Form 990 2016

What is the Form 990

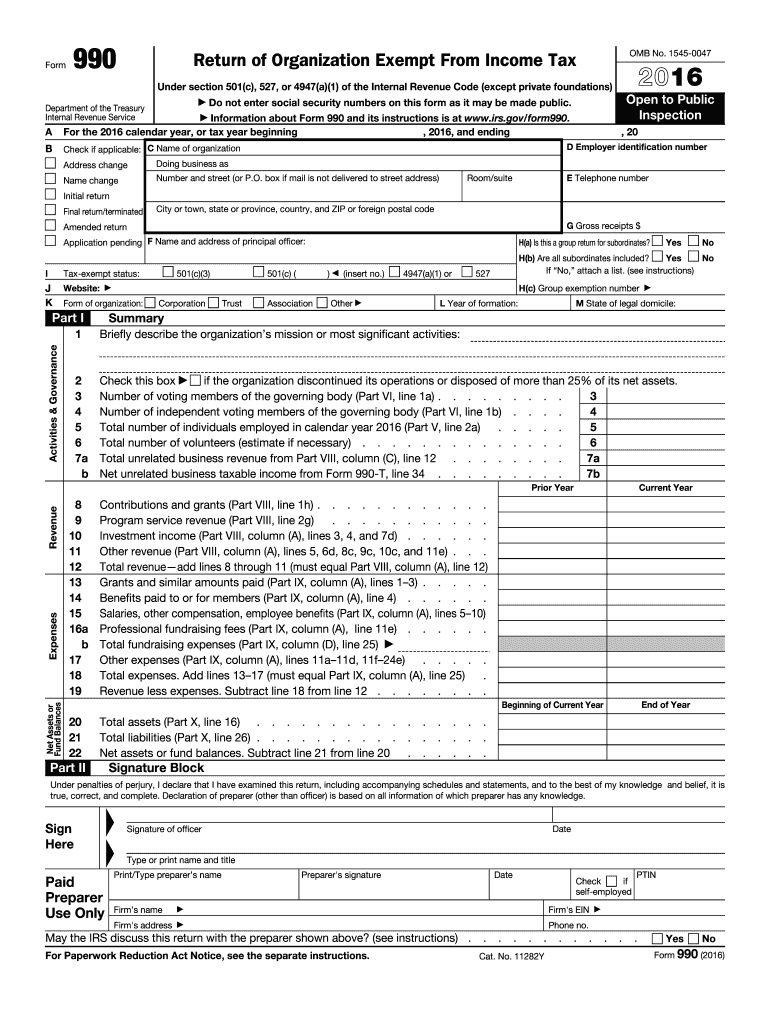

The Form 990 is a crucial document that tax-exempt organizations in the United States must file annually with the Internal Revenue Service (IRS). It provides detailed information about the organization’s financial activities, governance, and compliance with tax regulations. The form serves to promote transparency and accountability, allowing the public to understand how these organizations operate and utilize their resources. Nonprofits, charities, and other tax-exempt entities use this form to report their income, expenses, and activities, ensuring they maintain their tax-exempt status.

How to use the Form 990

Using the Form 990 involves several steps to ensure accurate and compliant reporting. Organizations must gather financial statements, including income statements and balance sheets, as well as information about their programs and governance. The form consists of several parts, each requiring specific details about the organization’s operations. It is essential to fill out each section accurately, as this information will be scrutinized by the IRS and may be made available to the public. Many organizations choose to consult with tax professionals to ensure that their Form 990 is completed correctly and in accordance with IRS guidelines.

Steps to complete the Form 990

Completing the Form 990 involves a systematic approach to ensure all required information is provided. Here are the key steps:

- Gather financial records, including revenue, expenses, and assets.

- Compile information about the organization’s mission, programs, and governance structure.

- Fill out the form sections, ensuring accuracy in reporting financial data.

- Review the completed form for any errors or omissions.

- File the form electronically or via mail, adhering to the submission deadlines set by the IRS.

Legal use of the Form 990

The legal use of the Form 990 is governed by IRS regulations, which mandate that tax-exempt organizations file this form annually. Failure to file or inaccuracies in the form can lead to penalties, including the loss of tax-exempt status. The form must be used to disclose financial information honestly and transparently, as it is intended to provide stakeholders, including donors and the public, insight into the organization’s operations. Compliance with the legal requirements surrounding the Form 990 is essential for maintaining credibility and trust within the community.

Filing Deadlines / Important Dates

Organizations must adhere to specific deadlines when filing the Form 990. Generally, the form is due on the 15th day of the fifth month after the end of the organization’s fiscal year. For example, if an organization’s fiscal year ends on December 31, the Form 990 would be due by May 15 of the following year. It is important for organizations to be aware of these deadlines to avoid penalties. Extensions may be available, but they must be requested in advance and are typically granted for six months.

Penalties for Non-Compliance

Non-compliance with Form 990 filing requirements can result in significant penalties for organizations. The IRS imposes fines for late filings, which can accumulate quickly. Additionally, failure to file for three consecutive years can lead to automatic revocation of tax-exempt status. Organizations may also face reputational damage, as non-compliance can erode public trust and deter potential donors. It is crucial for organizations to prioritize timely and accurate filing to avoid these consequences.

Quick guide on how to complete form 990 2016

Effortlessly Complete Form 990 on Any Device

Managing documents online has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed papers, as you can easily access the necessary form and securely store it online. airSlate SignNow provides all the tools you require to create, edit, and eSign your documents promptly and without delays. Handle Form 990 on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The Easiest Way to Edit and eSign Form 990 with Ease

- Find Form 990 and click on Get Form to begin.

- Utilize the tools available to complete your form.

- Select important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign feature, which takes only seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Decide how you would like to distribute your form, via email, SMS, invite link, or download it to your computer.

Eliminate worries about lost or misfiled documents, tedious form searches, or mistakes that require new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from your preferred device. Modify and eSign Form 990 to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 990 2016

Create this form in 5 minutes!

How to create an eSignature for the form 990 2016

How to generate an eSignature for your Form 990 2016 online

How to create an eSignature for the Form 990 2016 in Google Chrome

How to create an eSignature for signing the Form 990 2016 in Gmail

How to generate an eSignature for the Form 990 2016 right from your mobile device

How to generate an eSignature for the Form 990 2016 on iOS

How to make an eSignature for the Form 990 2016 on Android

People also ask

-

What is Form 990 and why is it important for nonprofits?

Form 990 is a tax document required by the IRS for tax-exempt organizations, including nonprofits. It provides the IRS and the public with insight into an organization's financial health and operations. Filing Form 990 accurately is crucial for maintaining tax-exempt status and transparency.

-

How can airSlate SignNow help with eSigning Form 990?

airSlate SignNow streamlines the eSigning process for Form 990, allowing you to collect signatures quickly and securely. With our easy-to-use platform, you can send Form 990 documents to multiple signers and track their progress in real-time. This ensures that your submissions are timely and compliant.

-

What features does airSlate SignNow offer for managing Form 990 documents?

airSlate SignNow offers several features for managing Form 990 documents, including customizable templates, advanced document tracking, and secure cloud storage. Our platform allows you to easily create and edit Form 990, ensuring that all necessary information is included and up-to-date. These features enhance your workflow and efficiency.

-

Is there a cost associated with using airSlate SignNow for Form 990 eSigning?

Yes, airSlate SignNow offers various pricing plans tailored to meet different organizational needs. Our cost-effective solution provides access to all the essential features for eSigning and managing Form 990 documents. You can choose a plan that fits your budget while ensuring compliance and efficiency.

-

Can airSlate SignNow integrate with other software for Form 990 management?

Absolutely! airSlate SignNow seamlessly integrates with a variety of software applications commonly used for Form 990 management. This includes accounting software, cloud storage services, and CRM systems, allowing you to streamline your data and workflow for maximum productivity.

-

What benefits does airSlate SignNow provide for nonprofits handling Form 990?

Using airSlate SignNow for Form 990 offers numerous benefits, such as faster turnaround times, improved document security, and enhanced collaboration among team members. Our platform ensures that your Form 990 is signed and submitted efficiently, reducing the risk of errors and delays in compliance.

-

How secure is airSlate SignNow for signing Form 990 documents?

airSlate SignNow prioritizes security with advanced encryption and compliance with industry standards, making it a safe choice for signing Form 990 documents. Our platform ensures that sensitive information remains protected throughout the signing process. You can have peace of mind knowing your documents are secure.

Get more for Form 990

Find out other Form 990

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter

- How Can I Electronic signature Hawaii Real Estate LLC Operating Agreement