Form 941 X Rev April Adjusted Employer's QUARTERLY Federal Tax Return or Claim for Refund 2022

What is the Form 941 X Rev April Adjusted Employer's QUARTERLY Federal Tax Return Or Claim For Refund

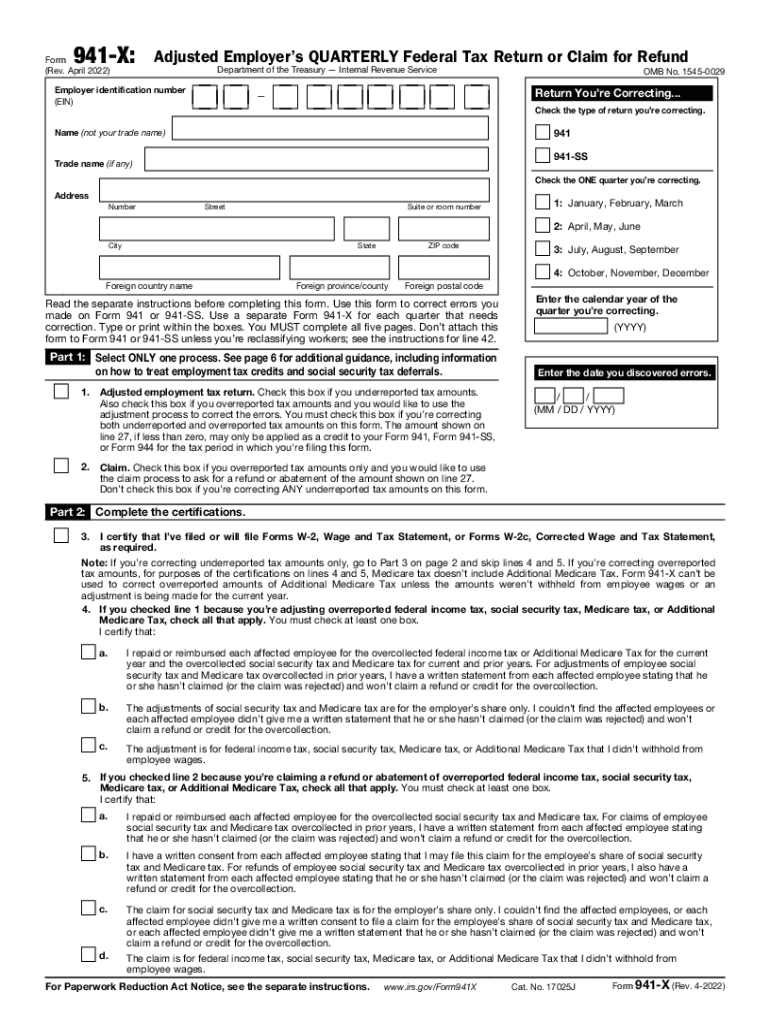

The Form 941 X is a crucial document used by employers in the United States to amend previously filed quarterly federal tax returns. This form allows employers to correct errors in their original Form 941 submissions, which report income taxes, Social Security tax, and Medicare tax withheld from employee wages. The adjustments can include changes to the amount of taxes owed, corrections to employee counts, or updates to tax credits claimed. Understanding the purpose of Form 941 X is essential for ensuring compliance with IRS regulations and for accurately reporting tax obligations.

How to use the Form 941 X Rev April Adjusted Employer's QUARTERLY Federal Tax Return Or Claim For Refund

Using Form 941 X involves several steps to ensure that all necessary corrections are made accurately. First, employers should gather all relevant information from the original Form 941 that needs amending. Next, complete the Form 941 X by providing details such as the tax period being amended, the corrected amounts, and the reasons for the changes. It is important to follow the specific instructions provided by the IRS for filling out the form to avoid further complications. Once completed, the form can be submitted to the appropriate IRS address based on the employer's location.

Steps to complete the Form 941 X Rev April Adjusted Employer's QUARTERLY Federal Tax Return Or Claim For Refund

Completing Form 941 X requires careful attention to detail. Here are the key steps:

- Identify the tax period for which you are amending the return.

- Fill out the top section with your business information, including your name, address, and Employer Identification Number (EIN).

- Complete the sections that require corrections, ensuring that you provide the original amounts and the corrected amounts side by side.

- Include a brief explanation of why the changes are necessary.

- Sign and date the form before submission.

Filing Deadlines / Important Dates

Filing deadlines for Form 941 X are critical to avoid penalties. Typically, employers should file this form within three years of the original filing date of the Form 941 being amended. Additionally, if you are claiming a refund, it is advisable to file as soon as you become aware of the error to expedite the refund process. Keeping track of these deadlines helps ensure compliance with IRS regulations and avoids unnecessary fines.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting Form 941 X. It is essential to refer to the latest IRS instructions, which detail the requirements for amending a return, including what information must be included and how to properly file the form. Following these guidelines helps ensure that the amendments are accepted without issue and that all corrections are accurately reflected in the IRS records.

Penalties for Non-Compliance

Failure to file Form 941 X or to correct errors in a timely manner can result in significant penalties. The IRS may impose fines for late filings, inaccuracies, or failure to pay the correct amount of taxes owed. Understanding the potential consequences of non-compliance emphasizes the importance of accurately completing and submitting this form, ensuring that all tax obligations are met in a timely fashion.

Quick guide on how to complete form 941 x rev april 2022 adjusted employers quarterly federal tax return or claim for refund

Complete Form 941 X Rev April Adjusted Employer's QUARTERLY Federal Tax Return Or Claim For Refund effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers a perfect sustainable alternative to traditional printed and signed documents, as you can obtain the necessary form and save it securely online. airSlate SignNow provides you with all the tools you require to create, modify, and eSign your documents quickly and without holdups. Manage Form 941 X Rev April Adjusted Employer's QUARTERLY Federal Tax Return Or Claim For Refund on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The simplest way to modify and eSign Form 941 X Rev April Adjusted Employer's QUARTERLY Federal Tax Return Or Claim For Refund with ease

- Locate Form 941 X Rev April Adjusted Employer's QUARTERLY Federal Tax Return Or Claim For Refund and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature with the Sign feature, which takes mere moments and holds the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to preserve your changes.

- Decide how you wish to send your form, whether via email, SMS, invitation link, or download it directly to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that require creating new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Alter and eSign Form 941 X Rev April Adjusted Employer's QUARTERLY Federal Tax Return Or Claim For Refund to ensure effective communication at every step of the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 941 x rev april 2022 adjusted employers quarterly federal tax return or claim for refund

Create this form in 5 minutes!

People also ask

-

What is the process for filing Form 941-X?

To file Form 941-X, you first need to complete the form with the necessary corrections for previously filed Forms 941. After completing, it's essential to know where to mail 941x, as submissions can vary by state. Make sure you refer to the IRS guidelines for the correct mailing address based on your location.

-

How much does it cost to use airSlate SignNow for sending documents?

airSlate SignNow offers a cost-effective solution for businesses looking to streamline document signing processes. Pricing plans are flexible and cater to various needs, ensuring you get the best value while managing documents, including those related to where to mail 941x.

-

What features does airSlate SignNow provide?

airSlate SignNow includes features such as eSigning, document templates, and automated workflows. These tools make it easier for businesses to manage documents securely and efficiently, including providing guidance on where to mail 941x after completing the necessary forms.

-

Can airSlate SignNow integrate with other platforms?

Yes, airSlate SignNow offers integrations with several popular platforms, enhancing your workflow. Whether you're using CRM systems, project management tools, or accounting software, it helps streamline processes, including guidance on where to mail 941x.

-

How does airSlate SignNow ensure document security?

Document security is a priority for airSlate SignNow, which uses advanced encryption and authentication measures. This ensures that your documents, including tax forms such as where to mail 941x, are protected against unauthorized access while being transmitted.

-

What benefits do I gain from using airSlate SignNow?

By using airSlate SignNow, businesses can save time and reduce errors associated with traditional document signing. The ease of eSigning helps you focus on critical tasks, while knowing where to mail 941x becomes a simplified part of your documentation process.

-

How can I track the status of my documents sent through airSlate SignNow?

Tracking the status of your documents sent through airSlate SignNow is straightforward with our dashboard. You can see when a document is sent, viewed, and signed, ensuring that every task, including knowing where to mail 941x, stays on track.

Get more for Form 941 X Rev April Adjusted Employer's QUARTERLY Federal Tax Return Or Claim For Refund

- Bill of sale for watercraft or boat oklahoma form

- Bill of sale of automobile and odometer statement for as is sale oklahoma form

- Construction contract cost plus or fixed fee oklahoma form

- Painting contract for contractor oklahoma form

- Trim carpenter contract for contractor oklahoma form

- Fencing contract for contractor oklahoma form

- Hvac contract for contractor oklahoma form

- Landscape contract for contractor oklahoma form

Find out other Form 941 X Rev April Adjusted Employer's QUARTERLY Federal Tax Return Or Claim For Refund

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors