Form 990 Return of Organization Exempt from Income Tax 2024-2026

What is the Form 990 Return of Organization Exempt From Income Tax

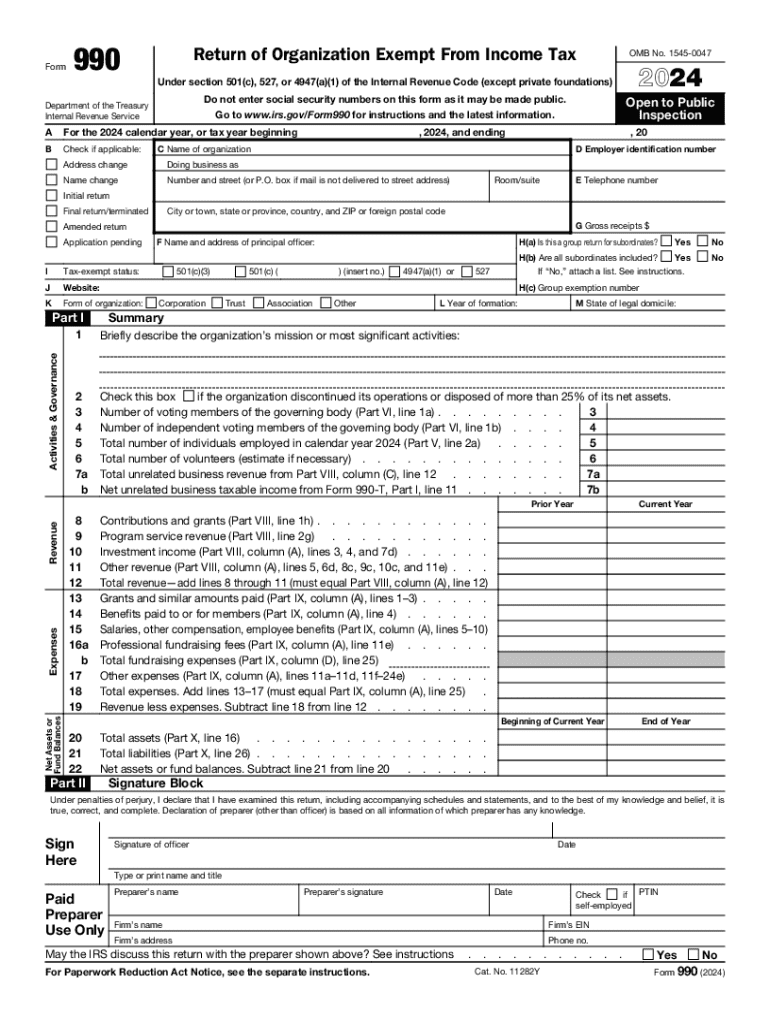

The Form 990 is a crucial document for tax-exempt organizations in the United States. It serves as an annual information return that provides the IRS and the public with details about the organization's financial activities, governance, and compliance with tax regulations. This form is essential for maintaining tax-exempt status under Section 501(c)(3) of the Internal Revenue Code. Organizations must disclose their revenue, expenses, and program accomplishments, ensuring transparency and accountability.

Steps to Complete the Form 990 Return of Organization Exempt From Income Tax

Completing the Form 990 involves several important steps. First, gather all necessary financial documents, including income statements, balance sheets, and details of program services. Next, ensure that you understand the various sections of the form, which include financial data, governance structure, and compliance information. After filling out the form, review it for accuracy and completeness. Finally, submit the form electronically or via mail, adhering to the filing deadlines set by the IRS.

Filing Deadlines / Important Dates

Organizations must be aware of the filing deadlines for Form 990 to maintain compliance. Generally, the due date for filing is the 15th day of the fifth month after the end of the organization's fiscal year. For example, if the fiscal year ends on December 31, the form is due by May 15 of the following year. Organizations can apply for an extension, but they must file Form 8868 to do so. It is crucial to adhere to these deadlines to avoid penalties.

Legal Use of the Form 990 Return of Organization Exempt From Income Tax

The Form 990 is legally required for most tax-exempt organizations to maintain their status. It is used by the IRS to ensure compliance with tax laws and regulations. Additionally, the form is accessible to the public, allowing donors, grantmakers, and the general public to evaluate an organization's financial health and governance practices. This transparency helps build trust and credibility within the community.

Key Elements of the Form 990 Return of Organization Exempt From Income Tax

The Form 990 includes several key elements that organizations must complete. These elements encompass financial statements, a summary of the organization's mission, a list of board members, and details about compensation for key personnel. Additionally, organizations must report on their program accomplishments and any changes in their governance structure. Ensuring that all these elements are accurately reported is vital for compliance and transparency.

Form Submission Methods (Online / Mail / In-Person)

Organizations have multiple options for submitting the Form 990. The preferred method is electronic filing, which can be done through the IRS e-file system. This method is efficient and allows for quicker processing. Alternatively, organizations can mail a paper copy of the form to the appropriate IRS address. In-person submission is generally not an option for this form. It is important to choose the method that best suits the organization's needs while ensuring compliance with IRS requirements.

Handy tips for filling out Form 990 Return Of Organization Exempt From Income Tax online

Quick steps to complete and e-sign Form 990 Return Of Organization Exempt From Income Tax online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We know how stressing filling out documents could be. Gain access to a HIPAA and GDPR compliant platform for optimum simpleness. Use signNow to e-sign and send Form 990 Return Of Organization Exempt From Income Tax for e-signing.

Create this form in 5 minutes or less

Find and fill out the correct form 990 return of organization exempt from income tax

Create this form in 5 minutes!

How to create an eSignature for the form 990 return of organization exempt from income tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process for completing a form 990 online using airSlate SignNow?

To complete a form 990 online with airSlate SignNow, simply upload your document, fill in the required fields, and add eSignatures where necessary. Our platform guides you through each step, ensuring compliance and accuracy. Once completed, you can easily download or share your form 990 online.

-

How much does it cost to file a form 990 online with airSlate SignNow?

airSlate SignNow offers competitive pricing plans that cater to various business needs. You can choose from monthly or annual subscriptions, which provide access to all features necessary for filing a form 990 online. Check our pricing page for detailed information on plans and discounts.

-

What features does airSlate SignNow offer for managing form 990 online?

Our platform includes features such as customizable templates, automated workflows, and secure eSignature capabilities, all designed to streamline the process of managing your form 990 online. Additionally, you can track document status and receive notifications for any updates.

-

Is airSlate SignNow secure for filing a form 990 online?

Yes, airSlate SignNow prioritizes security and compliance. We use advanced encryption and secure servers to protect your data while you file your form 990 online. Our platform is compliant with industry standards, ensuring your information remains confidential.

-

Can I integrate airSlate SignNow with other software for filing form 990 online?

Absolutely! airSlate SignNow offers seamless integrations with various software applications, including accounting and tax software. This allows you to streamline your workflow and efficiently manage your form 990 online alongside other business processes.

-

What are the benefits of using airSlate SignNow for form 990 online submissions?

Using airSlate SignNow for your form 990 online submissions provides numerous benefits, including time savings, reduced paperwork, and enhanced accuracy. Our user-friendly interface simplifies the filing process, allowing you to focus on your core business activities.

-

How can I get support while filing my form 990 online?

airSlate SignNow offers comprehensive customer support to assist you while filing your form 990 online. You can access our help center, chat with support representatives, or consult our extensive library of resources for guidance and troubleshooting.

Get more for Form 990 Return Of Organization Exempt From Income Tax

Find out other Form 990 Return Of Organization Exempt From Income Tax

- Sign Idaho Legal Living Will Online

- Sign Oklahoma Insurance Limited Power Of Attorney Now

- Sign Idaho Legal Separation Agreement Online

- Sign Illinois Legal IOU Later

- Sign Illinois Legal Cease And Desist Letter Fast

- Sign Indiana Legal Cease And Desist Letter Easy

- Can I Sign Kansas Legal LLC Operating Agreement

- Sign Kansas Legal Cease And Desist Letter Now

- Sign Pennsylvania Insurance Business Plan Template Safe

- Sign Pennsylvania Insurance Contract Safe

- How Do I Sign Louisiana Legal Cease And Desist Letter

- How Can I Sign Kentucky Legal Quitclaim Deed

- Sign Kentucky Legal Cease And Desist Letter Fast

- Sign Maryland Legal Quitclaim Deed Now

- Can I Sign Maine Legal NDA

- How To Sign Maine Legal Warranty Deed

- Sign Maine Legal Last Will And Testament Fast

- How To Sign Maine Legal Quitclaim Deed

- Sign Mississippi Legal Business Plan Template Easy

- How Do I Sign Minnesota Legal Residential Lease Agreement