whether you are married or single and the number of exemptions you wish to take to lower the amount of money with held for taxes from your paycheck. The number of exemptions refers to how many people you support, i. e. children. Say you are single and have 3 children, you can put down 4 exemptions, 1 for your self and 1 for each child. This means you will have more pay to take home because you aren’t having it with held from your paycheck. If you are single and have no children, you can either take 1 or 0 exemptions. If you make decent money, take 0 deductions, if you are barely making it you could probably take 1 exemption. Just realize that if you take exemptions, and not enough money is taken out of your check to pay your taxes, you will be liable for it come April 15th.If you are married and have no children and you make decent money, take 0 deductions. If you have children, only one spouse should take them as exemptions and it should be the one who makes the most money. For example, say your spouse is the major bread winner and you have 2 children, your spouse could take 4 exemptions (one for each member of the family) and then you would take 0 exemptions.Usually, it’s best to err on the side of caution and take the smaller amount of deductions so that you won’t owe a lot of money come tax time. If you’ve had too much with held it will come back to you as a refund.

Create this form in 5 minutes!

How to create an eSignature for the form 1120 w 2016

How to create an eSignature for your Form 1120 W 2016 online

How to create an eSignature for the Form 1120 W 2016 in Chrome

How to generate an eSignature for signing the Form 1120 W 2016 in Gmail

How to generate an electronic signature for the Form 1120 W 2016 right from your mobile device

How to generate an electronic signature for the Form 1120 W 2016 on iOS

How to make an electronic signature for the Form 1120 W 2016 on Android OS

People also ask

-

What is Form 1120 W, and why do I need it?

Form 1120 W is a tax form used by corporations to report their estimated tax payments. It helps businesses calculate their tax liability accurately, ensuring compliance with IRS regulations. Utilizing airSlate SignNow simplifies the process of signing and submitting Form 1120 W electronically, making tax season less stressful.

-

How can airSlate SignNow assist me with Form 1120 W?

airSlate SignNow offers a seamless platform to eSign and send Form 1120 W securely. With our user-friendly interface, you can complete your tax forms faster, ensuring you meet deadlines without hassle. Plus, our platform keeps your documents organized, so you can easily access your Form 1120 W when needed.

-

Is there a cost associated with using airSlate SignNow for Form 1120 W?

Yes, airSlate SignNow operates on a subscription-based model, providing various pricing tiers to fit your needs. Each plan includes features that simplify the eSigning process, including templates for Form 1120 W. You can choose a plan that best matches your business requirements and budget.

-

What features does airSlate SignNow offer for managing Form 1120 W?

airSlate SignNow includes features such as customizable templates for Form 1120 W, secure document storage, and real-time tracking of your documents. These features not only streamline the signing process but also enhance collaboration among team members involved in tax preparation. You can easily manage your Form 1120 W from any device.

-

Can I integrate airSlate SignNow with my accounting software for Form 1120 W?

Absolutely! airSlate SignNow integrates seamlessly with popular accounting software, allowing you to pull in data for Form 1120 W easily. This integration minimizes manual data entry and reduces errors, making your tax filing process more efficient. With airSlate SignNow, you can connect all your tools in one platform.

-

How secure is my information when using airSlate SignNow for Form 1120 W?

Your security is our top priority at airSlate SignNow. We utilize advanced encryption protocols to protect your documents, including Form 1120 W, during transmission and storage. With features like two-factor authentication and secure cloud storage, you can trust that your sensitive information remains safe.

-

What are the benefits of eSigning Form 1120 W with airSlate SignNow?

eSigning Form 1120 W with airSlate SignNow offers numerous benefits, including faster processing times and reduced paperwork. Our platform is designed for ease of use, making it simple for you and your team to sign documents electronically. Additionally, you can access your signed Form 1120 W anytime, anywhere, enhancing your productivity.

Get more for Form 1120 W

- J rock summer camp form

- Ohio permit application form us army corps of

- Declaration of intent to homeschool anacortes form

- Application for immigrant visa and alien registration form

- Minnesota state high school league dance team competition form

- Shingle springs tribal tanf fill online printable fillable form

- Landscape design certificatecincinnati state form

- Tuf middle school elective course request form

Find out other Form 1120 W

- Electronic signature Alaska Construction Lease Agreement Template Simple

- Electronic signature Construction Form Arizona Safe

- Electronic signature Kentucky Charity Living Will Safe

- Electronic signature Construction Form California Fast

- Help Me With Electronic signature Colorado Construction Rental Application

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed