Form 1120 W Estimated Tax for Corporations for Calendar Year , or Tax Year Beginning , , and Ending , 20 OMB No 2010

What is the Form 1120 W Estimated Tax For Corporations For Calendar Year, Or Tax Year Beginning, And Ending, 20 OMB No

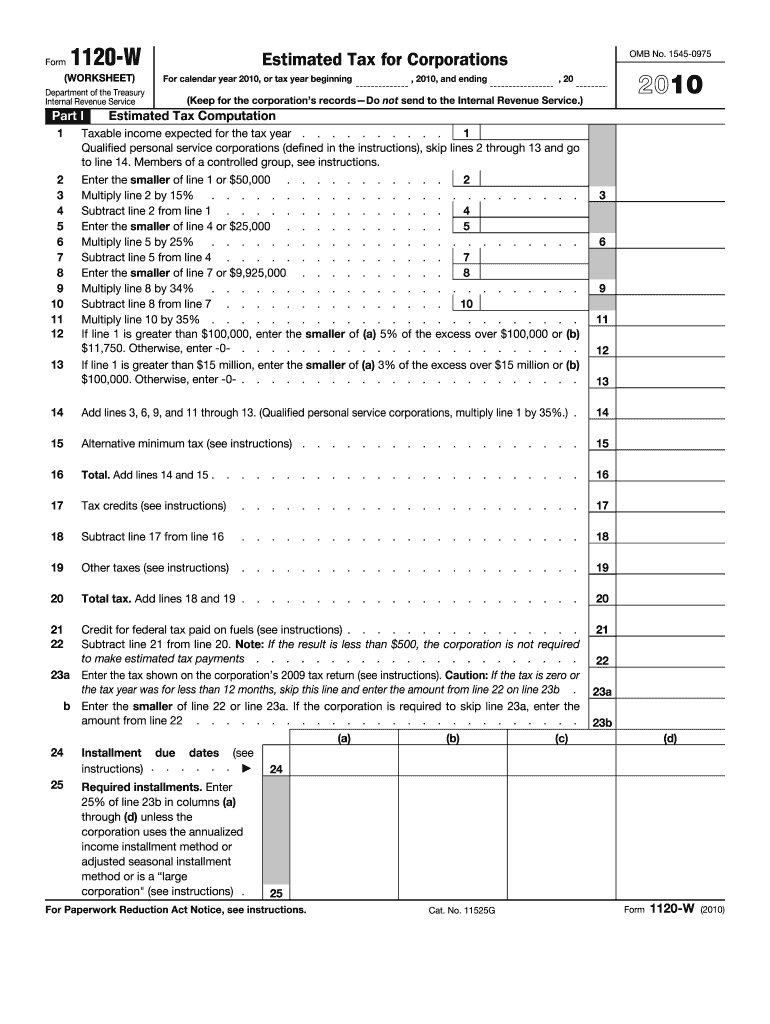

The Form 1120 W is a crucial document used by corporations in the United States to calculate their estimated tax payments for a specific calendar year or tax year. This form is essential for ensuring that corporations meet their federal tax obligations timely. The OMB number associated with the form indicates its approval for use by the Office of Management and Budget, which is necessary for the form’s validity. Corporations must accurately complete this form to avoid penalties and ensure compliance with IRS regulations.

Steps to Complete the Form 1120 W Estimated Tax For Corporations For Calendar Year, Or Tax Year Beginning, And Ending, 20 OMB No

Completing the Form 1120 W involves several key steps:

- Gather necessary financial documents, including income statements and previous tax returns.

- Determine the corporation's expected taxable income for the year.

- Calculate the estimated tax liability using the applicable tax rates.

- Fill in the form with the calculated amounts, ensuring all sections are completed accurately.

- Review the form for any errors or omissions before submission.

Following these steps will help ensure that the form is completed correctly and submitted on time.

How to Obtain the Form 1120 W Estimated Tax For Corporations For Calendar Year, Or Tax Year Beginning, And Ending, 20 OMB No

Corporations can obtain the Form 1120 W from the IRS website or by contacting the IRS directly. The form is typically available as a downloadable PDF, which can be printed and filled out manually. Additionally, many tax preparation software programs include this form, allowing for electronic completion and submission. It is essential to ensure that the most current version of the form is used to comply with IRS requirements.

Legal Use of the Form 1120 W Estimated Tax For Corporations For Calendar Year, Or Tax Year Beginning, And Ending, 20 OMB No

The legal use of Form 1120 W is governed by IRS regulations. To be considered legally binding, the form must be completed accurately and submitted within the designated deadlines. Corporations must ensure compliance with all relevant tax laws to avoid penalties. The use of electronic signatures is permissible, provided that the corporation adheres to the legal standards set forth by the ESIGN Act and relevant state laws. This ensures that the form holds legal weight in any tax-related matters.

Filing Deadlines / Important Dates

Corporations must be aware of key filing deadlines associated with Form 1120 W. Generally, the form is due on the 15th day of the fourth month following the end of the tax year. For corporations operating on a calendar year, this typically means the due date is April 15. It is important to keep track of these dates to avoid late fees and interest charges. Additionally, corporations should consider making estimated tax payments quarterly to meet their tax obligations throughout the year.

Penalties for Non-Compliance

Failure to comply with the requirements of Form 1120 W can result in significant penalties for corporations. The IRS may impose fines for late filing or underpayment of estimated taxes. These penalties can accumulate quickly, leading to increased financial burdens for the corporation. It is crucial for businesses to understand their obligations and ensure timely and accurate submissions to avoid these penalties.

Quick guide on how to complete form 1120 w estimated tax for corporations for calendar year 2010 or tax year beginning 2010 and ending 20 omb no

Complete Form 1120 W Estimated Tax For Corporations For Calendar Year , Or Tax Year Beginning , , And Ending , 20 OMB No effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to locate the necessary form and securely keep it online. airSlate SignNow provides all the tools you require to create, modify, and electronically sign your documents quickly without delays. Manage Form 1120 W Estimated Tax For Corporations For Calendar Year , Or Tax Year Beginning , , And Ending , 20 OMB No on any device with airSlate SignNow Android or iOS applications and enhance any document-driven workflow today.

The optimal way to modify and electronically sign Form 1120 W Estimated Tax For Corporations For Calendar Year , Or Tax Year Beginning , , And Ending , 20 OMB No with ease

- Obtain Form 1120 W Estimated Tax For Corporations For Calendar Year , Or Tax Year Beginning , , And Ending , 20 OMB No and then click Get Form to initiate.

- Utilize the tools we provide to complete your document.

- Emphasize relevant portions of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Verify the information and click on the Done button to save your modifications.

- Select your preferred method to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and electronically sign Form 1120 W Estimated Tax For Corporations For Calendar Year , Or Tax Year Beginning , , And Ending , 20 OMB No and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 1120 w estimated tax for corporations for calendar year 2010 or tax year beginning 2010 and ending 20 omb no

Create this form in 5 minutes!

How to create an eSignature for the form 1120 w estimated tax for corporations for calendar year 2010 or tax year beginning 2010 and ending 20 omb no

The way to make an eSignature for a PDF file online

The way to make an eSignature for a PDF file in Google Chrome

The way to create an electronic signature for signing PDFs in Gmail

How to make an eSignature straight from your mobile device

The way to make an eSignature for a PDF file on iOS

How to make an eSignature for a PDF document on Android devices

People also ask

-

What is the purpose of Form 1120 W Estimated Tax For Corporations For Calendar Year, Or Tax Year Beginning, And Ending, 20 OMB No.?

Form 1120 W Estimated Tax For Corporations For Calendar Year, Or Tax Year Beginning, And Ending, 20 OMB No. is used by corporations to report their estimated tax liabilities. This form helps ensure that corporations pay the right amount of tax throughout the year, avoiding any potential penalties for underpayment.

-

How can airSlate SignNow assist with completing Form 1120 W Estimated Tax For Corporations?

airSlate SignNow provides an intuitive platform that simplifies the eSigning and document management process, making it easier for businesses to complete Form 1120 W Estimated Tax For Corporations. With our solution, users can effortlessly fill out, sign, and send this form electronically, ensuring accuracy and compliance.

-

What features does airSlate SignNow offer for managing Form 1120 W Estimated Tax For Corporations?

airSlate SignNow offers features such as customizable templates, real-time document tracking, secure cloud storage, and advanced eSignature capabilities. These tools streamline the preparation and submission of Form 1120 W Estimated Tax For Corporations, enhancing productivity and reducing errors.

-

Is there a cost associated with using airSlate SignNow for Form 1120 W Estimated Tax?

Yes, airSlate SignNow offers various pricing plans to cater to different business needs. Our plans are designed to be cost-effective, providing a range of features that can help streamline the process of completing Form 1120 W Estimated Tax For Corporations.

-

Who can benefit from using airSlate SignNow for Form 1120 W Estimated Tax For Corporations?

Any corporation required to file Form 1120 W Estimated Tax For Corporations can benefit from airSlate SignNow. Our solution is particularly useful for accountants, finance teams, and business owners seeking a quick, compliant, and efficient way to manage their tax documentation.

-

Can I integrate airSlate SignNow with other financial software for Form 1120 W?

Absolutely! airSlate SignNow supports integration with various financial software and tools. This allows users to seamlessly link their systems for better management of Form 1120 W Estimated Tax For Corporations and other important documents.

-

What are the advantages of eSigning Form 1120 W Estimated Tax For Corporations with airSlate SignNow?

eSigning Form 1120 W Estimated Tax For Corporations with airSlate SignNow offers numerous advantages, including faster turnaround times, improved security, and reduced paperwork. Our electronic signature solution is legally binding and helps ensure that your forms are sent and received swiftly.

Get more for Form 1120 W Estimated Tax For Corporations For Calendar Year , Or Tax Year Beginning , , And Ending , 20 OMB No

- Letter from landlord to tenant for failure to keep premises as clean and safe as condition of premises permits remedy or lease 497305520 form

- Id ashes form

- Letter from landlord to tenant for failure to keep all plumbing fixtures in the dwelling unit as clean as their condition 497305522 form

- Id letter in form

- Letter from landlord to tenant as notice to tenant of tenants disturbance of neighbors peaceful enjoyment to remedy or lease 497305524 form

- Letter landlord tenant 497305525 form

- Letter from landlord to tenant about tenant engaging in illegal activity in premises as documented by law enforcement and if 497305526 form

- Letter from tenant to landlord containing notice to landlord to withdraw improper rent increase due to violation of rent 497305527 form

Find out other Form 1120 W Estimated Tax For Corporations For Calendar Year , Or Tax Year Beginning , , And Ending , 20 OMB No

- Can I Electronic signature West Virginia Courts PPT

- Send Sign PDF Free

- How To Send Sign PDF

- Send Sign Word Online

- Send Sign Word Now

- Send Sign Word Free

- Send Sign Word Android

- Send Sign Word iOS

- Send Sign Word iPad

- How To Send Sign Word

- Can I Send Sign Word

- How Can I Send Sign Word

- Send Sign Document Online

- Send Sign Document Computer

- Send Sign Document Myself

- Send Sign Document Secure

- Send Sign Document iOS

- Send Sign Document iPad

- How To Send Sign Document

- Fax Sign PDF Online