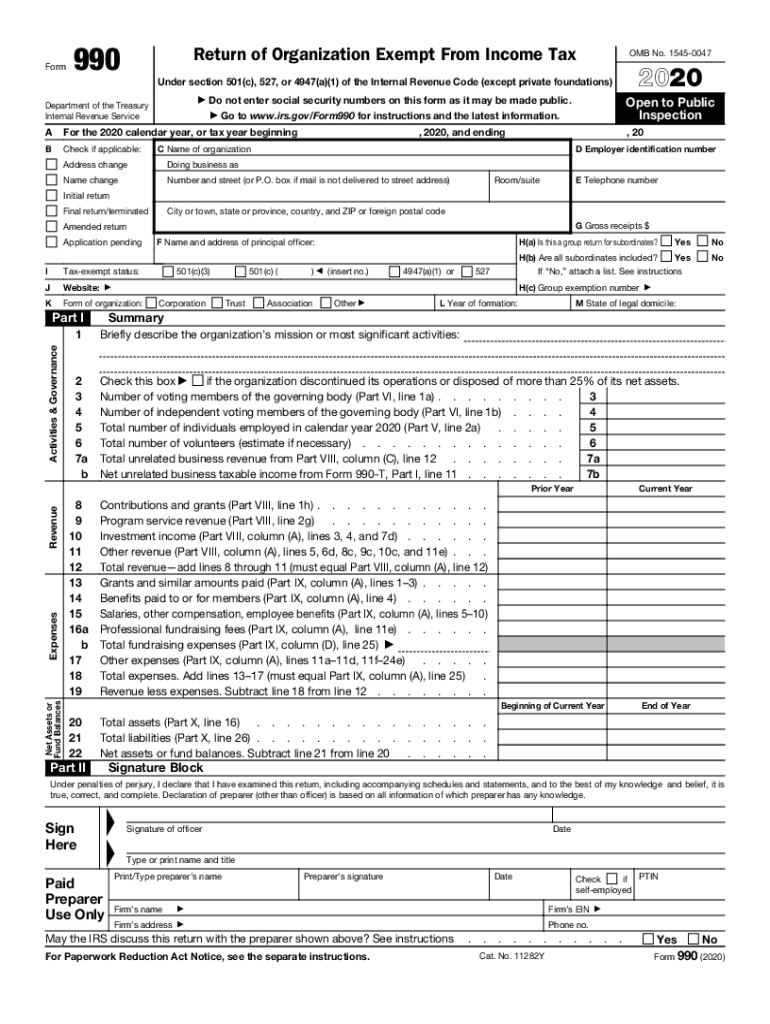

Form 990 Return of Organization Exempt from Income Tax 2020

What is the Form 990 Return Of Organization Exempt From Income Tax

The Form 990, officially known as the Return of Organization Exempt from Income Tax, is a crucial document for tax-exempt organizations in the United States. This form is required by the IRS for organizations that are classified as tax-exempt under section 501(c)(3) and other sections of the Internal Revenue Code. The primary purpose of Form 990 is to provide the IRS and the public with information about the organization’s activities, governance, and financial status. Organizations must disclose their revenue, expenses, and compensation for key employees, which helps ensure transparency and accountability.

Steps to complete the Form 990 Return Of Organization Exempt From Income Tax

Completing the Form 990 involves several key steps to ensure accuracy and compliance with IRS regulations. First, gather all necessary financial documents, including income statements, balance sheets, and records of expenses. Next, carefully fill out the form, starting with basic organizational information such as the name, address, and Employer Identification Number (EIN). It is essential to report all revenue sources and expenses accurately. After completing the form, review it for any errors or omissions. Finally, submit the form electronically or by mail, ensuring it is sent by the appropriate deadline.

Legal use of the Form 990 Return Of Organization Exempt From Income Tax

The legal use of Form 990 is vital for maintaining tax-exempt status and fulfilling compliance obligations. Organizations must file this form annually to report their financial activities to the IRS. Failure to file can result in penalties, including the loss of tax-exempt status. Additionally, the information provided in Form 990 is accessible to the public, which promotes transparency and trust among donors and stakeholders. Organizations should ensure that all information reported is accurate and complete to avoid legal repercussions.

Filing Deadlines / Important Dates

Filing deadlines for Form 990 are critical for compliance. Generally, organizations must file their Form 990 by the 15th day of the fifth month after the end of their fiscal year. For example, if an organization’s fiscal year ends on December 31, the form is due by May 15 of the following year. Extensions may be requested, allowing an additional six months to file. However, it is important to note that an extension to file does not extend the time to pay any taxes owed.

Form Submission Methods (Online / Mail / In-Person)

Organizations have several options for submitting Form 990. The preferred method is electronic filing through the IRS e-File system, which allows for quicker processing and confirmation of receipt. Alternatively, organizations can mail a paper version of the form to the appropriate IRS address based on their location and type of organization. In-person submissions are generally not accepted for Form 990. Regardless of the method chosen, organizations should retain a copy of the submitted form for their records.

Penalties for Non-Compliance

Non-compliance with Form 990 filing requirements can lead to significant penalties. Organizations that fail to file the form by the deadline may incur a penalty of $20 per day, up to a maximum of $10,000. In cases of willful neglect, the penalties can be even more severe. Additionally, repeated failures to file can result in the automatic revocation of tax-exempt status, which can have serious financial implications for the organization. It is essential for organizations to stay informed about their filing obligations to avoid these consequences.

Quick guide on how to complete 2020 form 990 return of organization exempt from income tax

Accomplish Form 990 Return Of Organization Exempt From Income Tax seamlessly on any gadget

Online document management has become increasingly popular among organizations and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed papers, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents swiftly without hold-ups. Handle Form 990 Return Of Organization Exempt From Income Tax on any device with airSlate SignNow's Android or iOS applications and enhance your document-related processes today.

How to modify and electronically sign Form 990 Return Of Organization Exempt From Income Tax effortlessly

- Obtain Form 990 Return Of Organization Exempt From Income Tax and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of the documents or cover sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet signature.

- Review all the details and click the Done button to secure your modifications.

- Select how you wish to share your form, via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious document searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from the device of your choosing. Alter and electronically sign Form 990 Return Of Organization Exempt From Income Tax and ensure excellent communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 form 990 return of organization exempt from income tax

Create this form in 5 minutes!

How to create an eSignature for the 2020 form 990 return of organization exempt from income tax

How to make an electronic signature for your PDF in the online mode

How to make an electronic signature for your PDF in Chrome

The best way to generate an electronic signature for putting it on PDFs in Gmail

The best way to create an eSignature right from your smart phone

The best way to generate an electronic signature for a PDF on iOS devices

The best way to create an eSignature for a PDF on Android OS

People also ask

-

What is the significance of irs gov 990n for nonprofit organizations?

The irs gov 990n form, also known as the e-Postcard, is crucial for small tax-exempt organizations as it provides essential financial information to the IRS. Filing this form ensures that your organization maintains its tax-exempt status without penalties. Keeping up with these requirements can be streamlined using airSlate SignNow's eSigning capabilities, making the process efficient.

-

How can airSlate SignNow help with the irs gov 990n filing process?

airSlate SignNow can facilitate the process of preparing and signing the supporting documents needed for the irs gov 990n. By utilizing our platform, users can quickly fill out and eSign necessary paperwork, ensuring timely and accurate submission. This helps organizations avoid delays and potential penalties.

-

Are there any costs associated with using airSlate SignNow for filing irs gov 990n?

airSlate SignNow offers various pricing plans that can fit a range of budgets for organizations, including options specifically for nonprofits. While the use of the irs gov 990n form itself is free for eligible organizations, utilizing our platform will incur a minimal cost that can ultimately save you time and resources.

-

What features does airSlate SignNow offer that simplify the irs gov 990n filing?

airSlate SignNow provides features such as customizable templates, document tracking, and real-time collaboration which are essential for filing the irs gov 990n. These tools ensure that all necessary information is easily accessible and can be quickly completed by your team, streamlining the filing process.

-

Can airSlate SignNow integrate with other software used for managing nonprofit records?

Yes, airSlate SignNow offers integrations with various software platforms, including accounting and nonprofit management tools, to help streamline your workflows. This means that once your documents are eSigned, you can easily store or share them with other applications essential for managing your nonprofit’s compliance with irs gov 990n.

-

What are the benefits of using airSlate SignNow for document signing in the context of irs gov 990n?

Using airSlate SignNow enhances the efficiency of document signing required for irs gov 990n by allowing users to electronically sign documents from anywhere, at any time. This flexibility not only speeds up the process but also ensures that all signatures are secure and legally valid, reducing the stress of meeting IRS deadlines.

-

Is airSlate SignNow compliant with regulations concerning irs gov 990n?

Absolutely, airSlate SignNow adheres to strict regulations and is compliant with standards required for forms like irs gov 990n. Our platform provides robust security features to protect sensitive information, ensuring that your organization remains compliant while managing its documentation.

Get more for Form 990 Return Of Organization Exempt From Income Tax

- Csd form download

- How to apply for ppda certificate in uganda form

- Wwe application form 2022

- Grade 4 english papers in sri lanka form

- Unam mature age entry application form 2023

- Grade 8 english exam papers with answers pdf form

- Royal rangers outpost 115 fall registration form monmouthworship

- Www royalfaces101 compostchemical peel greenchemical peel green peel consent form website

Find out other Form 990 Return Of Organization Exempt From Income Tax

- Sign Kentucky LLC Operating Agreement Later

- Sign Louisiana LLC Operating Agreement Computer

- How Do I Sign Massachusetts LLC Operating Agreement

- Sign Michigan LLC Operating Agreement Later

- Sign Oklahoma LLC Operating Agreement Safe

- Sign Rhode Island LLC Operating Agreement Mobile

- Sign Wisconsin LLC Operating Agreement Mobile

- Can I Sign Wyoming LLC Operating Agreement

- Sign Hawaii Rental Invoice Template Simple

- Sign California Commercial Lease Agreement Template Free

- Sign New Jersey Rental Invoice Template Online

- Sign Wisconsin Rental Invoice Template Online

- Can I Sign Massachusetts Commercial Lease Agreement Template

- Sign Nebraska Facility Rental Agreement Online

- Sign Arizona Sublease Agreement Template Fast

- How To Sign Florida Sublease Agreement Template

- Sign Wyoming Roommate Contract Safe

- Sign Arizona Roommate Rental Agreement Template Later

- How Do I Sign New York Sublease Agreement Template

- How To Sign Florida Roommate Rental Agreement Template