Form 941 X 2009

What is the Form 941 X

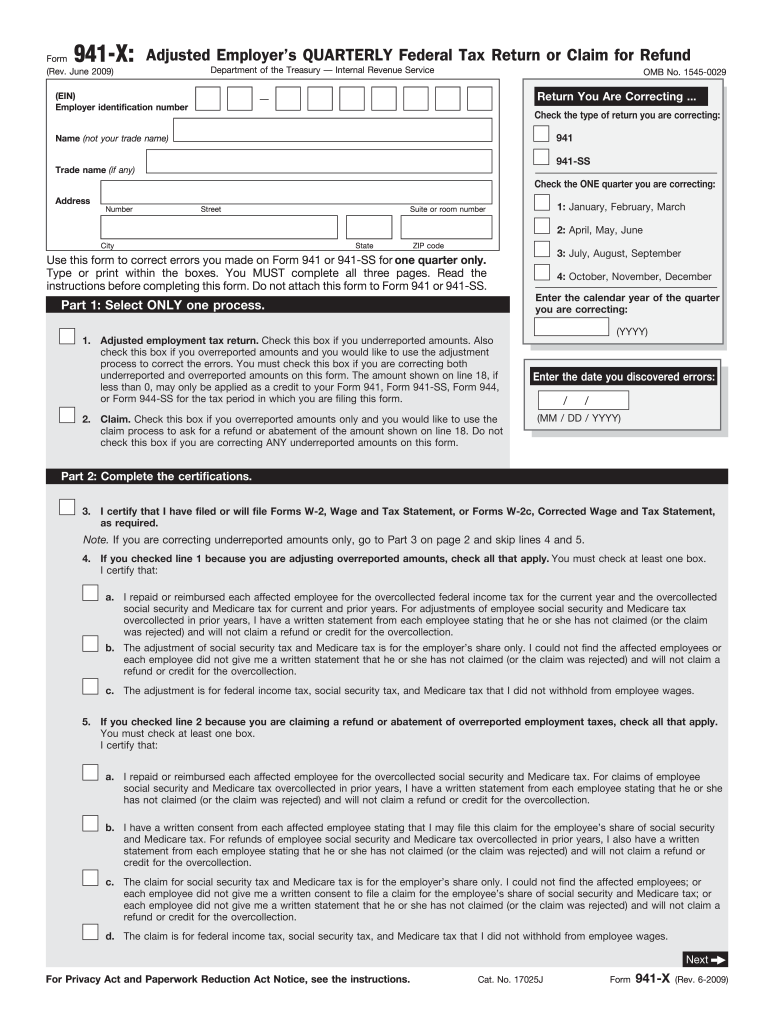

The Form 941 X is a tax form used by employers in the United States to correct errors made on previously filed Form 941, which is the Employer's Quarterly Federal Tax Return. This form allows businesses to amend their payroll tax filings, ensuring that they accurately report the amounts withheld for federal income tax, Social Security tax, and Medicare tax. It is essential for maintaining compliance with IRS regulations and for correcting any discrepancies that may affect an employer's tax obligations.

How to use the Form 941 X

To use the Form 941 X effectively, employers need to first identify the specific errors on their original Form 941. This may include mistakes in reported wages, tax withholdings, or credits claimed. Once the errors are identified, the employer should complete the Form 941 X by providing the corrected information in the appropriate sections. It is important to indicate the tax period being amended and to provide a clear explanation of the corrections being made. After completing the form, it should be submitted to the IRS following the guidelines for filing amended returns.

Steps to complete the Form 941 X

Completing the Form 941 X involves several key steps:

- Review the original Form 941 to identify errors.

- Obtain the Form 941 X from the IRS website or other official sources.

- Fill in the required information, including the tax period and corrected amounts.

- Provide a detailed explanation of the corrections in the designated area.

- Sign and date the form to certify its accuracy.

- Submit the completed Form 941 X to the IRS by mail or electronically, if applicable.

Legal use of the Form 941 X

The legal use of the Form 941 X is governed by IRS regulations. This form must be filed to correct any inaccuracies in previously submitted payroll tax returns. By using the Form 941 X, employers can ensure that they remain compliant with federal tax laws and avoid potential penalties. It is crucial for employers to follow the correct procedures and timelines for filing this form to maintain their legal standing and avoid complications with the IRS.

Filing Deadlines / Important Dates

Filing deadlines for the Form 941 X are typically aligned with the original Form 941 deadlines. Employers should submit the amended form as soon as they identify an error to minimize potential penalties and interest. The IRS recommends filing Form 941 X within three years of the original filing date or within two years of the date the tax was paid, whichever is later. Keeping track of these deadlines is essential for compliance and to ensure that any corrections are processed timely.

Form Submission Methods (Online / Mail / In-Person)

The Form 941 X can be submitted to the IRS through various methods. Employers may choose to file the form by mail, sending it to the appropriate IRS address based on their location. Some employers may also have the option to file electronically through compatible tax software that supports e-filing of amended returns. It is important to check the IRS guidelines for the most current submission methods and to ensure that the chosen method is appropriate for the specific circumstances of the filing.

Quick guide on how to complete form 941 x 2009

Effortlessly Prepare Form 941 X on Any Device

Managing documents online has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow provides all the tools required to swiftly create, modify, and eSign your documents without any hassle. Handle Form 941 X on any device using airSlate SignNow’s Android or iOS applications and enhance your document-oriented processes today.

The easiest method to edit and eSign Form 941 X with ease

- Obtain Form 941 X and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of your documents or obscure sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details and click the Done button to save your changes.

- Decide how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow effectively meets your document management needs in just a few clicks from any device of your choosing. Modify and eSign Form 941 X to ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 941 x 2009

Create this form in 5 minutes!

How to create an eSignature for the form 941 x 2009

The way to make an electronic signature for your PDF document in the online mode

The way to make an electronic signature for your PDF document in Chrome

The best way to make an electronic signature for putting it on PDFs in Gmail

The best way to make an eSignature from your mobile device

The way to generate an electronic signature for a PDF document on iOS devices

The best way to make an eSignature for a PDF file on Android devices

People also ask

-

What is Form 941 X, and when do I need to use it?

Form 941 X is used to amend a previously filed Form 941, allowing businesses to correct wage and tax errors. It is essential to file this form to ensure compliance with IRS regulations and maintain accurate payroll records. If you discover discrepancies in your quarterly payroll reporting, using Form 941 X is necessary to rectify those mistakes.

-

How does airSlate SignNow facilitate the completion of Form 941 X?

airSlate SignNow provides an intuitive platform designed to streamline the signing and submission process for Form 941 X. With features like template creation and electronic signatures, users can fill out the form quickly and efficiently, ensuring that their amendments are submitted on time. This simplifies an otherwise complex task for businesses.

-

What are the pricing options for using airSlate SignNow for Form 941 X?

airSlate SignNow offers various pricing plans tailored to meet the needs of different businesses, making it a cost-effective solution for managing Form 941 X. Whether you are a small business or a large enterprise, there is a plan that can accommodate your requirements. Subscription options come with a range of features to support efficient document management.

-

Can I store my Form 941 X electronically with airSlate SignNow?

Yes, airSlate SignNow allows you to securely store your Form 941 X electronically. This ensures that you have easy access to your documents whenever needed, helping with organization and compliance. The platform also features robust security measures to protect sensitive information.

-

What integrations does airSlate SignNow offer for managing Form 941 X?

airSlate SignNow integrates with various third-party applications, allowing seamless workflows for handling Form 941 X and other documents. Whether you use accounting software or HR management tools, these integrations enhance efficiency and coordination among different systems. This capability helps streamline your document processes considerably.

-

Are there benefits to using electronic signatures for Form 941 X?

Using electronic signatures for Form 941 X offers numerous benefits, including enhanced convenience and rapid turnaround times. With airSlate SignNow, stakeholders can review and sign the form from any location, reducing the need for physical paperwork. Additionally, electronic signatures are legally recognized, ensuring that your amended forms are compliant with legal standards.

-

How secure is airSlate SignNow when handling Form 941 X?

airSlate SignNow prioritizes the security of your documents, including Form 941 X, with advanced encryption and compliance measures. Your data is protected against unauthorized access, ensuring confidentiality throughout the signing and submission process. This commitment to security provides peace of mind for businesses managing sensitive tax documents.

Get more for Form 941 X

- Indiana ucc1 financing statement addendum indiana form

- Indiana ucc3 financing statement amendment addendum indiana form

- Legal last will and testament form for single person with no children indiana

- Legal last will and testament form for a single person with minor children indiana

- Legal last will and testament form for single person with adult and minor children indiana

- Legal last will and testament form for single person with adult children indiana

- Legal last will and testament for married person with minor children from prior marriage indiana form

- Legal last will and testament form for married person with adult children from prior marriage indiana

Find out other Form 941 X

- Can I Electronic signature Alabama Legal LLC Operating Agreement

- How To Electronic signature North Dakota Lawers Job Description Template

- Electronic signature Alabama Legal Limited Power Of Attorney Safe

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter

- How To Electronic signature Tennessee High Tech Job Offer

- Electronic signature South Carolina Lawers Rental Lease Agreement Online

- How Do I Electronic signature Arizona Legal Warranty Deed

- How To Electronic signature Arizona Legal Lease Termination Letter

- How To Electronic signature Virginia Lawers Promissory Note Template

- Electronic signature Vermont High Tech Contract Safe

- Electronic signature Legal Document Colorado Online

- Electronic signature Washington High Tech Contract Computer

- Can I Electronic signature Wisconsin High Tech Memorandum Of Understanding

- How Do I Electronic signature Wisconsin High Tech Operating Agreement

- How Can I Electronic signature Wisconsin High Tech Operating Agreement

- Electronic signature Delaware Legal Stock Certificate Later

- Electronic signature Legal PDF Georgia Online

- Electronic signature Georgia Legal Last Will And Testament Safe

- Can I Electronic signature Florida Legal Warranty Deed

- Electronic signature Georgia Legal Memorandum Of Understanding Simple