Form 990 2013

What is the Form 990

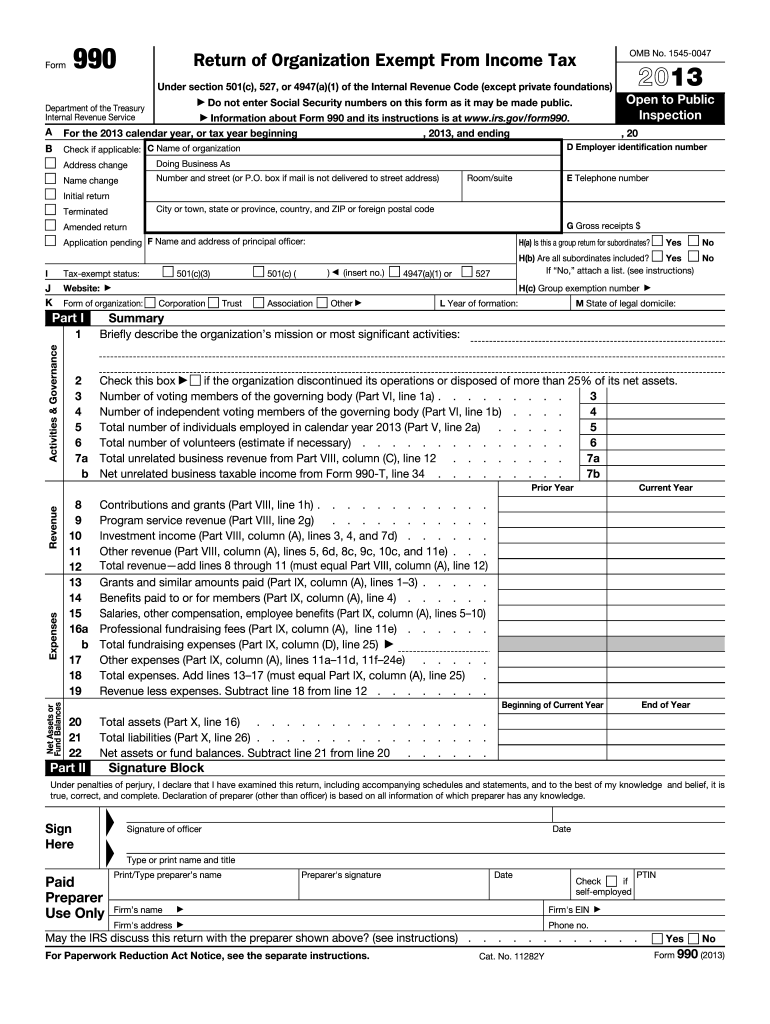

The Form 990 is a crucial document used by tax-exempt organizations in the United States to report their financial information to the Internal Revenue Service (IRS). This form provides transparency regarding the organization's activities, governance, and financial health. Nonprofits, charities, and other tax-exempt entities must file this form annually, allowing the IRS and the public to assess their compliance with tax laws and their operational effectiveness. The Form 990 is often referred to as the "Return of Organization Exempt from Income Tax." It serves as a key resource for donors, grantmakers, and regulators to evaluate the organization’s financial practices.

Steps to complete the Form 990

Completing the Form 990 involves several key steps to ensure accurate reporting and compliance. Begin by gathering all necessary financial documents, including income statements, balance sheets, and details about expenses. Next, follow these steps:

- Identify the correct version of Form 990 to use based on your organization's revenue and activities.

- Fill out the organizational information, including the name, address, and Employer Identification Number (EIN).

- Report financial data, including revenue, expenses, and net assets, in the designated sections.

- Provide information about the board of directors and key staff members, including their compensation.

- Complete the required schedules that apply to your organization, such as Schedule A for public charities.

- Review the entire form for accuracy and completeness before submission.

Legal use of the Form 990

The Form 990 must be completed and filed in accordance with IRS regulations to maintain the tax-exempt status of an organization. Legal use of this form involves ensuring that all reported information is truthful and accurate. Misrepresentation or failure to file can lead to penalties, including loss of tax-exempt status. Organizations should also be aware of the legal implications of the information disclosed on the form, as it may be scrutinized by donors and regulatory bodies. Compliance with the IRS guidelines is essential for continued operation and credibility.

Filing Deadlines / Important Dates

Organizations must adhere to specific filing deadlines to ensure compliance with IRS regulations. Generally, the Form 990 is due on the fifteenth day of the fifth month after the end of the organization’s fiscal year. For example, if an organization’s fiscal year ends on December thirty-first, the Form 990 must be filed by May fifteenth of the following year. If the deadline falls on a weekend or holiday, the due date is extended to the next business day. Organizations can apply for a six-month extension if needed, but this must be done before the original deadline.

Examples of using the Form 990

The Form 990 serves multiple purposes for various stakeholders. For example, potential donors often review Form 990 filings to assess the financial health and transparency of a nonprofit before making contributions. Grantmakers also rely on this form to evaluate funding requests and ensure that organizations align with their mission. Additionally, regulatory bodies use the information from Form 990 to monitor compliance with tax laws and assess the overall landscape of the nonprofit sector. These examples illustrate the importance of accurate and timely reporting.

Required Documents

To successfully complete the Form 990, organizations must gather several required documents. Key documents include:

- Financial statements, including income statements and balance sheets.

- Records of contributions and grants received during the fiscal year.

- Details of compensation for board members and key employees.

- Information on any related organizations or subsidiaries.

- Documentation supporting any special programs or initiatives undertaken during the year.

Having these documents ready will streamline the completion process and help ensure compliance with IRS requirements.

Quick guide on how to complete form 990 2013

Complete Form 990 effortlessly on any device

The management of online documents has gained considerable traction among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed papers, allowing you to access the correct version and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Form 990 on any platform with the airSlate SignNow apps for Android or iOS and streamline any document-based workflow today.

The simplest way to modify and electronically sign Form 990 effortlessly

- Locate Form 990 and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of your documents or obscure sensitive information with the tools that airSlate SignNow provides explicitly for that purpose.

- Generate your signature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you wish to send your form—via email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from your chosen device. Modify and electronically sign Form 990 and ensure optimal communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 990 2013

Create this form in 5 minutes!

How to create an eSignature for the form 990 2013

The way to generate an electronic signature for a PDF online

The way to generate an electronic signature for a PDF in Google Chrome

The way to create an eSignature for signing PDFs in Gmail

How to create an eSignature straight from your smartphone

The best way to make an eSignature for a PDF on iOS

How to create an eSignature for a PDF document on Android

People also ask

-

What is Form 990 and why is it important for nonprofits?

Form 990 is a tax form required by the IRS for tax-exempt organizations, providing essential financial information. It helps ensure transparency and public accountability, making it crucial for nonprofits to complete accurately.

-

How can airSlate SignNow simplify the submission of Form 990?

airSlate SignNow streamlines the completion and electronic signing of Form 990, allowing organizations to enhance efficiency. With our intuitive platform, nonprofits can easily send, sign, and file their Form 990 securely from anywhere.

-

What are the pricing options for using airSlate SignNow when filing Form 990?

airSlate SignNow offers various pricing plans, designed to fit the budgets of nonprofits. Each plan provides access to essential features for managing Form 990 efficiently, and you can choose a plan that meets your organization's needs.

-

What features does airSlate SignNow offer for Form 990 management?

airSlate SignNow provides features such as document templates, eSignature capabilities, and collaboration tools specifically designed for Form 990. These features allow organizations to manage their forms effectively while maintaining compliance with IRS requirements.

-

Is airSlate SignNow compliant with IRS regulations for Form 990?

Yes, airSlate SignNow is compliant with IRS regulations, ensuring that all eSigned Form 990 submissions meet necessary legal standards. Our platform provides a secure environment, helping organizations fulfill their regulatory obligations with confidence.

-

Can airSlate SignNow integrate with other accounting software for Form 990 filing?

Absolutely, airSlate SignNow can integrate seamlessly with various accounting software solutions, simplifying the Form 990 filing process. This integration allows for smooth data transfer and enhances overall productivity for finance teams.

-

What benefits does using airSlate SignNow provide for organizations completing Form 990?

Using airSlate SignNow for Form 990 offers several benefits, including reduced processing time, enhanced accuracy, and improved workflow management. Our solution empowers teams to collaborate effectively, ensuring a smoother filing process.

Get more for Form 990

- Maintainer bridges and tunnels exam no form

- New york city department of sanitation dsny commercial form

- P f1 tree fund payment application nyc parks form

- Form 112 nyc department of parks amp recreation labor law nycgovparks

- Annual certification report form pdf dec ny

- Health form adult gswnyorg

- Gloversville health history form

- Exhibit a openbook data usage questionnaire form

Find out other Form 990

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile

- Electronic signature California Car Dealer Rental Lease Agreement Fast

- Electronic signature Connecticut Car Dealer Lease Agreement Now

- Electronic signature Connecticut Car Dealer Warranty Deed Computer

- Electronic signature New Mexico Banking Job Offer Online

- How Can I Electronic signature Delaware Car Dealer Purchase Order Template

- How To Electronic signature Delaware Car Dealer Lease Template

- Electronic signature North Carolina Banking Claim Secure

- Electronic signature North Carolina Banking Separation Agreement Online

- How Can I Electronic signature Iowa Car Dealer Promissory Note Template

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Myself

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Fast

- How Do I Electronic signature Iowa Car Dealer Limited Power Of Attorney

- Electronic signature Kentucky Car Dealer LLC Operating Agreement Safe

- Electronic signature Louisiana Car Dealer Lease Template Now

- Electronic signature Maine Car Dealer Promissory Note Template Later

- Electronic signature Maryland Car Dealer POA Now