About Form 941 XInternal Revenue Service IRS Gov 2013

What is the About Form 941 XInternal Revenue Service IRS gov

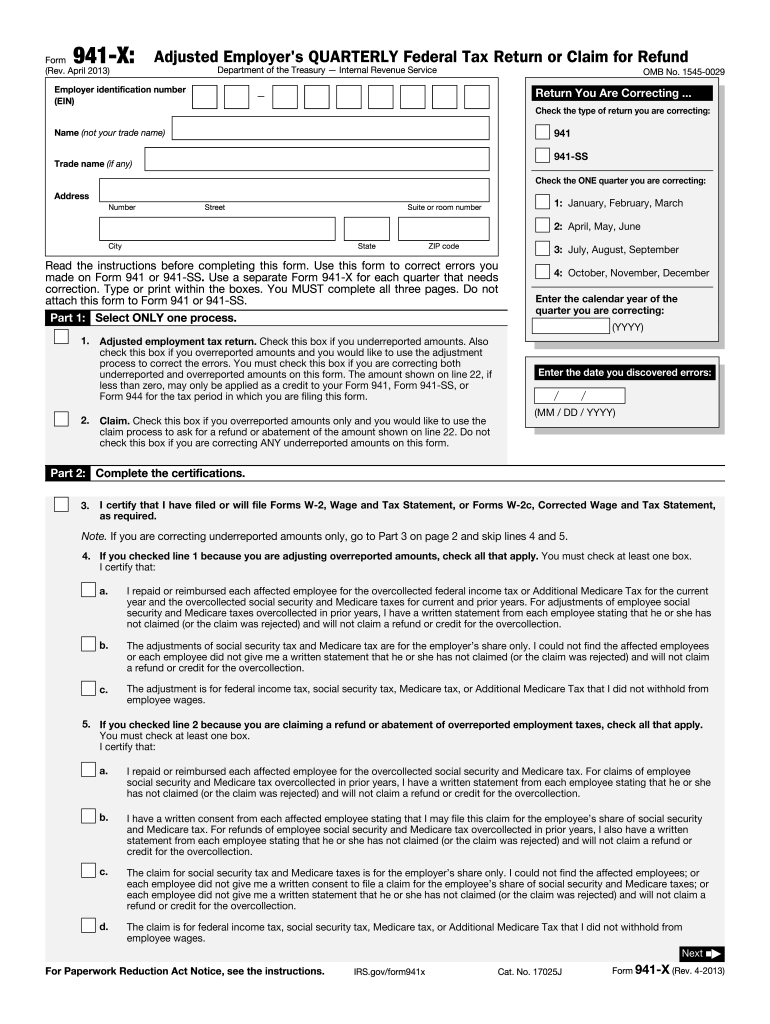

The About Form 941 is a crucial document issued by the Internal Revenue Service (IRS) for employers in the United States. It is used to report income taxes, Social Security tax, and Medicare tax withheld from employee wages. This form is essential for employers to ensure compliance with federal tax obligations and accurately report their payroll tax liabilities. The form provides a summary of the employer's payroll tax activities for a specific quarter, making it a vital component of tax reporting for businesses.

Steps to complete the About Form 941 XInternal Revenue Service IRS gov

Completing the About Form 941 involves several steps to ensure accuracy and compliance:

- Gather necessary information, including total wages paid, tips, and other compensation.

- Calculate the total taxes owed, including federal income tax withheld and Social Security and Medicare taxes.

- Fill out the form accurately, ensuring all sections are completed, including employer information and tax calculations.

- Review the completed form for any errors or omissions.

- Submit the form to the IRS by the specified deadline, either electronically or via mail.

Legal use of the About Form 941 XInternal Revenue Service IRS gov

The About Form 941 is legally binding when completed and submitted according to IRS regulations. Employers must ensure that all information provided is accurate and truthful, as any discrepancies may lead to penalties or audits. The form serves as an official record of payroll taxes and must be retained for at least four years after the date of filing. Compliance with the legal requirements surrounding this form is essential for avoiding potential legal issues and ensuring proper tax reporting.

Filing Deadlines / Important Dates

Employers must adhere to specific deadlines when filing the About Form 941. The form is typically due on the last day of the month following the end of each quarter. For example, the deadlines are:

- First Quarter (January - March): Due April 30

- Second Quarter (April - June): Due July 31

- Third Quarter (July - September): Due October 31

- Fourth Quarter (October - December): Due January 31 of the following year

Form Submission Methods (Online / Mail / In-Person)

The About Form 941 can be submitted to the IRS through various methods:

- Online: Employers can file electronically using IRS-approved e-file providers, which is often faster and more secure.

- Mail: The form can be printed and mailed to the appropriate IRS address based on the employer's location.

- In-Person: While not common, some employers may choose to deliver the form in person to their local IRS office.

Penalties for Non-Compliance

Failure to file the About Form 941 on time or providing inaccurate information can result in penalties. The IRS may impose fines based on the amount of tax owed and the duration of the delay. Additionally, employers may face interest charges on unpaid taxes. It is crucial for businesses to file accurately and on time to avoid these financial repercussions.

Quick guide on how to complete about form 941 xinternal revenue service irsgov

Complete About Form 941 XInternal Revenue Service IRS gov effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-conscious substitute for conventional printed and signed paperwork, enabling you to locate the correct form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly and efficiently. Handle About Form 941 XInternal Revenue Service IRS gov on any device using the airSlate SignNow Android or iOS applications and simplify any document-related procedures today.

The easiest way to modify and eSign About Form 941 XInternal Revenue Service IRS gov without hassle

- Obtain About Form 941 XInternal Revenue Service IRS gov and click on Get Form to begin.

- Utilize the available tools to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all information carefully and click on the Done button to save your modifications.

- Choose your preferred method to share your form, whether via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign About Form 941 XInternal Revenue Service IRS gov and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct about form 941 xinternal revenue service irsgov

Create this form in 5 minutes!

How to create an eSignature for the about form 941 xinternal revenue service irsgov

How to generate an eSignature for your PDF online

How to generate an eSignature for your PDF in Google Chrome

How to generate an electronic signature for signing PDFs in Gmail

How to make an eSignature straight from your smartphone

The best way to create an electronic signature for a PDF on iOS

How to make an eSignature for a PDF document on Android

People also ask

-

What is Form 941 X, and why is it important?

Form 941 X is the IRS form used to amend or correct previously filed Form 941 returns. Understanding About Form 941 XInternal Revenue Service IRS gov is essential for businesses to ensure compliance and accurate reporting of payroll taxes, thus avoiding potential penalties.

-

How can airSlate SignNow help with Form 941 X?

airSlate SignNow provides a seamless platform for electronically signing and sending Form 941 X. This enhances efficiency and ensures legal validity while managing About Form 941 XInternal Revenue Service IRS gov documentation.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow includes features such as customizable templates, secure eSignature, and document tracking. These functionalities can signNowly aid in managing About Form 941 XInternal Revenue Service IRS gov forms and other documents effectively.

-

Is there a cost associated with using airSlate SignNow for Form 941 X?

Yes, airSlate SignNow offers various pricing plans tailored to business needs. Utilizing their services for managing About Form 941 XInternal Revenue Service IRS gov can be a cost-effective solution compared to traditional methods.

-

Can I integrate airSlate SignNow with other business applications?

Absolutely! airSlate SignNow supports integration with a wide range of business applications, making it easy to streamline your workflow. This flexibility can enhance how you manage About Form 941 XInternal Revenue Service IRS gov processes and documents.

-

What benefits do I gain by using airSlate SignNow for my business?

Using airSlate SignNow offers numerous benefits including time-saving features, enhanced security, and improved compliance. These advantages are particularly valuable when handling critical forms like About Form 941 XInternal Revenue Service IRS gov.

-

Is it easy to get started with airSlate SignNow?

Yes, getting started with airSlate SignNow is intuitive and user-friendly. Their platform simplifies the process of managing About Form 941 XInternal Revenue Service IRS gov, allowing businesses to focus more on their core operations.

Get more for About Form 941 XInternal Revenue Service IRS gov

Find out other About Form 941 XInternal Revenue Service IRS gov

- eSign Missouri Real Estate Affidavit Of Heirship Simple

- eSign New Jersey Real Estate Limited Power Of Attorney Later

- eSign Alabama Police LLC Operating Agreement Fast

- eSign North Dakota Real Estate Business Letter Template Computer

- eSign North Dakota Real Estate Quitclaim Deed Myself

- eSign Maine Sports Quitclaim Deed Easy

- eSign Ohio Real Estate LLC Operating Agreement Now

- eSign Ohio Real Estate Promissory Note Template Online

- How To eSign Ohio Real Estate Residential Lease Agreement

- Help Me With eSign Arkansas Police Cease And Desist Letter

- How Can I eSign Rhode Island Real Estate Rental Lease Agreement

- How Do I eSign California Police Living Will

- Can I eSign South Dakota Real Estate Quitclaim Deed

- How To eSign Tennessee Real Estate Business Associate Agreement

- eSign Michigan Sports Cease And Desist Letter Free

- How To eSign Wisconsin Real Estate Contract

- How To eSign West Virginia Real Estate Quitclaim Deed

- eSign Hawaii Police Permission Slip Online

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy