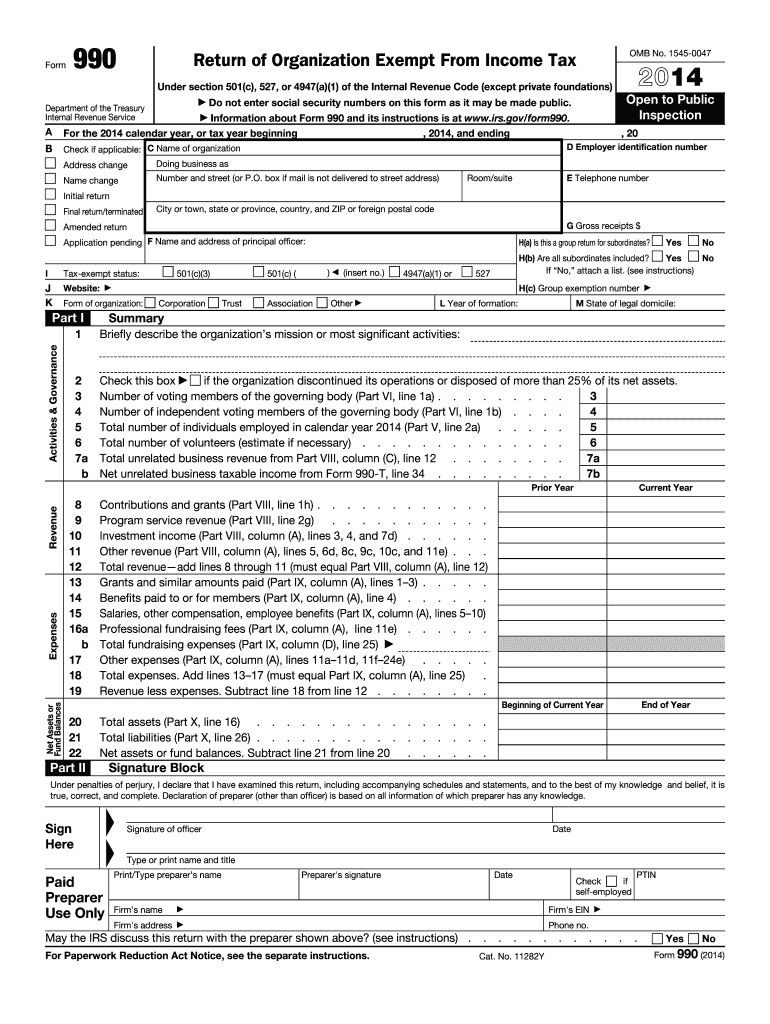

Irs Form 990 2014

What is the IRS Form 990

The IRS Form 990 is a crucial document that tax-exempt organizations, including charities, nonprofit organizations, and certain other entities, must file annually with the Internal Revenue Service (IRS). This form provides the IRS and the public with information about the organization’s mission, programs, and finances. The primary purpose of Form 990 is to promote transparency and accountability in the nonprofit sector, ensuring that organizations adhere to tax-exempt regulations.

Form 990 captures essential financial data, including revenue, expenses, and net assets, as well as detailed information about the organization's governance and operational practices. By requiring this form, the IRS helps maintain the integrity of tax-exempt status and encourages organizations to operate in a manner consistent with their charitable missions.

Steps to complete the IRS Form 990

Completing the IRS Form 990 involves several key steps that organizations should follow to ensure accuracy and compliance. First, gather all necessary financial records, including income statements, balance sheets, and details of program activities. This information will form the basis of the financial reporting required on the form.

Next, organizations should review the specific sections of Form 990, which include information about revenue, expenses, and program services. Each section must be filled out carefully, ensuring that all figures are accurate and reflect the organization's financial activities for the year. It is also essential to provide detailed descriptions of the organization's mission and programs, as this information is critical for transparency.

Once the form is completed, organizations should review it for any errors or omissions before submission. It is advisable to have a qualified accountant or tax professional review the form to ensure compliance with IRS regulations. Finally, submit the completed Form 990 electronically or by mail, depending on the organization's size and filing requirements.

Legal use of the IRS Form 990

The IRS Form 990 serves as a legally required document for tax-exempt organizations, ensuring compliance with federal regulations. Organizations must file this form annually to maintain their tax-exempt status. Failure to file can result in penalties, including the automatic revocation of tax-exempt status after three consecutive years of non-filing.

Moreover, Form 990 is often used by state regulators and the public to evaluate the financial health and operational transparency of nonprofit organizations. This legal requirement helps protect donors and the public by ensuring that organizations are held accountable for their financial practices and adherence to their stated missions.

Filing Deadlines / Important Dates

Organizations must be aware of the filing deadlines for the IRS Form 990 to avoid penalties. Generally, the due date for Form 990 is the fifteenth day of the fifth month after the end of the organization’s fiscal year. For example, if an organization’s fiscal year ends on December 31, the Form 990 is due on May 15 of the following year.

Organizations can apply for an automatic six-month extension by filing Form 8868, which extends the deadline to November 15 in this example. However, it is important to note that this extension only applies to the filing deadline and does not extend the time for payment of any taxes owed.

Key elements of the IRS Form 990

The IRS Form 990 includes several key elements that organizations must accurately report. These elements encompass financial data such as total revenue, total expenses, and changes in net assets. Additionally, the form requires detailed information about the organization's mission, governance structure, and program accomplishments.

Other critical sections include compensation details for key employees, board members, and highest-paid employees, which promote transparency in how organizations allocate their resources. The form also includes questions about compliance with public support tests and disclosures regarding potential conflicts of interest, ensuring that organizations operate ethically and in alignment with their charitable purposes.

Examples of using the IRS Form 990

Organizations utilize the IRS Form 990 for various purposes beyond compliance. For instance, potential donors often review Form 990 to assess an organization's financial health and operational transparency before making contributions. This form serves as a valuable tool for evaluating the effectiveness of an organization’s programs and its overall impact on the community.

Additionally, grant-making organizations frequently require Form 990 as part of their application process. By analyzing the information provided in the form, these entities can make informed decisions about funding allocations and ensure that their contributions align with their philanthropic goals.

Quick guide on how to complete irs form 990 2014

Prepare Irs Form 990 effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, as you can easily locate the correct form and safely keep it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Irs Form 990 on any device using the airSlate SignNow Android or iOS applications and enhance any document-related task today.

How to update and eSign Irs Form 990 without hassle

- Locate Irs Form 990 and then click Get Form to initiate the process.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to secure your modifications.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing additional document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Edit and eSign Irs Form 990 and ensure seamless communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs form 990 2014

Create this form in 5 minutes!

How to create an eSignature for the irs form 990 2014

The way to make an eSignature for your PDF document in the online mode

The way to make an eSignature for your PDF document in Chrome

The way to make an electronic signature for putting it on PDFs in Gmail

How to make an electronic signature straight from your mobile device

The way to make an electronic signature for a PDF document on iOS devices

How to make an electronic signature for a PDF document on Android devices

People also ask

-

What is IRS Form 990 and why is it important for nonprofits?

IRS Form 990 is an annual reporting return required by the Internal Revenue Service for tax-exempt organizations. It provides transparency about the organization’s financial activities, helping stakeholders understand how funds are used. Completing IRS Form 990 accurately is crucial for maintaining tax-exempt status and ensuring trust with donors.

-

How can airSlate SignNow help with completing IRS Form 990?

airSlate SignNow streamlines the process of completing IRS Form 990 by allowing users to easily fill out, sign, and send the document electronically. With customizable templates and eSignature capabilities, organizations can ensure their IRS Form 990 is completed accurately and submitted on time. This efficiency helps organizations save time and reduce errors.

-

What features does airSlate SignNow offer for managing IRS Form 990?

airSlate SignNow offers a variety of features tailored for managing IRS Form 990, including document templates, eSigning, and secure cloud storage. These features facilitate collaboration among team members and ensure that all necessary signatures are collected promptly. Additionally, the platform provides tracking options to monitor the submission status of your IRS Form 990.

-

Is airSlate SignNow cost-effective for nonprofits filing IRS Form 990?

Yes, airSlate SignNow is a cost-effective solution for nonprofits looking to manage their IRS Form 990 filings. With flexible pricing plans and features designed specifically for organizations, you can save money while ensuring compliance with IRS requirements. The platform’s efficiency can help reduce the administrative costs associated with filing the IRS Form 990.

-

Can I integrate airSlate SignNow with other software for IRS Form 990 preparation?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and nonprofit management software, making it easier to prepare your IRS Form 990. These integrations reduce the time needed for data entry and improve overall accuracy, ensuring that your IRS Form 990 is prepared efficiently and effectively.

-

What are the benefits of using airSlate SignNow for IRS Form 990 submissions?

Using airSlate SignNow for IRS Form 990 submissions offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced compliance. The platform's user-friendly interface makes it easy for teams to collaborate, while eSigning capabilities ensure timely submissions. Overall, airSlate SignNow simplifies the IRS Form 990 process for organizations of all sizes.

-

How secure is airSlate SignNow when handling sensitive IRS Form 990 data?

airSlate SignNow prioritizes security by implementing advanced encryption and data protection measures for all documents, including IRS Form 990. This ensures that sensitive information remains confidential and secure throughout the signing process. With compliance to industry standards, users can trust that their IRS Form 990 data is in safe hands.

Get more for Irs Form 990

Find out other Irs Form 990

- Sign Wisconsin Government Cease And Desist Letter Online

- Sign Louisiana Healthcare / Medical Limited Power Of Attorney Mobile

- Sign Healthcare / Medical PPT Michigan Now

- Sign Massachusetts Healthcare / Medical Permission Slip Now

- Sign Wyoming Government LLC Operating Agreement Mobile

- Sign Wyoming Government Quitclaim Deed Free

- How To Sign Nebraska Healthcare / Medical Living Will

- Sign Nevada Healthcare / Medical Business Plan Template Free

- Sign Nebraska Healthcare / Medical Permission Slip Now

- Help Me With Sign New Mexico Healthcare / Medical Medical History

- Can I Sign Ohio Healthcare / Medical Residential Lease Agreement

- How To Sign Oregon Healthcare / Medical Living Will

- How Can I Sign South Carolina Healthcare / Medical Profit And Loss Statement

- Sign Tennessee Healthcare / Medical Business Plan Template Free

- Help Me With Sign Tennessee Healthcare / Medical Living Will

- Sign Texas Healthcare / Medical Contract Mobile

- Sign Washington Healthcare / Medical LLC Operating Agreement Now

- Sign Wisconsin Healthcare / Medical Contract Safe

- Sign Alabama High Tech Last Will And Testament Online

- Sign Delaware High Tech Rental Lease Agreement Online