Form 1120 W 2011

What is the Form 1120 W

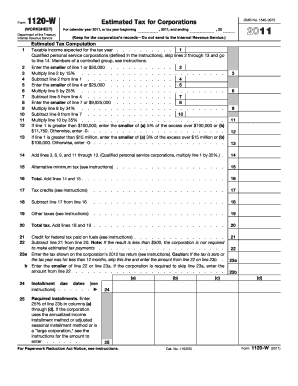

The Form 1120 W is a tax form used by corporations in the United States to calculate their estimated tax payments. It is specifically designed for corporations that expect to owe tax of five hundred dollars or more when they file their tax return. This form helps businesses manage their tax obligations by allowing them to estimate their tax liability and make timely payments throughout the year. Completing the Form 1120 W accurately is essential for avoiding penalties and ensuring compliance with IRS regulations.

How to use the Form 1120 W

Using the Form 1120 W involves several steps to ensure that the estimated tax payments are calculated correctly. First, gather all necessary financial information, including revenue, expenses, and any applicable deductions. Next, follow the instructions provided on the form to input the relevant figures. The form will guide you through calculating the estimated tax liability based on your corporation's expected income. Once completed, the form can be submitted electronically or via mail, depending on your preference.

Steps to complete the Form 1120 W

Completing the Form 1120 W requires careful attention to detail. Here are the steps to follow:

- Gather financial documents, including income statements and expense reports.

- Fill out the corporation's identifying information at the top of the form.

- Calculate the estimated taxable income based on your financial data.

- Determine the estimated tax liability using the appropriate tax rates.

- Review the calculations for accuracy before finalizing the form.

- Submit the completed form to the IRS by the required deadline.

Legal use of the Form 1120 W

The legal use of the Form 1120 W is governed by IRS regulations. This form must be completed accurately to reflect the corporation's estimated tax obligations. Failure to do so can result in penalties, including interest on unpaid taxes. It is important to ensure that all figures reported on the form are based on sound accounting practices and supported by documentation. Corporations should retain copies of the submitted form and any supporting documents for their records.

Filing Deadlines / Important Dates

Corporations must adhere to specific filing deadlines when submitting the Form 1120 W. Generally, the form is due on the 15th day of the third month of the tax year. For corporations operating on a calendar year, this means the deadline is March 15. If the deadline falls on a weekend or holiday, the due date is extended to the next business day. Timely submission is crucial to avoid penalties and ensure compliance with IRS requirements.

Form Submission Methods (Online / Mail / In-Person)

The Form 1120 W can be submitted through various methods. Corporations have the option to file electronically using IRS-approved e-filing software, which often simplifies the process and provides immediate confirmation of receipt. Alternatively, the form can be mailed to the appropriate IRS address, which varies based on the corporation's location. In-person submissions are generally not available for this form, making electronic filing or mail the preferred methods.

Quick guide on how to complete form 1120 w 2011

Complete Form 1120 W effortlessly on any device

Web-based document management has gained traction among companies and individuals. It offers an excellent environmentally friendly substitute for traditional printed and signed paperwork, as you can acquire the necessary form and securely store it online. airSlate SignNow equips you with everything required to generate, modify, and eSign your documents rapidly without delays. Handle Form 1120 W on any device with airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to adjust and eSign Form 1120 W with ease

- Locate Form 1120 W and click Get Form to begin.

- Use the tools we offer to fill out your form.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you want to send your form, via email, SMS, or an invite link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form searches, or errors that require printing new document versions. airSlate SignNow caters to all your document management needs in just a few clicks from any device you prefer. Modify and eSign Form 1120 W and guarantee effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 1120 w 2011

Create this form in 5 minutes!

How to create an eSignature for the form 1120 w 2011

The way to make an electronic signature for a PDF file in the online mode

The way to make an electronic signature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

How to generate an electronic signature straight from your smartphone

The way to generate an eSignature for a PDF file on iOS devices

How to generate an electronic signature for a PDF document on Android

People also ask

-

What is Form 1120 W and who needs it?

Form 1120 W is a tax form specifically designed for corporations to report their income, deductions, and tax liability to the IRS. Businesses that operate as corporations and need to file their annual tax returns will typically require Form 1120 W. Understanding this form is crucial for proper tax compliance.

-

How can airSlate SignNow help with Form 1120 W?

airSlate SignNow offers seamless solutions for businesses looking to eSign and manage Form 1120 W efficiently. With its user-friendly interface, you can easily prepare, send, and sign this important tax document, ensuring that you stay compliant while saving valuable time in the process.

-

Is there a cost associated with using airSlate SignNow for Form 1120 W?

Yes, airSlate SignNow has flexible pricing plans tailored to fit different business needs. The cost varies based on the features you choose but is generally considered cost-effective for companies needing to manage documents like Form 1120 W efficiently.

-

What features does airSlate SignNow offer for Form 1120 W?

airSlate SignNow provides robust features such as customizable templates, secure eSigning, and document tracking specifically for Form 1120 W. These features ensure that your documents are handled with precision and security, enhancing your workflow efficiency when dealing with tax forms.

-

Can I integrate airSlate SignNow with other tools for Form 1120 W?

Absolutely! airSlate SignNow allows for seamless integration with various business tools and software. This means you can easily connect apps that you use for payroll, accounting, and more to streamline the management of your Form 1120 W.

-

How secure is airSlate SignNow when handling Form 1120 W?

Security is a top priority for airSlate SignNow. When you handle Form 1120 W and other sensitive documents, airSlate SignNow employs industry-leading security measures, including encryption and secure cloud storage, to protect your data from unauthorized access.

-

What are the benefits of using airSlate SignNow for Form 1120 W?

Using airSlate SignNow for Form 1120 W offers numerous benefits, including improved efficiency, reduced paper waste, and enhanced accuracy in document handling. Additionally, the convenience of eSigning helps ensure timely submissions, ultimately aiding in better tax management for your business.

Get more for Form 1120 W

- Special durable power of attorney for bank account matters iowa form

- Iowa small business startup package iowa form

- Iowa property management package iowa form

- Ia limited company 497305274 form

- Sample operating agreement for professional limited liability company pllc iowa form

- Iowa pllc 497305276 form

- Sample transmittal letter template 497305277 form

- Ia law form

Find out other Form 1120 W

- Can I eSign Nebraska Police Form

- Can I eSign Nebraska Courts PDF

- How Can I eSign North Carolina Courts Presentation

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT