Form 1040 X Rev July Amended U S Individual Income Tax Return 2021

What is the Form 1040-X Amended U.S. Individual Income Tax Return

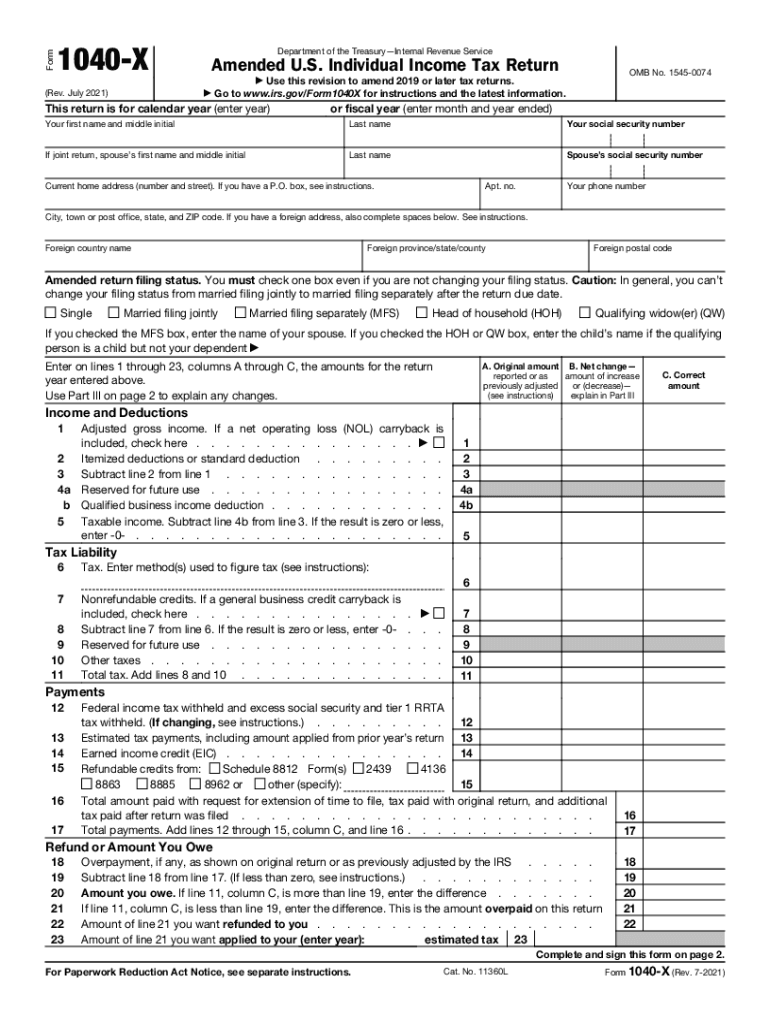

The Form 1040-X is the official document used by taxpayers to amend their previously filed U.S. individual income tax returns. It allows individuals to correct errors or make changes to their original tax filings, including adjustments to income, deductions, or credits. The amended tax return is essential for ensuring that taxpayers report accurate information to the IRS, which can prevent potential issues or penalties in the future. This form is specifically designed to accommodate various tax years, allowing taxpayers to amend returns for past years as needed.

Steps to Complete the Form 1040-X

Completing the Form 1040-X involves several key steps to ensure accuracy and compliance. First, gather all relevant documents, including your original tax return and any supporting documentation for the changes you are making. Next, fill out the form by providing your personal information, the tax year you are amending, and the specific changes you are making. Be sure to explain the reasons for the amendments in the designated section. After completing the form, review it carefully for any errors before submitting it to the IRS. It is also important to retain copies of your amended return and any related documents for your records.

IRS Guidelines for Amended Returns

The IRS has specific guidelines regarding the submission of amended tax returns. Taxpayers should file Form 1040-X within three years from the original filing date or within two years from the date they paid the tax, whichever is later. If you are amending multiple years, a separate Form 1040-X must be filed for each tax year. The IRS advises that processing times for amended returns can take up to 16 weeks, so taxpayers should be patient while awaiting updates on their amendments. Additionally, it is crucial to ensure that any changes made do not result in additional taxes owed without timely payment to avoid penalties.

Required Documents for Filing an Amended Return

When filing an amended tax return using Form 1040-X, certain documents are typically required to support the changes being made. These may include copies of the original tax return, any W-2s or 1099s that reflect the income being amended, and documentation for any deductions or credits being claimed. If the amendment involves changes to your filing status or dependents, relevant documentation should also be included. Keeping thorough records will help facilitate a smoother amendment process and ensure that the IRS has all necessary information to process your return accurately.

Form Submission Methods for 1040-X

Taxpayers have various options for submitting their amended returns using Form 1040-X. The form can be filed electronically through certain tax software programs that support e-filing for amended returns. Alternatively, taxpayers can print the completed form and submit it via mail to the appropriate IRS address, which varies based on the taxpayer's location. It is important to check the IRS guidelines for the correct mailing address to ensure timely processing. Additionally, individuals may choose to file in person at their local IRS office if they prefer direct interaction.

Penalties for Non-Compliance

Failing to file an amended tax return when necessary can lead to penalties and interest charges. If the IRS determines that a taxpayer has underreported income or claimed incorrect deductions, they may impose penalties based on the amount of tax owed. Additionally, interest accrues on any unpaid taxes from the original due date until the tax is paid in full. To avoid these consequences, it is advisable for taxpayers to file Form 1040-X promptly if they discover any errors in their original returns.

Eligibility Criteria for Amending a Tax Return

Not every taxpayer may need to file an amended return. Eligibility for using Form 1040-X generally includes situations where a taxpayer needs to correct errors in their original return, such as misreported income, incorrect filing status, or changes in dependents. Taxpayers should also consider amending their returns if they have received additional information that affects their tax liability, such as corrected W-2s or 1099s. It is important to assess whether the changes will impact the overall tax outcome before deciding to file an amended return.

Quick guide on how to complete form 1040 x rev july 2021 amended us individual income tax return

Easily Prepare Form 1040 X Rev July Amended U S Individual Income Tax Return on Any Device

Managing documents online has gained signNow traction among businesses and individuals. It offers an ideal environmentally-friendly alternative to traditional printed and signed paperwork, as you can easily locate the necessary form and securely keep it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents quickly without any holdups. Control Form 1040 X Rev July Amended U S Individual Income Tax Return on any device using the airSlate SignNow apps for Android or iOS, and streamline any document-related process today.

How to Adjust and Electronically Sign Form 1040 X Rev July Amended U S Individual Income Tax Return Effortlessly

- Locate Form 1040 X Rev July Amended U S Individual Income Tax Return and click on Get Form to begin.

- Utilize the available tools to complete your form.

- Mark important sections of the documents or obscure sensitive data with features that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review the details and then click on the Done button to finalize your changes.

- Choose your preferred method of sending the form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or mistakes that require new document printouts. airSlate SignNow meets all your document management requirements in just a few clicks from your chosen device. Adjust and electronically sign Form 1040 X Rev July Amended U S Individual Income Tax Return to ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 1040 x rev july 2021 amended us individual income tax return

Create this form in 5 minutes!

How to create an eSignature for the form 1040 x rev july 2021 amended us individual income tax return

The way to create an e-signature for a PDF in the online mode

The way to create an e-signature for a PDF in Chrome

The best way to create an e-signature for putting it on PDFs in Gmail

The way to make an electronic signature from your smart phone

The best way to generate an e-signature for a PDF on iOS devices

The way to make an electronic signature for a PDF file on Android OS

People also ask

-

What is an amended tax return and why do I need it?

An amended tax return is a form filed to correct errors or make changes to a previously submitted tax return. You might need an amended tax return if you discover mistakes in your income, deductions, or credits after filing. By using airSlate SignNow, you can easily eSign and send your amended tax return, ensuring a swift and secure process.

-

How can airSlate SignNow help with submitting an amended tax return?

airSlate SignNow provides a user-friendly platform for eSigning and sending your amended tax return documents. With its cost-effective solution, you can streamline the submission process, reducing the time and effort involved in correcting your tax filings. This not only enhances accuracy but also speeds up the overall tax amendment workflow.

-

What features does airSlate SignNow offer for handling amended tax returns?

airSlate SignNow offers features like document templates, secure eSigning, and customizable workflows to simplify the process of handling amended tax returns. These tools allow you to efficiently prepare, edit, and send your documents without any hassle. Additionally, real-time tracking ensures you stay updated on the status of your amendments.

-

Is there a cost associated with using airSlate SignNow for my amended tax return?

Yes, airSlate SignNow offers affordable pricing plans tailored to meet different business needs. While the cost is minimal, the benefits of using the platform for your amended tax return can be substantial, providing savings in time and resources. You can choose from various plans based on your expected usage.

-

Can I integrate airSlate SignNow with other accounting software for my amended tax return?

Absolutely! airSlate SignNow can seamlessly integrate with popular accounting and tax software, simplifying the amendment process. This integration allows you to directly pull up your previous tax returns and amend them efficiently without switching between platforms. It’s a convenient way to ensure your amended tax return is accurate and submitted on time.

-

What benefits does airSlate SignNow offer when preparing my amended tax return?

By using airSlate SignNow for your amended tax return, you enjoy a range of benefits including enhanced accuracy, reduced turnaround time, and improved security for your sensitive documents. The platform's intuitive interface allows you to manage your amendments easily, allowing for quicker resolutions to any tax discrepancies. Moreover, digital tracking and notifications keep you informed throughout the process.

-

How secure is the process of eSigning my amended tax return with airSlate SignNow?

Security is a top priority at airSlate SignNow. The platform complies with industry-standard security measures, including encryption and secure storage, to protect your amended tax return documents. With airSlate SignNow, you can confidently eSign your sensitive tax documents, knowing that they are safeguarded from unauthorized access.

Get more for Form 1040 X Rev July Amended U S Individual Income Tax Return

- Agreed written termination of lease by landlord and tenant idaho form

- Notice of breach of written lease for violating specific provisions of lease with right to cure for residential property from 497305569 form

- Breach lease tenant form

- Notice of breach of written lease for violating specific provisions of lease with no right to cure for residential property 497305571 form

- Notice of breach of written lease for violating specific provisions of lease with no right to cure for nonresidential property 497305572 form

- Decree divorce blank form

- Petition for final distribution idaho form

- Business credit application idaho form

Find out other Form 1040 X Rev July Amended U S Individual Income Tax Return

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF