Form 990 2011

What is the Form 990

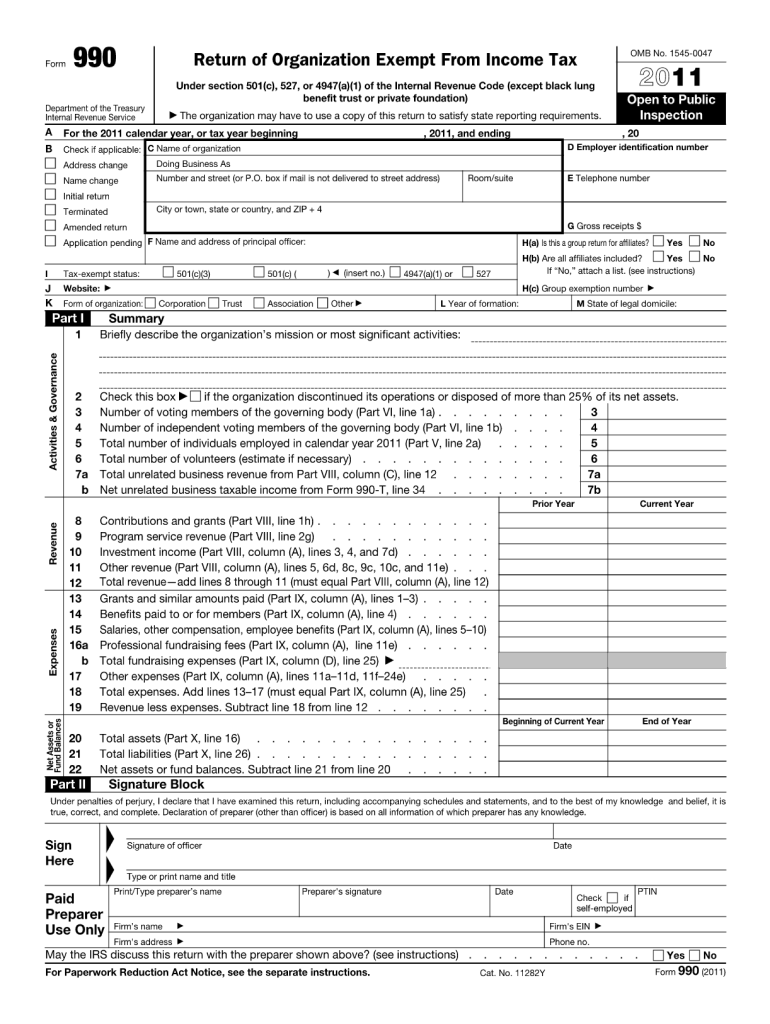

The Form 990 is an annual reporting return that tax-exempt organizations in the United States must file with the Internal Revenue Service (IRS). This form provides the IRS and the public with essential information about the organization’s activities, governance, and financial performance. It is crucial for maintaining transparency and accountability within the nonprofit sector. The Form 990 includes details such as revenue, expenses, and compensation of highest-paid employees, which helps stakeholders assess the organization’s operations and compliance with tax regulations.

Steps to complete the Form 990

Completing the Form 990 involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements, balance sheets, and records of fundraising activities. Next, review the instructions provided by the IRS for the specific version of the Form 990 you are completing, as there are different variants based on the size and type of organization. Fill out the form systematically, ensuring that all required fields are completed. After filling out the form, double-check for any errors or omissions before submission. Finally, submit the completed Form 990 electronically or via mail, depending on your organization’s filing requirements.

Legal use of the Form 990

The Form 990 serves as a legal document that demonstrates compliance with federal tax regulations for tax-exempt organizations. It is important for organizations to ensure that the information reported is accurate and truthful, as discrepancies can lead to penalties or loss of tax-exempt status. The form must be filed annually, and organizations are required to retain copies for their records. Proper use of the Form 990 helps maintain public trust and supports the organization’s mission by demonstrating accountability to donors and stakeholders.

Filing Deadlines / Important Dates

Organizations must adhere to specific deadlines for filing the Form 990 to avoid penalties. Generally, the Form 990 is due on the 15th day of the fifth month after the end of the organization’s fiscal year. For example, if an organization’s fiscal year ends on December 31, the Form 990 would be due on May 15 of the following year. Organizations can apply for an automatic extension of six months, but they must file Form 8868 to obtain this extension. It is crucial to be aware of these deadlines to ensure timely compliance and avoid late fees.

Key elements of the Form 990

The Form 990 consists of several key elements that provide a comprehensive overview of an organization’s financial health and operational activities. These elements include:

- Revenue and Expenses: Detailed reporting of income sources and expenditures.

- Program Services: Information about the organization’s primary activities and their impact.

- Governance: Disclosure of the organization’s board members and governance practices.

- Compensation: Reporting of compensation for the highest-paid employees and contractors.

- Financial Statements: Inclusion of balance sheets and income statements for transparency.

Form Submission Methods (Online / Mail / In-Person)

Organizations have several options for submitting the Form 990. The preferred method is electronic filing through the IRS e-File system, which allows for faster processing and confirmation of receipt. Alternatively, organizations can submit the form by mail, ensuring that it is sent to the correct address based on the organization’s location and type. In-person submissions are generally not accepted for the Form 990. Regardless of the submission method, it is essential to keep a copy of the filed form and any confirmation received for record-keeping purposes.

Quick guide on how to complete form 990 2011

Complete Form 990 effortlessly on any device

Online document management has become increasingly popular with both companies and individuals. It serves as an excellent environmentally-friendly alternative to traditional printed and signed documents, allowing you to access the appropriate form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents quickly without delays. Manage Form 990 on any device with the airSlate SignNow Android or iOS applications and simplify any document-based operation today.

How to modify and eSign Form 990 with ease

- Find Form 990 and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that aim.

- Craft your signature using the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your choice. Edit and eSign Form 990 and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 990 2011

Create this form in 5 minutes!

How to create an eSignature for the form 990 2011

The best way to generate an eSignature for a PDF document in the online mode

The best way to generate an eSignature for a PDF document in Chrome

How to generate an eSignature for putting it on PDFs in Gmail

The best way to create an eSignature from your mobile device

How to create an eSignature for a PDF document on iOS devices

The best way to create an eSignature for a PDF file on Android devices

People also ask

-

What is Form 990 and why is it important for nonprofits?

Form 990 is an annual reporting return that tax-exempt organizations must file with the IRS. It provides information on the organization’s mission, programs, and finances, making it essential for transparency and accountability. Properly filing Form 990 can also enhance donor confidence and ensure compliance with IRS regulations.

-

How can airSlate SignNow assist with the completion of Form 990?

airSlate SignNow streamlines the process of filling out Form 990 by allowing users to eSign and send documents securely. Our easy-to-use platform helps nonprofits manage signatures and documents efficiently, ensuring timely submissions. This efficiency reduces the hassle associated with paper forms and enhances organization.

-

Are there specific features in airSlate SignNow tailored for Form 990 preparation?

Yes, airSlate SignNow offers features such as document templates, real-time collaboration, and secure storage that are particularly beneficial for preparing Form 990. These tools simplify editing and ensure that all necessary parties can contribute to or review the document seamlessly. This can signNowly expedite the preparation of your Form 990.

-

What pricing options does airSlate SignNow provide for users needing to file Form 990?

airSlate SignNow offers flexible pricing plans that cater to various organizational needs, including options for nonprofits specifically. Each plan includes access to features necessary for efficiently managing the documentation involved in filing Form 990. Potential users can explore different tiers to find the best fit for their budget and requirements.

-

Can airSlate SignNow integrate with other accounting or tax software to help with Form 990?

Absolutely! airSlate SignNow supports integrations with popular accounting and tax software, facilitating a smooth workflow when preparing Form 990. These integrations allow for automatic data population and enhance accuracy, reducing the time spent on manual entry while ensuring compliance with IRS standards.

-

What are the main benefits of using airSlate SignNow for Form 990 submissions?

Using airSlate SignNow for Form 990 submissions offers numerous benefits, including enhanced security, document tracking, and simplified collaboration. Users can also save time with templates and automation features that minimize errors and streamline the process. This ensures that organizations can focus more on their mission rather than paperwork.

-

Is it easy to eSign Form 990 documents with airSlate SignNow?

Yes, eSigning Form 990 documents with airSlate SignNow is straightforward and user-friendly. The platform allows users to send, sign, and store their Form 990 documents securely, all in one place. This ease of use signNowly simplifies the task of gathering signatures from board members or financial officers.

Get more for Form 990

Find out other Form 990

- Can I Sign Kentucky Performance Contract

- How Do I Sign Florida Investment Contract

- Sign Colorado General Power of Attorney Template Simple

- How Do I Sign Florida General Power of Attorney Template

- Sign South Dakota Sponsorship Proposal Template Safe

- Sign West Virginia Sponsorship Proposal Template Free

- Sign Tennessee Investment Contract Safe

- Sign Maryland Consulting Agreement Template Fast

- Sign California Distributor Agreement Template Myself

- How Do I Sign Louisiana Startup Business Plan Template

- Can I Sign Nevada Startup Business Plan Template

- Sign Rhode Island Startup Business Plan Template Now

- How Can I Sign Connecticut Business Letter Template

- Sign Georgia Business Letter Template Easy

- Sign Massachusetts Business Letter Template Fast

- Can I Sign Virginia Business Letter Template

- Can I Sign Ohio Startup Costs Budget Worksheet

- How Do I Sign Maryland 12 Month Sales Forecast

- How Do I Sign Maine Profit and Loss Statement

- How To Sign Wisconsin Operational Budget Template