2021 Form 1120 W Worksheet Estimated Tax for Corporations 2021

Understanding the 1120 W Tax Form

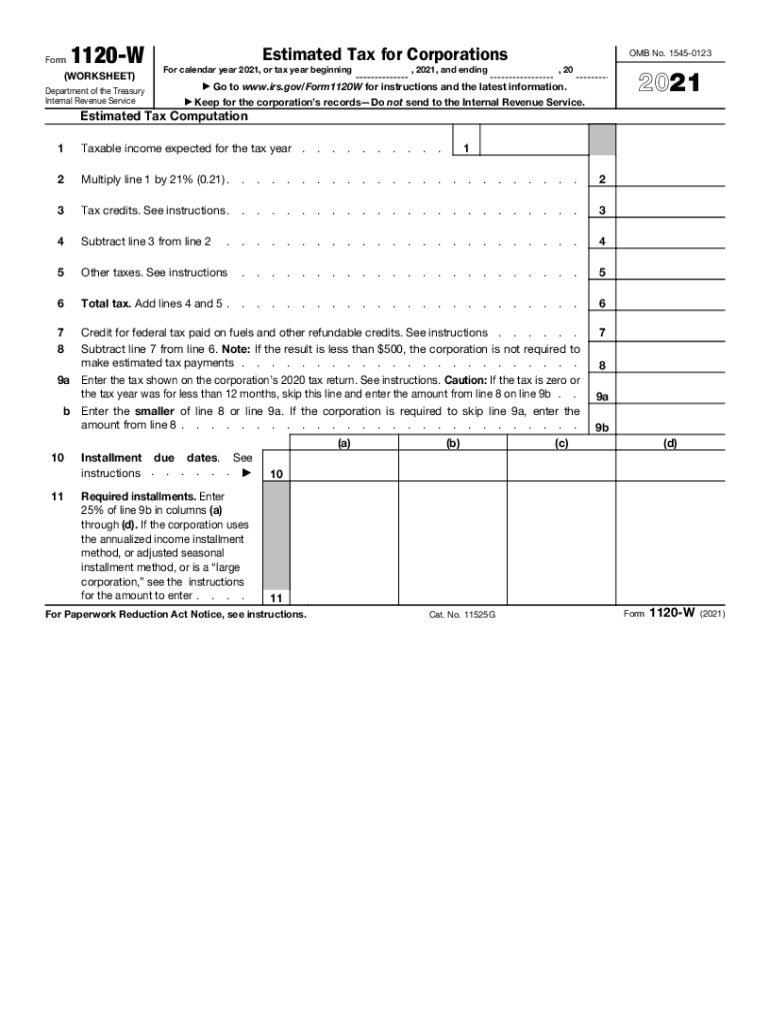

The 1120 W tax form is a crucial document for corporations in the United States, specifically designed to help businesses calculate their estimated tax payments for the year. This form is particularly important for corporations that expect to owe tax of five hundred dollars or more when filing their annual return. The 1120 W allows businesses to report their estimated income, deductions, and credits, which ultimately assists in determining the appropriate amount of tax to pay throughout the year.

Steps to Complete the 1120 W Tax Form

Completing the 1120 W involves several steps to ensure accuracy and compliance with IRS guidelines. Begin by gathering all necessary financial documents, including income statements and expense reports. Next, follow these steps:

- Fill out the corporation's name, address, and Employer Identification Number (EIN) at the top of the form.

- Report the estimated taxable income for the year, which will be the basis for calculating the estimated tax.

- Include any deductions and credits that the corporation qualifies for, as these will reduce the overall tax liability.

- Calculate the estimated tax due based on the provided tax rates.

- Sign and date the form to validate it before submission.

Legal Use of the 1120 W Tax Form

The 1120 W tax form must be filled out and submitted in accordance with IRS regulations to be considered legally valid. This includes ensuring that all information is accurate and that the form is signed by an authorized representative of the corporation. Digital signatures are accepted and can enhance the security and efficiency of the submission process. Compliance with the eSignature laws, such as ESIGN and UETA, ensures that electronic submissions are recognized legally.

Filing Deadlines for the 1120 W Tax Form

Corporations need to be aware of the filing deadlines associated with the 1120 W tax form. Typically, the estimated tax payments are due quarterly, with specific deadlines falling on the fifteenth day of the fourth, sixth, ninth, and twelfth months of the tax year. It is essential for businesses to mark these dates on their calendars to avoid penalties for late payments.

Examples of Using the 1120 W Tax Form

Understanding practical applications of the 1120 W can help corporations navigate their tax obligations more effectively. For instance, a corporation expecting significant income growth may use the 1120 W to project higher estimated tax payments to avoid underpayment penalties. Alternatively, a corporation anticipating lower income may adjust its estimated payments accordingly to manage cash flow more efficiently.

IRS Guidelines for the 1120 W Tax Form

The IRS provides specific guidelines for completing and submitting the 1120 W tax form. These guidelines include instructions on how to calculate estimated income, the appropriate use of deductions, and the necessary documentation required for submission. It is advisable for corporations to review these guidelines thoroughly to ensure compliance and to avoid potential issues during the filing process.

Quick guide on how to complete 2021 form 1120 w worksheet estimated tax for corporations

Effortlessly prepare 2021 Form 1120 W Worksheet Estimated Tax For Corporations on any device

Managing documents online has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed paperwork, allowing you to obtain the correct format and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly without delays. Manage 2021 Form 1120 W Worksheet Estimated Tax For Corporations on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused task today.

The simplest way to modify and electronically sign 2021 Form 1120 W Worksheet Estimated Tax For Corporations with ease

- Obtain 2021 Form 1120 W Worksheet Estimated Tax For Corporations and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Generate your electronic signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review all the details and then click the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced files, tedious form searches, or errors that necessitate printing new copies of documents. airSlate SignNow fulfills all your document management needs in just a few clicks from your chosen device. Modify and electronically sign 2021 Form 1120 W Worksheet Estimated Tax For Corporations and ensure effective communication at any stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2021 form 1120 w worksheet estimated tax for corporations

Create this form in 5 minutes!

How to create an eSignature for the 2021 form 1120 w worksheet estimated tax for corporations

The best way to generate an eSignature for a PDF file online

The best way to generate an eSignature for a PDF file in Google Chrome

How to create an electronic signature for signing PDFs in Gmail

The best way to create an eSignature right from your mobile device

How to create an eSignature for a PDF file on iOS

The best way to create an eSignature for a PDF on Android devices

People also ask

-

What is the 1120 W tax form and who needs to file it?

The 1120 W tax form is used by corporations in the United States to report income and calculate their tax liabilities. Typically, C corporations that are subject to taxation must file this form annually. Understanding the purpose and requirements of the 1120 W tax form is essential for ensuring compliance and avoiding penalties.

-

How can airSlate SignNow help with filing the 1120 W tax form?

airSlate SignNow can streamline the process of preparing and submitting your 1120 W tax form by allowing you to securely eSign documents and collect signatures from stakeholders. This enhances efficiency, reduces paperwork, and ensures that every step of the filing is compliant and timely. With our platform, managing complex forms like the 1120 W tax form becomes simpler.

-

Is there a cost associated with using airSlate SignNow for the 1120 W tax form?

Yes, there is a cost to use airSlate SignNow, but it is a cost-effective solution compared to traditional methods. Pricing plans are available to accommodate different business needs, allowing you to select a package that makes managing tax forms like the 1120 W tax form affordable. Your investment includes access to valuable features that enhance the document signing experience.

-

What features does airSlate SignNow offer for managing the 1120 W tax form?

airSlate SignNow provides features like eSignature technology, document templates, and secure cloud storage, all tailored to streamline the process of handling forms such as the 1120 W tax form. These tools enhance collaboration and ensure that your documents are handled efficiently. Moreover, our platform is user-friendly, allowing you to manage your tax filings with ease.

-

Can I integrate airSlate SignNow with other software to assist with my 1120 W tax form?

Yes, airSlate SignNow integrates seamlessly with various accounting and productivity software, which can be helpful when dealing with the 1120 W tax form. This means you can connect it with your existing tools for a more cohesive workflow. Integrations help ensure you have all necessary information at your fingertips when preparing tax documents.

-

What are the benefits of using airSlate SignNow for tax documents like the 1120 W tax form?

Using airSlate SignNow for your 1120 W tax form offers several benefits, including increased efficiency, reduced paper clutter, and enhanced security for your sensitive documents. The eSigning process is quick and reliable, saving you time on manual handling. Additionally, you can track the signing status and receive notifications, ensuring that you meet deadlines seamlessly.

-

Is airSlate SignNow secure for handling sensitive documents like the 1120 W tax form?

Absolutely! airSlate SignNow employs top-notch security measures to protect sensitive documents, including the 1120 W tax form. We use encryption, secure cloud platforms, and compliance with industry standards to ensure your data is safe at all times. You can rest easy knowing that your tax documents are handled with the utmost security.

Get more for 2021 Form 1120 W Worksheet Estimated Tax For Corporations

- Power of attorney forms package wyoming

- Revocation of advance healthcare directive wyoming form

- Revised uniform anatomical gift act donation wyoming

- Employment hiring process package wyoming form

- Wyoming uniform act

- Wy act form

- Employment or job termination package wyoming form

- Newly widowed individuals package wyoming form

Find out other 2021 Form 1120 W Worksheet Estimated Tax For Corporations

- eSign Minnesota Share Donation Agreement Simple

- Can I eSign Hawaii Collateral Debenture

- eSign Hawaii Business Credit Application Mobile

- Help Me With eSign California Credit Memo

- eSign Hawaii Credit Memo Online

- Help Me With eSign Hawaii Credit Memo

- How Can I eSign Hawaii Credit Memo

- eSign Utah Outsourcing Services Contract Computer

- How Do I eSign Maryland Interview Non-Disclosure (NDA)

- Help Me With eSign North Dakota Leave of Absence Agreement

- How To eSign Hawaii Acknowledgement of Resignation

- How Can I eSign New Jersey Resignation Letter

- How Do I eSign Ohio Resignation Letter

- eSign Arkansas Military Leave Policy Myself

- How To eSign Hawaii Time Off Policy

- How Do I eSign Hawaii Time Off Policy

- Help Me With eSign Hawaii Time Off Policy

- How To eSign Hawaii Addressing Harassement

- How To eSign Arkansas Company Bonus Letter

- eSign Hawaii Promotion Announcement Secure