Form 1120 W 2012

What is the Form 1120 W

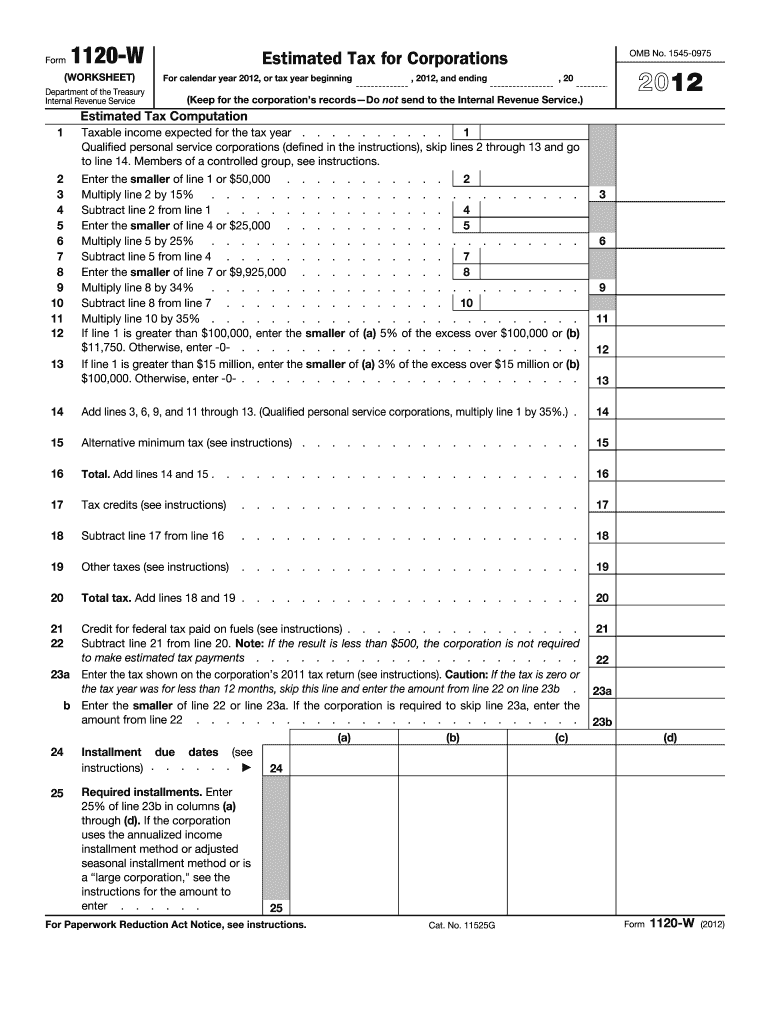

The Form 1120 W is a tax form used by corporations in the United States to calculate their estimated tax payments for the current tax year. This form is essential for ensuring that corporations meet their tax obligations and avoid penalties for underpayment. It allows businesses to estimate their tax liability based on expected income and deductions, providing a structured approach to managing tax responsibilities throughout the year.

How to use the Form 1120 W

To effectively use the Form 1120 W, corporations must first gather relevant financial information, including expected income, deductions, and credits for the tax year. The form requires businesses to input this data to calculate estimated tax payments. It is important for corporations to review their financial situation regularly to adjust these estimates as necessary, ensuring compliance with IRS regulations.

Steps to complete the Form 1120 W

Completing the Form 1120 W involves several key steps:

- Gather necessary financial documents, including income statements and expense reports.

- Calculate the expected taxable income for the year.

- Determine applicable deductions and credits.

- Fill out the form by entering the calculated figures in the appropriate sections.

- Review the completed form for accuracy before submission.

Legal use of the Form 1120 W

The legal use of the Form 1120 W is governed by IRS regulations. Corporations must ensure that the information provided is accurate and complete to avoid potential legal issues. Submitting this form correctly helps establish a corporation's commitment to fulfilling its tax obligations, thereby reducing the risk of penalties or audits. Compliance with tax laws is essential for maintaining good standing with the IRS.

Filing Deadlines / Important Dates

Corporations must adhere to specific deadlines when filing the Form 1120 W. Typically, the form is due on the 15th day of the fourth month following the end of the corporation's tax year. For corporations operating on a calendar year, this means the form is due by April 15 of the following year. It is crucial for businesses to mark these dates on their calendars to ensure timely submissions and avoid late fees.

Form Submission Methods (Online / Mail / In-Person)

The Form 1120 W can be submitted through various methods, including online filing, mailing a paper form, or delivering it in person to the appropriate IRS office. Online filing is often the most efficient method, as it allows for quicker processing and confirmation of receipt. However, businesses should choose the method that best suits their operational needs and compliance preferences.

Penalties for Non-Compliance

Failure to comply with the requirements associated with the Form 1120 W can result in significant penalties. Corporations may face fines for late submissions or underpayment of estimated taxes. Additionally, non-compliance can lead to increased scrutiny from the IRS, which may result in audits or further legal action. It is essential for businesses to understand these risks and take proactive steps to ensure compliance.

Quick guide on how to complete form 1120 w 2012

Finalize Form 1120 W effortlessly on any gadget

Managing documents online has gained signNow traction among companies and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to access the necessary form and securely store it on the web. airSlate SignNow provides you with all the tools needed to create, modify, and eSign your documents swiftly and without delays. Handle Form 1120 W on any gadget using airSlate SignNow Android or iOS applications and enhance any document-centric task today.

How to modify and eSign Form 1120 W effortlessly

- Obtain Form 1120 W and click on Get Form to commence.

- Utilize the tools we offer to fill out your form.

- Highlight pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal significance as a traditional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you would like to send your completed form, via email, text message (SMS), or invitation link, or download it to your computer.

Put aside worries about lost or misfiled documents, lengthy form searching, or errors that necessitate printing fresh copies. airSlate SignNow addresses all your document management requirements in a few clicks from your chosen device. Modify and eSign Form 1120 W and maintain exceptional communication at every step of the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 1120 w 2012

Create this form in 5 minutes!

How to create an eSignature for the form 1120 w 2012

The way to create an eSignature for your PDF document in the online mode

The way to create an eSignature for your PDF document in Chrome

The best way to make an electronic signature for putting it on PDFs in Gmail

How to create an eSignature from your mobile device

The best way to generate an electronic signature for a PDF document on iOS devices

How to create an eSignature for a PDF file on Android devices

People also ask

-

What is Form 1120 W and why do I need it?

Form 1120 W is a tax form used by corporations to calculate their estimated tax payments for the year. Businesses often need this form to comply with federal tax regulations and ensure they are paying the correct amount. airSlate SignNow simplifies the process of filling out and submitting Form 1120 W, making it easier for companies to stay compliant.

-

How can airSlate SignNow assist with Form 1120 W?

airSlate SignNow offers an intuitive platform that allows users to eSign and manage documents like Form 1120 W easily. With our solution, businesses can ensure that all signatures are collected promptly and documents are securely stored. This streamlines the filing process and helps in reducing errors.

-

What are the key features of airSlate SignNow for handling Form 1120 W?

Some key features include customizable templates for Form 1120 W, automated reminders for signers, and a secure document storage system. Additionally, users can track the status of documents in real-time, ensuring that Form 1120 W is submitted on time. This level of efficiency helps businesses manage their tax obligations with ease.

-

Is there a cost associated with using airSlate SignNow for Form 1120 W?

Yes, airSlate SignNow offers various pricing plans tailored to fit different business needs. Depending on the plan, users can access features designed specifically for managing important documents, including Form 1120 W. We recommend reviewing our pricing page to determine which plan provides the best value for your requirements.

-

Can I integrate airSlate SignNow with other tools for managing Form 1120 W?

Absolutely! airSlate SignNow integrates seamlessly with several popular applications and tools. Whether you're using accounting software or customer relationship management systems, our platform can help you streamline the process of preparing and submitting Form 1120 W.

-

What benefits does airSlate SignNow provide for Form 1120 W submissions?

Using airSlate SignNow for submitting Form 1120 W can signNowly reduce processing time and improve accuracy. The platform allows for easy document sharing and real-time tracking, which minimizes the risk of delays in submission. This ensures that businesses can focus on their core operations while remaining compliant with tax requirements.

-

Is airSlate SignNow secure for handling sensitive documents like Form 1120 W?

Yes, security is a top priority for airSlate SignNow. The platform employs advanced encryption methods and complies with industry standards to protect sensitive information. This makes it a reliable choice for businesses needing to manage and submit Form 1120 W with confidentiality.

Get more for Form 1120 W

- Commercial sublease iowa form

- Iowa lease 497305043 form

- Notice to lessor exercising option to purchase iowa form

- Assignment of lease and rent from borrower to lender iowa form

- Assignment of lease from lessor with notice of assignment iowa form

- Ia tenant form

- Iowa motion form

- Guaranty or guarantee of payment of rent iowa form

Find out other Form 1120 W

- Can I eSignature Minnesota House rental lease agreement

- eSignature Missouri Landlord lease agreement Fast

- eSignature Utah Landlord lease agreement Simple

- eSignature West Virginia Landlord lease agreement Easy

- How Do I eSignature Idaho Landlord tenant lease agreement

- eSignature Washington Landlord tenant lease agreement Free

- eSignature Wisconsin Landlord tenant lease agreement Online

- eSignature Wyoming Landlord tenant lease agreement Online

- How Can I eSignature Oregon lease agreement

- eSignature Washington Lease agreement form Easy

- eSignature Alaska Lease agreement template Online

- eSignature Alaska Lease agreement template Later

- eSignature Massachusetts Lease agreement template Myself

- Can I eSignature Arizona Loan agreement

- eSignature Florida Loan agreement Online

- eSignature Florida Month to month lease agreement Later

- Can I eSignature Nevada Non-disclosure agreement PDF

- eSignature New Mexico Non-disclosure agreement PDF Online

- Can I eSignature Utah Non-disclosure agreement PDF

- eSignature Rhode Island Rental agreement lease Easy