Form 990 Return of Organization Exempt from Income Tax 2022

What is the Form 990 Return Of Organization Exempt From Income Tax

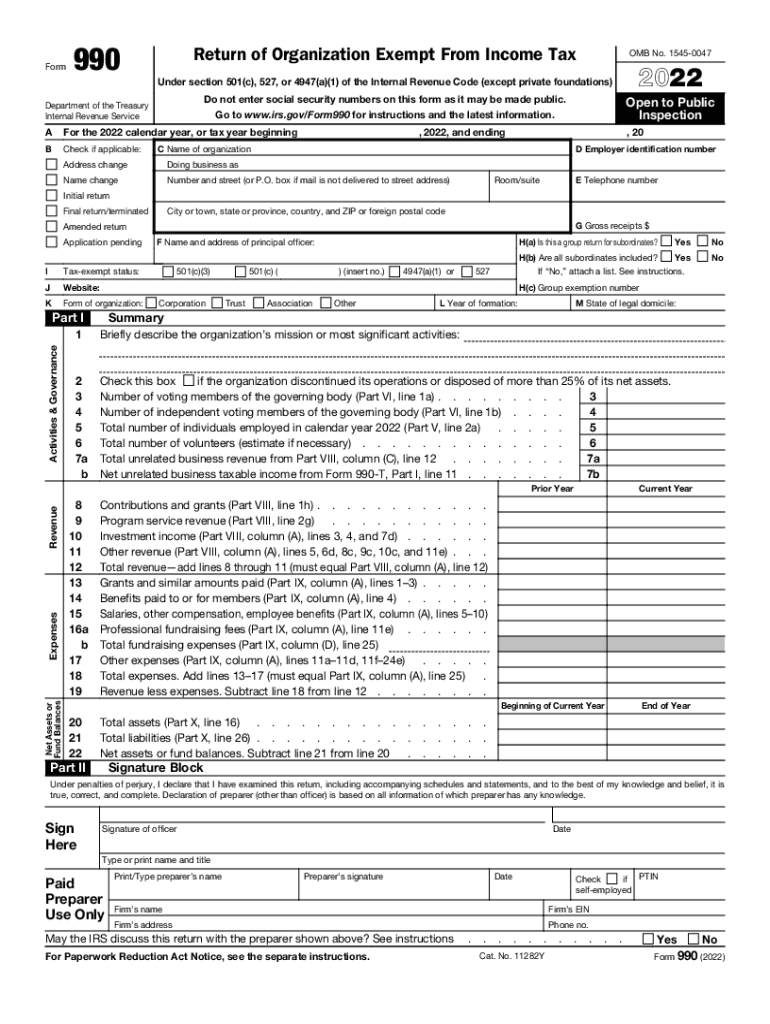

The Form 990, officially known as the Return of Organization Exempt From Income Tax, is a crucial document for tax-exempt organizations in the United States. This form provides the IRS with detailed information about the organization’s mission, programs, and finances. It is primarily used by non-profit organizations to report their financial activities and ensure compliance with federal tax regulations. The Form 990 helps maintain transparency and accountability, allowing the IRS and the public to understand how these organizations operate and allocate their resources.

Steps to Complete the Form 990 Return Of Organization Exempt From Income Tax

Completing the Form 990 involves several key steps to ensure accuracy and compliance. First, gather all necessary financial records, including income statements, balance sheets, and details of program expenditures. Next, begin filling out the form by providing basic information about the organization, such as its name, address, and Employer Identification Number (EIN). Follow this by detailing revenue sources, expenses, and any changes in net assets. It is important to review the IRS instructions for the specific version of the form being used, as there may be variations based on the organization’s size and type. Finally, ensure all information is accurate and submit the form by the designated deadline.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the Form 990 is essential for compliance. Generally, the form is due on the fifteenth day of the fifth month after the end of the organization’s accounting period. For organizations operating on a calendar year, this typically means the form is due on May fifteenth. If additional time is needed, organizations can file for an automatic six-month extension, but it is crucial to submit the extension request before the original due date. Missing the deadline can result in penalties, so organizations should mark their calendars and prepare in advance.

Legal Use of the Form 990 Return Of Organization Exempt From Income Tax

The legal use of Form 990 is primarily to maintain tax-exempt status and ensure compliance with federal regulations. Organizations must file this form annually to report their financial activities and demonstrate that they are operating within the guidelines set forth by the IRS. Failure to file or inaccuracies in the form can lead to penalties, loss of tax-exempt status, or increased scrutiny from the IRS. Therefore, it is essential for organizations to understand the legal implications of their reporting and to use the form as a tool for transparency and accountability.

Key Elements of the Form 990 Return Of Organization Exempt From Income Tax

Key elements of the Form 990 include various sections that provide comprehensive information about the organization. These sections typically cover the organization’s mission statement, governance structure, financial statements, and detailed accounts of revenue and expenses. Additionally, the form requires disclosures related to compensation for key personnel, contributions, and any significant changes in the organization’s operations. Each element plays a critical role in painting a complete picture of the organization’s activities and financial health, which is vital for stakeholders and regulatory bodies.

Who Issues the Form

The Form 990 is issued by the Internal Revenue Service (IRS), the U.S. government agency responsible for tax collection and enforcement of tax laws. The IRS provides specific guidelines and instructions for completing the form, ensuring that organizations understand their reporting obligations. It is important for organizations to stay updated on any changes to the form or filing requirements, as these can impact their compliance status and overall operations.

Quick guide on how to complete 2022 form 990 return of organization exempt from income tax

Complete Form 990 Return Of Organization Exempt From Income Tax effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the resources you need to create, modify, and electronically sign your documents swiftly without interruptions. Manage Form 990 Return Of Organization Exempt From Income Tax on any device using airSlate SignNow Android or iOS applications and enhance any document-driven process today.

How to edit and electronically sign Form 990 Return Of Organization Exempt From Income Tax with ease

- Acquire Form 990 Return Of Organization Exempt From Income Tax and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or obscure sensitive details with tools specifically offered by airSlate SignNow for this purpose.

- Create your signature using the Sign feature, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Select how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate issues with lost or misplaced files, tedious form searching, or mistakes that require new document copies to be printed. airSlate SignNow addresses all your document management needs in just a few clicks from a device of your choice. Edit and electronically sign Form 990 Return Of Organization Exempt From Income Tax and guarantee outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2022 form 990 return of organization exempt from income tax

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow, and how does it relate to 990 n?

airSlate SignNow is a powerful eSignature solution that enables businesses to streamline their document signing processes. The '990 n' documentation capabilities allow users to send and eSign important forms securely and efficiently. Utilizing airSlate SignNow can signNowly reduce the time and resources required for managing the 990 n process.

-

How can airSlate SignNow help with my 990 n filings?

With airSlate SignNow, you can easily prepare, send, and sign the 990 n forms electronically, ensuring a seamless workflow. The platform's ease of use simplifies the document handling process, making compliance with 990 n regulations less burdensome. This can help your organization save time and improve accuracy in submissions.

-

What features does airSlate SignNow offer for 990 n handling?

airSlate SignNow provides various features like template creation, bulk sending, and advanced security options for handling 990 n forms. Users can also track document status in real-time, ensuring that no step is overlooked during the signing process. The efficiency of these features helps organizations manage their 990 n submissions more effectively.

-

Is airSlate SignNow affordable for small businesses dealing with 990 n?

Yes, airSlate SignNow offers cost-effective pricing plans tailored to meet the needs of small businesses handling 990 n submissions. The platform eliminates the need for physical paperwork and postage, signNowly lowering overall costs. This affordability allows small businesses to access powerful tools for managing their 990 n filings efficiently.

-

Can airSlate SignNow integrate with other software for 990 n processing?

Absolutely! airSlate SignNow seamlessly integrates with various business applications, enhancing your ability to manage 990 n filings. These integrations allow you to synchronize data across platforms and streamline your overall documentation process. Utilizing these features ensures that your 990 n submissions are efficient and organized.

-

What security measures does airSlate SignNow have for 990 n documents?

airSlate SignNow prioritizes the security of your 990 n documents with features such as encryption, secure cloud storage, and compliance certifications. These measures protect your sensitive information from unauthorized access and ensure that your eSigned documents are legally valid. With airSlate SignNow, you can confidently manage and store your 990 n filings.

-

How quickly can I get up and running with airSlate SignNow for my 990 n needs?

Setting up airSlate SignNow for your 990 n needs is quick and straightforward. Most users can create an account and start sending documents within minutes. Its intuitive interface is designed for ease of use, ensuring that you can efficiently manage your 990 n filings right away.

Get more for Form 990 Return Of Organization Exempt From Income Tax

Find out other Form 990 Return Of Organization Exempt From Income Tax

- eSignature Washington Real Estate Lease Agreement Form Mobile

- How Can I eSignature New York Sports Executive Summary Template

- eSignature Arkansas Courts LLC Operating Agreement Now

- How Do I eSignature Arizona Courts Moving Checklist

- eSignature Wyoming Real Estate Quitclaim Deed Myself

- eSignature Wyoming Real Estate Lease Agreement Template Online

- How Can I eSignature Delaware Courts Stock Certificate

- How Can I eSignature Georgia Courts Quitclaim Deed

- Help Me With eSignature Florida Courts Affidavit Of Heirship

- Electronic signature Alabama Banking RFP Online

- eSignature Iowa Courts Quitclaim Deed Now

- eSignature Kentucky Courts Moving Checklist Online

- eSignature Louisiana Courts Cease And Desist Letter Online

- How Can I Electronic signature Arkansas Banking Lease Termination Letter

- eSignature Maryland Courts Rental Application Now

- eSignature Michigan Courts Affidavit Of Heirship Simple

- eSignature Courts Word Mississippi Later

- eSignature Tennessee Sports Last Will And Testament Mobile

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online